- Solana has seen an increase in network and trading volume.

- SOL price has declined in the last 24 hours.

Over the last few days, Solana [SOL] has exhibited a consistent trading volume within a specific range, and its Total Value Locked (TVL) has responded positively.

More recently, in the last 24 hours, there has been a significant increase in SOL’s trading volume. This uptick coincides with the price of Solana attempting to stabilize after fluctuations.

Solana volume and TVL surges

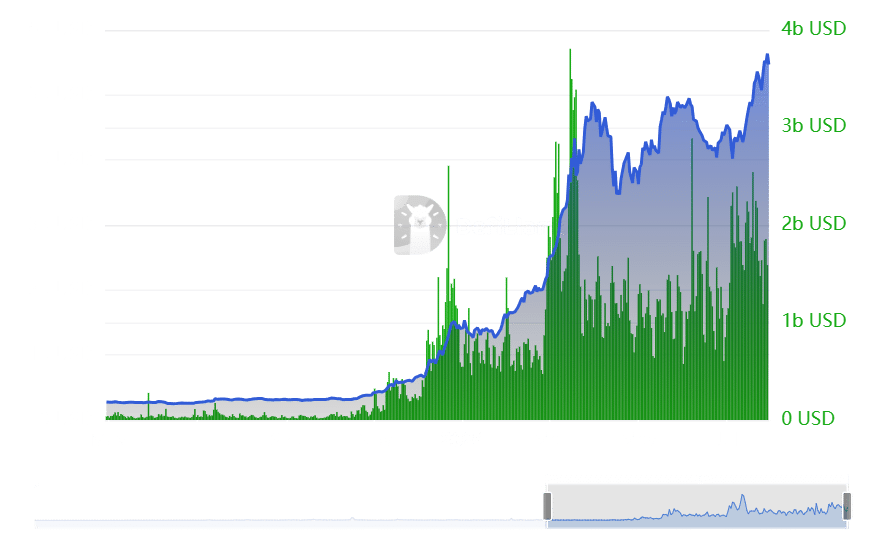

The analysis of Solana’s volume on DeFiLlama revealed that it has consistently hovered near $2 billion over recent days.

Notably, Solana’s trading volume began to breach the $1 billion threshold earlier this month consistently and, at several junctures, even surpassed $2 billion. Currently, the volume stands at approximately $1.6 billion.

A contributing factor to this surge in volume has been the rise of memecoins on the Solana platform. The rise of these memecoins has attracted significant trader attention and activity.

This increase in volume has paralleled a boost in Total Value Locked (TVL).

Source: DefiLlama

On 29th July, the TVL of the platform peaked at over $5.6 billion, marking the highest level since its decline around October 2022.

As of the latest data, the TVL has slightly adjusted to around $5.5 billion. This sustained high level of TVL, and trading volume underscores high engagement and liquidity within the ecosystem.

SOL volume shows mixed signals

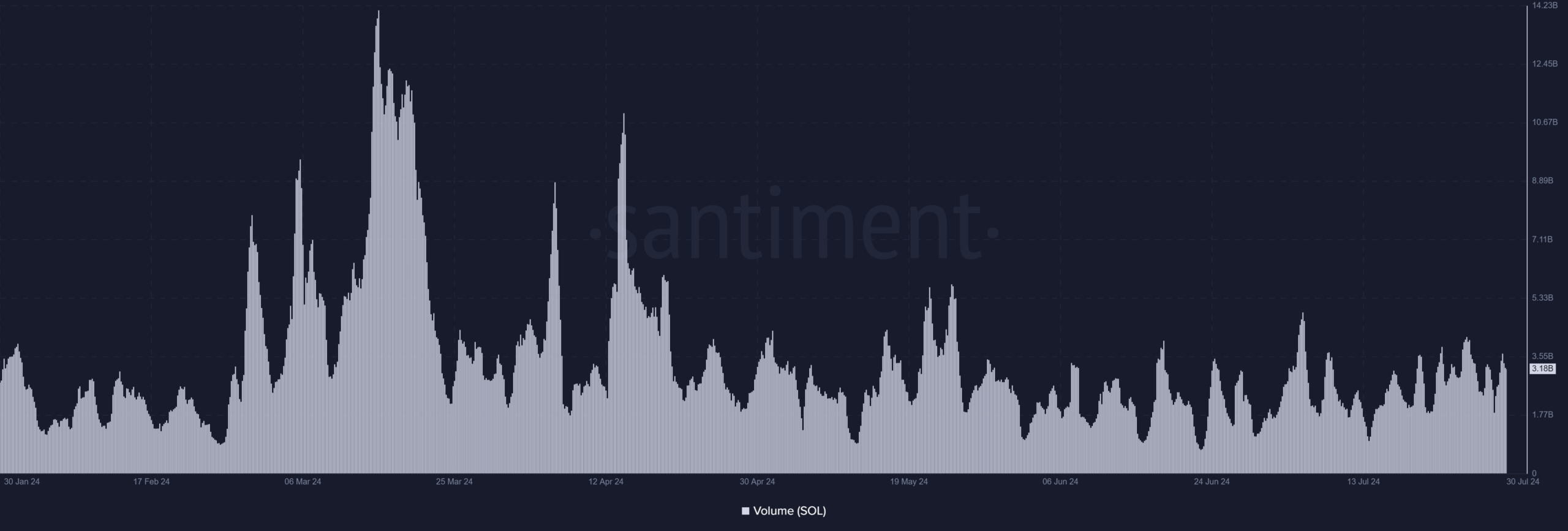

A recent analysis of Solana’s trading activity on Santiment indicates a significant increase in volume over the last 24 hours. As of this writing, the SOL trading volume was over $3.2 billion.

Additionally, data from CoinMarketCap confirmed this upward trend, noting an 18% increase in volume during the same period.

Source: Santiment

However, despite the heightened trading activity, the price trend analysis suggests that the market is currently seller-dominated.

This implies that the increased volume largely stems from selling pressure, which could indicate traders taking profits or reacting to specific market conditions that have prompted a bearish sentiment.

Solana trends downward

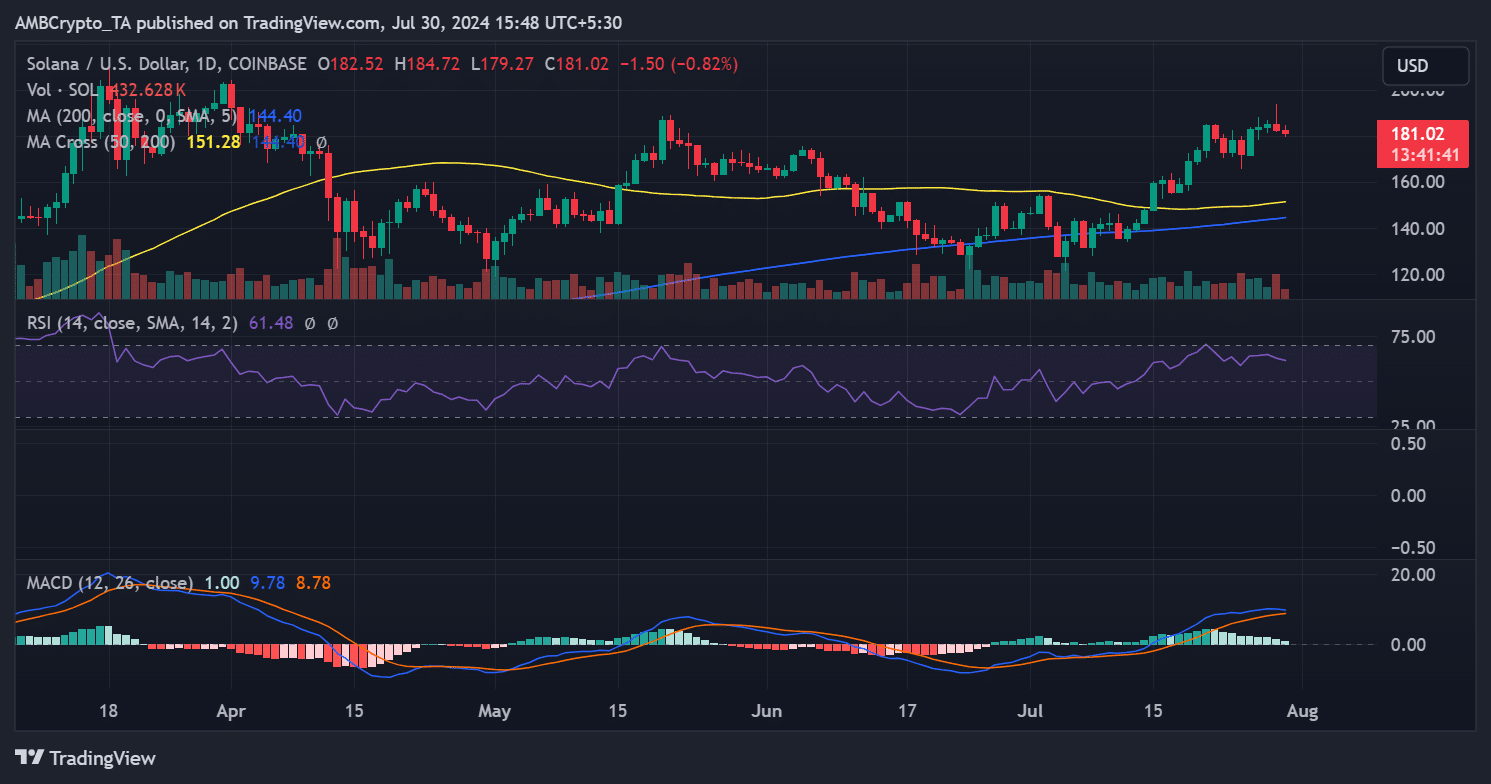

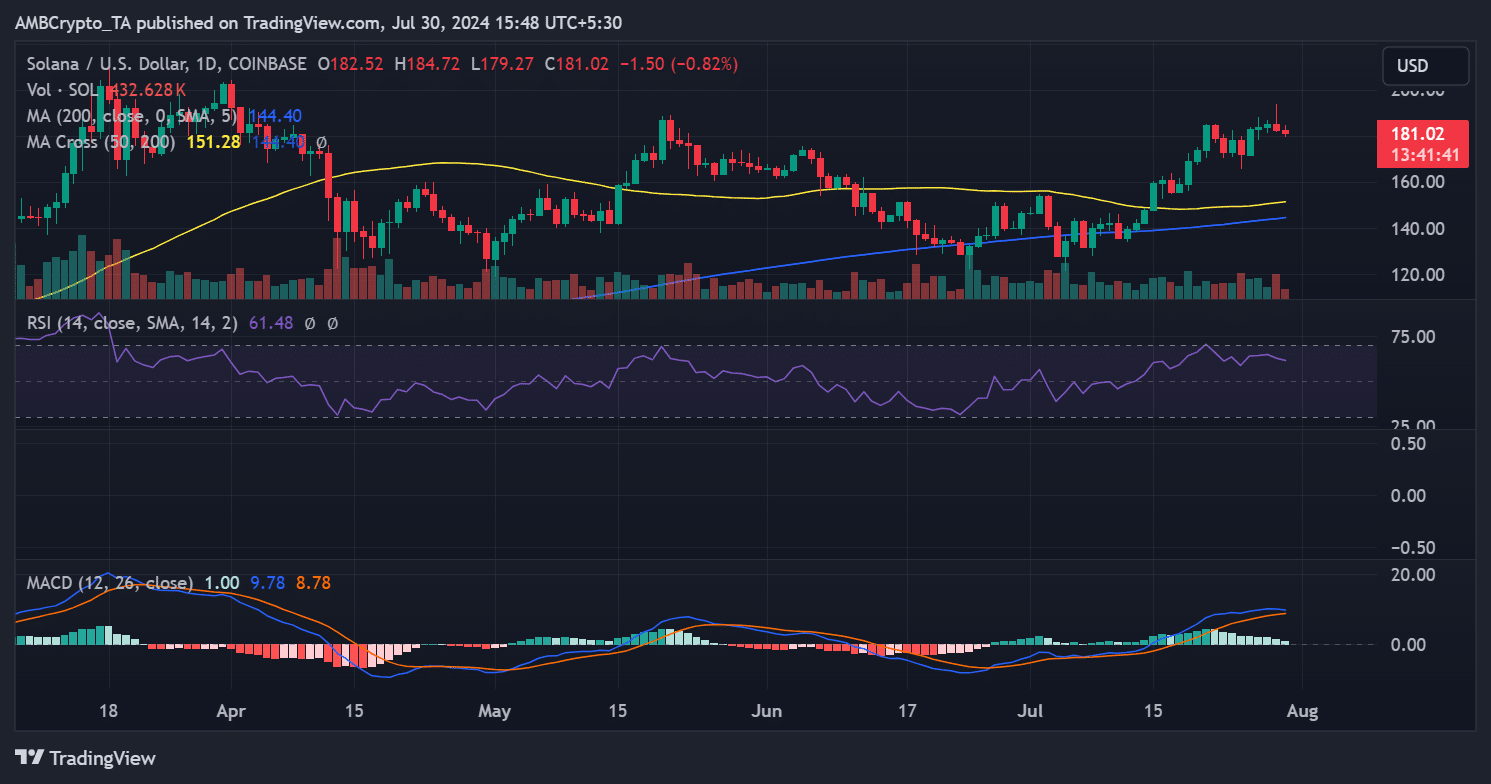

The recent analysis of Solana’s price on a daily timeframe indicates a potential trend reversal. Previously, SOL’s price had been on a steady upward trajectory, approaching the $186 price point it last reached in May.

Source: TradingView

Is your portfolio green? Check out the Solana Profit Calculator

However, a shift occurred on 29th July, with the price declining by over 1%, falling from nearly $185 to around $182.

As of the latest data, it continued to face downward pressure, trading with a 1% decline and dropping to around $180.