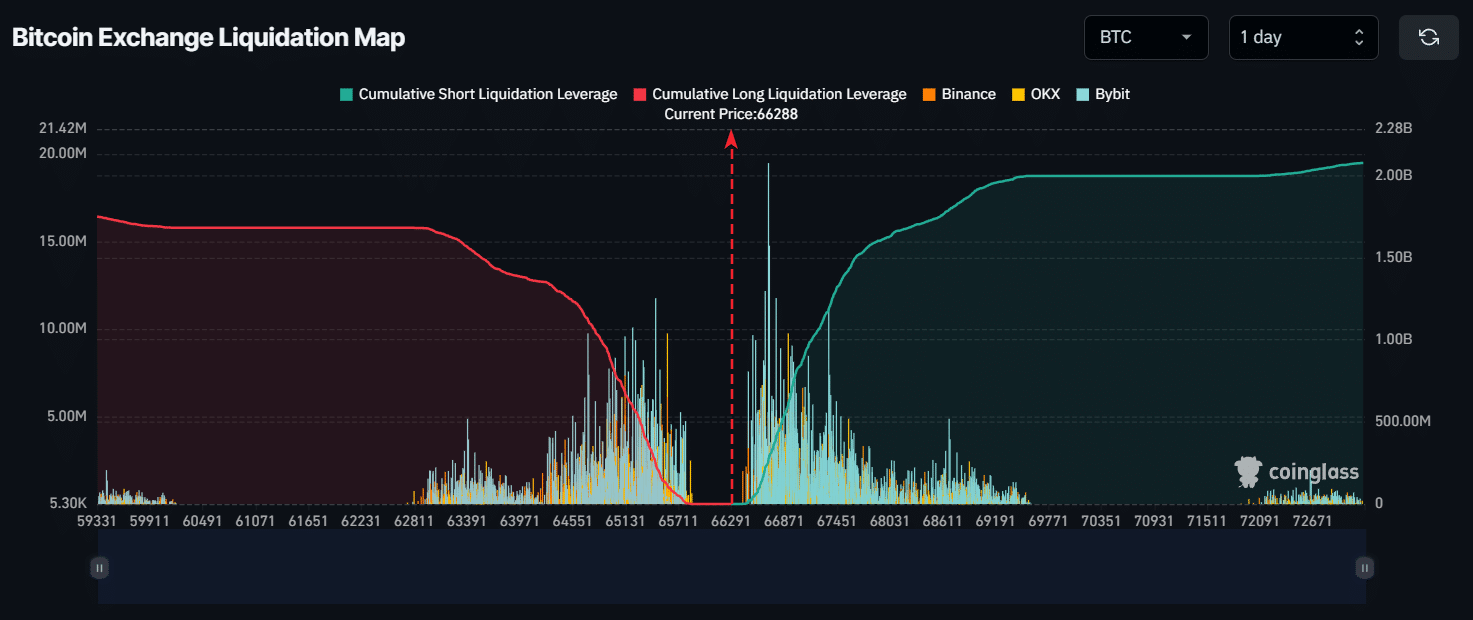

- Bitcoin’s major liquidation levels were $66,700 on the higher side and $65,450 on the lower side.

- However, historical data suggested that Bitcoin could fall to the $63,000 level.

The overall cryptocurrency market was experiencing massive selling pressure, as Bitcoin [BTC], the world’s biggest cryptocurrency, slid to the $65,500 level.

Amid this price drop, former hedge fund manager James Lavish made a post on X (previously Twitter) stating that BTC could rise to $428,000 if it captures 1% of the total global investment market.

What it will take for BTC to hit $428K

According to Lavish, the current total investment assets in the world are $900 trillion, and BTC is just 0.15% of the total, at $67,000. If BTC captures just 1% of these assets, its value could jump to a massive $428,000 level.

Besides this insight, investors and whales looked bullish on Bitcoin as well. Recently, crypto analyst Julien Bittel predicted that BTC could hit the $190,000 mark.

He explained that the current Bollinger Band Indicator was completely compressed, which may cause a significant bull run.

Additionally, whales have accumulated a significant 5,900 BTC, worth $397 million, as reported by AMBCrypto on the 30th of July.

Price-performance analysis

At press time, BTC was trading near the $66,000 level and has experienced a 1.35% price drop in the last 24 hours. Trading volume also dropped by 28% during the same period.

The fall in trading volume signals lower participation from traders and investors.

Similarly, BTC’s Open Interest (OI) dropped by 4%, suggesting fear in the market, according to on-chain analytics firm CoinGlass.

Whereas, the major liquidation levels were at $66,700 on the higher side and $65,450 on the lower side.

Source: CoinGlass

If market sentiment remains unchanged and BTC falls to the $65,450 level, $275 million of long positions will be liquidated.

On the other hand, If sentiment changes and the BTC price rises to the $66,700 level, $233 million of short positions will be liquidated.

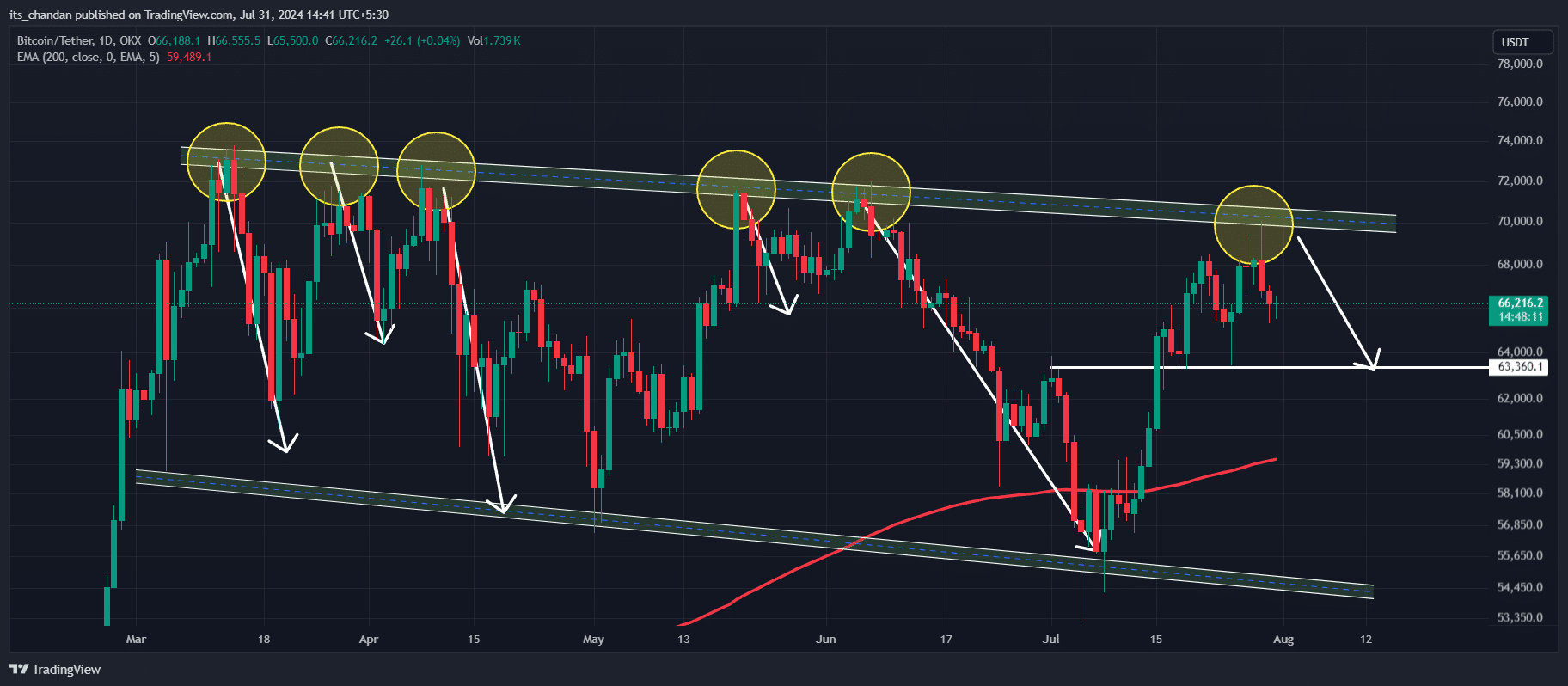

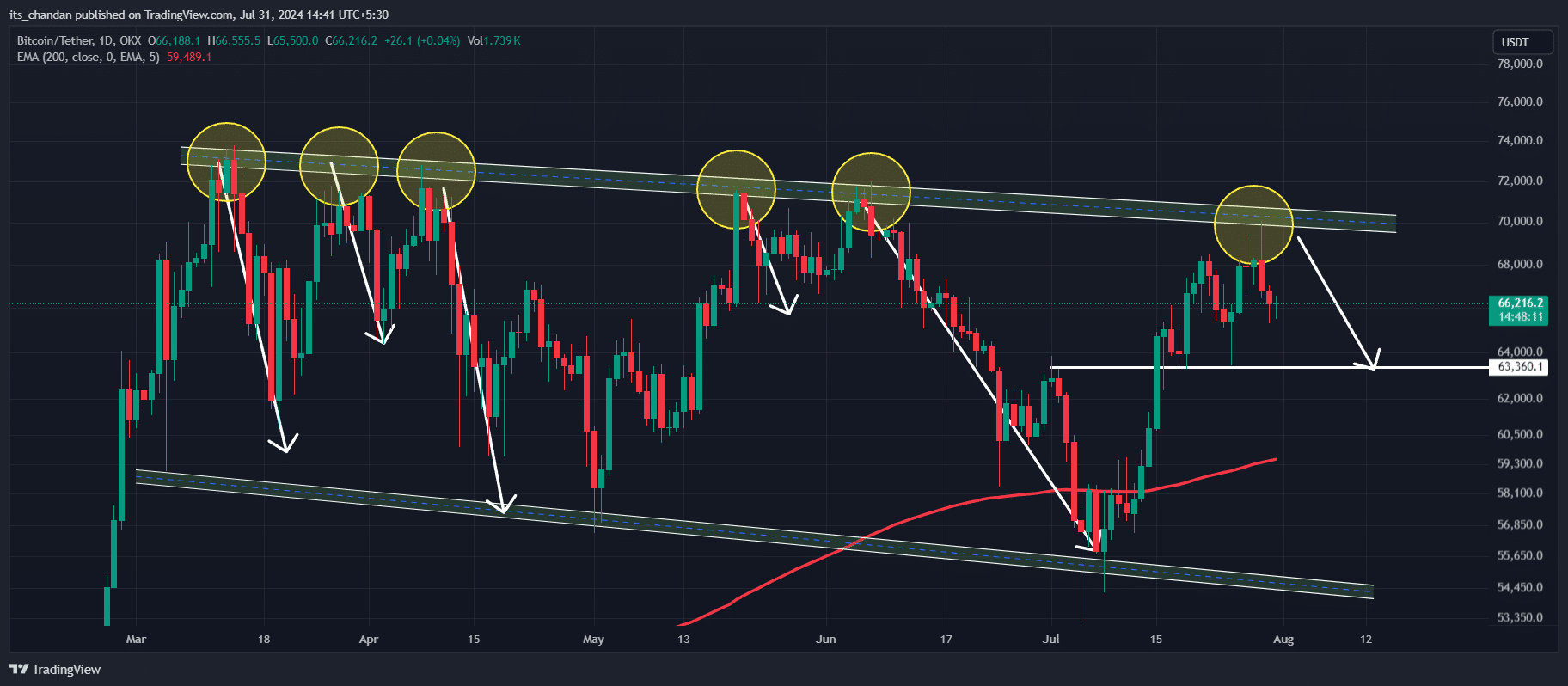

Bitcoin price prediction

According to expert technical analysis, BTC looked bearish at press time and may reach $63,300 level in the coming days.

The potential reason behind this bearishness is the recent price rejection from a strong resistance level of $70,000.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-25

Historical data shows that BTC has reached this level five times since March 2024, and each time it faced rejection and experienced a massive price drop. This time, there is similar speculation that BTC could fall again.

The Relative Strength Index (RSI) also supported this bearish outlook, as its value was in the overbought area at press time. The RSI value in the overbought area signals upcoming price reversals of assets.