- PENDLE could soar by 20% to the $5 level and even higher.

- PENDLE’s future open has increased by 4.5% over the past 24 hours, and 7.8% over the past four hours.

Over the past few days, BitMEX ex-CEO and co-founder Arthur Hayes has been in the spotlight, following his significant selloff of Pendle [PENDLE] tokens.

On the 24th of September, Hayes once again dumped a massive 240,000 PENDLE tokens, worth $957,600, according to on-chain analytics firm Lookonchain.

Arthur Hayes’s PENDLE sell-off

Lookchain noted that Arthur Hayes dumped over 1.83 million PENDLE tokens, worth $6.58 million at an average price of $3.58, in the last four days.

Given this significant selloff, it appears that PENDLE may experience a substantial price decline in the coming days.

The potential reason behind this significant token selloff is Hayes’s interest in another token.

Recently, an on-chain analytic firm made a post on X, revealing that Hayes had accumulated a substantial 62.258 million Aethir (ATH) tokens, worth $4.08 million, over the past month.

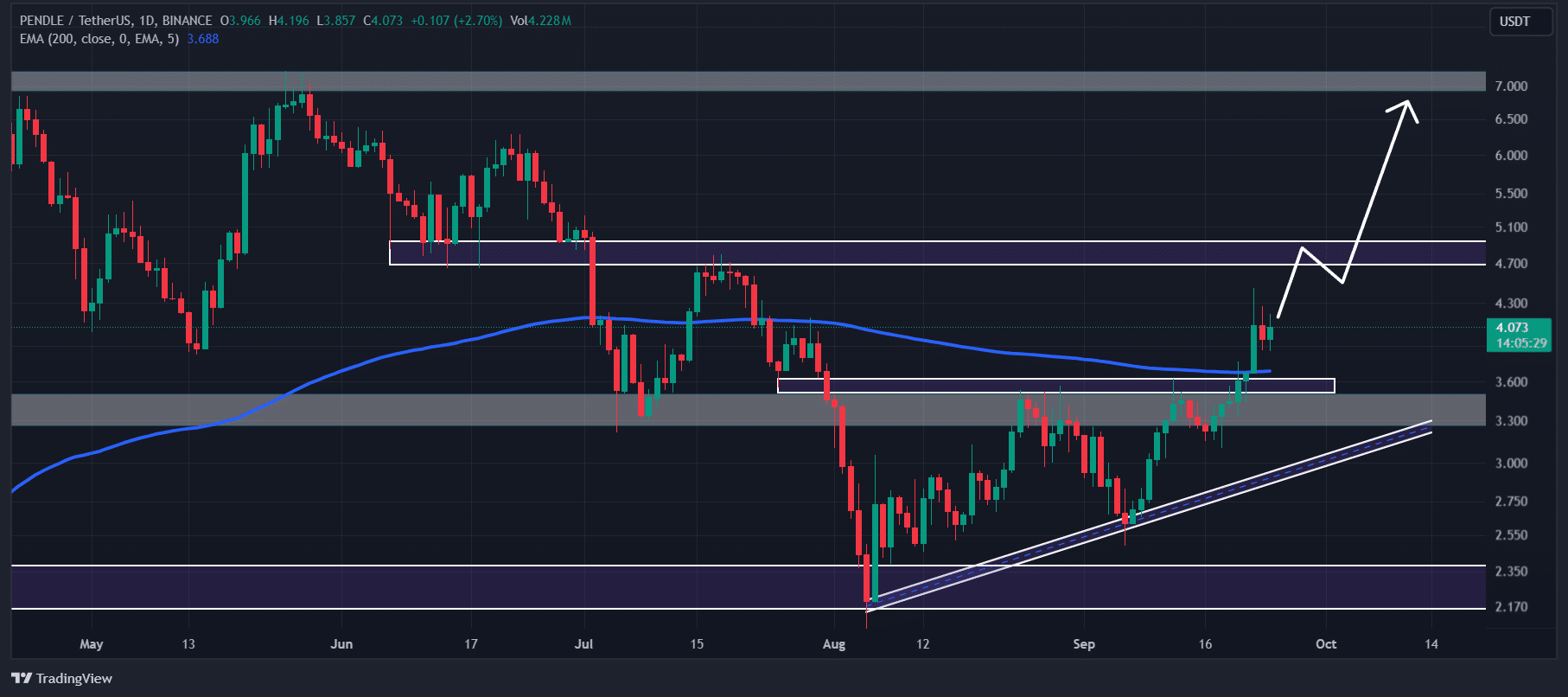

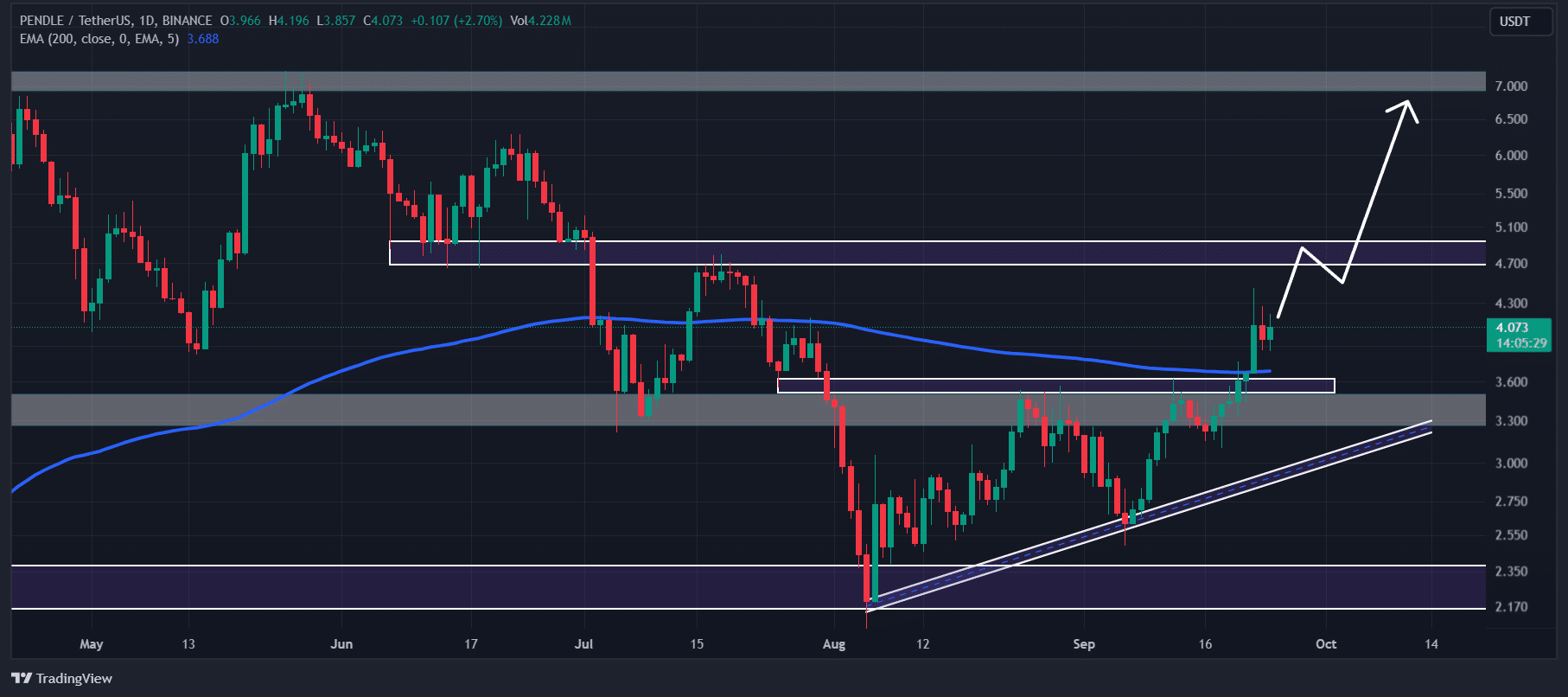

PENDLE’s price action and key levels

According to AMBCrypto’s technical analysis, despite the significant selloff, PENDLE still appeared bullish.

Based on historical price momentum and current market sentiment, there is a strong possibility that the PENDLE price could soar by 20% to the $5 level and even higher in the coming days.

Source: TradingView

Additionally, it is trading above the 200 Exponential Moving Average (EMA) on a daily time frame.

The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

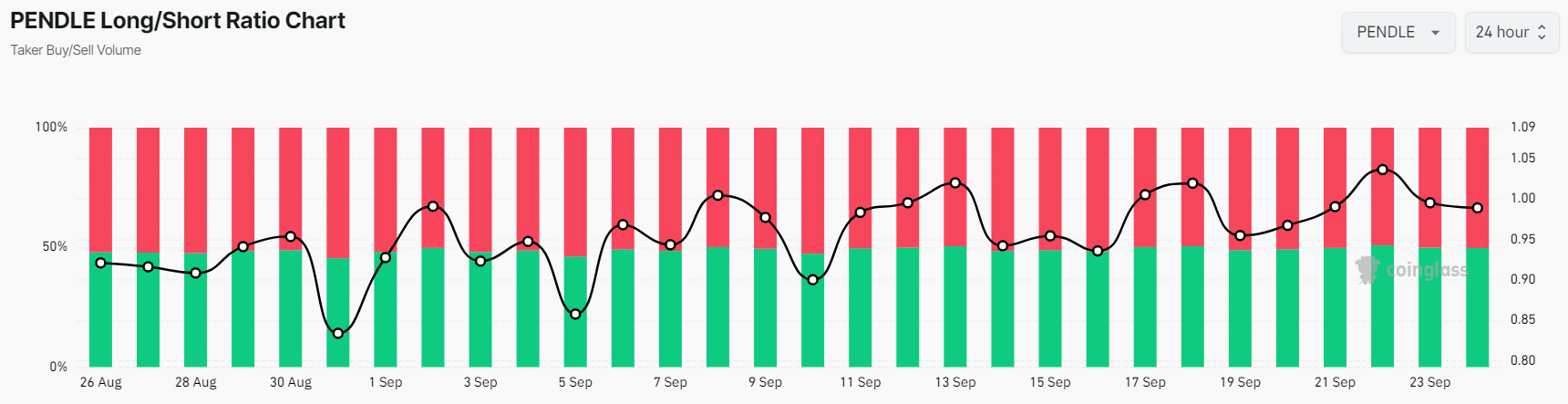

Bullish on-chain metrics

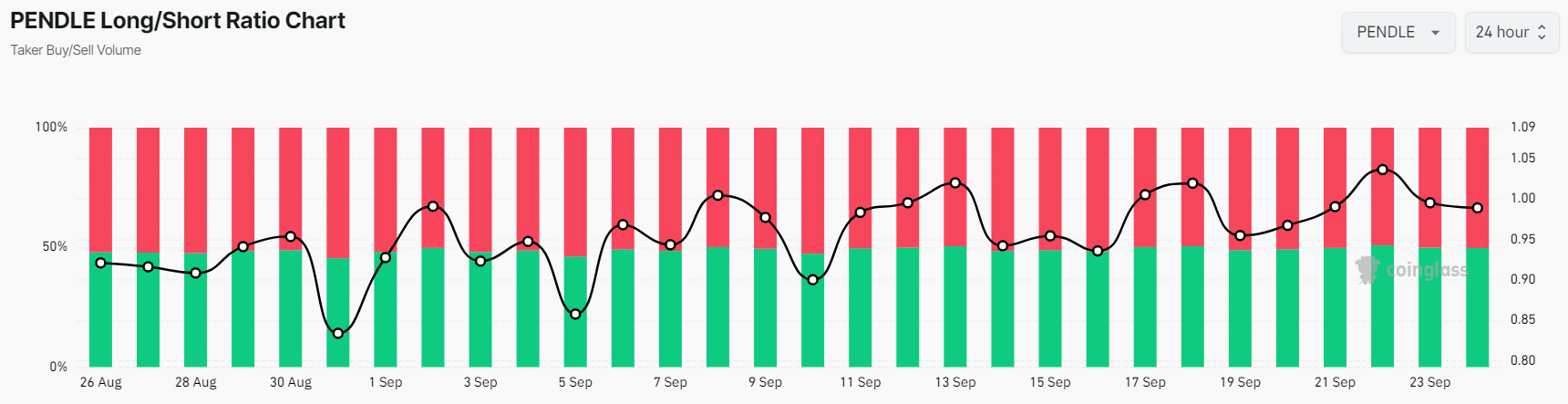

This bullish outlook is further supported by on-chain metrics. According to the on-chain analytic firm Coinglass, PENDLE’s Long/Short Ratio was 1.005 at press time, indicating bullish market sentiment among traders.

Source: Coinglass

The coin’s future open has increased by 4.5% over the past 24 hours, and 7.8% over the past four hours. This rising Open Interest suggests that traders are potentially building more long positions.

Read Pendle’s [PENDLE] Price Prediction 2024-2025

Traders and investors often use the combination of rising open interest and a Long/Short ratio above 1 while building long positions. At press time, 50.5% of top traders held long positions, while 49.5% held short positions.

PENDLE was trading near $4.14 at this time after a price surge of over 3.5% in the last 24 hours. During the same period, its trading volume dropped by 51%, indicating lower participation from traders amid this selloff.