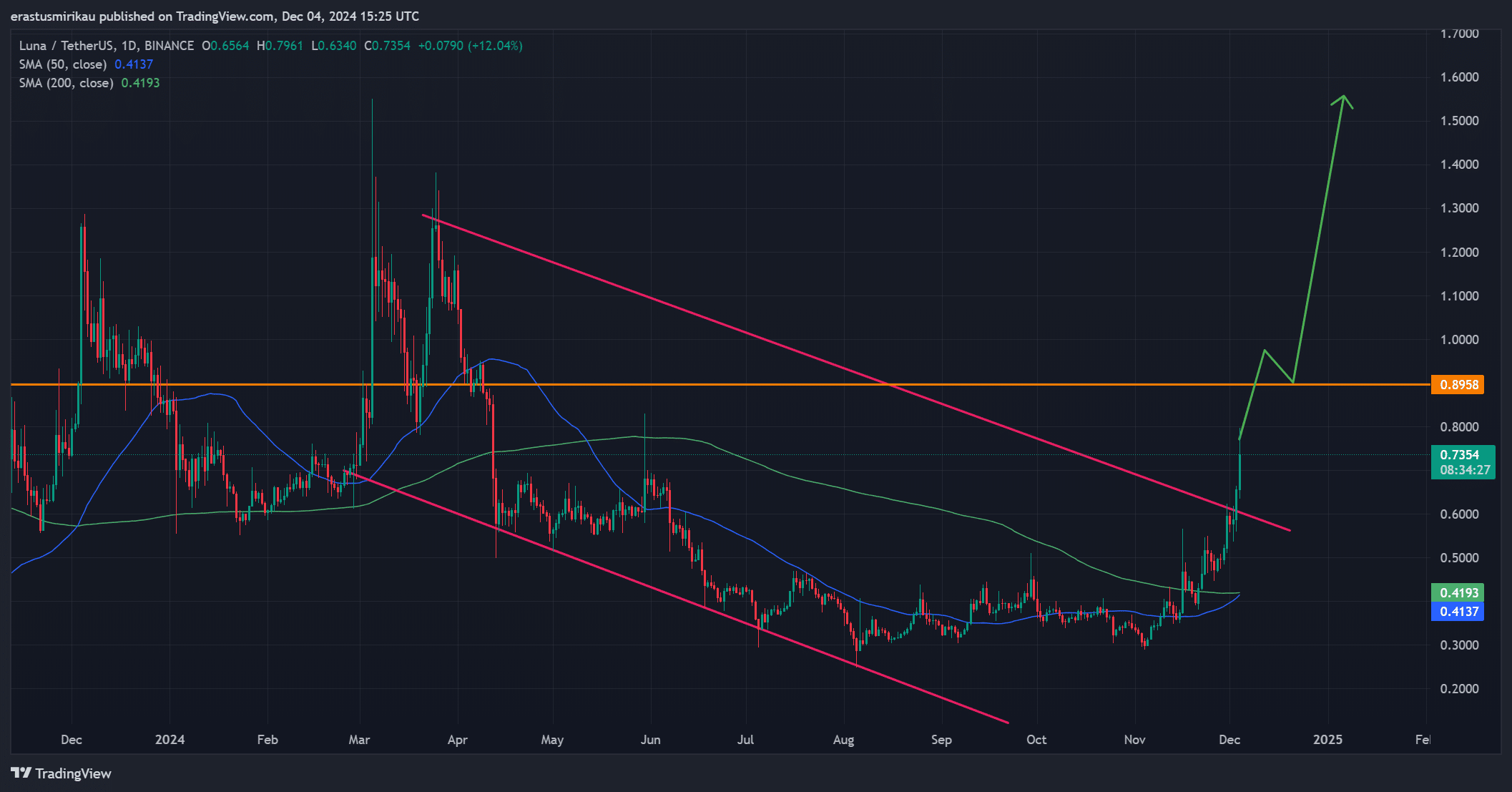

- LUNA broke its descending channel, while eyeing the $0.895 resistance with $1.50 as the next target

- Social dominance and technical indicators signaled strong bullish momentum, despite the overbought RSI

Terra [LUNA] surged by an impressive 30.58% in just one day, breaking free from its descending channel. At press time, the altcoin was valued at at $0.789, with the same moving closer to a critical resistance level at $0.895.

If LUNA manages to break through this resistance, the next possible target could be $1.50. Additionally, a golden cross seemed to be forming, signaling a potential trend reversal. However, the question remains – Can LUNA maintain this upward momentum and hit new highs?

What does the breakout mean for LUNA’s future price action?

LUNA’s breakout from the descending channel marked a significant shift in market sentiment. The price, at press time, was approaching a key resistance level at $0.895. Therefore, this level will play a crucial role in determining whether the breakout can sustain itself. A successful breakout above $0.895 could potentially push the altcoin towards $1.50.

Consequently, traders will be closely monitoring the price action for confirmation of this bullish trend.

The near completion of the golden cross further strengthened the possibility of a bullish reversal. Especially as this technical indicator often signals the start of a new uptrend.

Source: TradingView

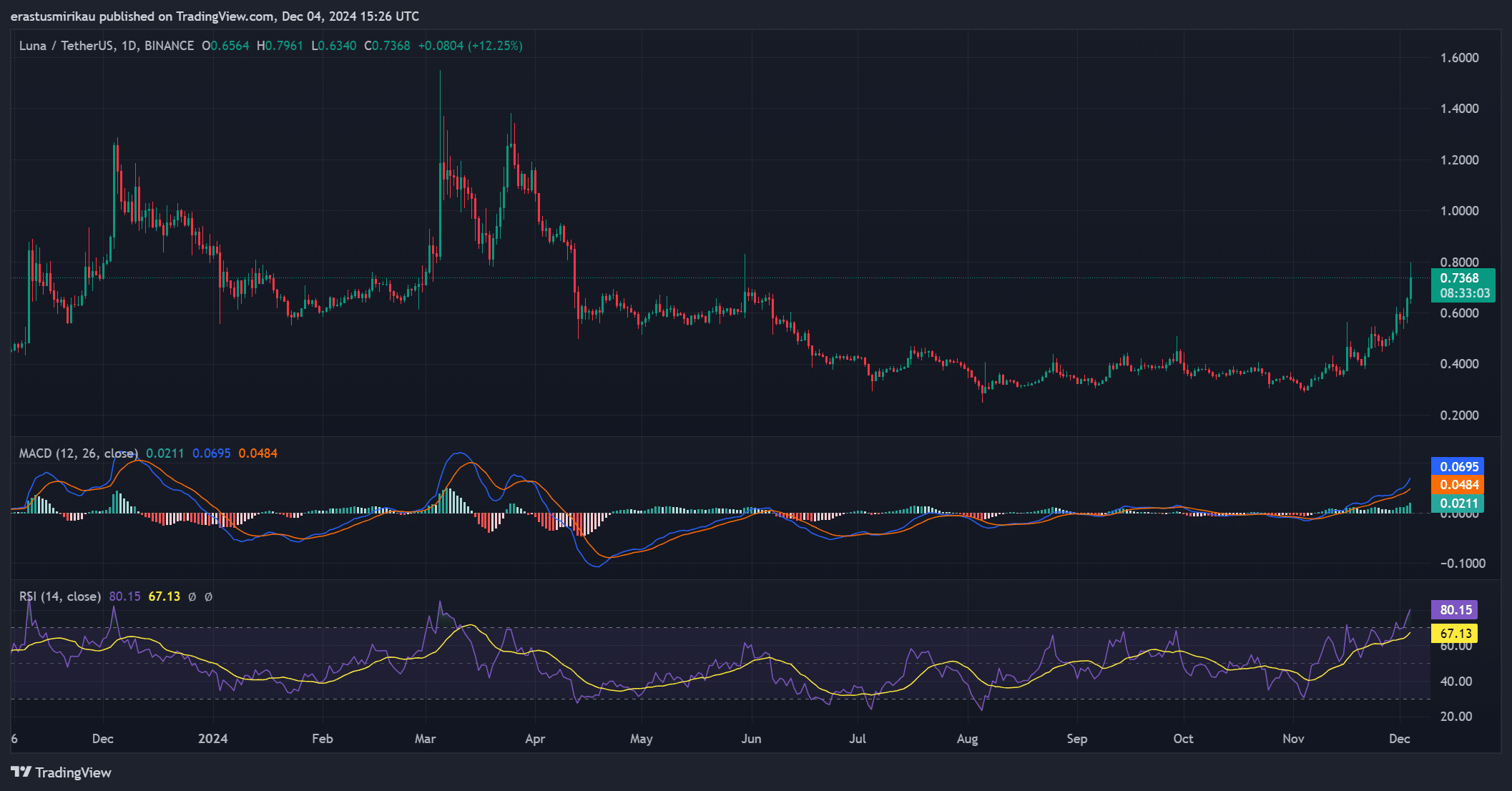

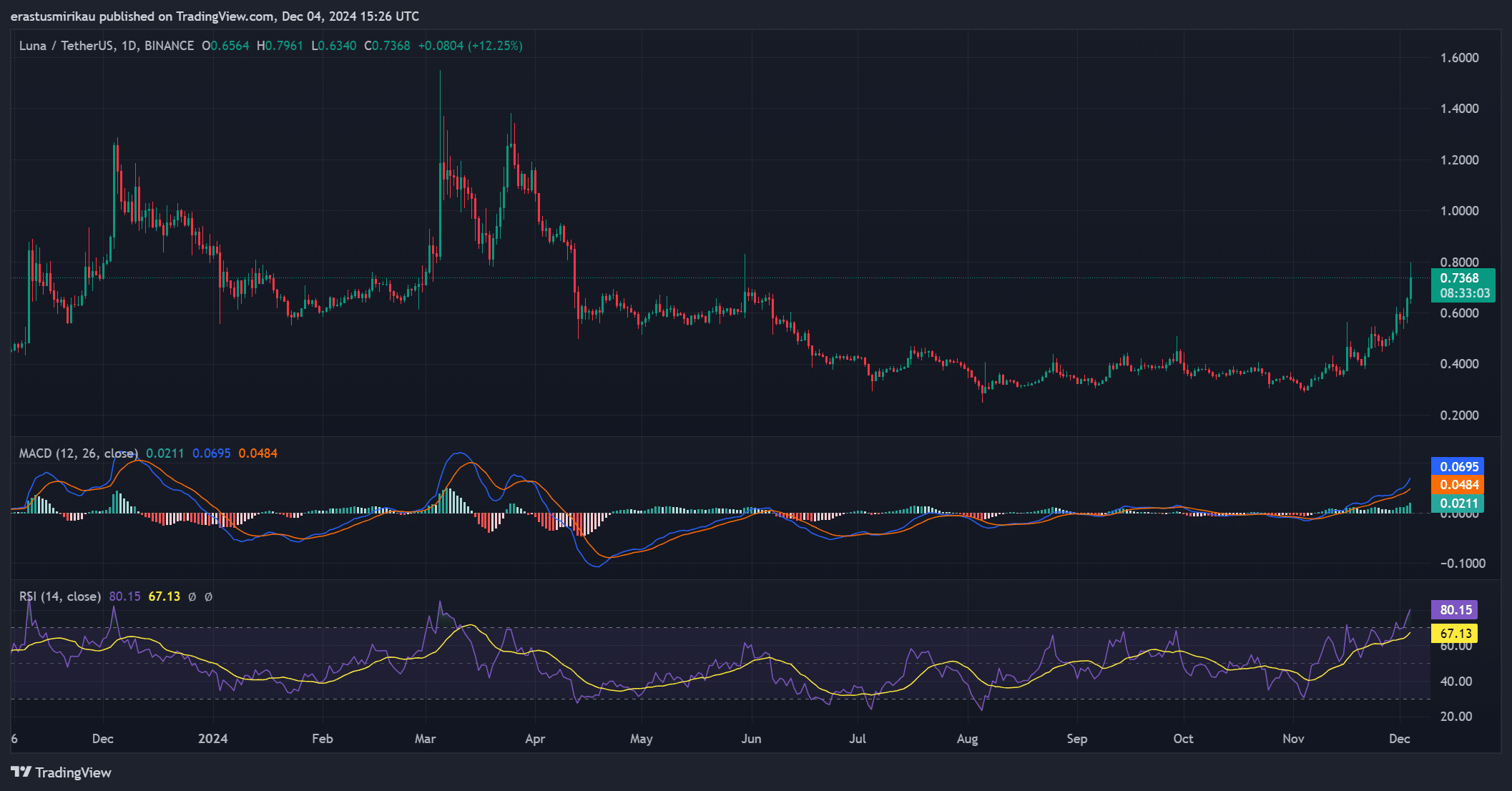

Are the technical indicators signaling a strong bullish trend?

At the time of writing, Terra’s technical indicators continued to reflect strong momentum. The RSI had a value of 80.15, indicating that LUNA was in overbought territory. However, this level also alluded to strong upward momentum, suggesting that the rally may still have some room to run.

Additionally, the MACD’s reading of 0.0211 further supported this bullish outlook.

Therefore, LUNA appeared poised for sustained upward movement in the short term, although caution may be necessary due to the overbought conditions.

Source: TradingView

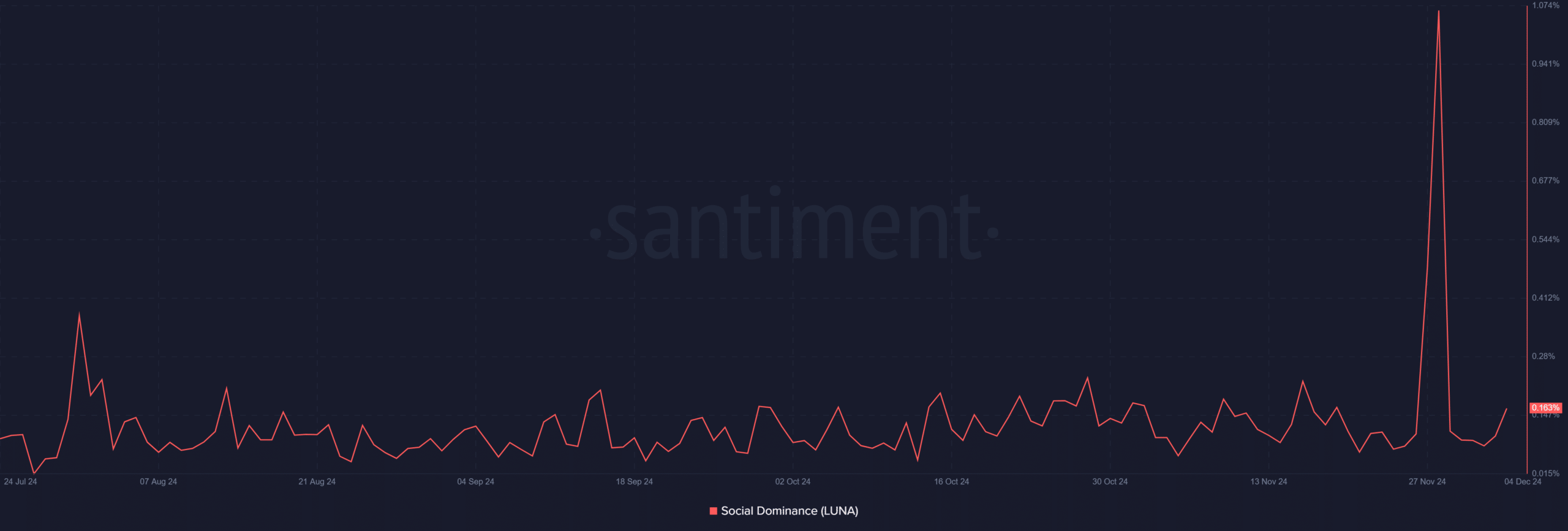

How is social sentiment influencing the price movement?

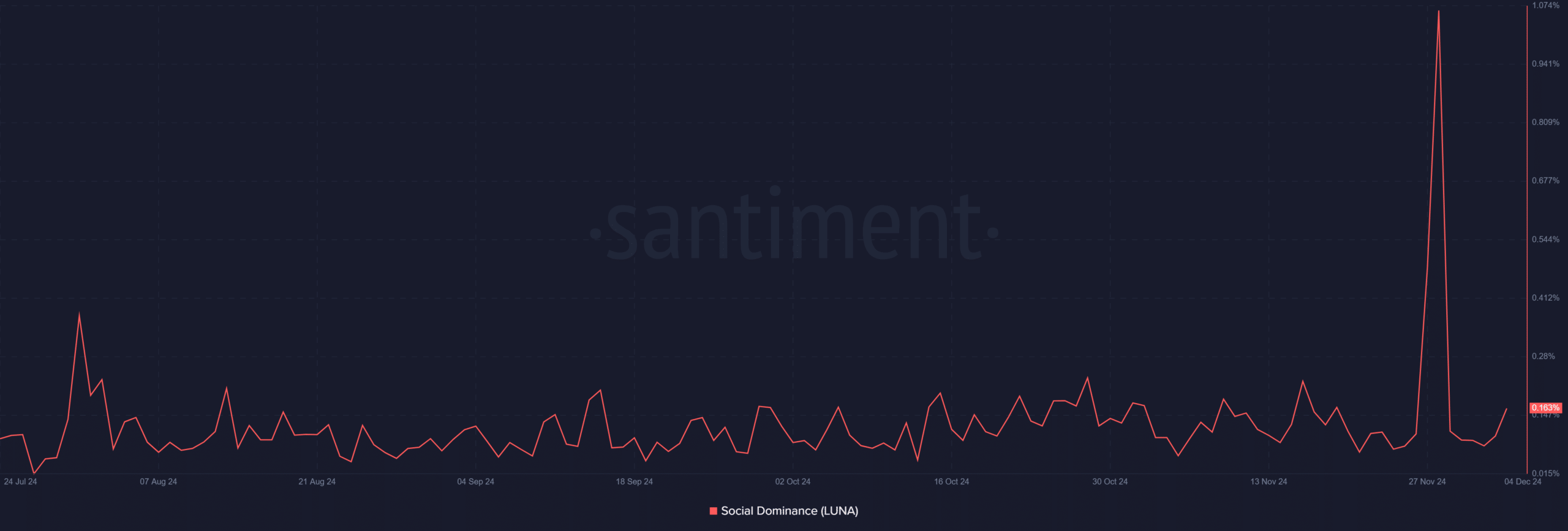

LUNA’s social dominance increased significantly, rising from 0.100 to 0.163 in just 24 hours.

Consequently, this hike in social attention can contribute to greater market interest and support the rally. However, heightened social dominance often leads to greater volatility, as sentiment can shift rapidly in either direction.

Source: Santiment

What does the market sentiment say about Terra’s future?

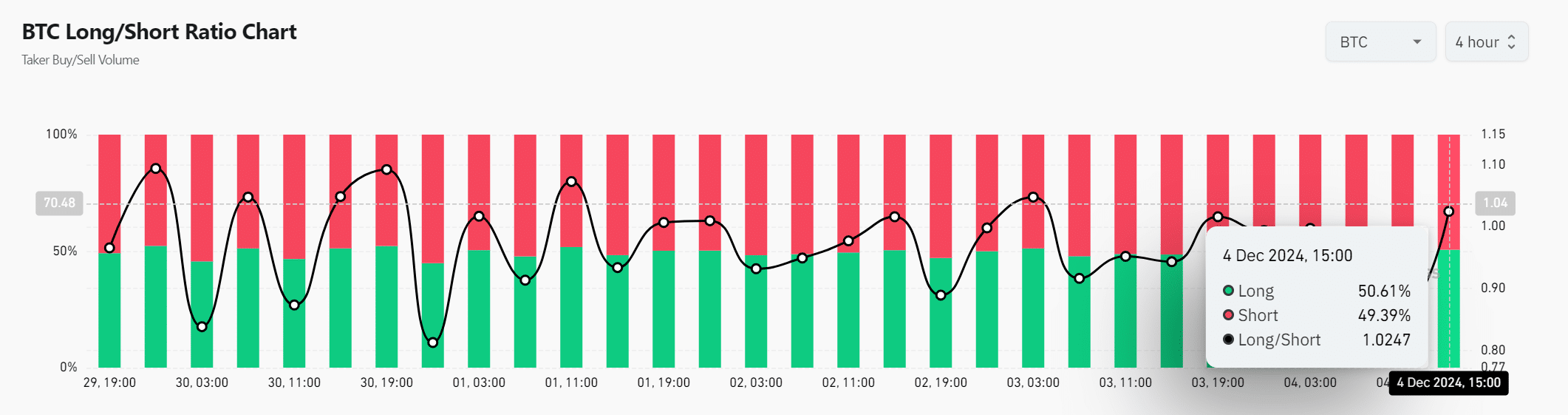

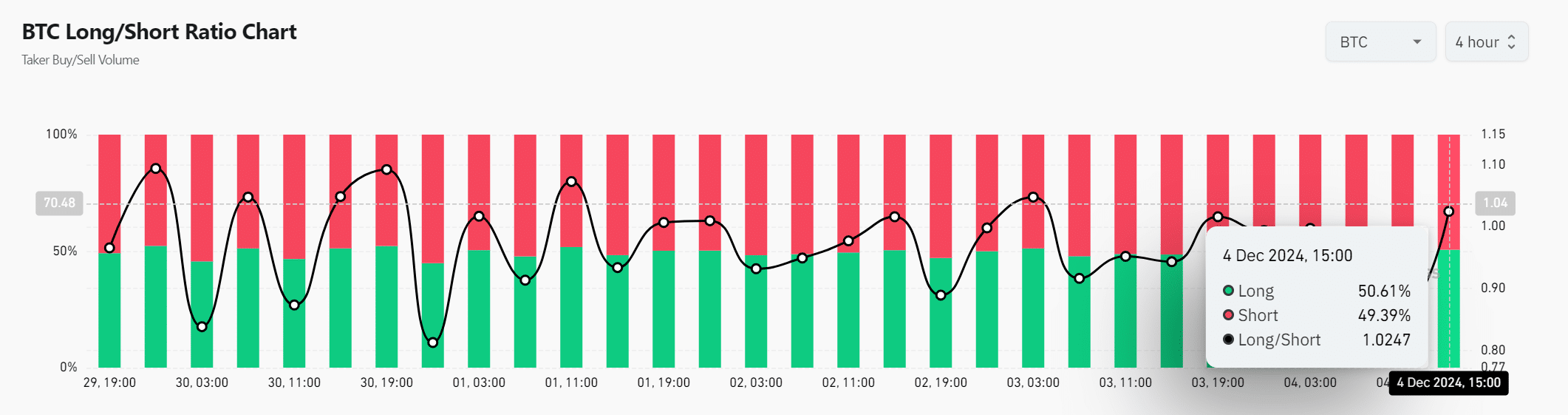

At press time, the short-to-long ratio for LUNA stood at 49.39% shorts and 50.61% longs, indicating a near equilibrium between bulls and bears.

Consequently, this balance suggested uncertainty in the market’s future direction. Nevertheless, if LUNA successfully breaks through $0.895, the bulls may gain the upper hand.

Source: Coinglass

Is your portfolio green? Check the Terra Luna Classic Profit Calculator

Will LUNA maintain the bullish momentum?

LUNA’s technical indicators, social dominance, and recent price action, all pointed to a potential trend reversal. However, the key resistance at $0.895 remains a significant hurdle. If LUNA can break through this resistance and confirm its golden cross, it may target $1.50.

Nevertheless, traders should remain cautious, as the overbought conditions and balanced long-to-short ratio indicated potential volatility ahead. Therefore, LUNA’s future performance depends on whether it can sustain its momentum and break past its critical resistance level.