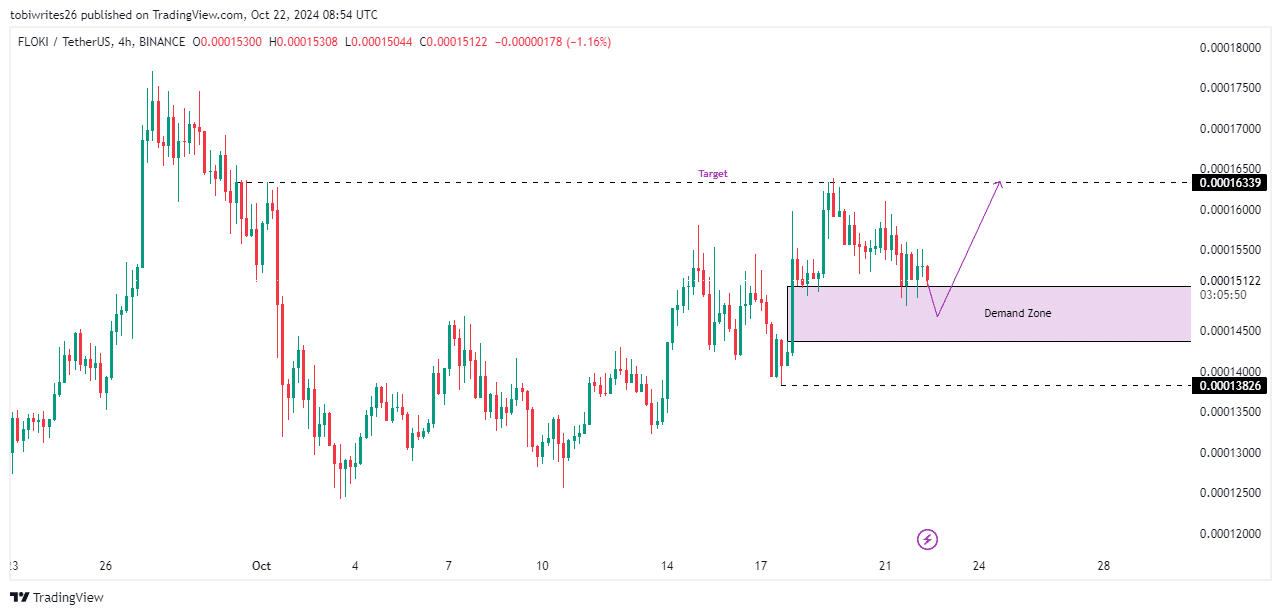

- FLOKI remained in a month-long ascending channel on the daily time frame, which could limit its ability to break higher.

- A key factor to watch is the memecoin’s reaction to the 4-hour demand zone.

Floki’s [FLOKI] current market movement reflected its struggle with a major resistance level, resulting in a 3.53% drop over the last 24 hours and a slight 0.08% dip for the week.

Although its monthly performance has taken a hit, it still clung to a 14.59% gain.

A shift in this bearish outlook could reverse FLOKI’s fortunes—but will it happen? AMBCrypto analyzes FLOKI’s next move.

No clear signal for a rally just yet

Although FLOKI has entered this critical demand zone, its response has been sluggish, falling short of the typical strong rebound usually seen at such levels.

Due to this underwhelming reaction, FLOKI may continue its decline, possibly dropping deeper into the mid-range of the demand zone between 0.00015055 and 0.00014377.

If this zone holds, FLOKI’s next move could be a climb back toward the resistance at 0.00016339—the level that triggered its recent sharp drop.

With enough buying pressure, FLOKI could break through this resistance, defying the constraints of the ascending channel.

On the other hand, if the demand zone fails, FLOKI could fall further to 0.00013826. A break below this level would confirm continued trading within its month-long ascending channel.

Source: TradingView

Traders eyeing a lower FLOKI

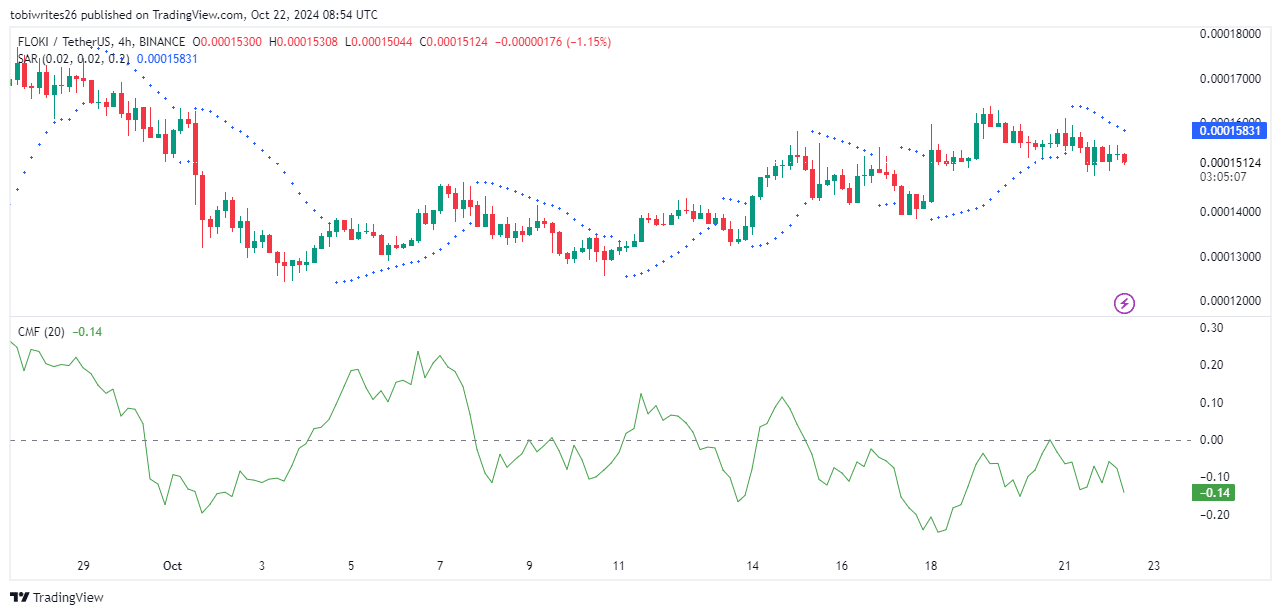

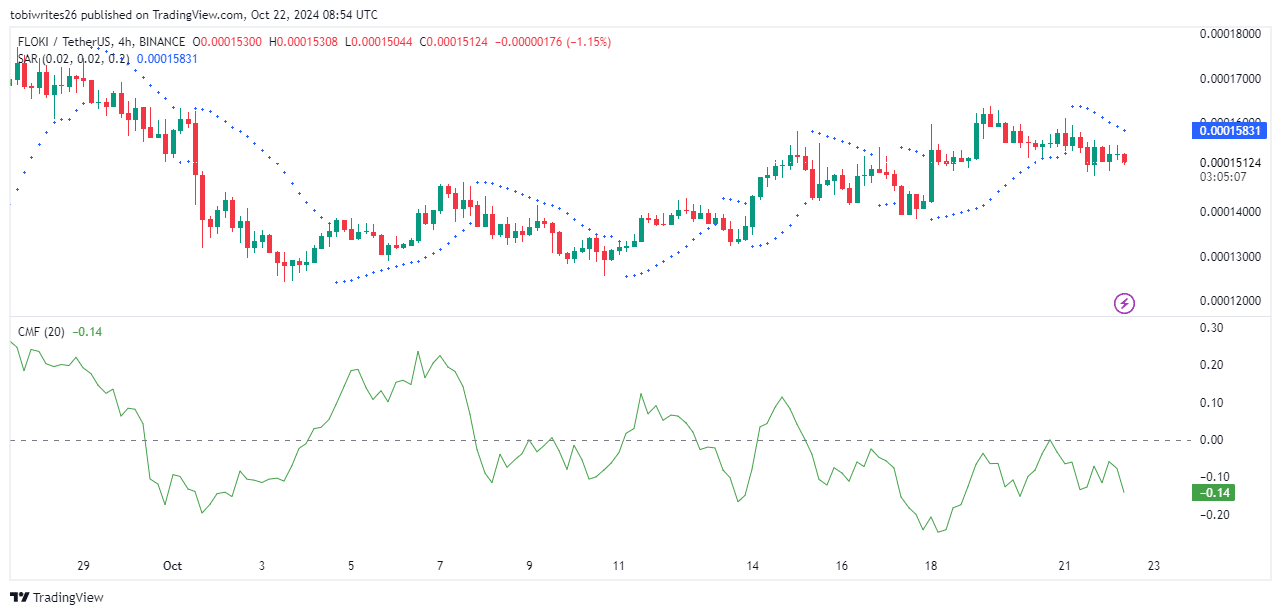

Recent trading activity suggests that traders are positioning for FLOKI to drop, potentially to the mid-range of the demand zone.

This outlook is supported by the Parabolic SAR (Stop and Reverse), which uses dots to track price direction. Currently, the dots are appearing above FLOKI’s price, indicating a bearish trend.

Additionally, the Chaikin Money Flow has been steadily declining, signaling a significant outflow of liquidity from the asset. This suggests that FLOKI could lose further value as selling pressure increases.

Source: TradingView

Traders align for a drop

Data from Coinglass further supported this bearish sentiment, showing that FLOKI is likely to fall from its current price.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

The Open Interest (OI) has sharply declined by 7.57%, now sitting at $19.83 million. This indicates that more short positions have been opened, with traders betting on a price drop.

If this trend continues, FLOKI may experience a further decline before any potential bullish reversal.