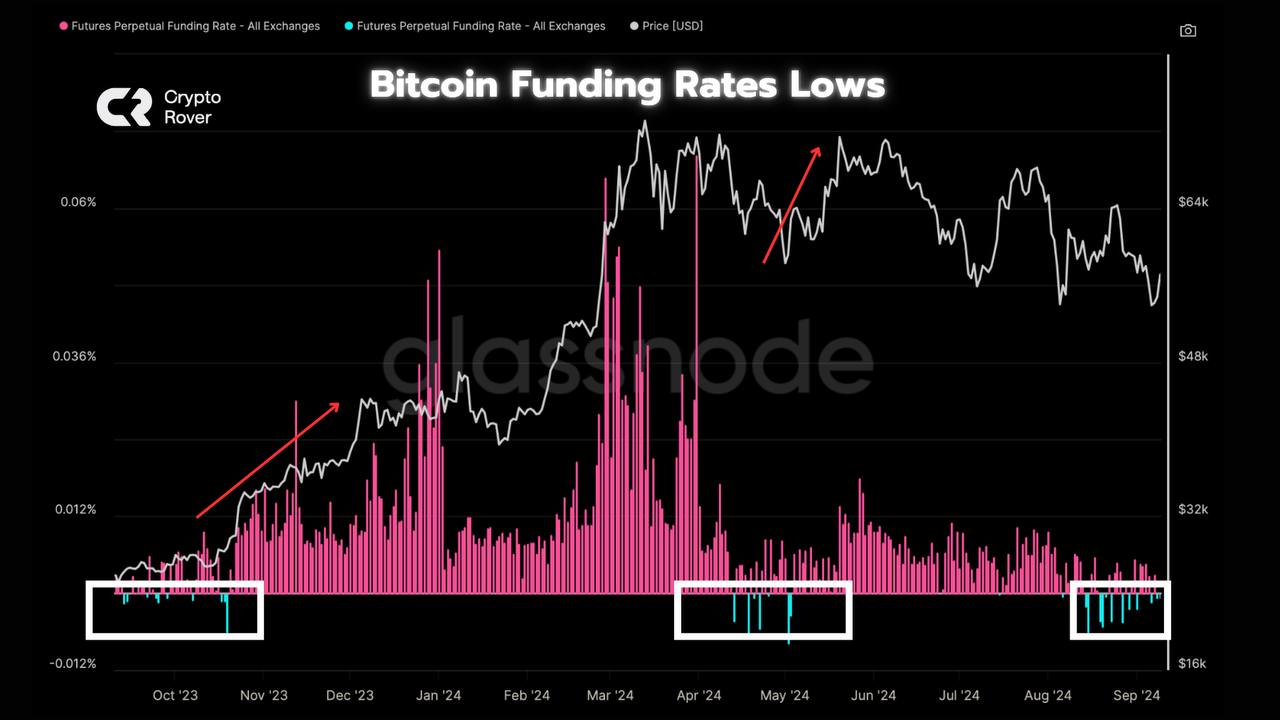

- The Bitcoin Funding Rates turned negative at press time — the sign of a potential reversal.

- Bitcoin is set to make new highs if it breaks through the $65K mark.

Bitcoin’s [BTC] Funding Rate turned negative, signaling a shift in market sentiment. Traders are becoming cautious, with the long/short ratio dipping to 1.61 at press time.

Futures show stronger selling pressure, as CVD Futures stand at -1.91 billion. Historically, when Funding Rates turn negative, it has often indicated market bottoms.

Bitcoin Funding Rate drops hints

Since 2018, when the 30-day average Funding Rates turned negative, Bitcoin saw an average 90-day return of 79%, according to K33 Research.

Negative Funding Rates can often lead to short squeezes, pushing the price higher as bearish positions fuel a rebound.

Source: Glassnode

Looking at Bitcoin’s price action, particularly the BTC/USDT pair, it appears that the market is showing signs of change.

Bitcoin was trading near a critical resistance level of $58,000 at press time. If the king coin breaks and sustains above this level, it could push the price higher toward $65,000.

Historically, negative Funding Rates signal an upcoming surge, and the recent strong candles suggest the move may happen soon.

If Bitcoin fails to break the $58,000 level, the price could revisit lower key levels, potentially reaching liquidity around the $50,000 psychological level.

Source: TradingView

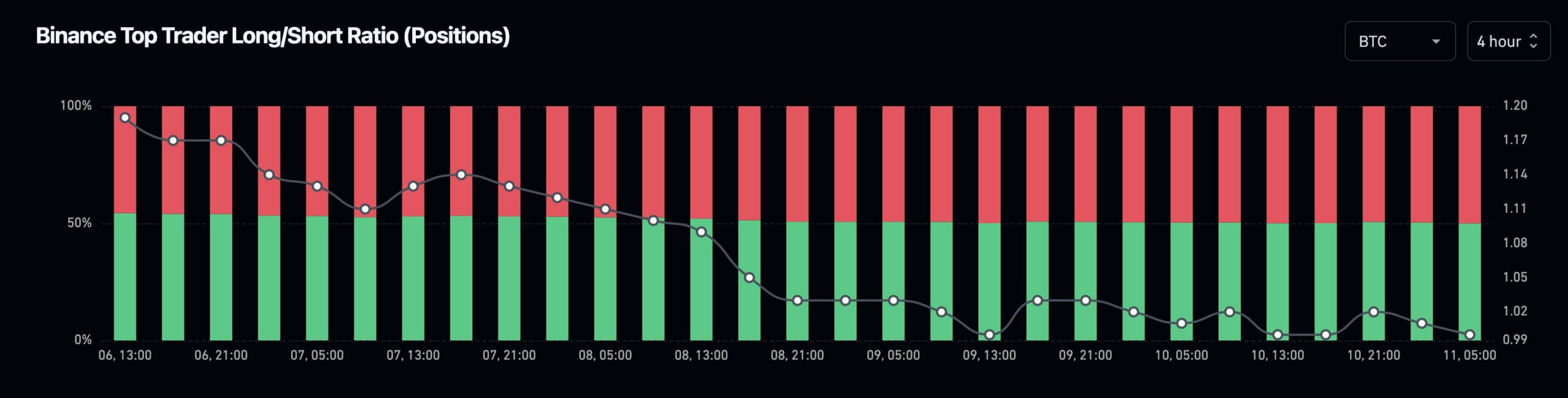

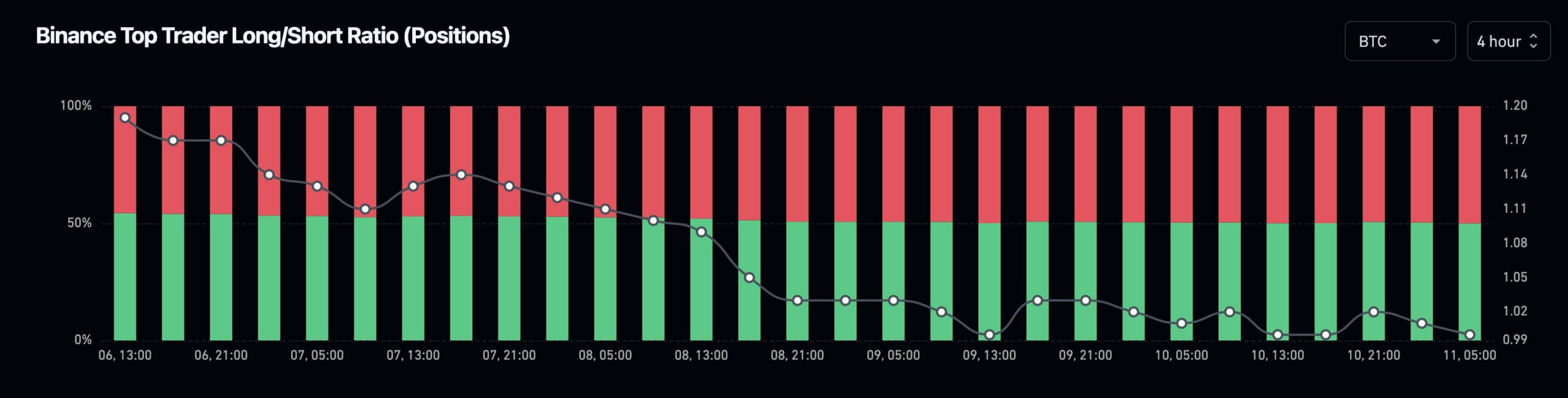

Exchanges’ top traders turn long

Further analysis revealed that top traders on exchanges like Binance [BNB] have switched to long positions, signaling confidence in a higher BTC price.

These top traders, often considered smart money, are buying Bitcoin while the market remains fearful. The shift in long trades supports the idea that Bitcoin is set for a price surge, with data indicating a bullish outlook.

Source: X

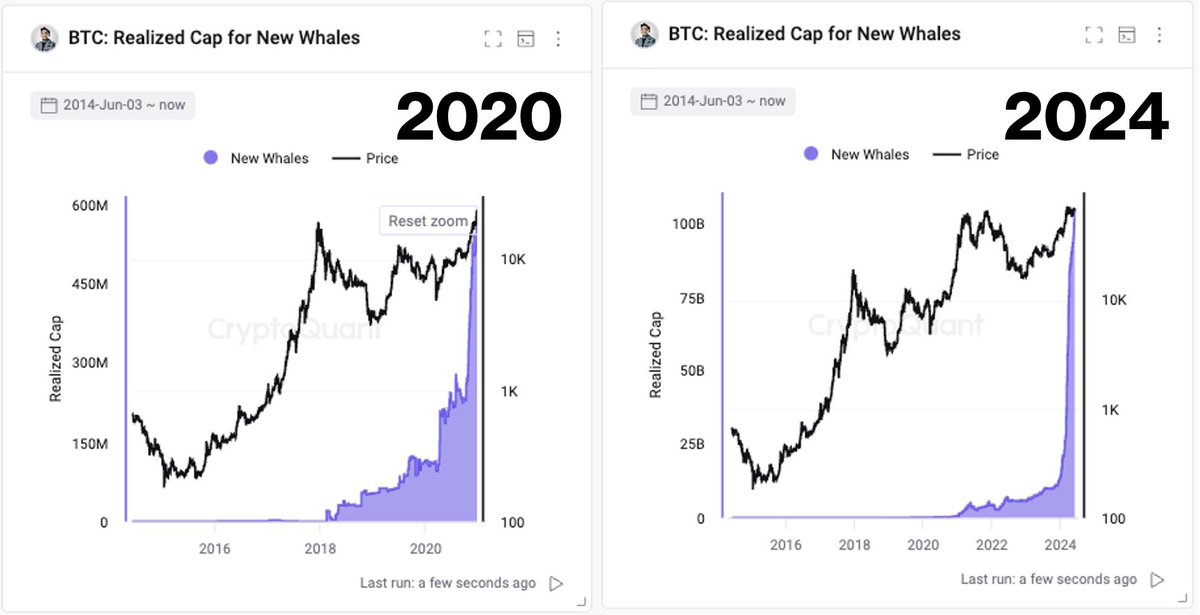

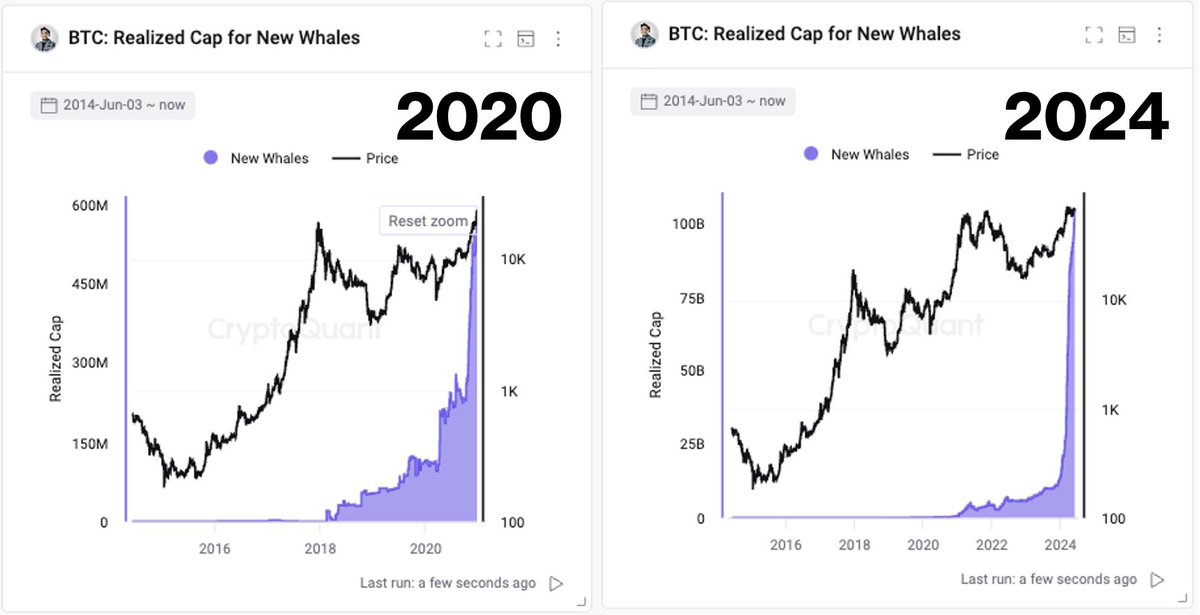

Whales buy aggressively

New Bitcoin whales were also making aggressive moves, further affirming the bullish sentiment.

New whales in 2024 have multiplied their holdings by 150 times compared to those from 2020, a time when Bitcoin experienced a major bull run.

This increase in whale activity signaled stronger adoption of Bitcoin in this cycle compared to previous ones.

Source: CryptoQuant

The influx of new whale investments suggested that the negative Funding Rates may trigger a rally toward a new all-time high, possibly by the end of this year or early next year, as it did at the beginning of 2024.

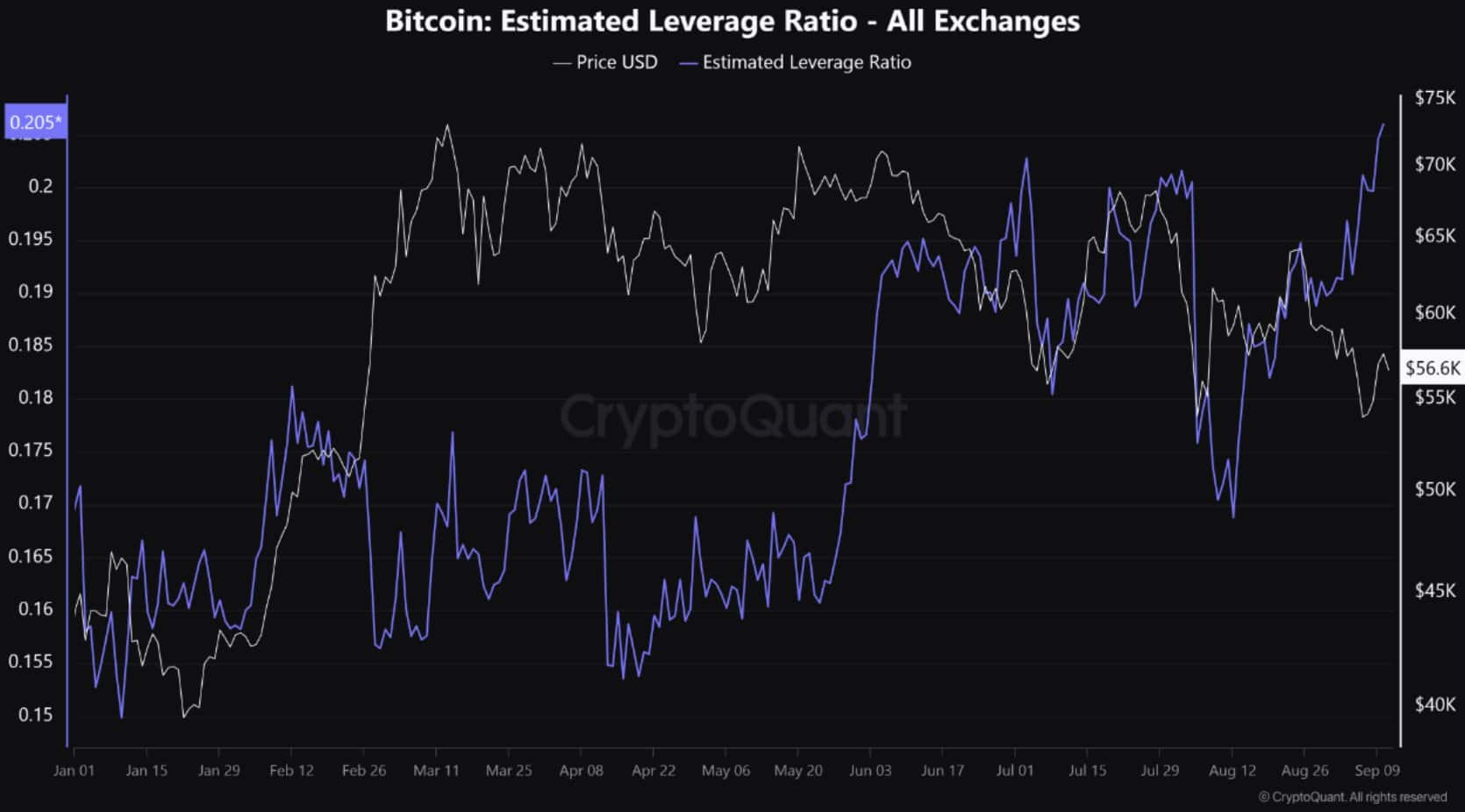

Estimated leverage ratio

Lastly, Bitcoin’s Estimated Leverage Ratio has reached a new year-to-date high. This increase in leverage in the derivatives market indicated that investors are becoming more active.

The growing engagement in derivatives is likely to boost Bitcoin’s price action over the long term.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As more traders use leverage, the chances of significant price movements increase, pushing Bitcoin’s price higher in the near future.

With the current market conditions and key indicators aligning, Bitcoin seems poised for higher gains.

Source: CryptoQuant