- Miners might have been selling BTC because of their reduced revenue.

- However, long-term investors were confident in BTC.

Bitcoin [BTC] has managed to push its price in the last 24 hours, but it has still been struggling under the $60k mark. The recent price uptick couldn’t help change the sentiment of Bitcoin miners as they continued to sell their holdings.

Will miners’ latest sell-off push BTC down towards $54k again?

Bitcoin miners are selling BTC

The bulls took control in the last 24 hours as they pushed BTC’s price up by over 3%. At the time of writing, BTC was trading at $56,675.42 with a market capitalization of over $1.11 trillion.

However, the miners still chose to sell BTC while its price gained bullish momentum.

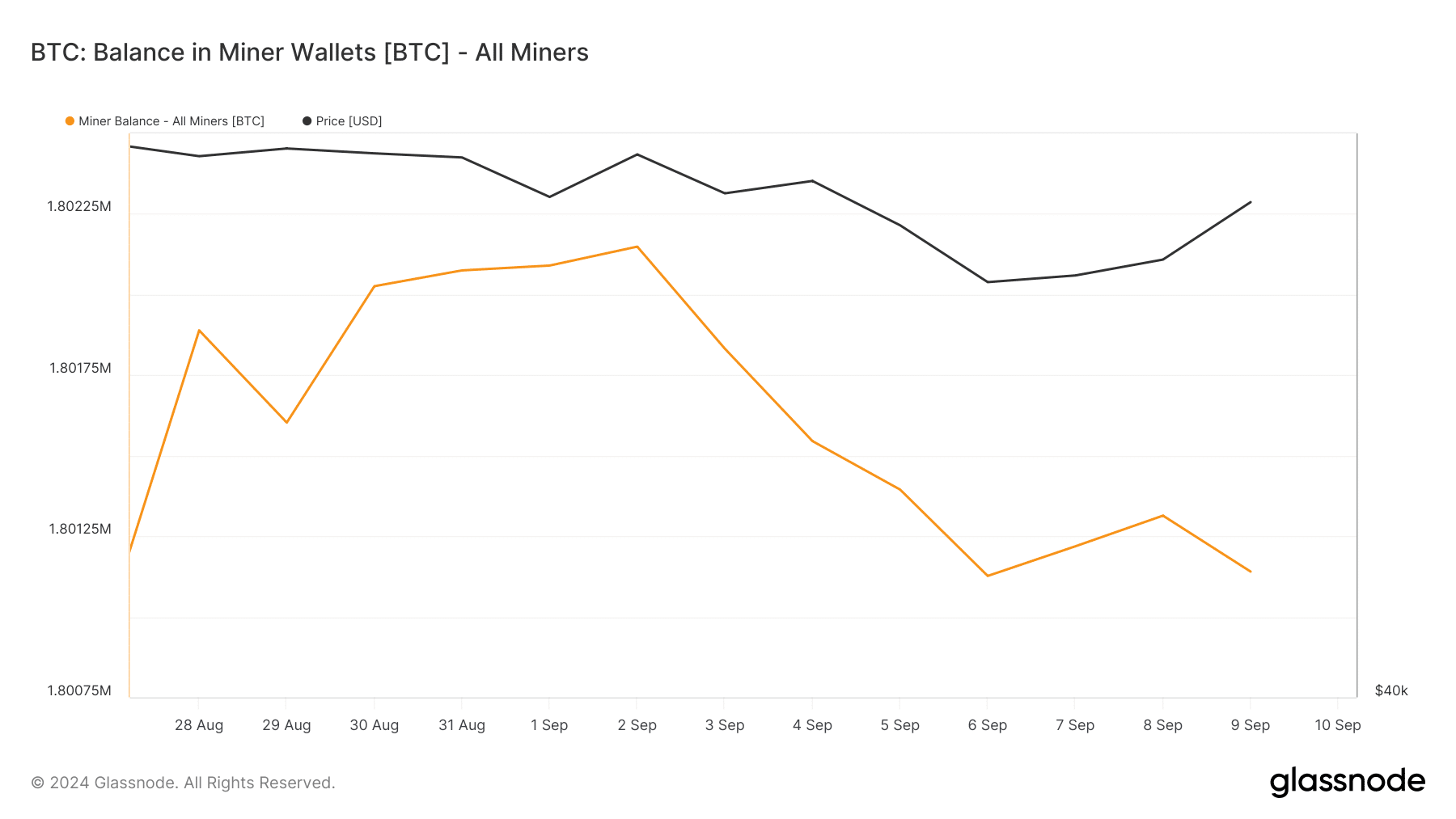

As per AMBCrypto’s look at Glassnode’s data, balance in miner wallets fell to 1.8 million BTC. This suggested that miners were not expecting the king coin’s price to rise further.

Source: Glassnode

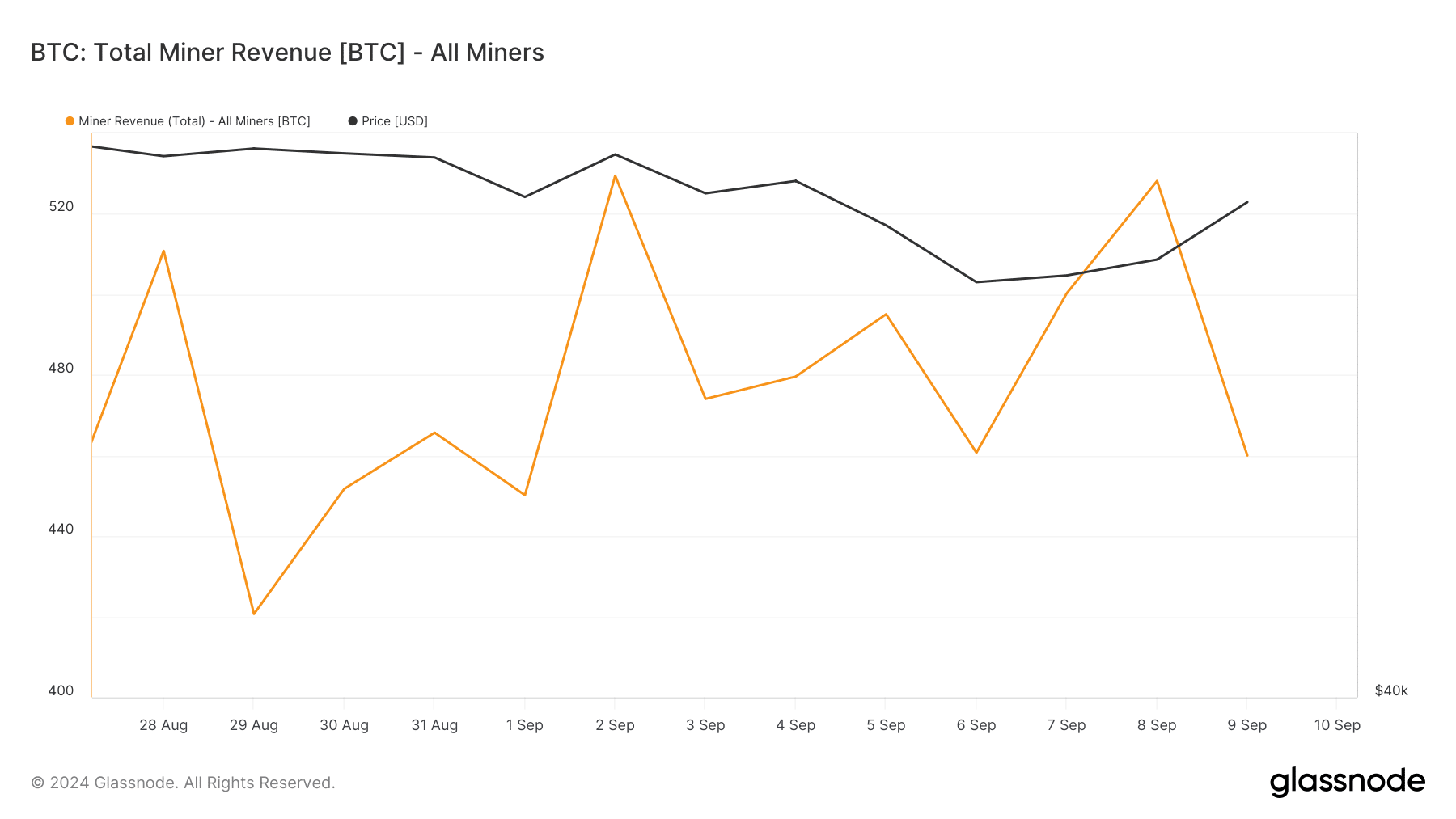

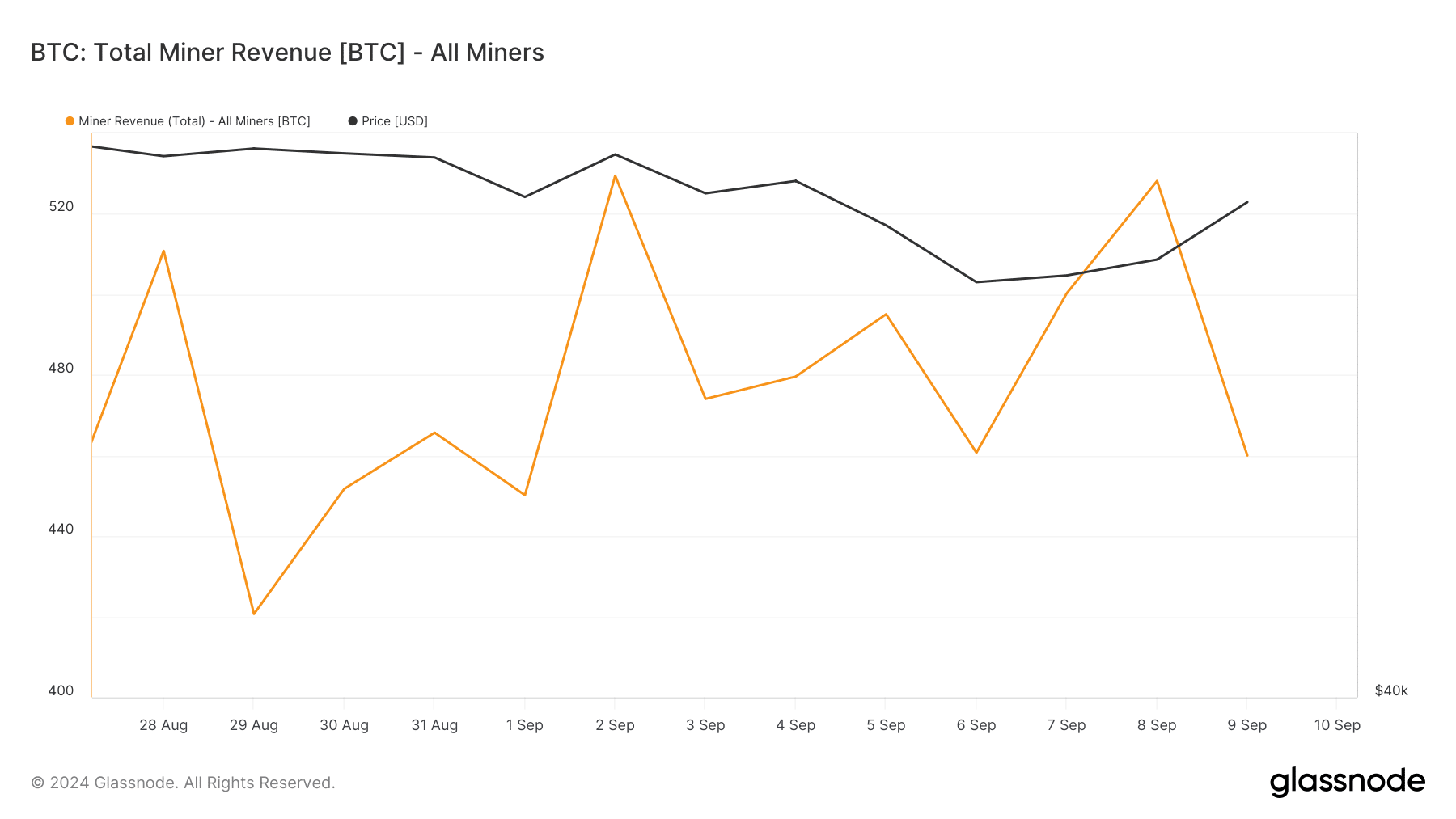

We then checked miners’ revenue to find out what motivated them to sell. Interestingly, their revenue also registered a decline in the recent past.

Source: Glassnode

The drop in miners balance and revenue also affected the blockchain’s hashrate. As per Coinwarz’s data, BTC’s hashrate dropped in the last few days. At press time, the number stood at 712.57 EH/s.

Will BTC’s price be affected?

There is a chance that this behavior of miners will affect BTC’s price as sell pressure generally results in price corrections.

In fact, Ali, a popular crypto analyst, recently posted a tweet revealing that if BTC drops to $54.2k, then it will face a liquidation worth $24 million.

Therefore, AMBCrypto checked more data sets to find other red flags.

As per our analysis of CryptoQuant’s data, BTS’s aSORP was red, meaning that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, the rest of the metrics looked bullish. For instance, Bitcoin’s Binary CDD revealed that long-term holders’ movement in the last seven days was lower than the average. They have a motive to hold their coins.

Source: CryptoQuant

Apart from that, things in the derivatives market also looked pretty optimistic, as the coin’s taker’s buy/sell ratio was green. This indicated that buying sentiment was dominant among futures investors.