- ADA has declined by over 16% in the last 24 hours.

- Rising on-chain activity shows network growth, but cautious sentiment clouds ADA’s recovery.

The cryptocurrency market has witnessed volatility recently, and Cardano [ADA] has not been an exception.

The digital asset slipped below the crucial $1.20 support level, a price point where approximately 93K addresses had previously acquired 2.54 billion ADA.

This development raises questions about its near-term price trajectory and potential support zones.

Cardano’s decline and key support levels

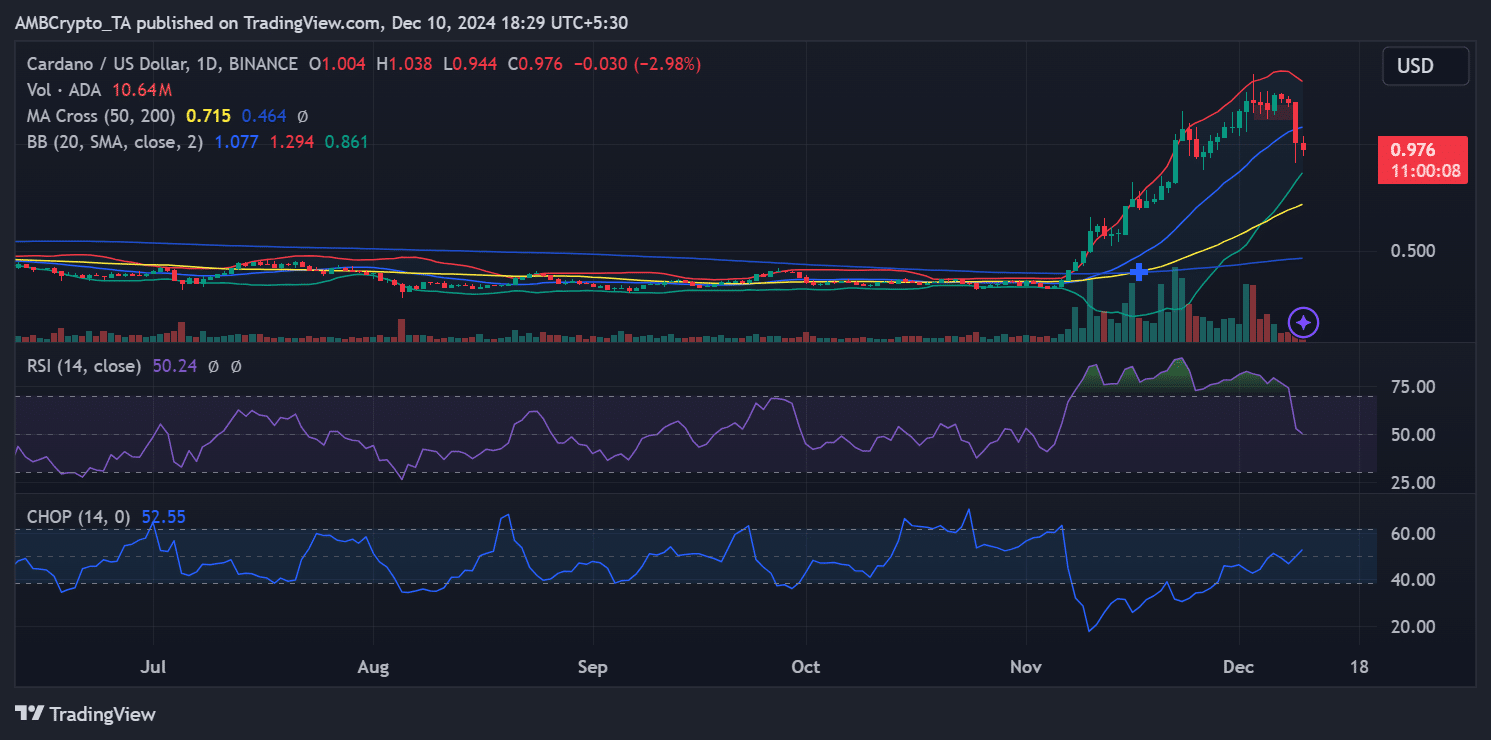

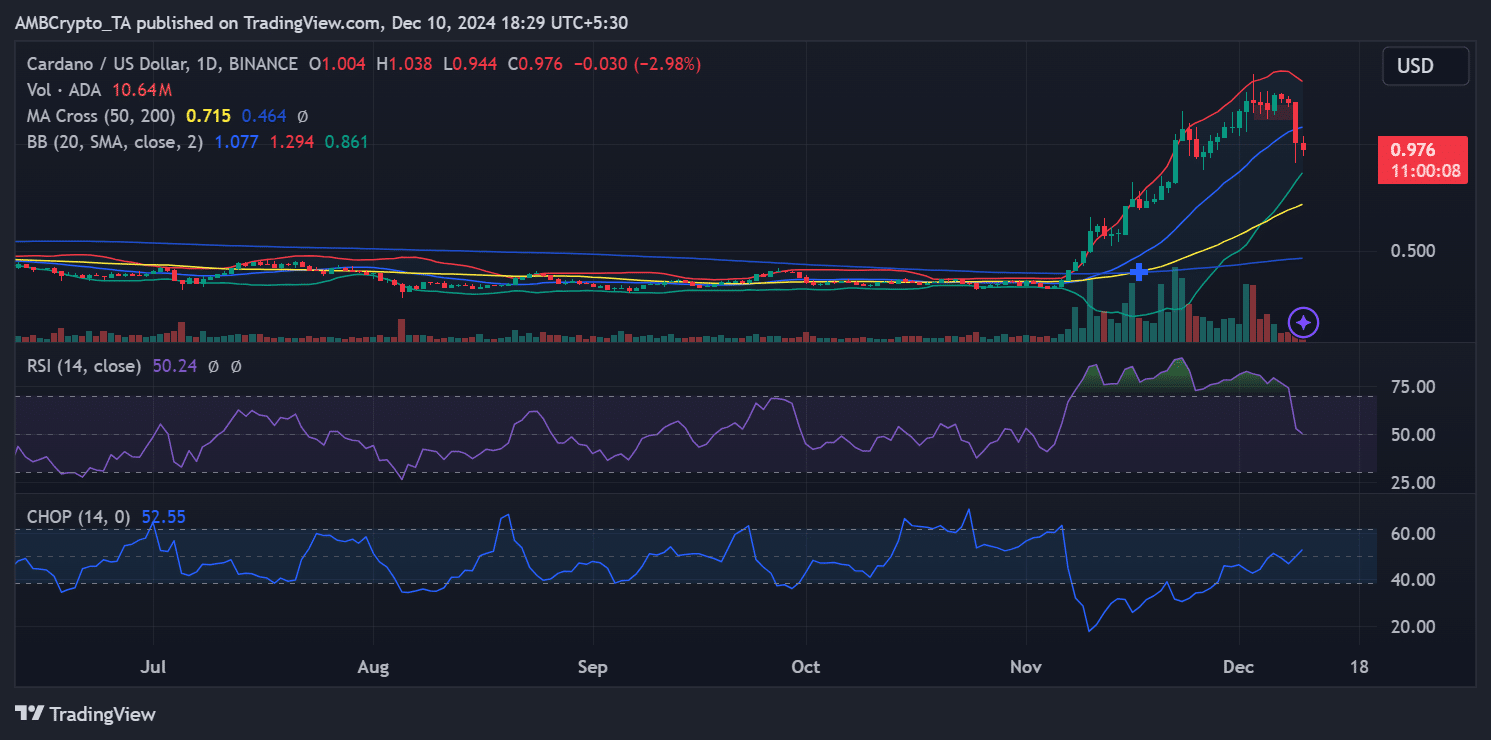

Cardano’s price has been on a downward trend, as seen in the daily chart.

After hitting the $1.20 mark, which acted as a strong support level due to the significant accumulation by holders, ADA has now slipped below this critical threshold.

The next notable demand zone is around the $1 mark, where additional accumulation could provide much-needed stability.

Source: TradingView

AMBCrypto’s analysis of the price chart revealed a decline in momentum, with ADA trading at approximately $0.97 at the time of writing.

Indicators such as the Relative Strength Index (RSI) pointed to a neutral stance, suggesting a balance between buying and selling pressures.

However, the Choppiness Index indicated that the market could remain choppy in the short term, further complicating ADA’s price recovery.

On-chain insights

The In/Out of the Money Around Price chart provided additional insights into Cardano’s price levels. As per the data, the $1.20 level hosted many holders, making it a crucial area for market stability.

With the breach of this level, the market could see increased selling pressure, particularly from those who acquired ADA at higher prices.

Furthermore, approximately 34.44% of ADA is “in the money” (held at a profit), while 64.68% remains “out of the money” (held at a loss).

This distribution reflects the precarious position of many ADA holders, which could influence market sentiment and trading activity in the coming days.

Active addresses on the rise

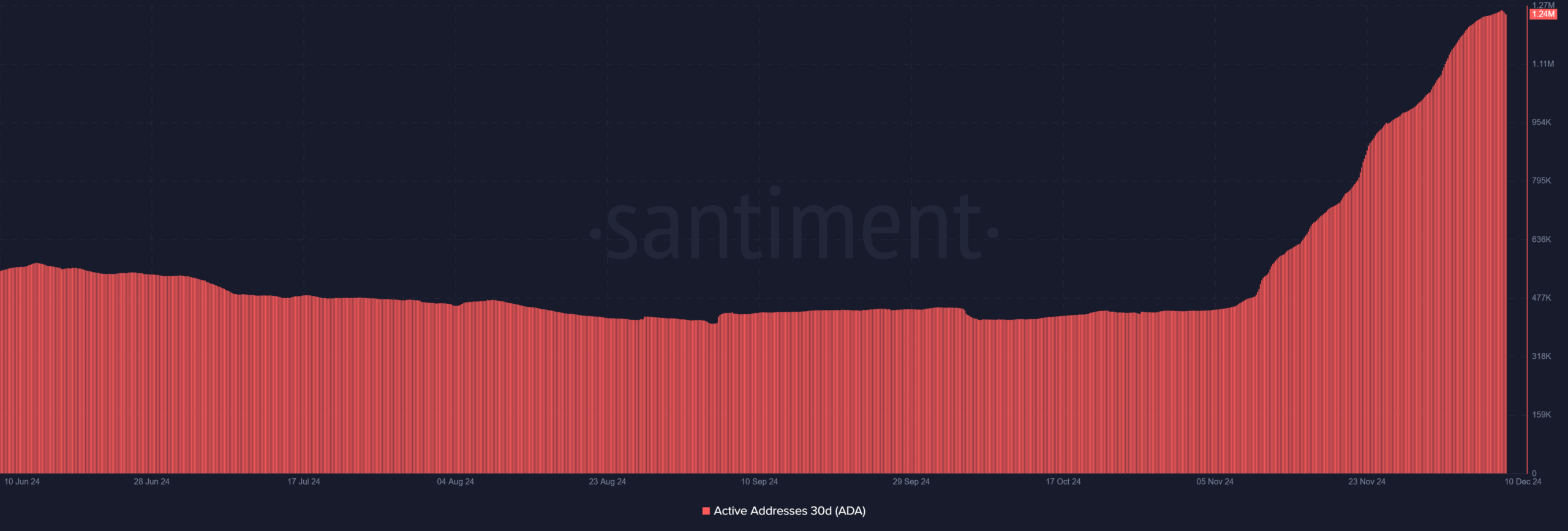

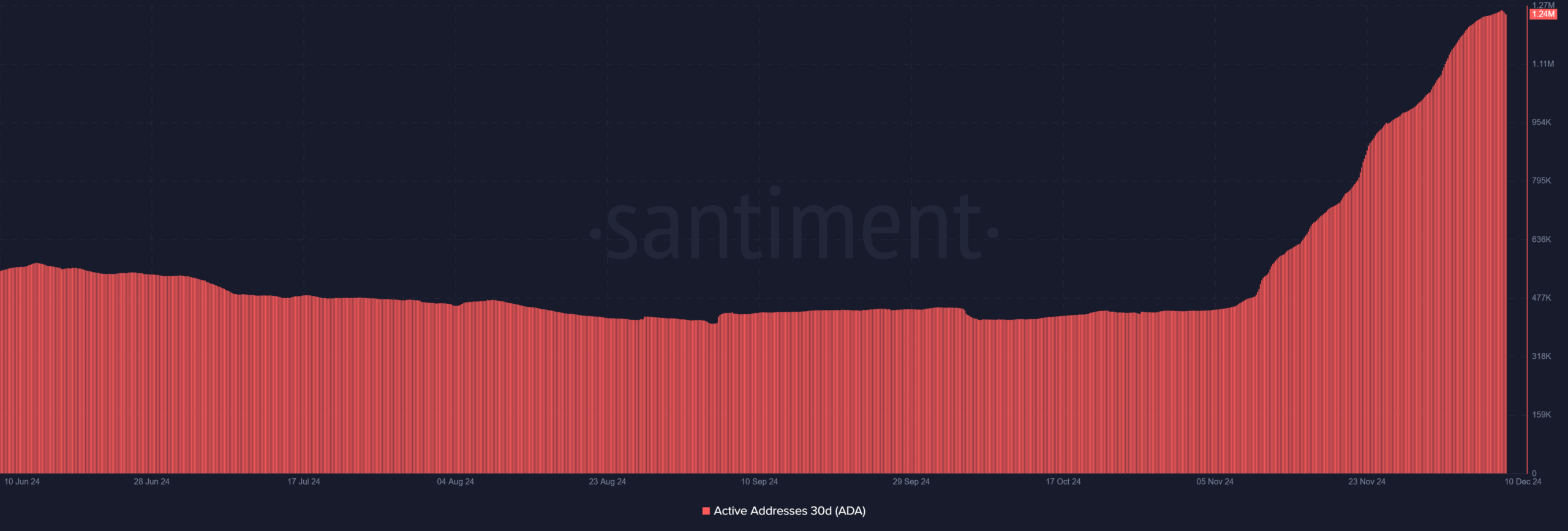

Interestingly, Cardano’s on-chain activity has been increasing. The 30-day active address showed steady growth, reaching 1.24 million.

This rise indicated sustained engagement with the Cardano network, potentially driven by developments in its ecosystem and anticipation of future updates.

Source: Santiment

However, it remains to be seen if this increase in network activity can translate into a price recovery, especially as market sentiment appears cautious following the breach of the $1.20 support.

Realistic or not, here’s ADA’s market cap in BTC’s terms

Cardano’s dip below $1.20 marks a significant shift in its price dynamics.

While the $1 level could act as the next support zone, the broader market conditions and Cardano’s ability to maintain network activity will be crucial in its price recovery.