- Bitcoin Cash rally stalled after a slight drop in 24 hours but bullish signs on its one-day chart persisted.

- Large transaction volumes surged by 123% in 24 hours as open interest hit a two-month high.

Bitcoin Cash [BCH] traded at $379 at press time, after a slight 0.58% drop in 24 hours. Despite the recent decline, BCH is still up by around 7% in the last seven days.

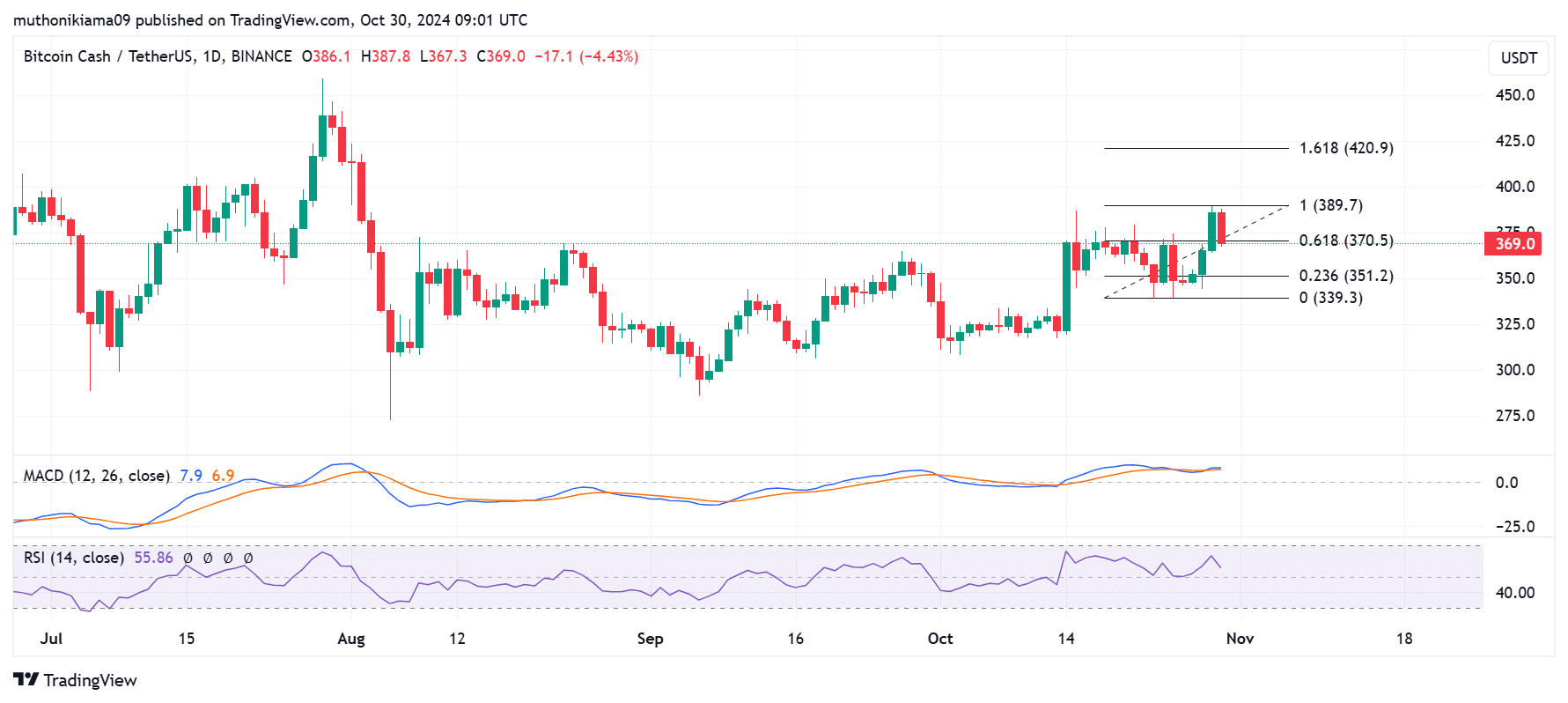

On the one-day chart, BCH was showing several bullish signs. The Moving Average Convergence Divergence (MACD) was above the signal line suggesting that an uptrend was underway.

The Relative Strength Index at 56 also suggested that buyers were slightly more than sellers. However, this line is tipping south, which could precede a trend reversal if there is no fresh uptick in buying activity.

Source: TradingView

Bitcoin Cash managed to flip resistance at the 0.681 Fibonacci level ($370) but failed to sustain the gains. If it flips this resistance again and the uptrend continues, the next target for the altcoin will be the 1.618 Fibonacci level (420).

A look at on-chain metrics suggests that this rally is likely as whale activity is increasing while network activity is rising.

Whale activity & network growth could fuel the rally

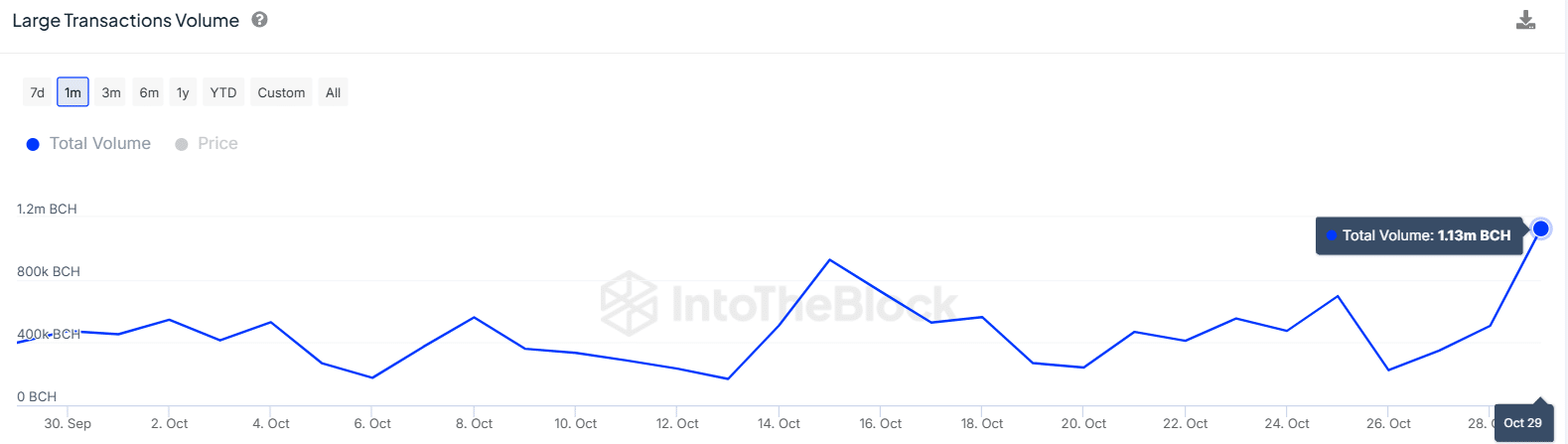

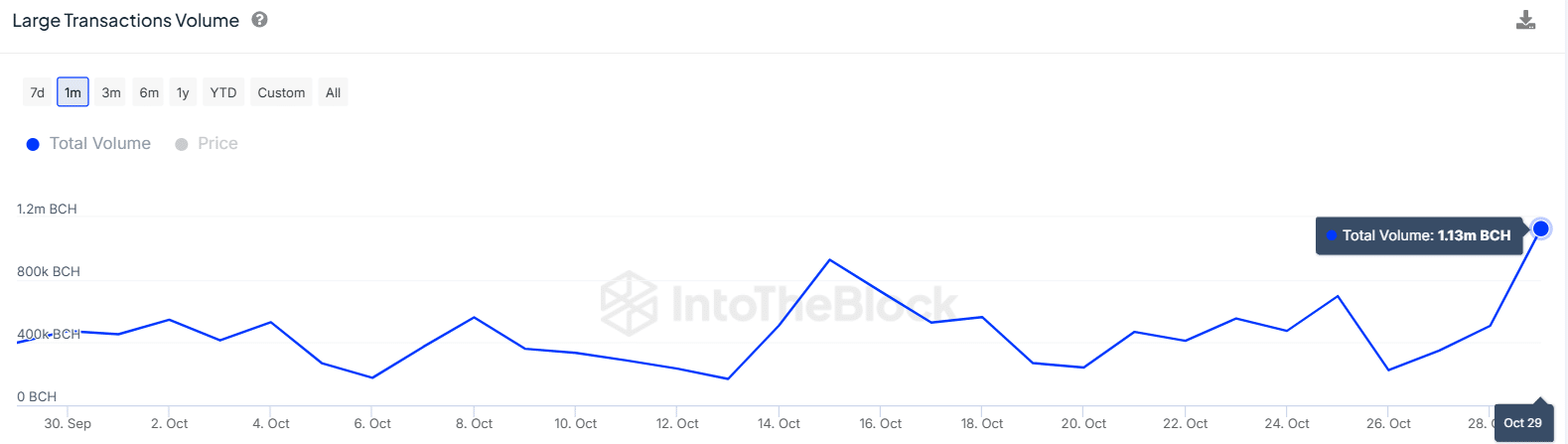

Data from IntotheBlock shows that volumes for BCH transactions exceeding $100,000 have increased to 1.13M. This represents a 123% increase in just 24 hours.

Source: IntoTheBlock

Whale activity can be a catalyst for price growth. However, whales control only 16% of BCH’s supply, suggesting that for the price to make a significant recovery, interest from the retail market is also needed.

At the same time, the Bitcoin Cash network has experienced rising usage. In 24 hours, the active addresses jumped from 45,000 to 121,000.

A rise in active addresses can fuel the rally as it shows rising interest in a token. If these addresses are actively trading BCH, the price is set for volatile movements.

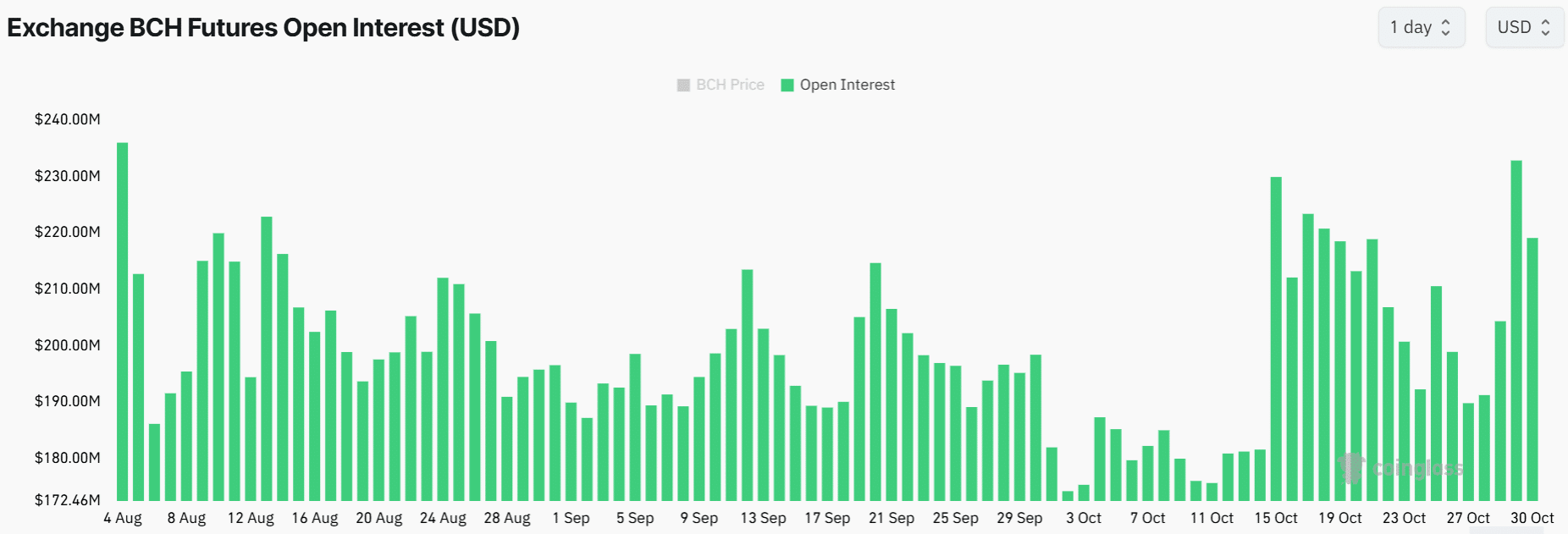

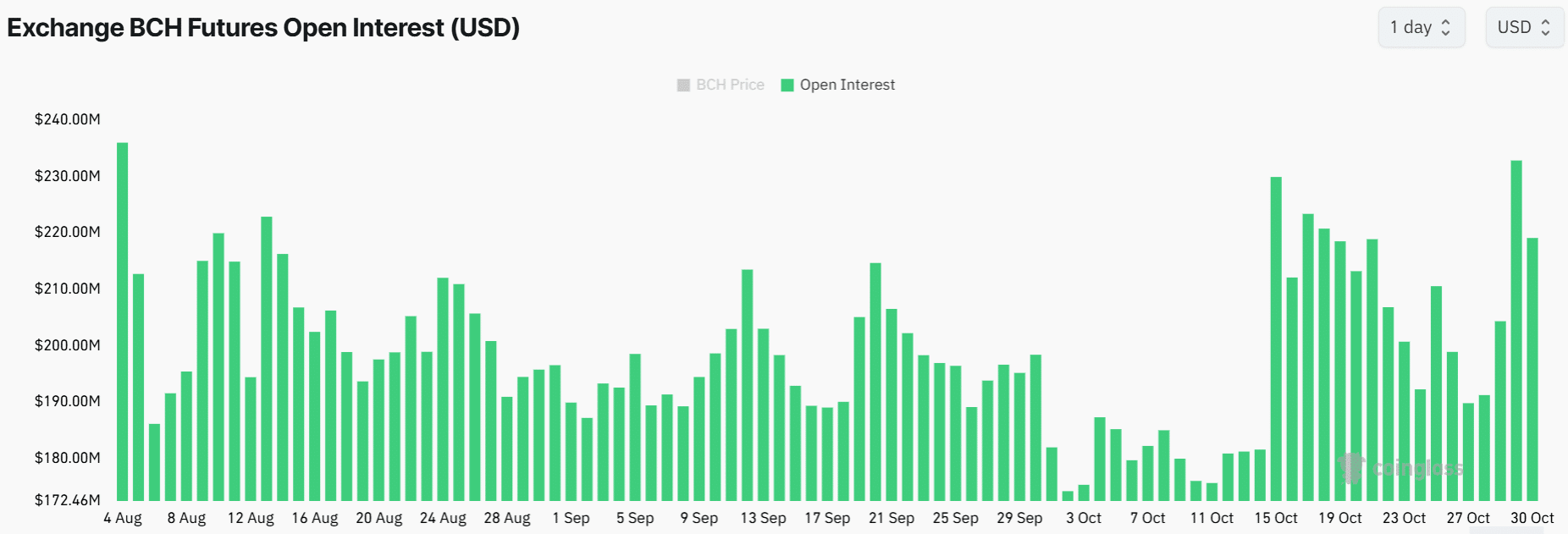

Bitcoin Cash open interest surges

BCH open interest recently surged to $232 million, the highest level in more than two months. This increase points towards increasing market participation by traders as they open and add to their existing positions on BCH.

Source: Coinglass

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

The rising open interest also coincided with positive funding rates, which show an influx in long positions. This underscores a strong conviction among derivative traders that BCH could extend its gains.

The bullish sentiment in the derivatives market, rising whale activity, and network usage make a bullish case for BCH and the likelihood of a rally past $400.