- Global traders going long on dogwifhat despite price decline.

- Positive aggregated predicted funding rates indicate WIF buyers are willing to pay sellers.

dogwifhat [WIF] gained traction in its first cycle and now stands at the forefront of the anticipated “memecoin supercycle.” This supercycle, which is expected to last until 2025, has stirred excitement.

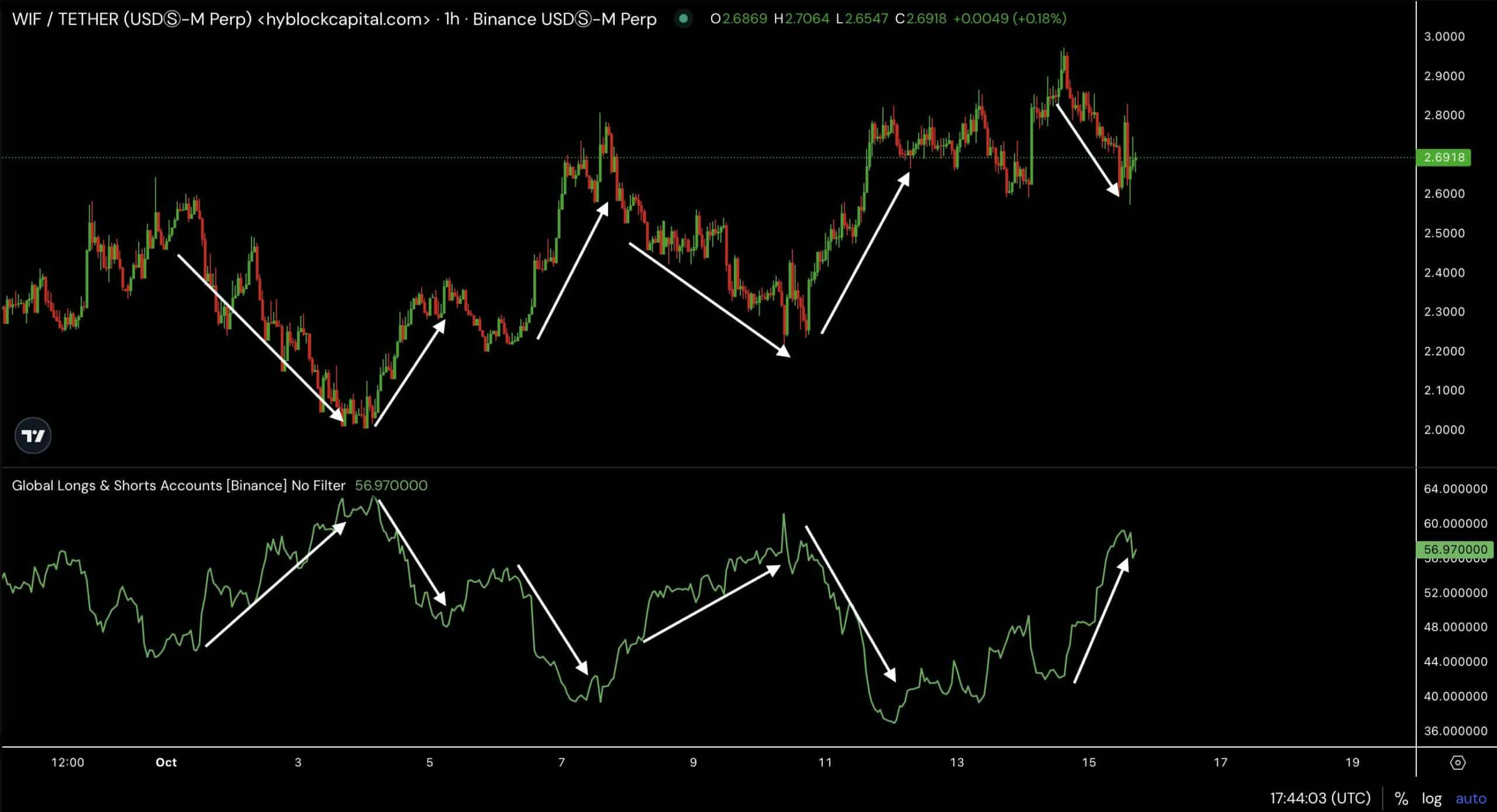

However, while WIF recently experienced a surge, there are signs of potential short-term correction. The Global Accounts Long% and WIF’s price are moving inversely, with a correlation of -0.92.

This could suggest that WIF was temporarily overvalued.

This mismatch between traders’ expectations and actual price movement hinted at over-optimism in the market. Traders may be heavily long, expecting a rise in WIF’s price, but the reality shows a price decline.

Source: Hyblock Capital

This divergence typically suggests a need for correction or continued bearishness before WIF resumes its upward trajectory.

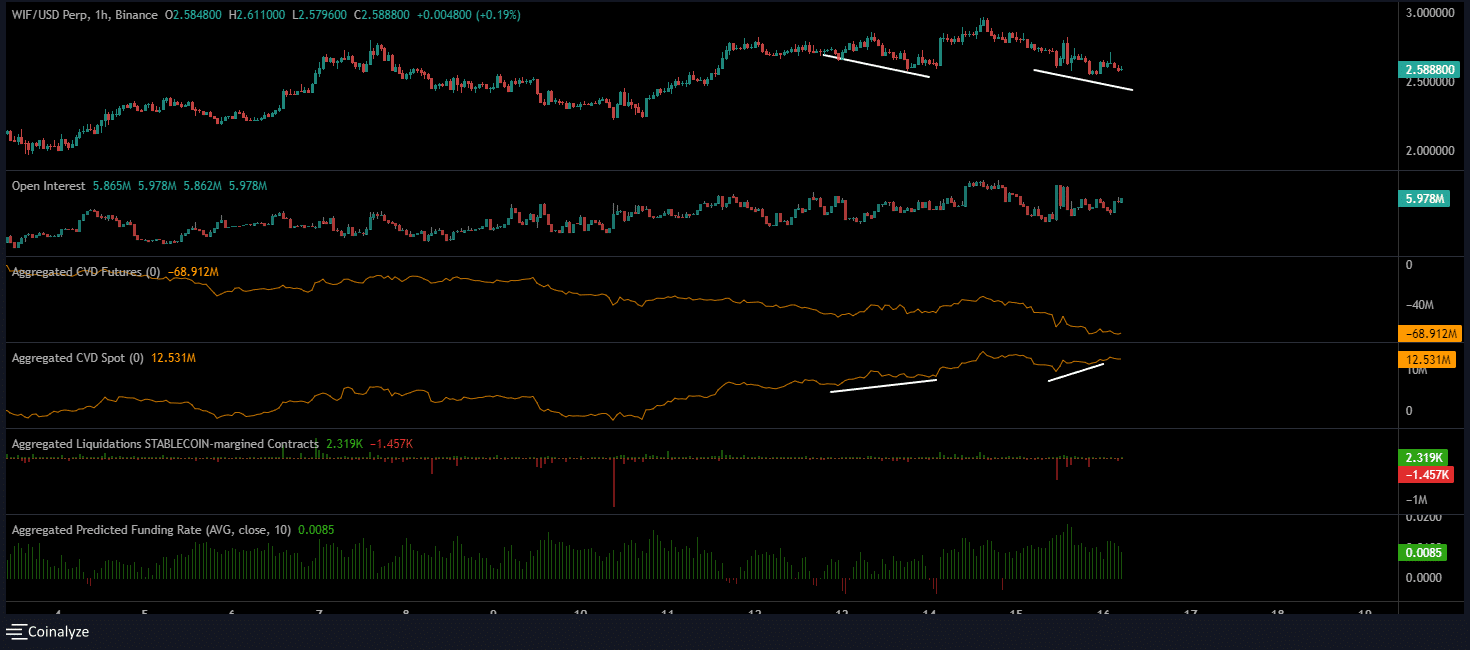

WIF price action in correction phase

To evaluate how low WIF might drop before bouncing back, a closer look at the price action is essential, especially for traders eyeing a strategic entry point.

WIF was trading at $2.50 at press time, but the formation of a head and shoulders pattern on the 15-minute timeframe indicated that WIF could drop further before rebounding.

Based on this pattern, WIF is likely to approach the $2 level soon.

Additionally, the stochastic RSI, below the neutral zone at press time, further supported the likelihood of a brief correction before a potential bounce.

Source: TradingView

Despite this dip, buyers have shown resilience, stepping in after every drop, which suggests accumulating interest in WIF and confidence that a rebound is imminent.

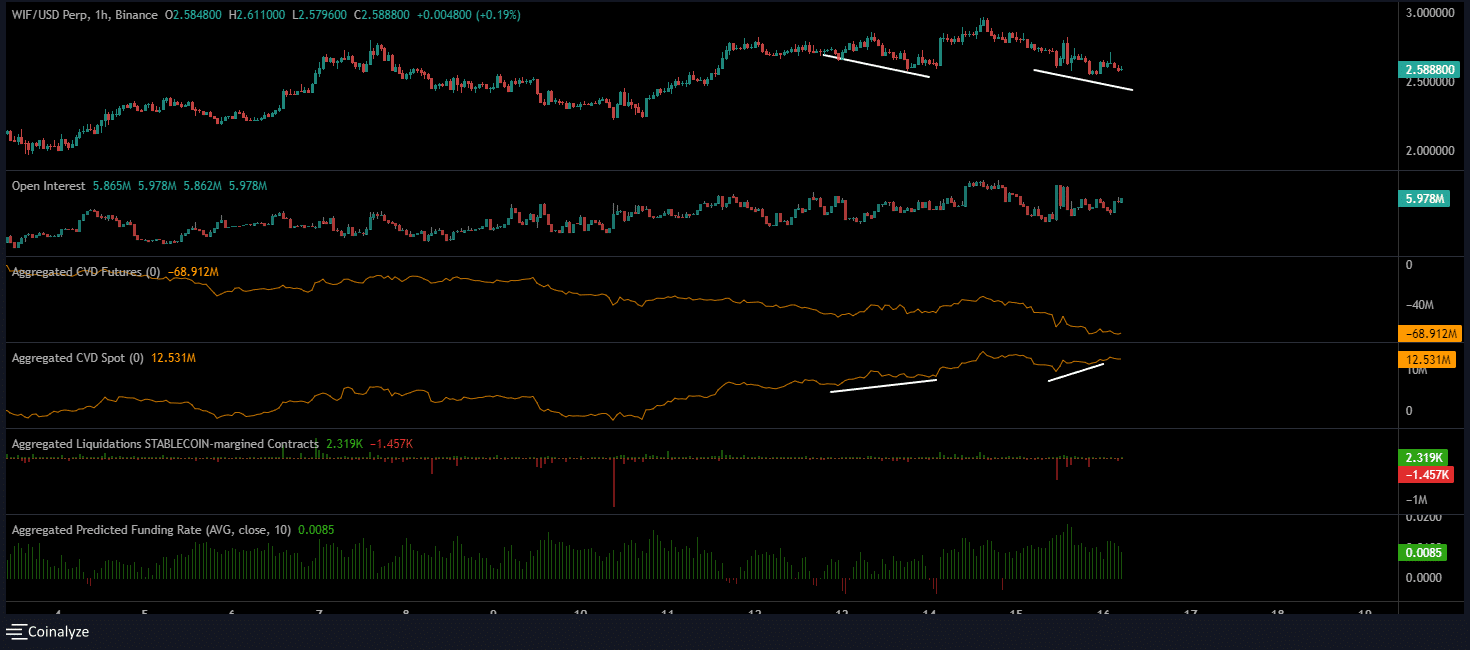

Sellers stave off

AMBCrypto’s look at WIF’s Open Interest (OI), aggregated Funding Rates, and cumulative volume delta (CVD) confirmed that sellers were not exerting significant pressure.

There is no considerable passive spot bidding, implying that Open Interest was favoring WIF. Positive aggregated predicted Funding Rates showed that buyers were paying sellers, reinforcing bullish sentiment.

The rising CVD in spot trading added to this confluence, suggesting that dogwifhat was poised for a bounce.

Source: Coinalyze

Additionally, the decline in CVD for Futures presented another divergence signal. So, an upward move could unfold soon.

Read dogwifhat’s [WIF] Price Prediction’s [WIF] 2024–2025

Divergences typically offer traders an opportunity to go long, aligning with the idea that dogwifhat may bounce back after this correction.

As Bitcoin [BTC] hovers around $67K, the broader market’s bullish sentiment could further fuel WIF’s recovery, potentially driving its price higher and closer to new highs.