- TON’s network activity surged after the DOGS airdrop.

- While DOGS’ indicators were bullish, TON’s indicators hinted at a price decline.

The memecoin mania is nowhere from stopping with the launch of multiple new cryptos, one of the latest being DOGS.

The memecoin gained much traction because of its airdrop news on Toncoin [TON], which also caused a massive rise in network activity. But will this be enough to get rid of the bears?

Bears are here

For the uninitiated, DOGS is a memecoin developed as a mini-app on Telegram that allows users to receive DOGS tokens.

The launch also disturbed the working of Toncoin, as the blockchain went down because of the high volume of traffic DOGS generated. But soon after the launch, it witnessed a major price correction.

According to CoinMarketCap, DOGS’ price had dropped by more than 33% since its launch. At the time of writing, the memecoin was trading at $0.001105 with a market capitalization of over $570 million.

The launch also disturbed the working of Toncoin, as the blockchain went down because of the high volume of traffic DOGS generated.

According to a tweet from IntoTheBlock, the TON blockchain processed over 46 million transactions last week, driven by the excitement surrounding the DOGS airdrop.

However, the massive surge in activity didn’t have a positive impact on TON’s price action.

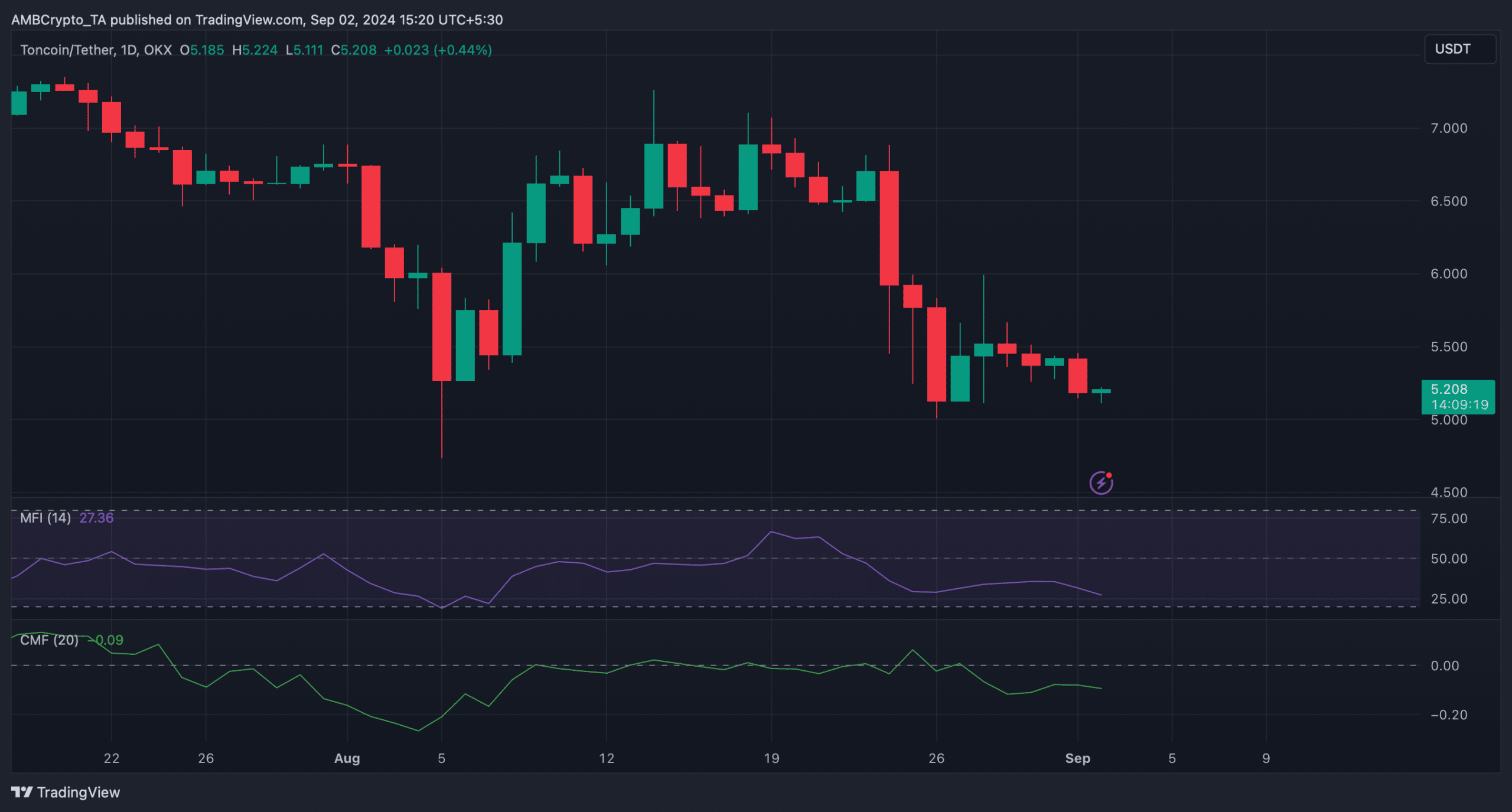

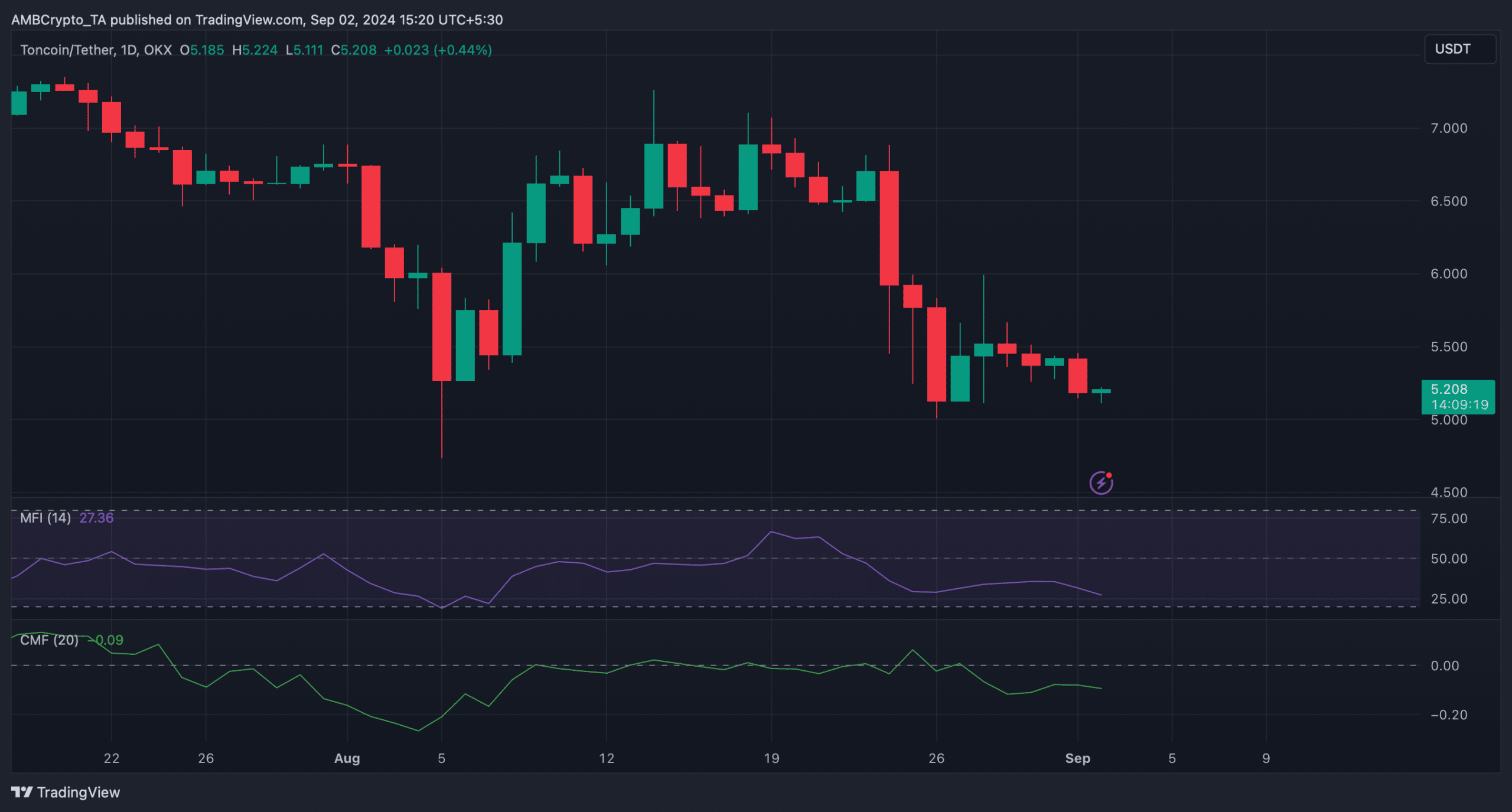

The token’s value dropped by over 7% in the last seven days. At press time, TON was trading at $5.20 with a market capitalization of over $13.19 billion, making it the 10th largest crypto.

Will DOGS and TON turn bullish?

AMBCrypto assessed DOGS and TON’s on-chain data to find whether their popularity could stir up bullish sentiment in the market.

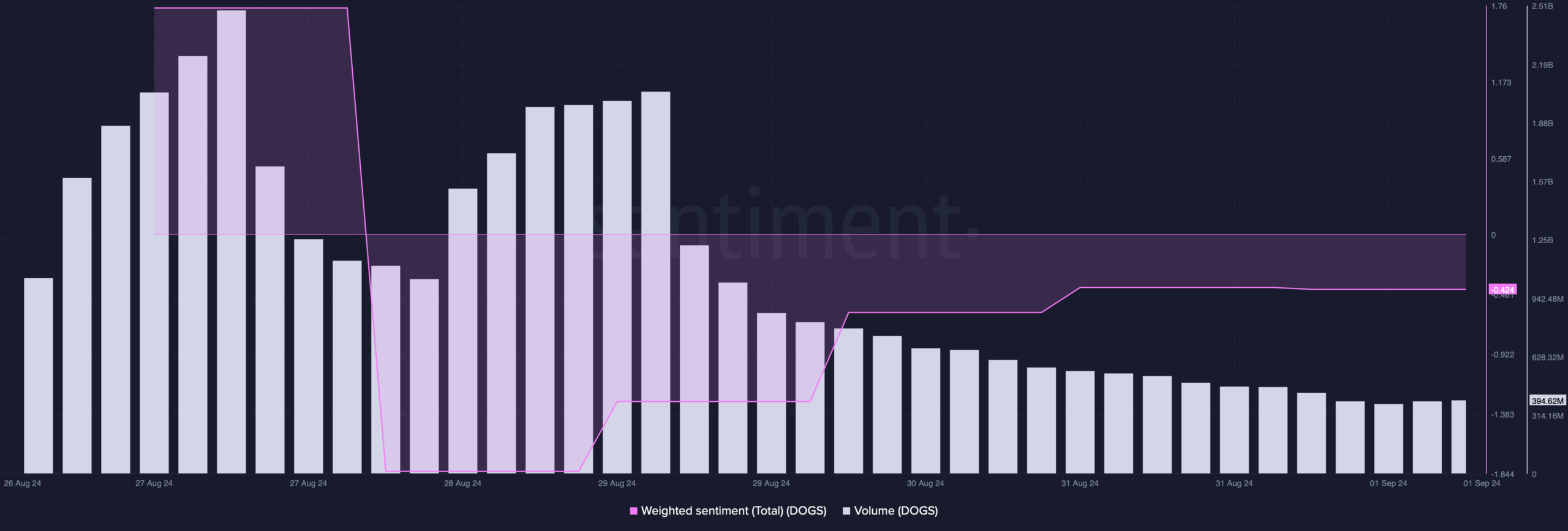

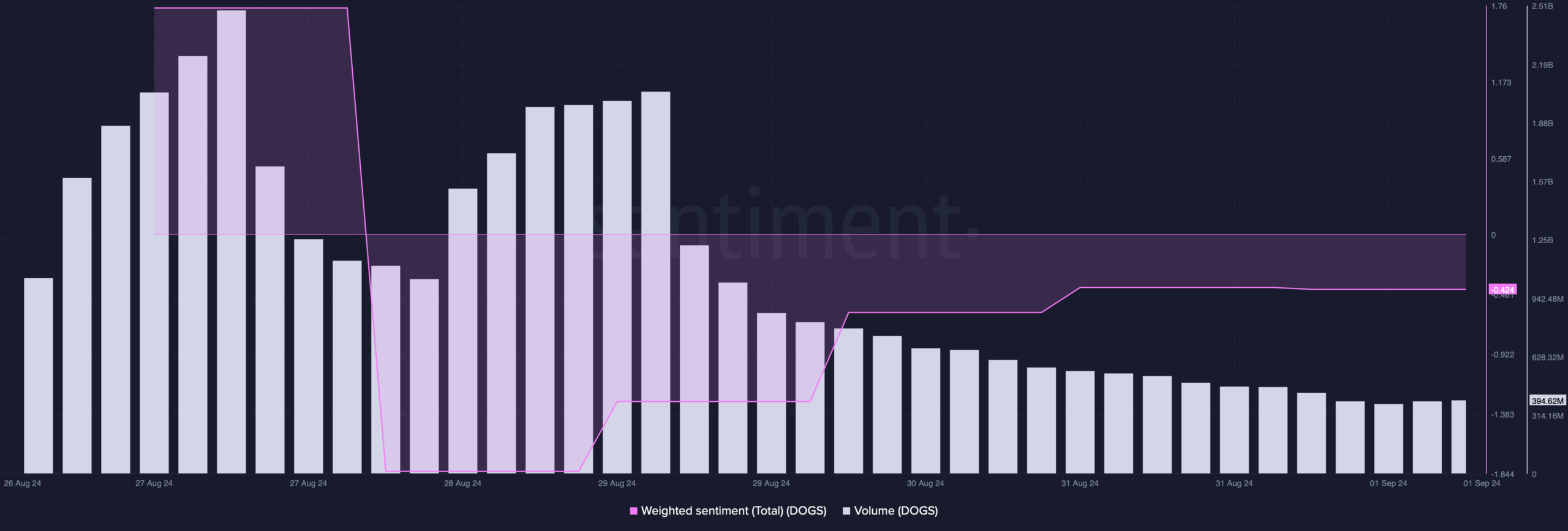

Beginning with DOGS, its Weighted Sentiment improved, which can be inferred as a bullish signal. Additionally, its Trading Volume fell along with its price, hinting at a trend reversal.

Source: Santiment

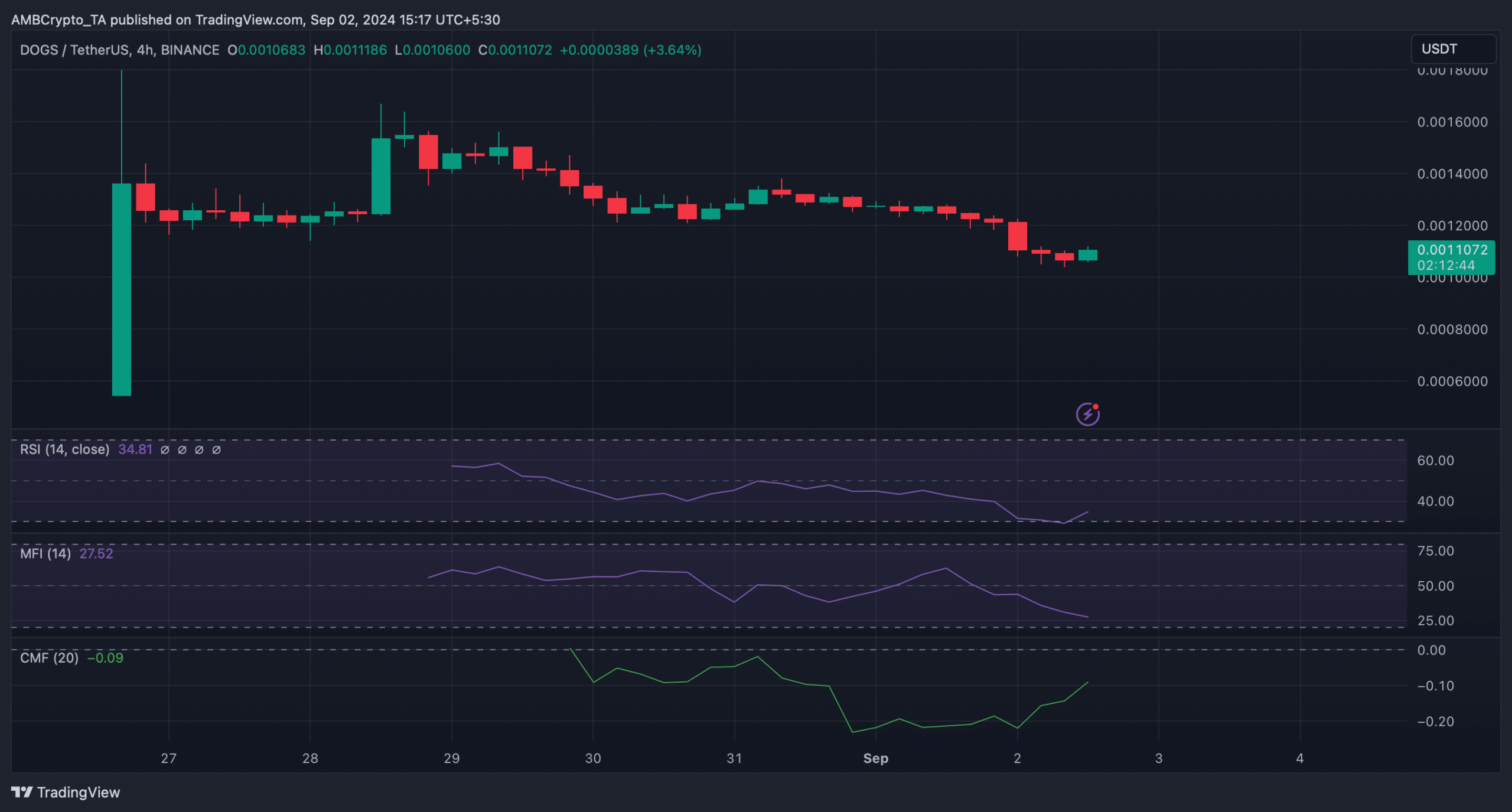

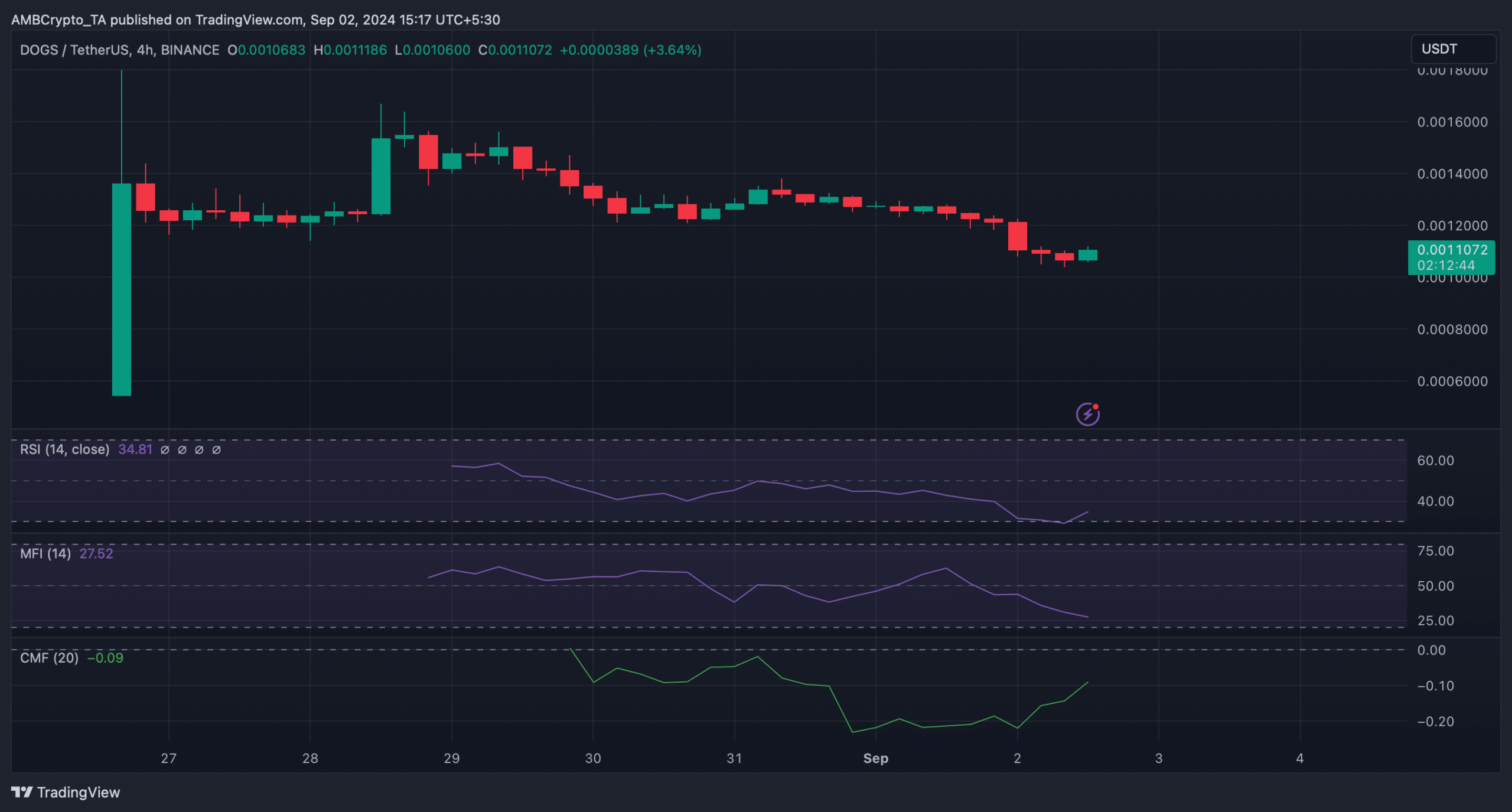

A look at the memecoin’s 4-hour chart also revealed a few bullish indicators. For example, DOGS’s Chaikin Money Flow (CMF) and Relative Strength Index (RSI) both registered upticks, hinting at a price rise.

But the Money Flow Index (MFI) remained bearish as it moved southwards.

Source: TradingView

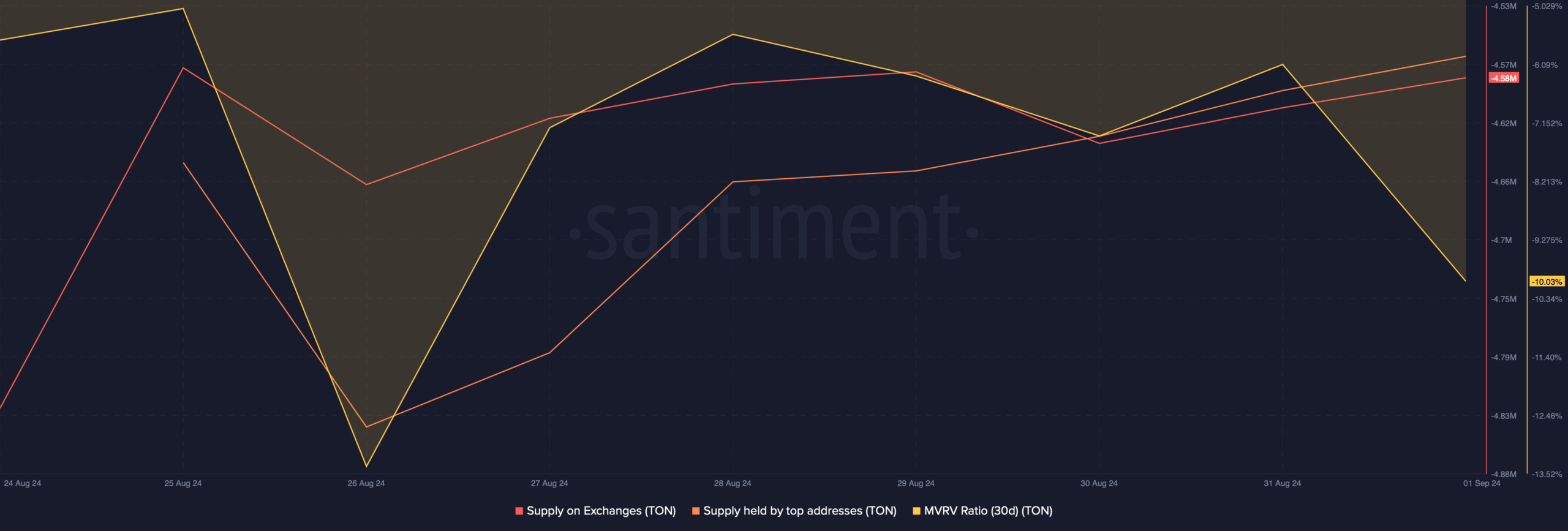

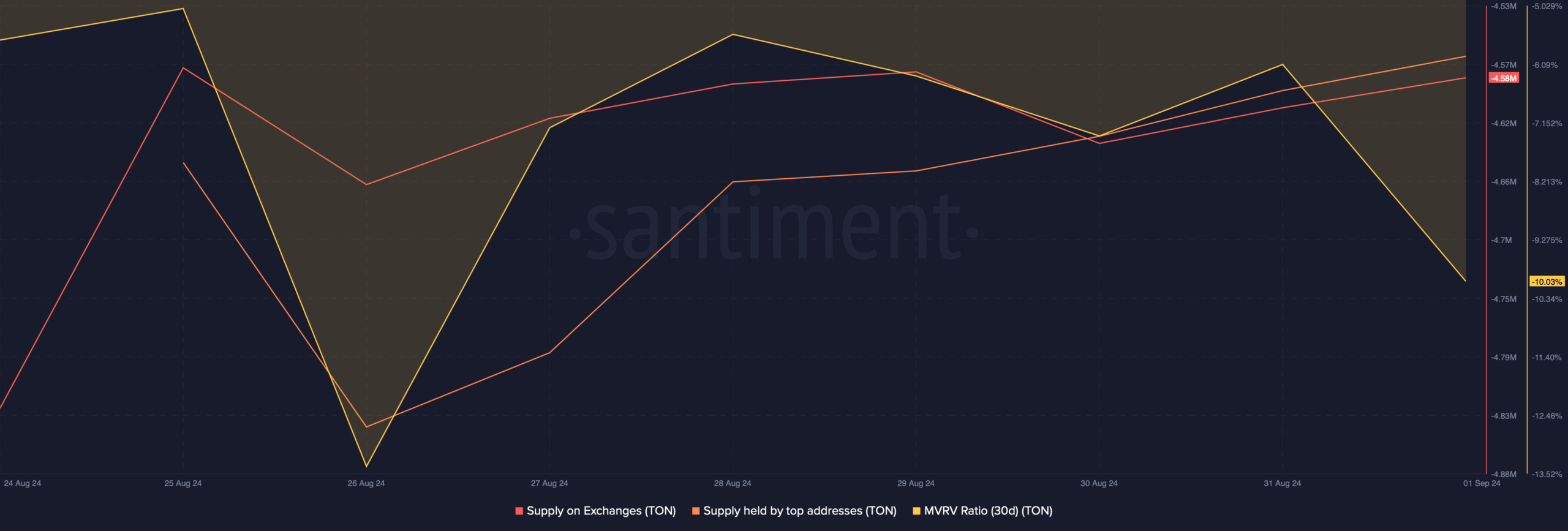

Moving on, AMBCrypto then checked TON’s state. Our analysis of Santiment’s data revealed that investors were selling TON. The token’s Supply on Exchanges surged, which pointed to a possible price drop soon.

Is your portfolio green? Check out the TON Profit Calculator

Another bearish metric was the MVRV ratio, which also declined. Nonetheless, Toncoin whales were confident in the token as the supply held by top addresses increased.

Source: Santiment

However, unlike DOGS, TON’s technical indicators looked bearish. For instance, the CMF moved downward. The MFI also followed a similar trend, hinting at a continued price drop in the coming days.

Source: TradingView