- Japan’s ‘MicroStrategy’ is intent on buying more BTC for its reserves

- Ongoing market dynamics might dictate widespread corporate adoption

Japan’s Metaplanet has secured a substantial loan of JPY 1 billion from MMXX Ventures Limited, a key shareholder in the company, to fund the purchase of additional Bitcoin (BTC). This loan will allow Metaplanet to acquire over 110 BTC, significantly bolstering its cryptocurrency holdings.

Source: X

Not the first step…

This move follows a series of strategic decisions aimed at increasing the company’s BTC reserves. For example, a few days ago, Metaplanet announced a JPY 10.08 billion Gratis Allotment of Stock Acquisition Rights, also intended to facilitate the purchase of more BTC.

Additionally, the company recently joined the ‘Bitcoin for Corporations’ initiative, aligning itself with a growing number of firms that view Bitcoin as a viable treasury reserve asset.

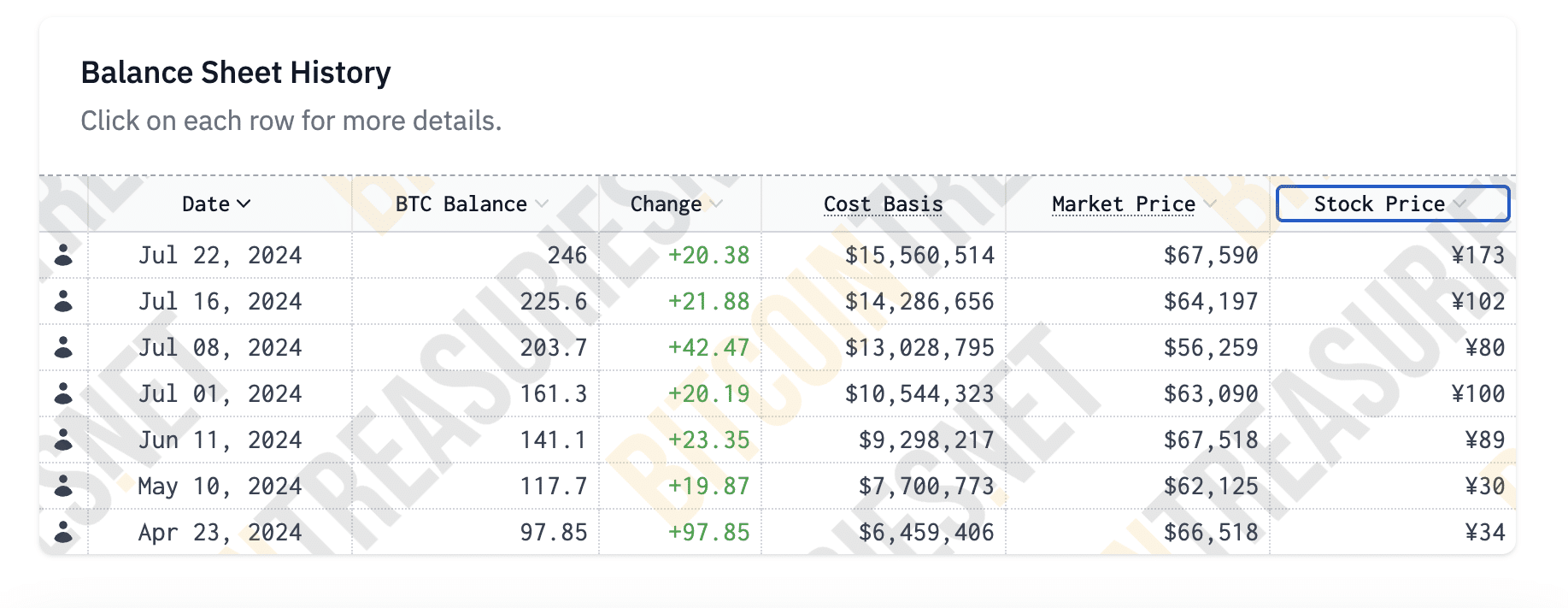

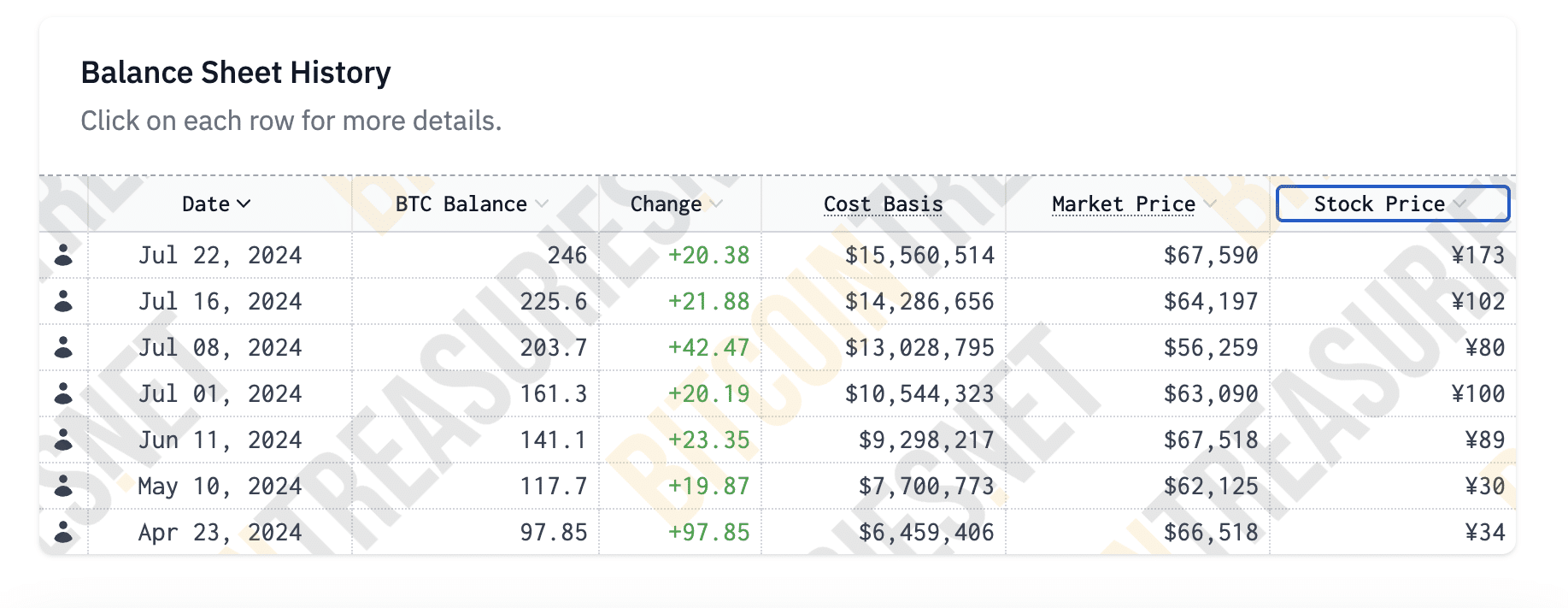

According to Bitcoin Treasuries, Metaplanet owns approximately 246 Bitcoin right now. The firm’s aggressive accumulation strategy is a sign of a strong belief in the long-term value and stability of Bitcoin.

Source: BitcoinTreasuries

By increasing its BTC holdings, Metaplanet aims to hedge against inflation and diversify its asset base, leveraging Bitcoin’s potential for high returns and its growing acceptance as a store of value.

The decision to dive deeper into Bitcoin and cryptocurrency is driven by several factors though.

For starters, Bitcoin’s finite supply and decentralized nature make it an attractive hedge against traditional financial market volatility and inflation.

Secondly, as central banks continue to implement expansive monetary policies, companies like Metaplanet see Bitcoin as a safeguard against currency devaluation and economic instability.

A trend in the making?

Metaplanet’s bold moves may inspire other public companies to follow suit. If more corporations begin to maintain BTC treasury reserves, it could have a significant impact on Bitcoin’s price. Not only that, but this trend could also polish Bitcoin’s legitimacy as a credible and mainstream financial asset.

Take MicroStrategy, for instance – The business intelligence firm has already set a precedent by converting a substantial portion of its cash reserves into Bitcoin. This move not only boosted MicroStrategy’s stock value, but also signaled a shift in how corporations view Bitcoin.

Similarly, Tesla’s announcement of a major Bitcoin purchase led to a notable price surge too.

Moves like these allow corporations to be more confident about adopting Bitcoin, an asset that has for long struggled with skepticism from many quarters. Especially on the regulatory and governmental front.