- ETC eyes a rally as bullish momentum builds.

- Short position takers dominate 54.6% of the market supply, but increasing social activity could tip the balance.

Ethereum Classic [ETC] has caught the market attention as its structure hints at potential upside momentum.

Ethereum Classic’s reveals an encouraging uptrend according to the daily chart, though it is currently in a retracement phase.

This pullback to the local support level provides an excellent opportunity for the bulls to step in and push the price upward again.

Zooming in on the 4-hour chart, ETC is beginning to pick up bullish momentum, suggesting that a potential breakout could be on the horizon.

Source: Tradingview

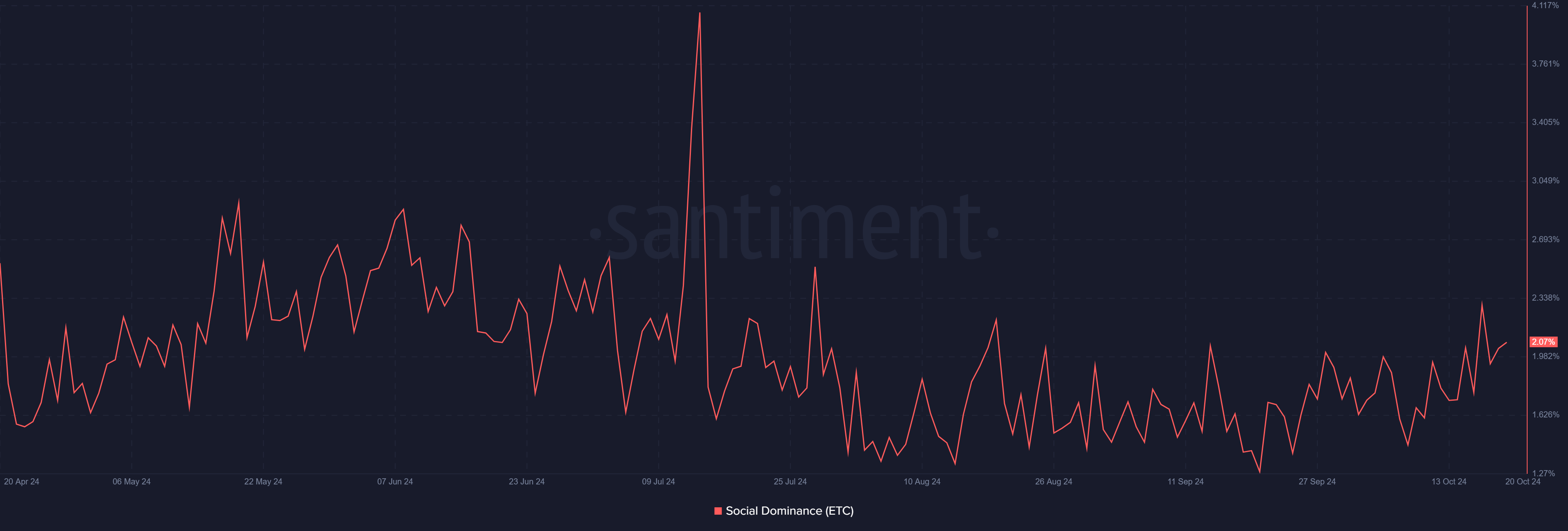

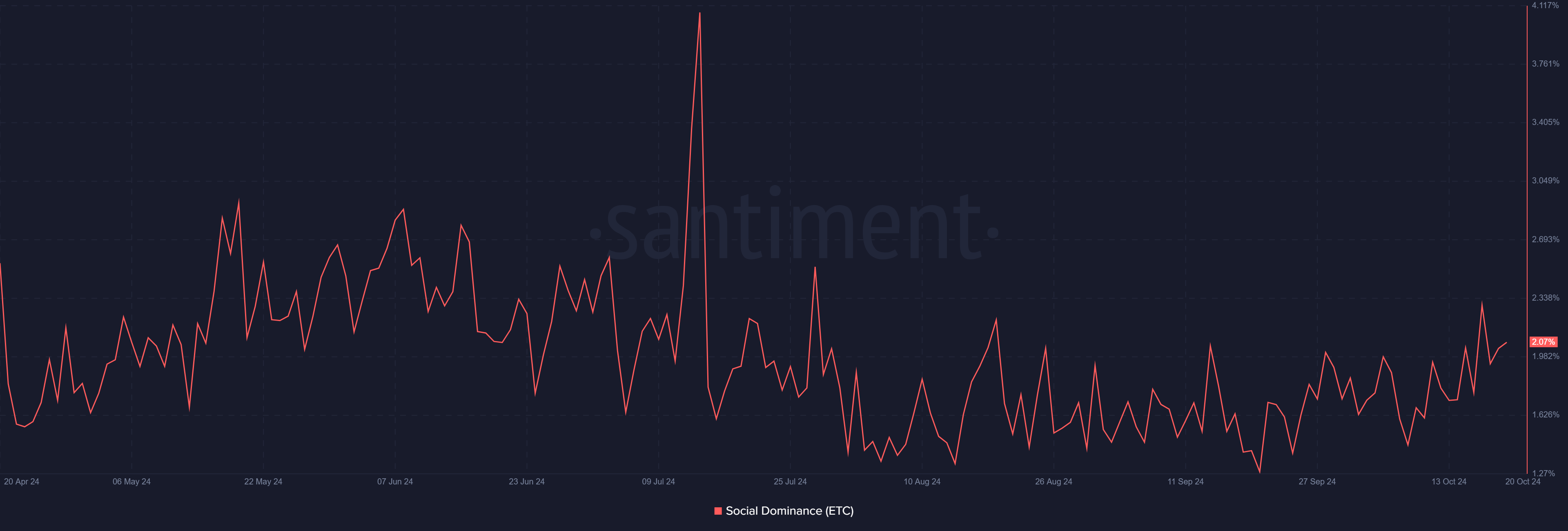

Social dominance on the rise

One key metric that supports this positive outlook is Ethereum Classic’s social dominance. As per our analysis of the Santiment data, ETC social dominance currently stands at 2.07% and steadily increasing.

Social dominance is a major determinant of market sentiment, and its upward trend often correlates with price rallies.

As more eyes start turning towards ETC, this activity could theoretically lead to a well-fed upward movement, driving it way higher.

Source: Santiment

ETC short traders still control the market

Interestingly, 54.6% of the Ethereum Classic market is presently controlled by the short position takers.

A short positioning this high only goes to expose that a great deal of traders are expecting a drop in price. However, if ETC keeps building on its bullish momentum, then a short squeeze may occur, which may drive prices higher.

Source: Coinglass

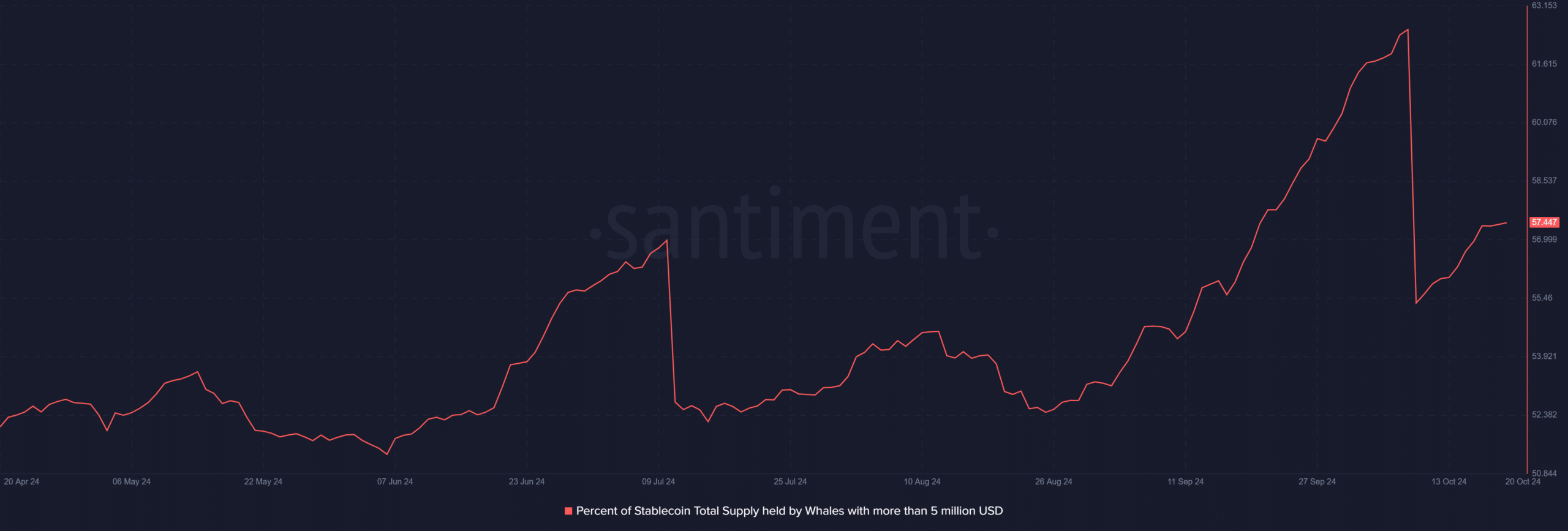

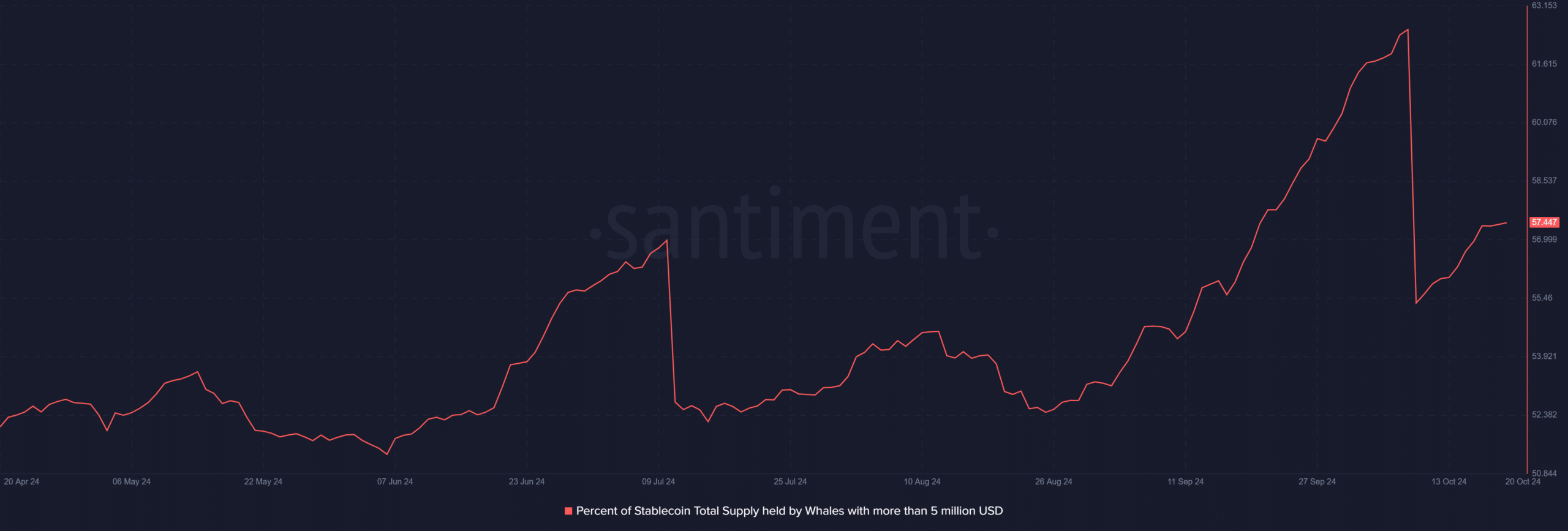

ETC whales on the move

Adding to the aforementioned positive sentiments, the whale activity has spiked since 9th October. The percentage of supply by whales with over 5 million currently stands at 57%.

This suggests that in case of any movement by the whales, ETC could make a significant move.

Source: Santiment

Read Ethereum Classic’s [ETC] Price Prediction 2024–2025

With growing social dominance and a bullish bias visible on both the daily and 4-hour charts, Ethereum Classic looks apt to witness a rally.