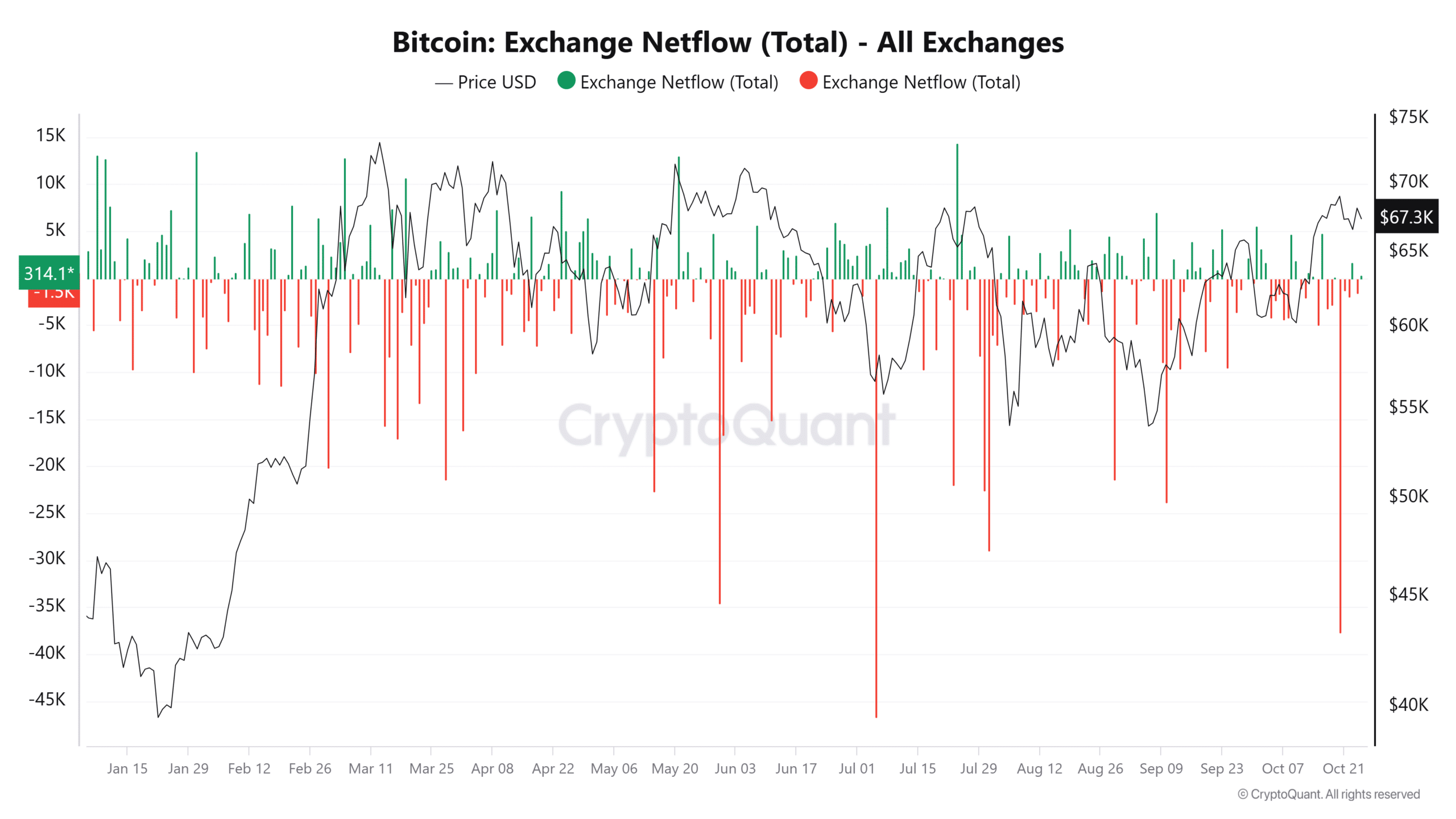

- Bitcoin has experienced its largest single-day exchange outflow since mid-September.

- Open Interest has surged to $20.3 billion, reflecting increased speculative activity.

Bitcoin [BTC] has experienced its largest exchange outflows since mid-September, a key signal of increased buying activity as investors take their BTC off exchanges and into private wallets.

The data comes as BTC hovers less than 10% below its all-time high, sparking optimism in the market. Exchange outflows are often viewed as a bullish indicator.

Bitcoin exchange outflows signal accumulation

According to data from CryptoQuant, more than 15,000 Bitcoin were withdrawn from exchanges on the 22nd of October, marking the largest single-day outflow in over a month.

When significant volumes of BTC are moved off exchanges, it generally signals investor confidence in its future price movements.

This shift reflects a desire to hold assets for the long term, as BTC nears important resistance points close to its all-time high.

Source: CryptoQuant

The pattern of exchange outflows has been building as BTC’s price steadily climbed above $67,000.

With withdrawals aligning with rising prices, there is a clear indication of bullish sentiment taking shape in the market.

This accumulation trend often precedes rallies, as less BTC on exchanges can reduce sell-side pressure, supporting a potential price breakout.

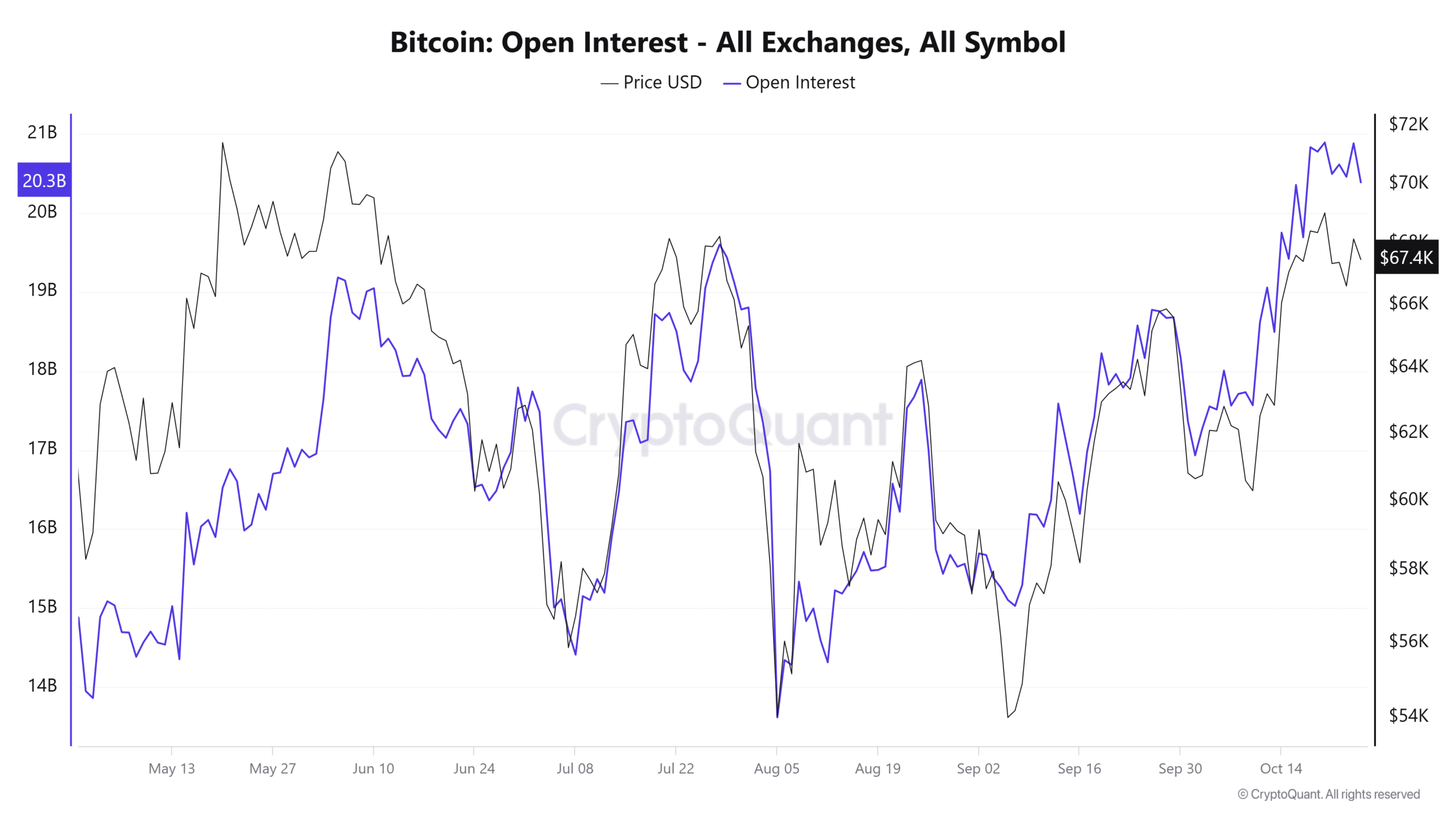

Open Interest shows increased speculative activity

Alongside the exchange outflows, Bitcoin’s Open Interest in futures contracts has risen to $20.3 billion, suggesting a surge in speculative activity.

Open Interest represents the total value of active derivative contracts. When it rises along with outflows, it often signifies both long-term investor accumulation and short-term speculative positioning.

This trend indicates that traders are preparing for potential price fluctuations, either by hedging positions or betting on further upside.

Source: CryptoQuant

However, high Open Interest can also signal impending volatility. Any rapid price movement could trigger leveraged position liquidations, creating a ripple effect on the market.

Such activity often leads to short-term price swings, even amid an overarching bullish sentiment.

Bitcoin price action nears key resistance levels

Bitcoin was trading around $66,900 at press time, nearing a resistance level that, if breached, could pave the way for further gains.

The Chaikin Money Flow (CMF) indicator, which measures capital inflows and outflows, stood at 0.13, indicating positive momentum as capital flows into Bitcoin.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-25

Traders are closely watching for a breakthrough of this resistance level, as it could potentially trigger a strong rally.

The heightened Open Interest serves as a cautionary sign, suggesting that increased volatility could be on the horizon. If Bitcoin manages to surpass this resistance, it may lead to a significant upward trend.