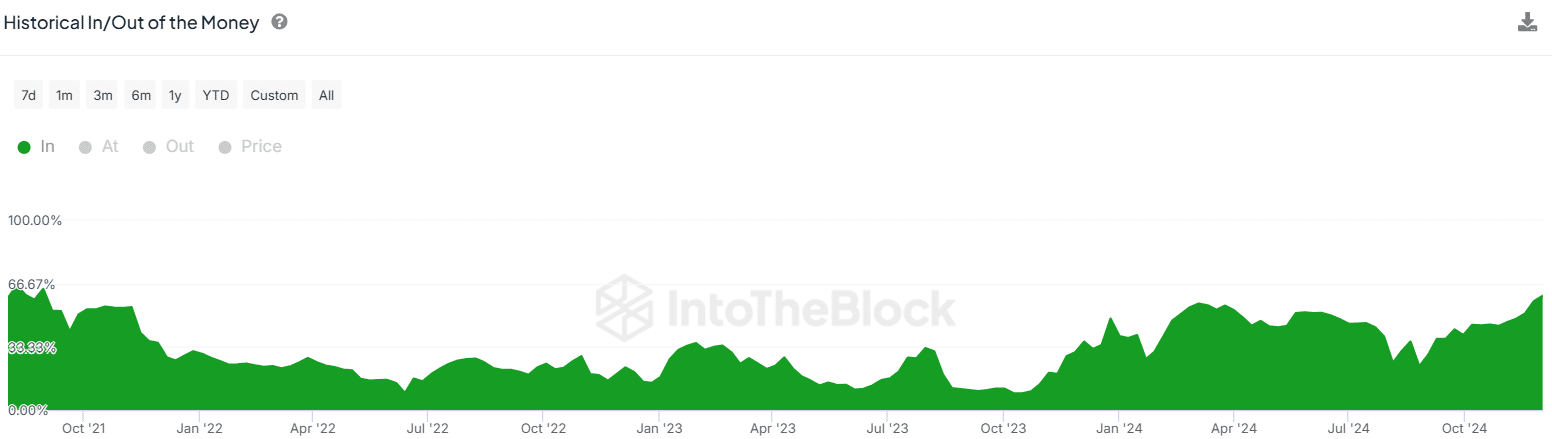

- 60% Uniswap investors are sitting in profits after a 122% gain in 30 days.

- Wallet profitability is at the highest level since 2021, increasing the likelihood of profit-taking activity.

Uniswap [UNI] has displayed a strong bull run in the last 30 days after a 124% gain. At press time, UNI traded at $15.55 with trading volumes of more than $1 billion per CoinMarketCap.

UNI’s rally appears to be cooling off after Bitcoin [BTC] drew attention away from altcoins after pushing past $100,000. Nevertheless, the altcoin remains in bullish territory amid an influx in wallet profitability.

Data from IntoTheBlock shows that currently, more than 60% of UNI holders are In the Money (in profit), marking the highest level of wallet profitability since mid-2021.

Source: IntoTheBlock

Whenever the number of wallets in profits increases as the rally shows signs of exhaustion, traders tend to start selling to book profits. This could cause the rally to stall or trigger a downturn.

UNI exchange inflows on the rise

Some trades are already booking profits on UNI amid a surge in inflows to spot exchanges. Per CryptoQuant, Uniswap exchange inflows reached a one-week high of 1.54M UNI, valued at more than $24M, on the 4th of December.

Source: CryptoQuant

The spike in exchange inflows coincided with UNI rallying to an 8-month high of $16.52, an indication that this level may have signaled a local top.

However, given that netflows during the day came in negative, it could suggest that there is ample demand to prevent a trend reversal. Additionally, buyers remain active, making the case for further gains.

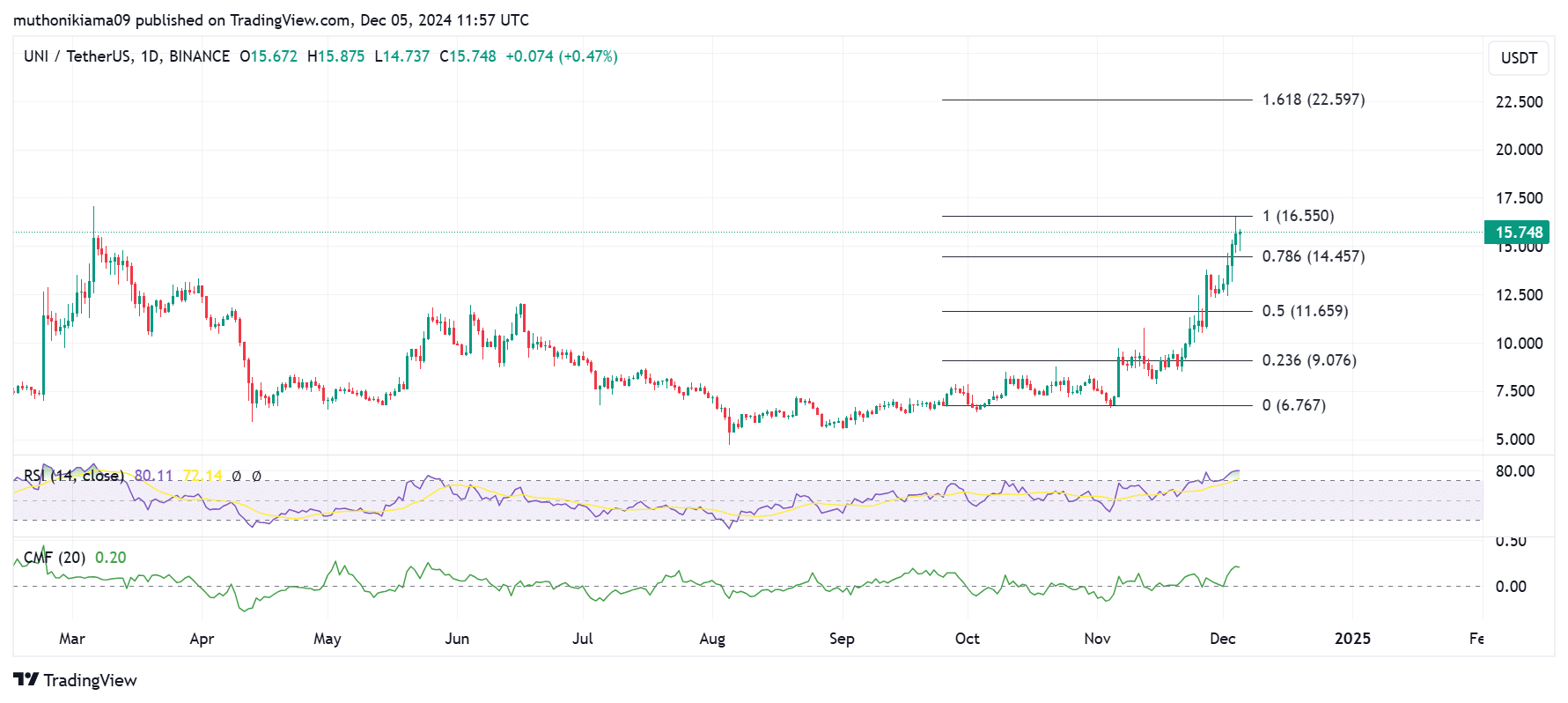

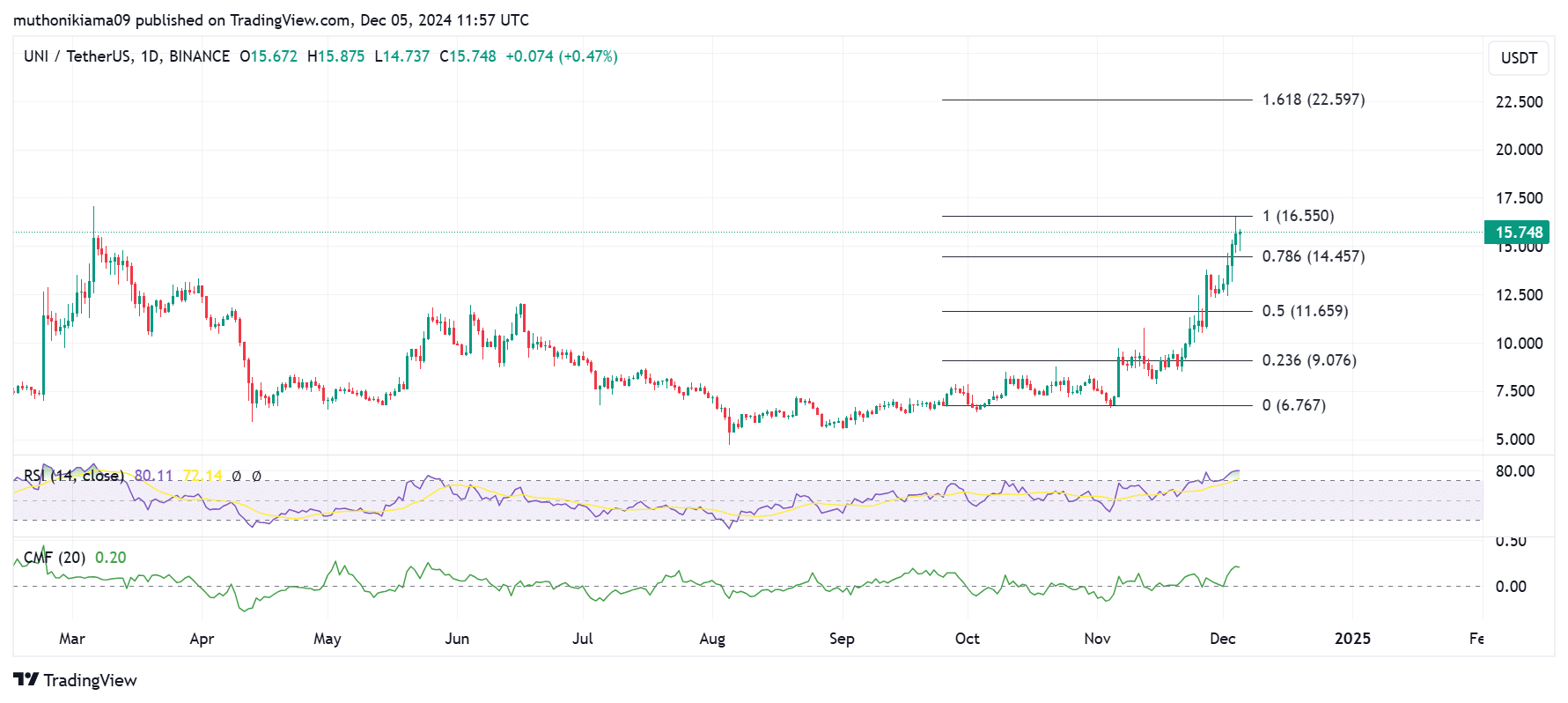

Uniswap’s RSI is at overbought levels

Uniswap’s daily chart shows that the altcoin is at an overbought level after the Relative Strength Index (RSI) reached 78. This could precede a correction in the short-term, as has been the case in the past.

Meanwhile, UNI’s Chaikin Money Flow (CMF) has reached 0.20, suggesting that buying activity is at its highest level in months.

(Source: Tradingview)

If buyers keep up the momentum, UNI could surge towards the 1.618 Fibonacci level ($22.59), and reach its highest level since early 2022. Conversely, a drop below $14.45 could fuel another downturn.

Read Uniswap’s [UNI] Price Prediction 2024–2025

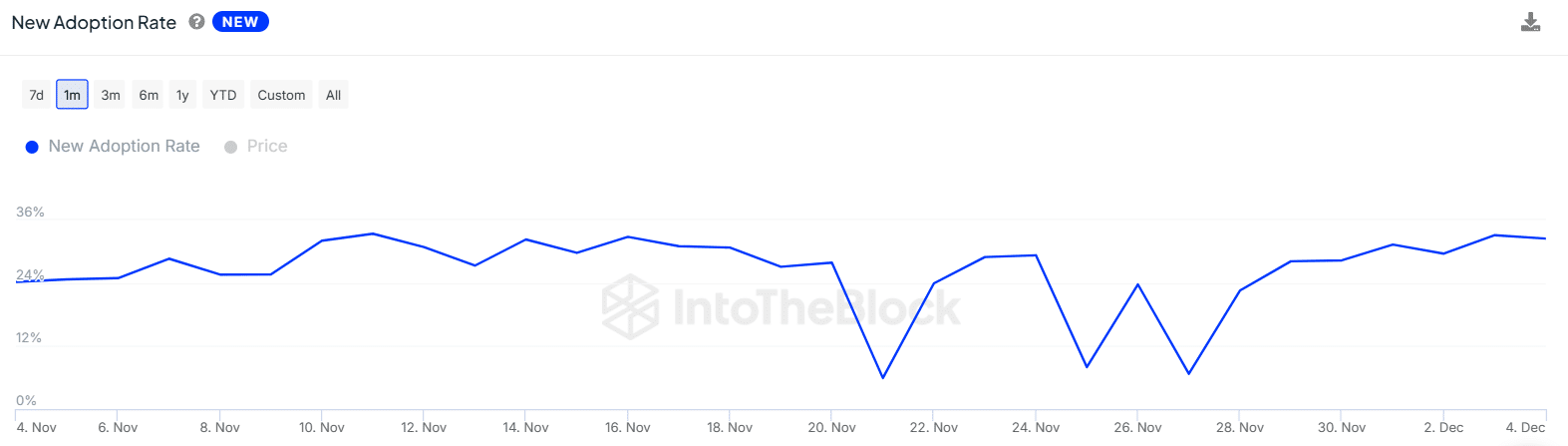

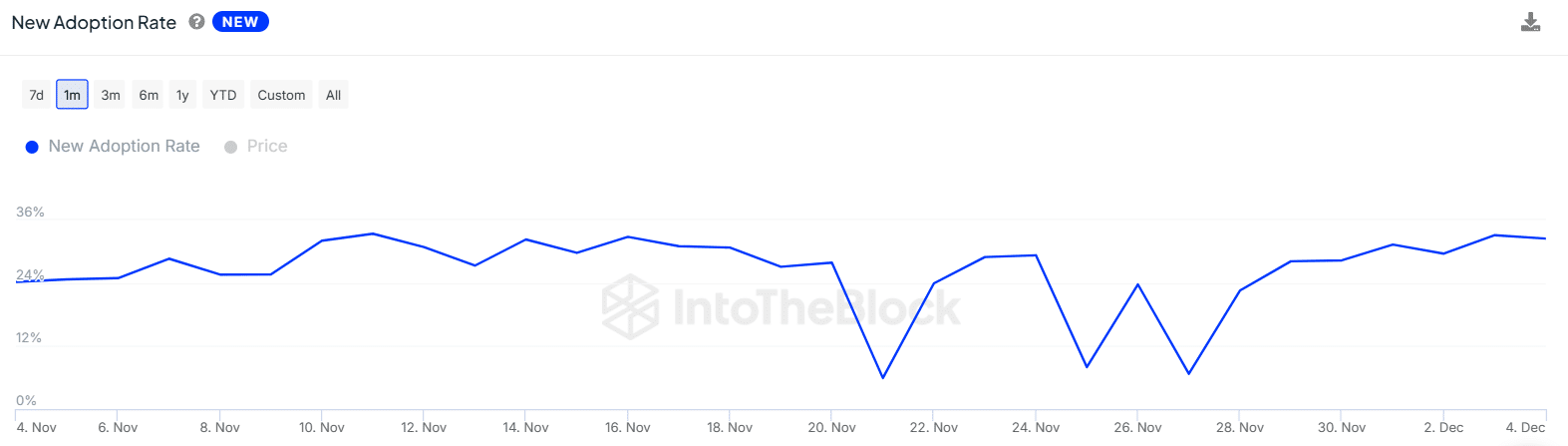

Rising new adoption rate suggests…

The new adoption rate has been on a gradual rise over the past week per IntoTheBlock to 32.44%. This suggests that there is a high number of new buyers accumulating Uniswap.

Source: IntoTheBlock

An increase in new Uniswap addresses indicates retail FOMO, which could help accelerate the uptrend and drive more gains for UNI.