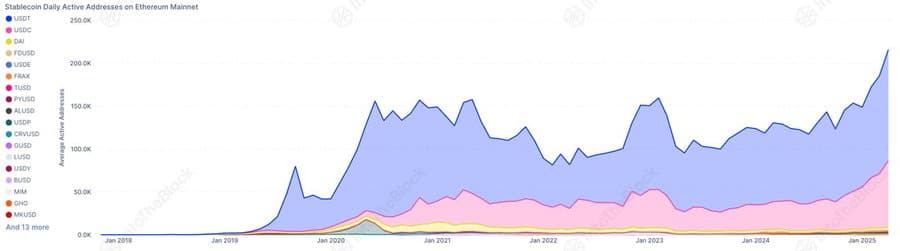

- Ethereum hits over 200,000 unique addresses using stablecoins, marking a shift towards sustained utility

- Stablecoins are becoming essential to Ethereum’s ecosystem, driving liquidity, and shaping future cross-border finance

Something’s stirring on the Ethereum mainnet – not visible across headlines, but in the data.

More than 200,000 unique addresses on Ethereum [ETH] are now holding stablecoins, and that number just hit an all-time high. It’s a subtle signal, but one that says a lot about where the smart money’s headed… and what it wants from crypto.

A record high in stablecoin engagement on Ethereum

Source: IntoTheBlock

USDT has emerged as the dominant stablecoin, while USDC and DAI continue to make steady progress. Once viewed primarily as trading tools, stablecoins have now become essential for transactions, value storage, and interactions within Ethereum’s ecosystem.

This shift reflects the growth of a utility-focused, mature digital economy increasingly anchored by stable digital currencies.

What this means for Ethereum and beyond

The rise in stablecoin activity on Ethereum signals increased market liquidity across DeFi and centralized platforms. This growth supports faster, more efficient transactions and unlocks new opportunities in cross-border finance.

However, the expansion has drawn heightened regulatory scrutiny, focusing on reserve transparency, AML compliance, and taxation.

While Ethereum may continue to lead, competition from blockchains like Solana and Base is intensifying.

Whether through multichain growth or deeper Ethereum integration, stablecoins have become the backbone of on-chain finance, no longer a secondary feature.