- The WIF whale held a substantial profit of $68 million at press time.

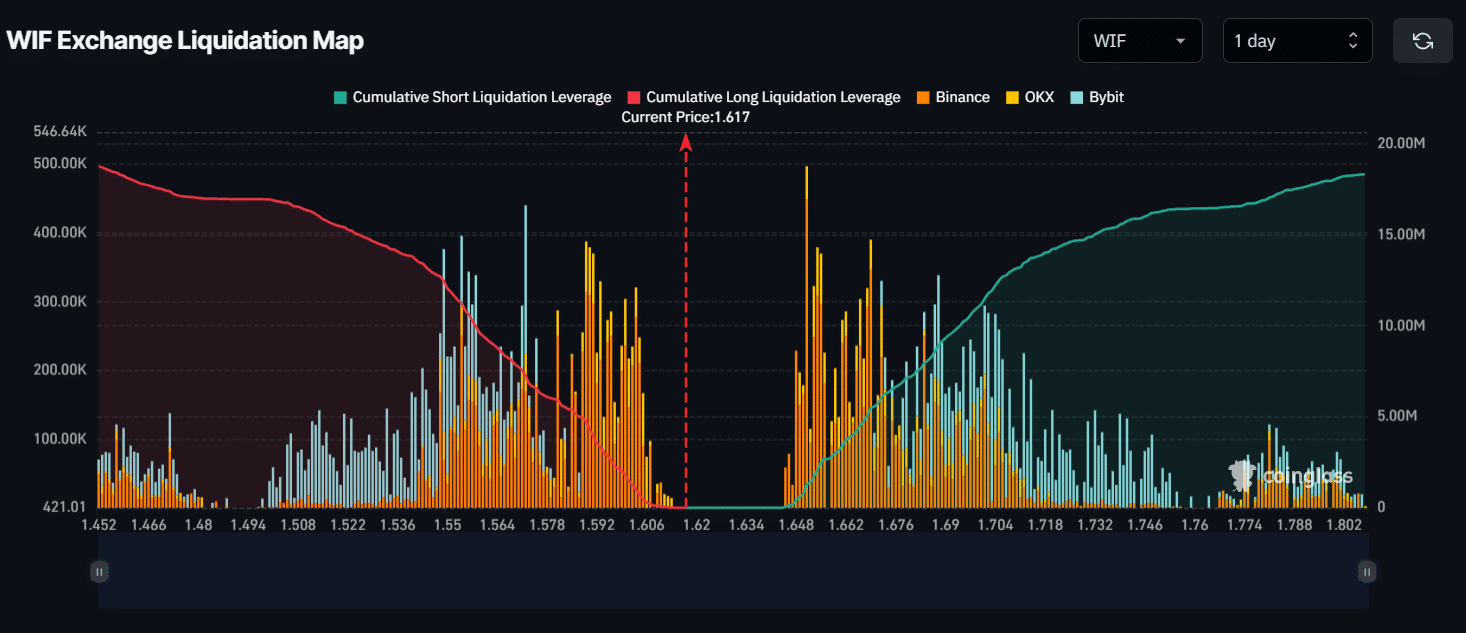

- The memecoin’s major liquidation levels were near the $1.57 level on the lower side and $1.65 on the upper side.

The popular Solana [SOL]-based memecoin, dogwifhat [WIF], has now been getting significant attention from the crypto community.

As the market continued in a downtrend, on the 23rd of August 2024, the largest WIF holder purchased over 1.8 million WIF tokens worth $2.61 million, according to the on-chain analytics firm Lookonchain.

Crypto whale buys 1.8 million WIF tokens

According to a post on X (formerly Twitter), the whale borrowed 2.61 million USDC from Kamino to purchase these notable tokens.

This massive token buy occurred near a crucial support level and during the formation of a bullish double-bottom price action pattern.

However, from the 13th to the 15th of December 2023, this whale spent $226K and purchased 19.86 WIF tokens at an average price of $0.00114.

Following this purchase, the whale held a substantial 27.2 million WIF tokens worth $44.36 million at press time, with a total profit of more than $68 million.

Price analysis and Open Interest

Despite this notable WIF purchase, at press time, the memecoin was trading near $1.63, having experienced a price drop of 2% in the last 24 hours.

Meanwhile, its trading volume dropped by over 13% during the same period, indicating lower participation from traders.

However, WIF’s Open Interest has remained unchanged over the last 24 hours, according to the on-chain analytic firm Coinglass.

WIF: Key levels

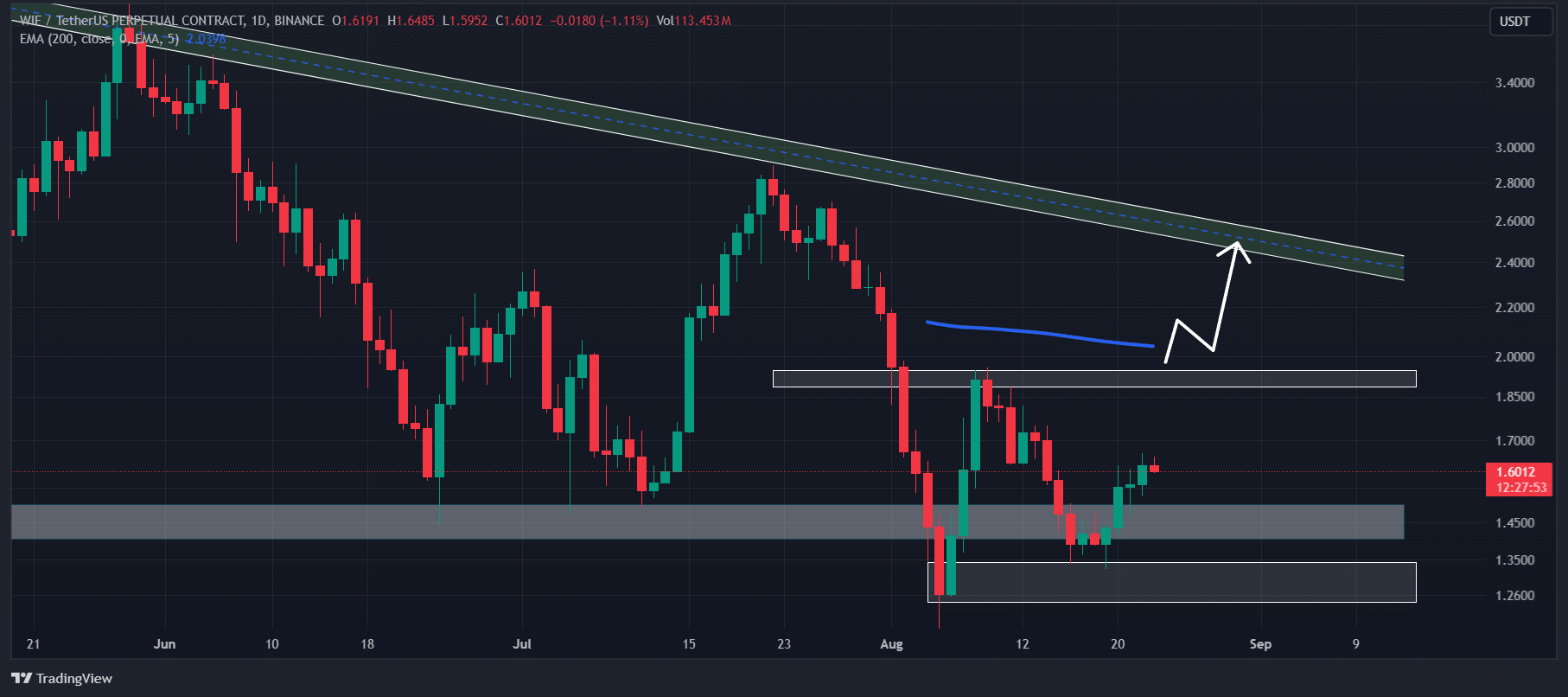

According to AMBCrypto’s technical analysis, WIF looked bullish despite trading below the 200 Exponential Moving Average (EMA) on a daily time frame.

The potential reason behind this bullish outlook is the formation of a double-bottom price action pattern and the crucial support level of $1.4.

Source: TradingView

Historically, whenever WIF reaches this support level, it tends to experience a massive price surge. This time there is a similar expectation investors and traders are expecting.

The formation of the bullish double-bottom price action pattern suggested that WIF could initially soar to $2 and later following the breakout it could soar to the $2.8 level.

Major liquidation levels

At press time, WIF’s major liquidation levels were near the $1.57 level on the lower side and $1.65 on the upper side, as traders were highly leveraged at this level, according to Coinglass.

Source: CoinGlass

Read dogwifhat’s [WIF] Price Prediction 2024–2025

If the market sentiment remains bullish and the price rises to the $1.65 level, nearly $1.27 million worth of short positions will be liquidated.

Conversely, if the sentiment shifts and the price falls to the $1.57 level, nearly $7.26 million worth of long positions will be liquidated.