- Bitcoin’s exchange flow and reserves have fallen over the last few months

- A move towards $100k remains very likely for world’s largest cryptocurrency

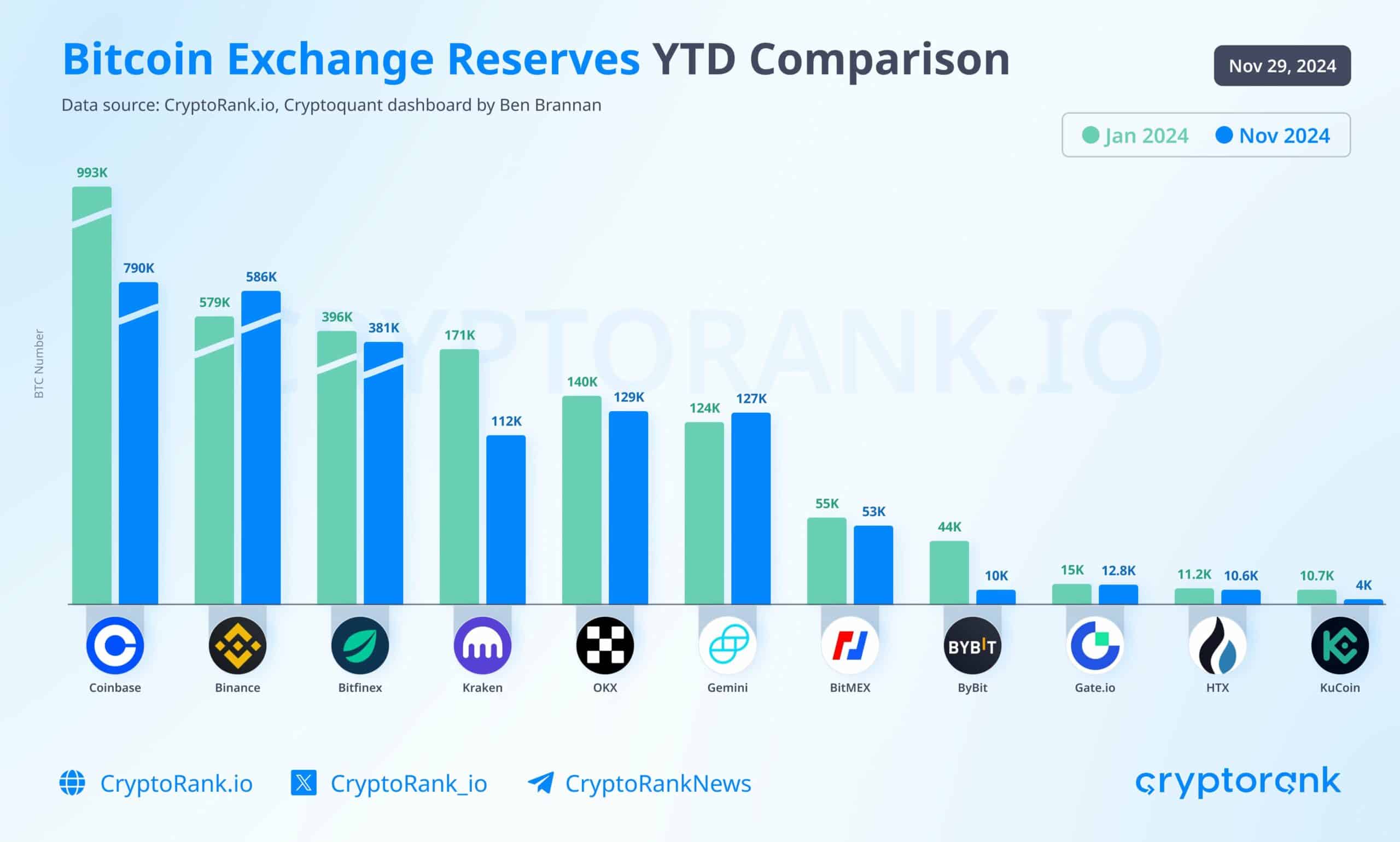

Bitcoin reserves across centralized exchanges (CEXs) have shown notable differences this year. While some exchanges like Binance have maintained relatively stable reserves, others like Coinbase have seen major declines.

These trends have been accompanied by a significant drop in exchange-to-exchange Bitcoin flows. This can be interpreted as a sign of a maturing market and greater confidence among investors.

Bitcoin exchange flows and market sentiment

The exchange-to-exchange flow metric, which tracks Bitcoin transfers between exchanges, dropped to unprecedented lows, according to CryptoQuant. Historically, spikes in these flows have coincided with periods of market turmoil, as traders moved BTC to Binance during major price declines.

However, diminished flows could also allude to reduced panic-driven behavior – A sign of a more stable and confident market environment.

Source: CryptoQuant

At the same time, Bitcoin’s exchange reserves, particularly across all centralized exchanges, declined sharply over the past two years.

From over 3.3 million BTC in early 2022 to just 2.5 million BTC in late 2024, this drop underlined a broader trend of self-custody adoption and reduced reliance on exchanges for storage. The accompanying chart illustrated this steady decline, correlating with Bitcoin’s bullish trajectory towards $100,000.

How exchanges hold reserves differently

A deeper dive into exchange-specific data revealed stark differences in how platforms manage Bitcoin reserves.

Coinbase, catering largely to institutional investors, has seen significant outflows over the year, with reserves dropping from 993,000 BTC in January to 790,000 BTC in November. This trend pointed to the growing institutional preference for long-term self-custody solutions or cold storage.

Source: CryptoRank

On the contrary, Binance’s reserves have remained relatively stable, dipping only marginally from 579,000 BTC to 586,000 BTC.

The divergence between these two major exchanges reiterates the differing strategies of their user bases – Coinbase for institutional custody and Binance for retail trading.

Bitcoin’s price trends support market stability

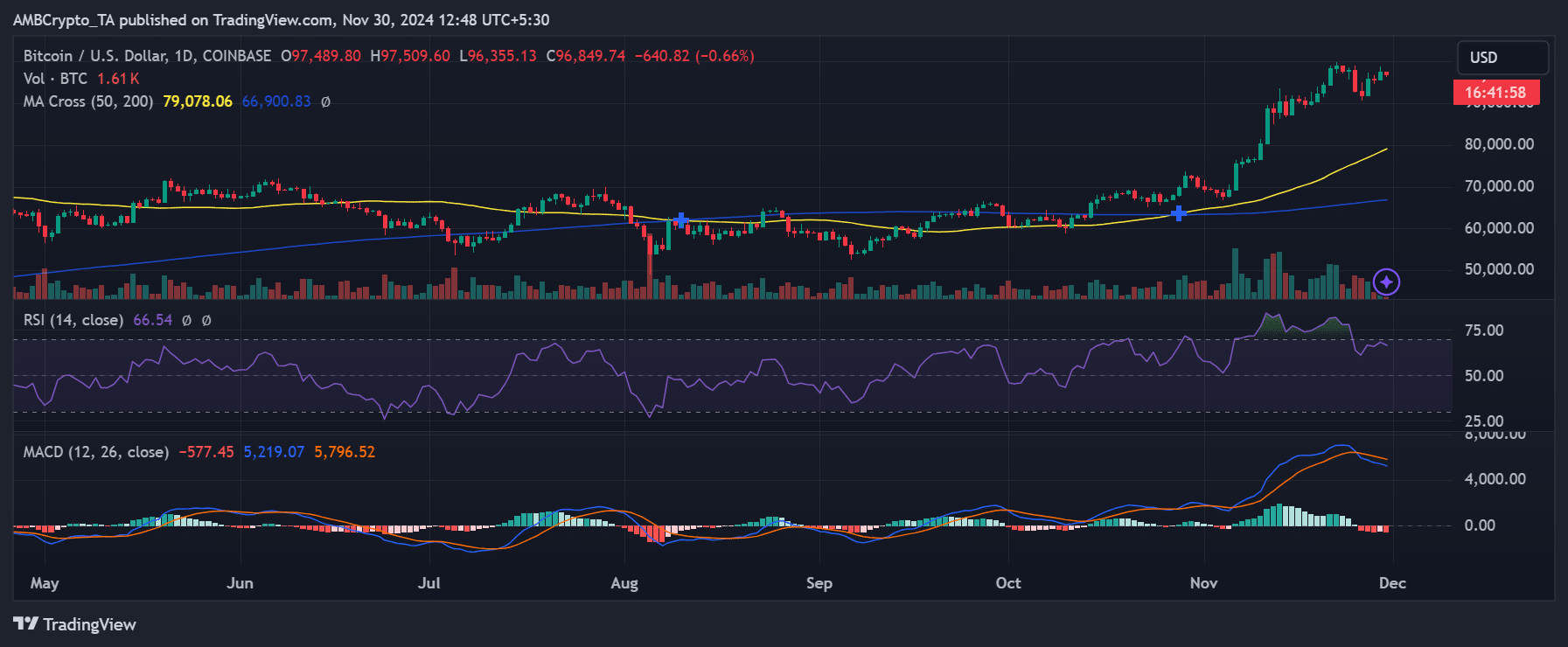

Valued at $96,849 at press time, Bitcoin’s price reflected the broader market’s strength.

The RSI’s reading of of 66.54 suggested the asset remains in overbought territory, but without alarming divergence. The moving average convergence divergence (MACD) also indicated sustained bullish sentiment – A sign of investor confidence.

Source: TradingView

Despite price corrections, reduced Bitcoin movements between exchanges means a lack of panic-driven selling. This stability is a departure from previous cycles where heightened flows often coincided with sharp price declines.

The broader decline in exchange reserves and reduced flows to Binance could allude to an evolving market dynamic. A lower volume of BTC on exchanges reduces immediate selling pressure, potentially paving the way for further price hikes.

Moreover, the rise in self-custody is in line with a maturing market, one where investors are less likely to succumb to panic selling.

– Read Bitcoin (BTC) Price Prediction 2024-25

However, the concentration of liquidity on fewer exchanges like Binance poses its own challenges. In times of heightened trading activity, liquidity constraints could emerge. Especially as the market inches closer to Bitcoin’s psychological $100,000-level.