- Whales have been steadily accumulating BTC, a factor that has contributed to the recent price surge.

- Also, there was little liquidity below Bitcoin’s price, with major resistance levels above, especially at a new price target.

In the past 24 hours, Bitcoin’s [BTC] has gained 2.73%, recovering from a dip that saw the price drop to $94,150.05 after hitting a high of $104,000 earlier this month.

The recent rally in BTC’s price is largely driven by growing investor demand, as large-scale acquisitions continue to push prices upward.

Whales lead the charge

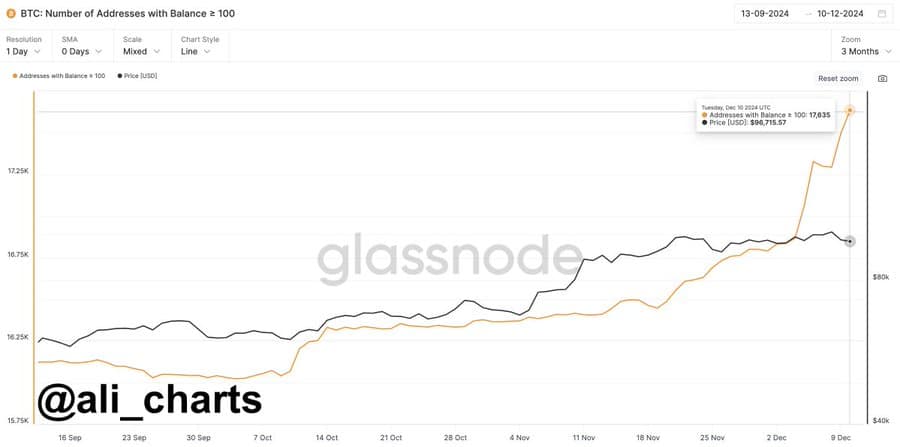

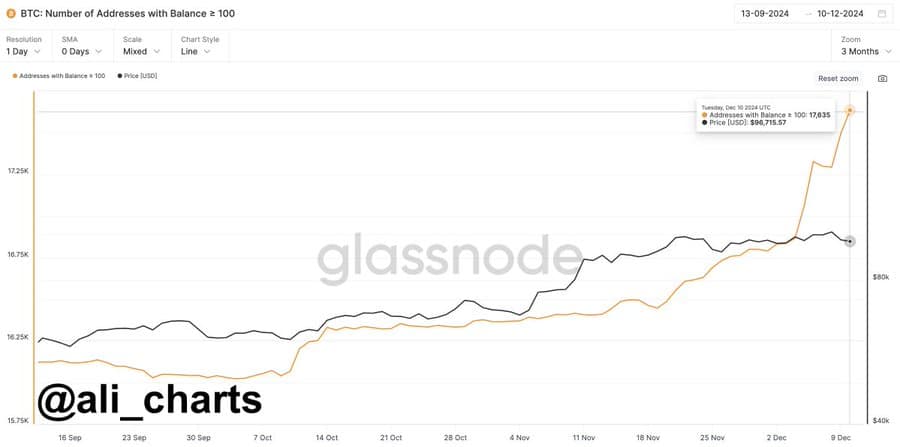

Interest in Bitcoin has surged again, with whales playing a key role in the recent price increase, according to cryptocurrency analyst Ali Chart using data from Glassnode.

The chart highlighted that large investors, or whales, have been acquiring BTC in significant quantities. He pointed to a chart showing 342 wallets, each holding over 100 BTC (valued at approximately $10 million based on CoinMarketCap), taking advantage of BTC’s sharp drop to $90,000.

Source: X

Notably, such moves typically indicate that whales view the dip as an opportunity to acquire BTC at a discounted price in anticipation of another market rally, which has already materialized as BTC now trades above $100,000.

BTC could be aiming for a new high

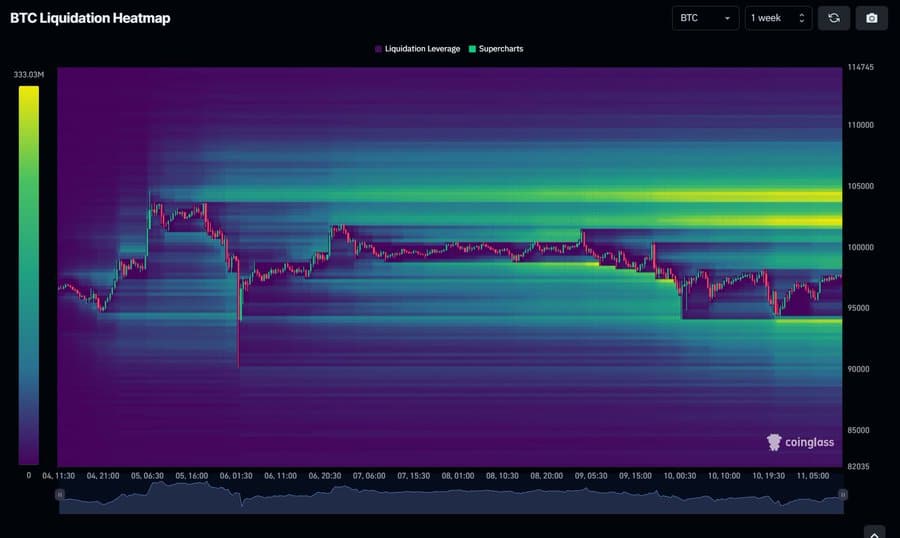

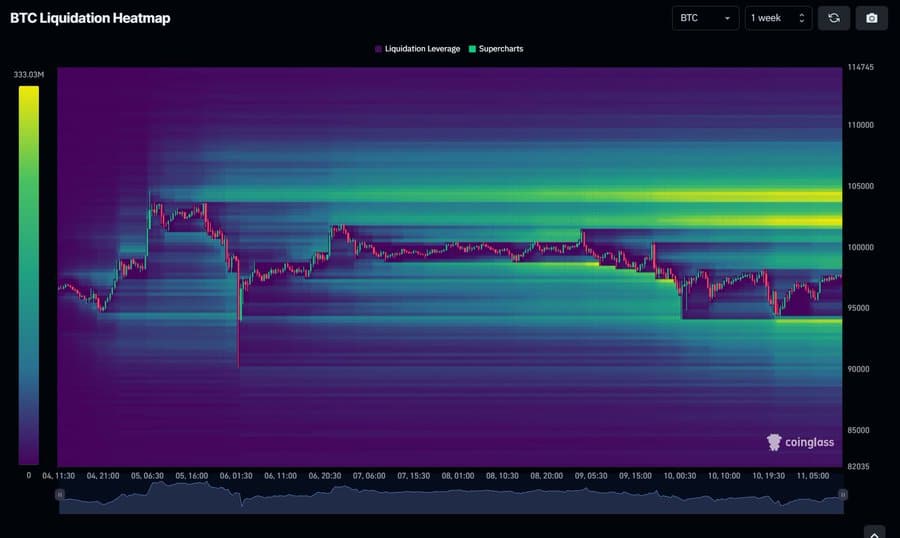

Liquidity data from Coinglass, shared by analyst Mister Crypto, suggests that the coin is poised to target a new high, potentially sustaining its price above the $100,000 threshold.

Liquidity levels indicate key price points where assets tend to gravitate, acting as magnets that attract price movement.

Source: X

At the time of writing, BTC has cleared all significant liquidity levels below its current price. The next critical resistance point is at $105,000, which surpasses its previous all-time high target of $104,000.

Increased liquidity in the market

Whale Tracker reports that Tether (USDT) has minted an additional $1 billion at Tether Treasury. This signaled an influx of liquidity into the market.

This surge in liquidity reflects growing demand for USDT, which market participants are likely to use to acquire crypto. With BTC positioned as a prime candidate, it stands to benefit from this inflow as traders leverage USDT to purchase Bitcoin.

In a related report, Whale Tracker notes that market confidence in the coin is returning. A major holder recently transferred 7,999 BTC—valued at over $800 million—back to secure wallets for safekeeping.

Given these developments, BTC seems increasingly likely to reach a new all-time high soon.