- Ethereum’s price falls by 10% post-ETF launch, contrary to bullish predictions.

- Factors like market corrections and external economic pressures contribute to the downturn

In recent developments, Ethereum [ETH] price has witnessed a notable downturn, dipping by nearly 10% within the past 24 hours, and currently standing at $3,164.

This decline strikes as particularly significant given its timing—right after the launch of the highly anticipated spot Ethereum ETFs, which many had expected to catalyze a bullish trend for ETH.

Although this is just the beginning of the live trading of these ETH financial products, 10x Research, a Digital Asset Research for Traders and Institutions has given some notable factors on why Ethereum is plunging despite their launch.

Why the sudden drop?

Despite the optimism that surrounded the initial trading of these ETFs, the response has not lived up to expectations.

According to insights from 10x Research, the rapid dissipation of the initial excitement around the Ethereum ETFs has led to a classic “sell-the-news” scenario.

This phenomenon isn’t new to the cryptocurrency market; similar trends were observed in past significant events within the digital assets space, including multiple instances throughout 2017, 2021, and earlier in 2024.

10x Research points out that the timing of the ETF launch may have exacerbated the situation.

It coincided not only with the distribution of Bitcoin from the long-standing Mt. Gox case but also with a broader market downturn influenced by poor performances in the U.S. tech sector.

Companies like Alphabet and Tesla have seen notable sell-offs, contributing to a cautious or bearish outlook across investment spaces due to weakened consumer spending forecasts.

Furthermore, the impact of these factors appears to be more pronounced for Ethereum.

Ahead of the ETF’s launch, 10x Research already marked Ethereum as overbought, suggesting that the market was ripe for a correction. This perspective seems to have been validated by the recent price movements, which saw Ethereum struggling even as significant capital flowed into the new ETFs.

Ethereum ETF inflows and price drop impact

Despite the downturn in spot prices, the Ethereum ETFs have attracted considerable attention from investors. On their first day of trading, these funds collectively garnered net inflows of around $106 million.

Leading the charge was BlackRock’s iShares Ethereum Trust ETF, which alone pulled in $266.5 million. Close on its heels was the Bitwise Ethereum ETF, with $204 million in inflows, and the Fidelity Ethereum Fund, which attracted $71 million.

However, not all funds experienced positive inflows. The Grayscale Ethereum Trust, transitioning into an ETF, saw significant outflows totaling $484 million—markedly higher than the initial outflows experienced by its Bitcoin counterpart earlier in the year.

Meanwhile, as the market digests the new developments and adjusts to the influx of ETF products, Ethereum’s price volatility has left many traders facing substantial losses.

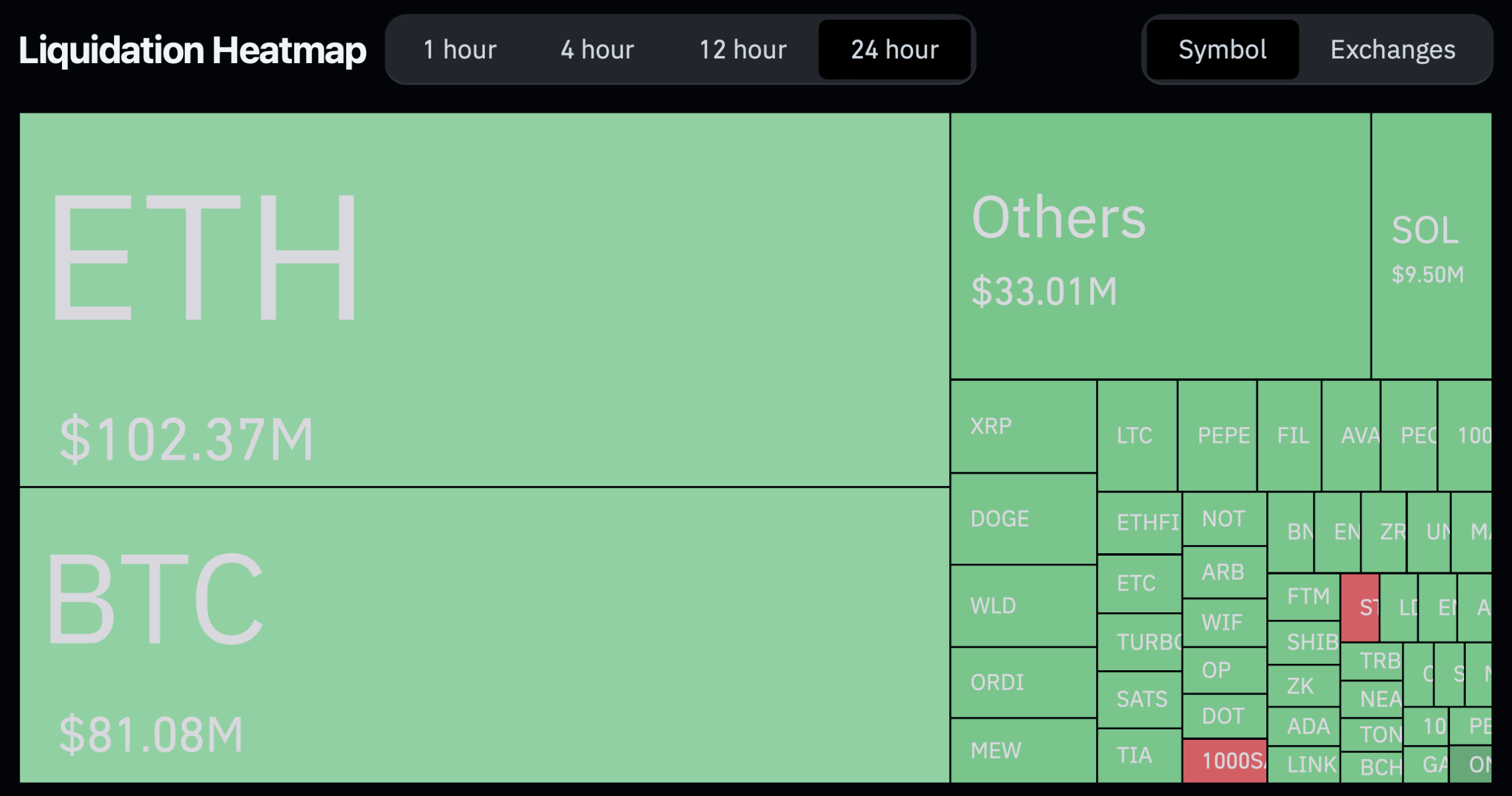

Source: Coinglass

Over the past day, a whopping 73,119 traders were liquidated, with Ethereum-related liquidations accounting for $102.37 million.

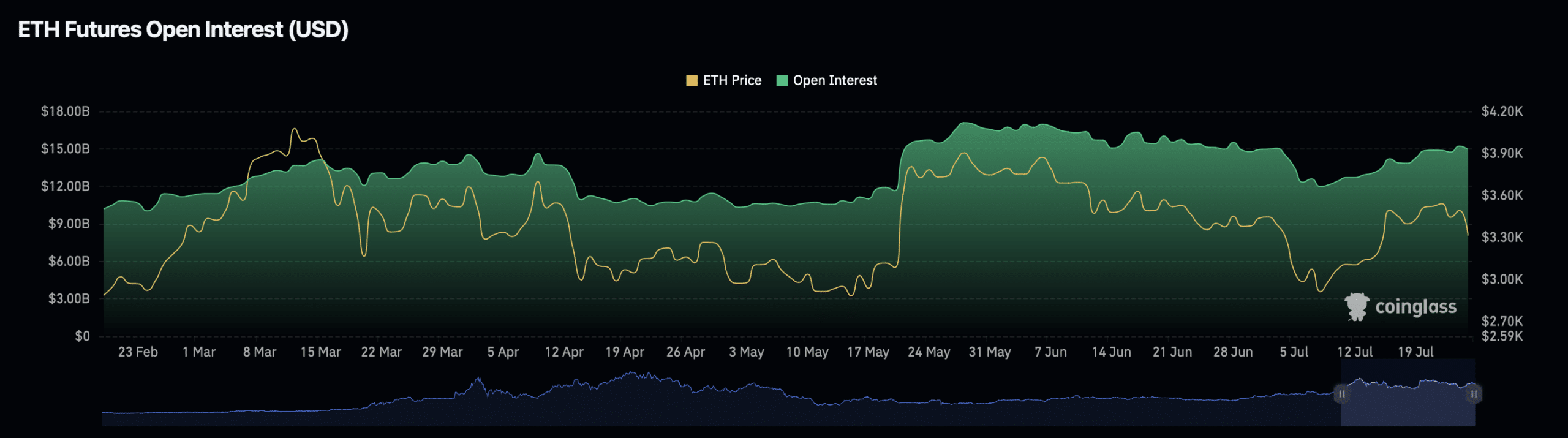

This has also influenced Ethereum’s open interest, which has seen a decline of nearly 5%, standing at $14.32 billion, with the volume decreasing by 3.92%.

Source: Coinglass