- TRX has recorded a 4% price increase over the past seven days.

- TRX’s large transaction surged to over 500 in the last trading session.

In the past week, TRON [TRX] has emerged as one of the few cryptocurrencies to gain value amidst a broader market decline.

While most digital assets have struggled to maintain value, TRON and Solana [SOL] have shown upward momentum, with TRX recording a price increase of over 4%.

This rise underscores TRON’s solid position and as other assets search for support.

Increased large transactions on the TRON network

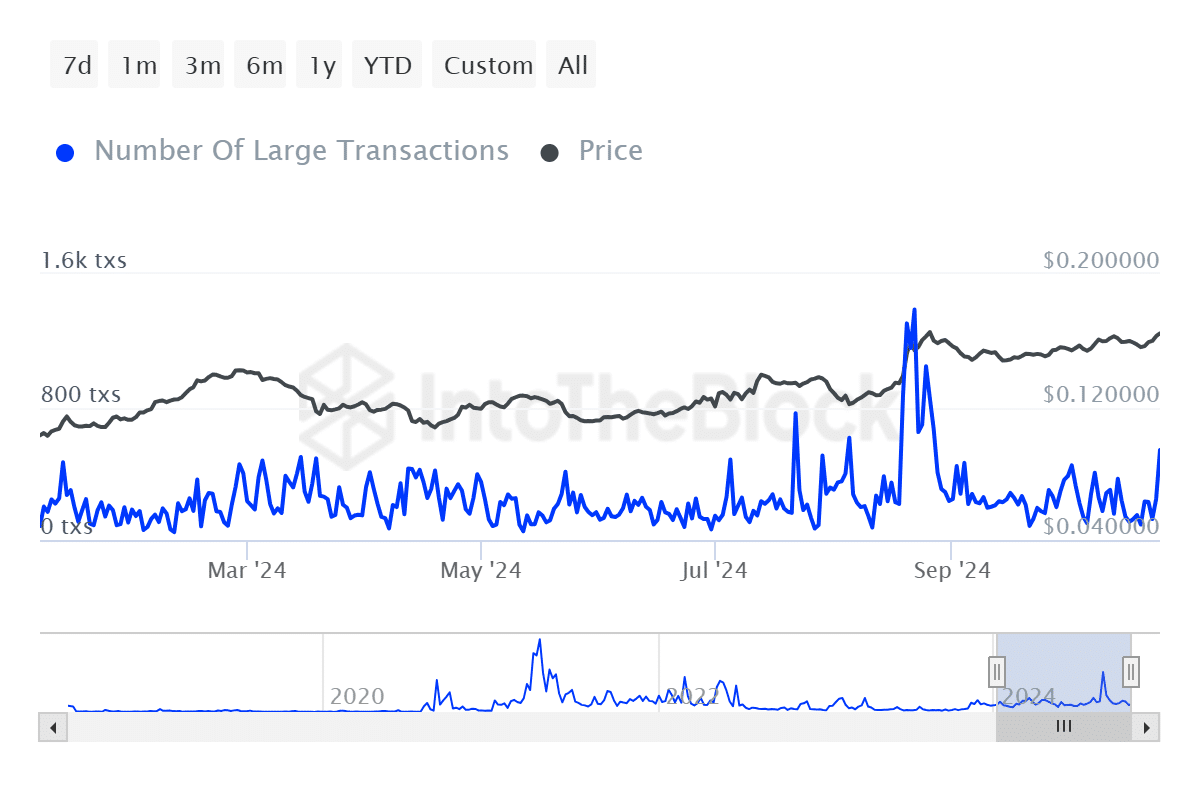

One significant contributor to TRON’s recent positive trend is the rise in large transactions on its network.

This surge indicates heightened activity among major investors or institutions, reflecting increased confidence in TRX’s potential.

According to data from IntoTheBlock, the number of substantial TRX transactions reached 542 on the 25th of October, a level not seen since August.

Large transactions are often associated with strategic accumulation or growing optimism from investors. This suggests that TRX is attracting considerable attention even as the broader market faces challenges.

Source: IntoTheBlock

Strong technical indicators reflect positive sentiment

From a technical standpoint, TRON’s daily chart highlighted a strong upward trend, with prices consistently staying above both the 50-day and 200-day moving averages.

Additionally, the Relative Strength Index (RSI) is at approximately 64. The trend signals a healthy positive momentum without entering overbought territory.

Source: TradingView

This balanced RSI level suggests that TRX’s price still has room for potential growth without facing significant pullbacks due to overextension.

The strong technical indicators appear to be reinforcing investor confidence, boosting its upward trajectory even as the market faces broader challenges.

Increasing network value

TRON’s Network Value to Transactions (NVT) ratio has also fluctuated notably. The fluctuation highlights changes in transaction volume relative to its market capitalization.

Generally, a lower NVT ratio indicates a healthy balance between the asset’s value and network activity. This is often considered a bullish sign.

Is your portfolio green? Check out the TRON Profit Calculator

Recent spikes in TRX’s NVT ratio suggest that market participants are increasingly engaging with the network, likely driven by strategic interest.

As TRON sustains its growth momentum, these metrics highlight a favorable trend, emphasizing its positive performance in a week that saw overall declines.