- Analyst foresees Bitcoin mirroring gold’s rally.

- Meanwhile, the possibility of a dip also remains.

Bitcoin’s [BTC] ‘to the moon’ dreams appear to be turning into reality. The king coin has hit a new all-time high of over $75,000, breaking its previous peak of $73,777, set in March.

This milestone arrives amidst intense build-up around the U.S. presidential election, which has fueled renewed interest in the crypto sphere.

At press time, BTC exchanged hands at $74,318.73. As per CoinMarketCap data, this marked an 8.82% gain over the past 24 hours and a remarkable year-over-year increase of 112.88%.

Will Bitcoin follow gold?

While BTC’s record high has fueled market optimism, the question remains: will the bull run last?

Tony Severino, crypto analyst and founder of CoinChartist, recently shared his insights regarding BTC’s prospects on X. He suggested that Bitcoin’s trajectory may mirror gold.

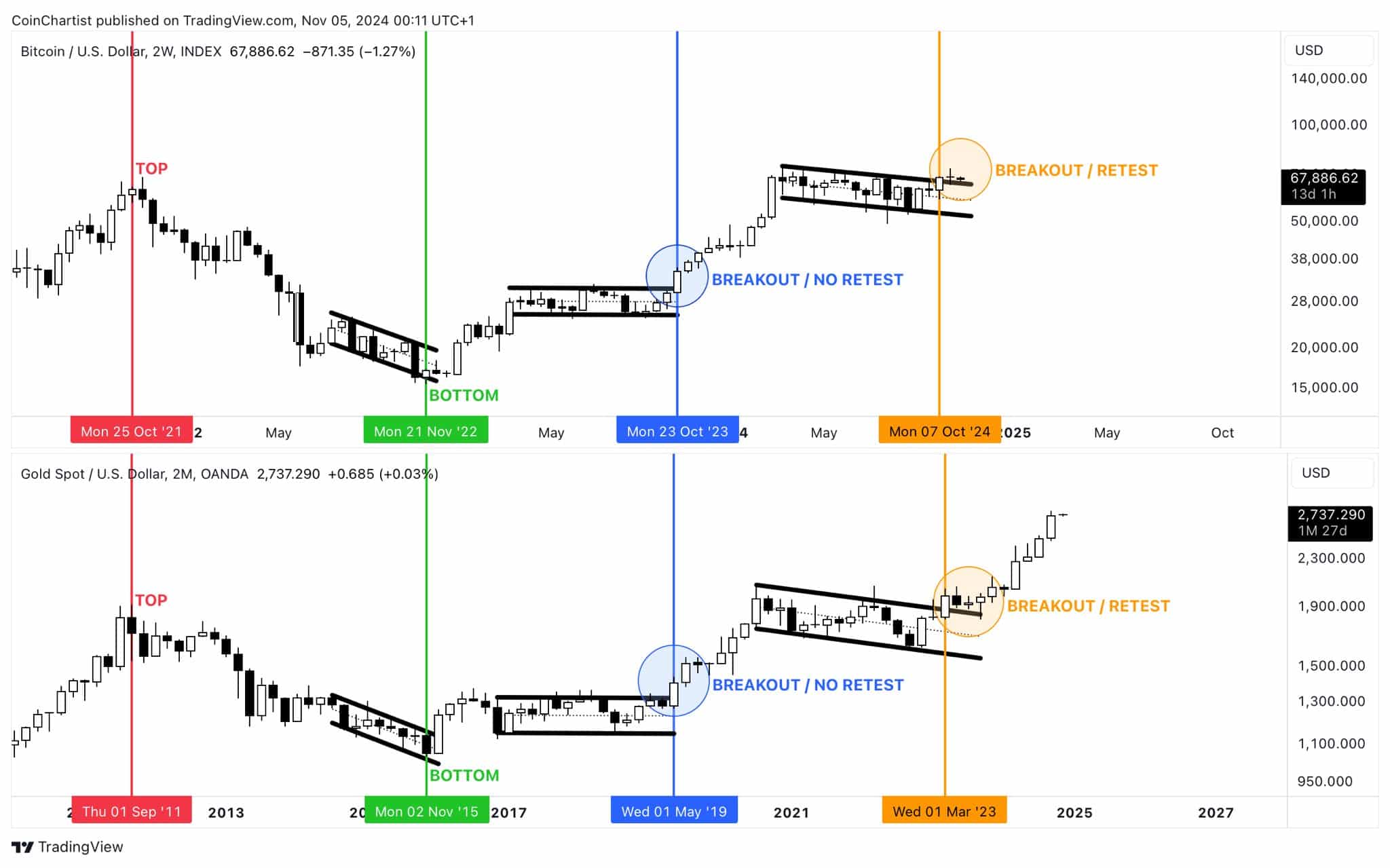

The correlation between Bitcoin and gold, according to Severino’s analysis, stemmed from their cyclical price actions. Both assets show recurring “top,” “bottom,” and “breakout” patterns, with Bitcoin seemingly following gold’s lead by several years.

Source: Tony Severino/X

Thus, if Bitcoin indeed follows gold’s historical pattern, the recent breakout could signify the beginning of a bullish phase similar to gold’s March 2023 rally.

He noted that while Bitcoin might require more retesting, it is nonetheless on an upward path. Severino stated,

“New ATHs by EOY, $100K+ by end of Q125.”

Furthermore, the analyst predicted a possible retest at the $64,500 level before Bitcoin rallies further.

BTC to $188k?

Amid these bullish projections, Matthew Sigel, Head of Digital Assets Research at VanEck, also projected a potential post-election surge in Bitcoin’s price. Drawing comparisons with the 2020 post-election rally on X, Sigel remarked:

“If this cycle produces half of 2020’s returns, that’s 175% or $188k.”

AMBCrypto recently reported that post-election periods have often marked the start of significant bull runs for Bitcoin. So, the prediction might not be too far-fetched.

Bitcoin vs gold

While Bitcoin’s latest milestone was celebrated by many, not all shared the enthusiasm. Peter Schiff, founder of Schiff Gold and an outspoken critic of Bitcoin, noted on X that while the cryptocurrency may have hit a record high in dollar terms, it remained about 27% below its peak value when measured against gold.

He attributed Bitcoin’s rise partly to speculative bets that Trump, perceived by some as a pro-Bitcoin candidate, could return to the White House. However, Schiff remained skeptical, stating that:

“That’s one of several promises Trump will break.”

As the crypto community anticipates the next moves, BTC’s rally continues to fuel debate, with some viewing it as a sign of more gains to come, while others remain cautious.

The coming months will reveal whether this surge is the start of a sustained bull market—or simply another peak along Bitcoin’s journey.