- Despite massive price drops, LTHs’ confidence in MATIC remains high

- Buying pressure also rose over the last few days

Polygon [MATIC] investors have been facing hardships for a couple of months, especially as the token’s value declined sharply on the charts. However, as the MATIC to POL upgrade date draws closer, there is hope that the bearish trend might change soon.

Hence, let’s take a look at MATIC’s current state to find out the right buying opportunities for investors to accumulate the token, before it turns bullish post-upgrade.

MATIC’s dark days

CoinMarketCap’s data revealed that MATIC has been struggling to list its price up. Within a singular 30-day period, the token saw a 13% price drop. This got even worse over the past week as MATIC’s value plummeted by more than 20%.

At the time of writing, MATIC was trading at $0.4244 with a market capitalization of over 44.2 billion, making it the 21st largest crypto.

The series of price corrections pushed a majority of the investors into losses. As per IntoTheBlock, only 2% of MATIC investors are in profit right now.

However, while the token’s value plunged, long-term holders (addresses holding MATIC for more than 1 year) showed confidence in the token. This was the case as the number of LTHs rose over the past few months – A sign that they were bullish on MATIC in the long term.

Source: IntoTheBlock

Is MATIC/POL ready for a recovery?

A possible reason behind this confidence could be MATIC’s upcoming upgrade to POL. The major update is scheduled to happen on 4 September, which will make POL the native gas token for Polygon. The upgrade might stir up bullish sentiment in the market and in turn, kickstart Polygon’s recovery from its previous losses.

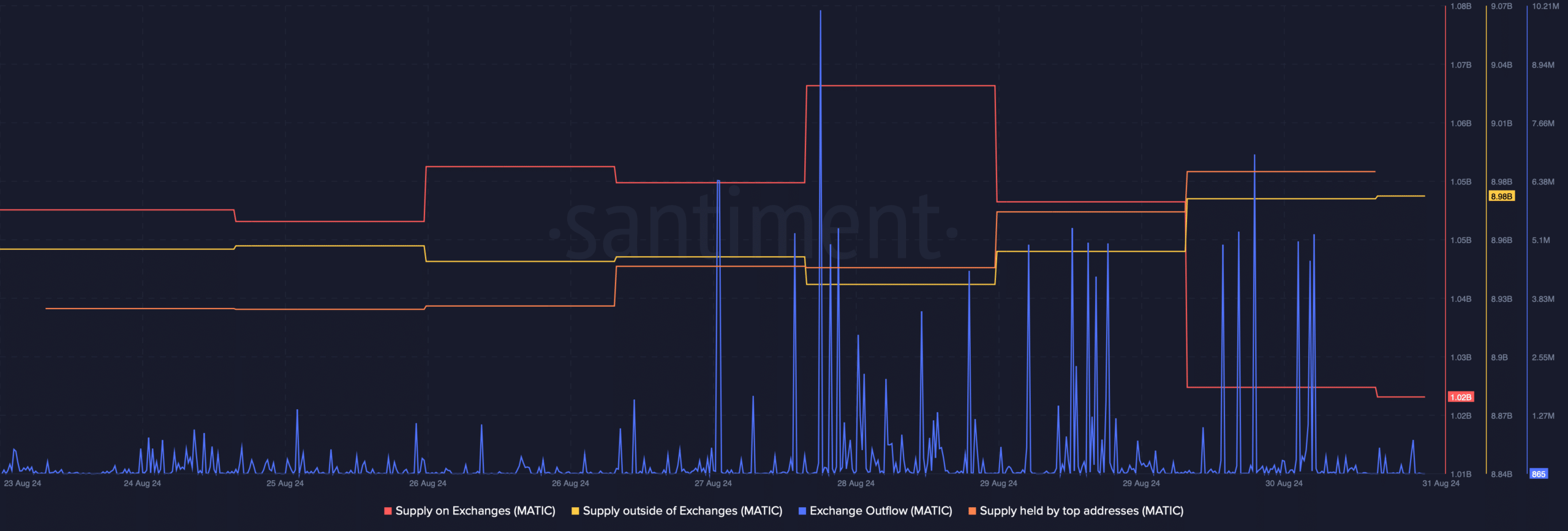

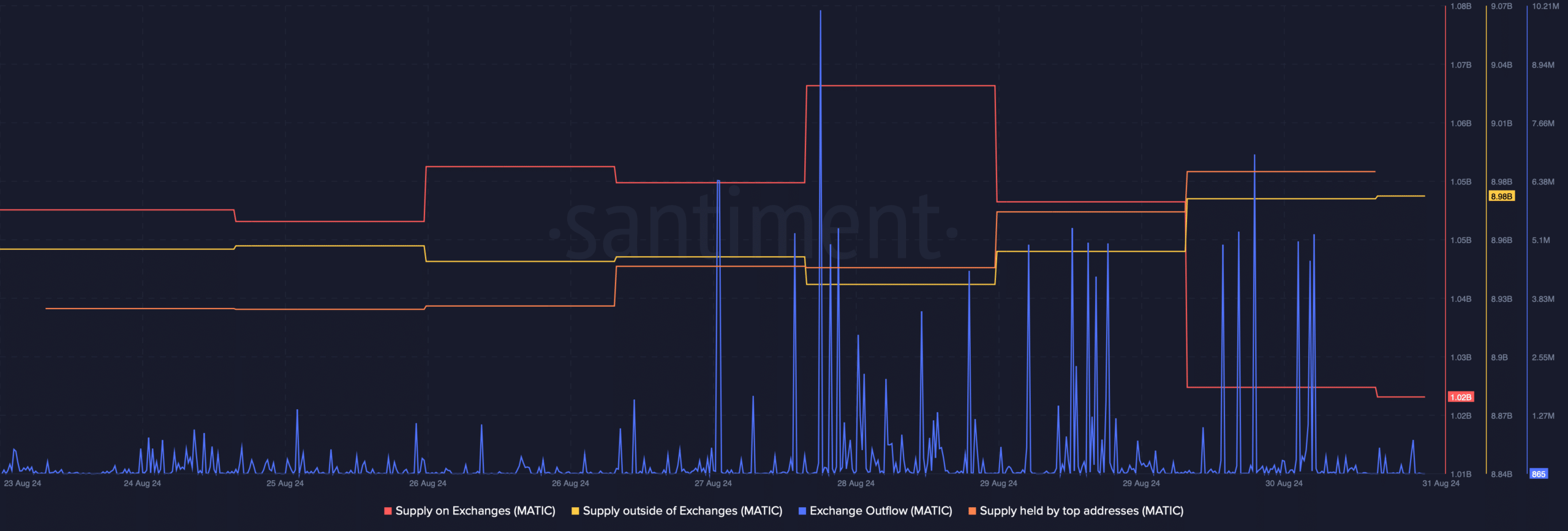

In fact, AMBCrypto’s analysis of Santiment’s data revealed that investors have already started to accumulate MATIC. The token’s supply on exchanges dropped sharply on 30 August, while its supply outside of exchanges increased. The fact that investors were buying was further proven by the rise in its exchange outflows.

Additionally, whales have also been stockpiling as the supply held by top addresses rose.

Source: Santiment

While this might just be the right time to accumulate MATIC, AMBCrypto’s analysis of the token’s daily chart revealed that a drop under $0.419 would be an even better chance to stockpile MATIC.

In fact, the technical indicator MACD flashed a bearish advantage. It suggested that MATIC might as well fall to the aforementioned level.

Is your portfolio green? Check out the MATIC Profit Calculator

Finally, our look at the altcoin’s liquidation heatmap revealed a similar possibility of MATIC falling under $0.419.

However, if the bears step up early, then it won’t be surprising to see MATIC quickly climb to $0.45 in the short-term.

Source: Hyblock Capital