- ADA has declined by 8.77% over the past 24 hours.

- Market fundamentals show strong bearish outlook while an analyst predict a rally after correction.

Since hitting $1.3, Cardano [ADA] has struggled to maintain an upward momentum. As such, it has experienced a strong downward pressure which has strengthened over the past week. Over this period, ADA has dropped to hit a low of $0.77.

In fact, at the time of writing, Cardano was trading at $0.9013. This marked an 8.77% decline over the past day. Equally, it has declined by 14.45% on weekly charts.

The recent decline has left Cardano community talking with some analysts showing optimism. Popular crypto analyst Ali Martinez has suggested a potential rally to $6 citing previous cycles.

Market sentiment

In his analysis, Martinez posited that Cardano is following a similar pattern to its previous cycles.

Source: X

According to him, back in 2020, the first major correction after a bull rally started at the same time it happened today. Thus, after this correction, the market will strengthen enough for another rally.

In context, during the 2020 rally, ADA surged from $0.088 to $0.190. After this uptrend, the altcoin retraced to a low of $0.12. However, after the market correction, Cardano rallied from a low of $0.12 on 20th December, 2020, to $1.02 through February 2024. This marked a whopping 750% rally.

Therefore, if history is anything to go by, Cardano could see a massive rally after the current correction.

What ADA charts indicate

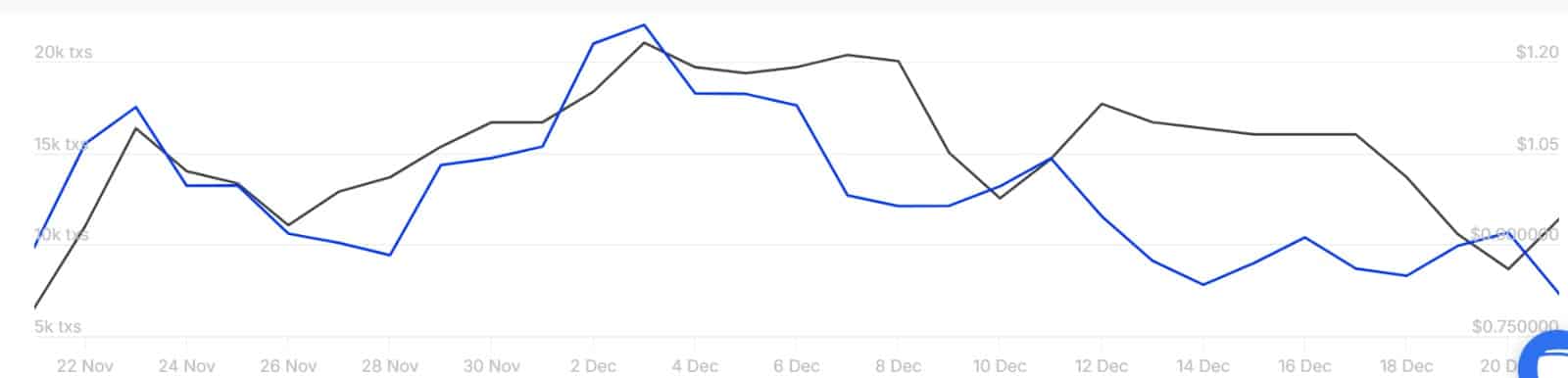

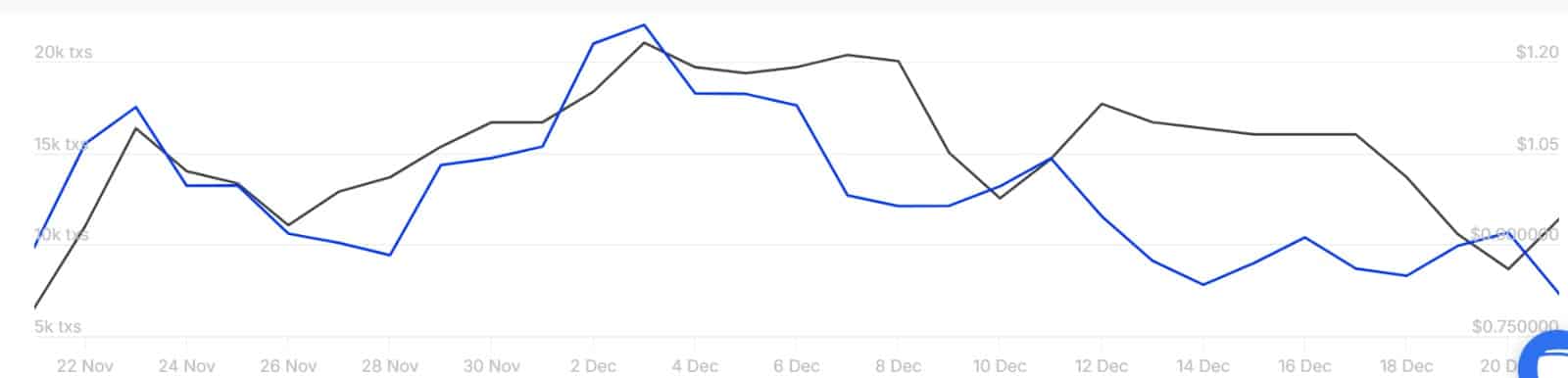

While the historical cycle provided by Martinez offers a promising outlook, other market indicators tell a different story. This is especially because Cardano’s on-chain activities have dropped to recent lows.

Source: Santiment

For starters, Cardano’s Price DAA divergence has remained negative over the past week. When this remains negative for a long period, it implies that the current ADA price and market valuation are not supported by growth in on-chain activities.

Source: IntoTheBlock

We can see this phenomenon, especially among large holders. As such, large transactions have dropped to hit a monthly low.

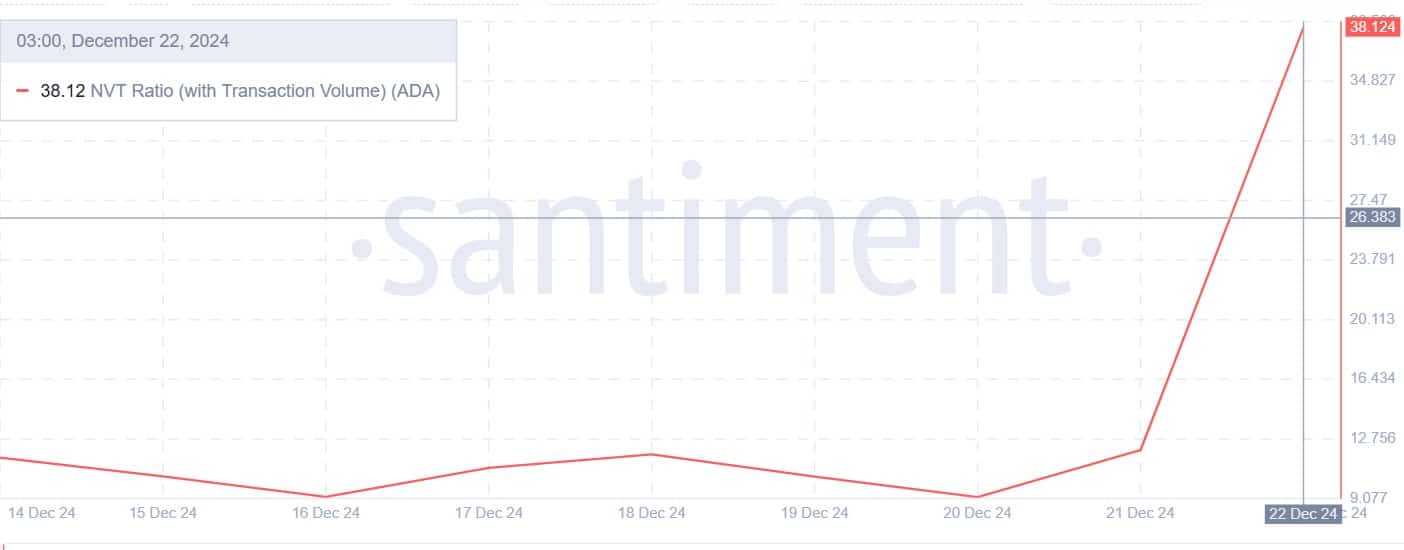

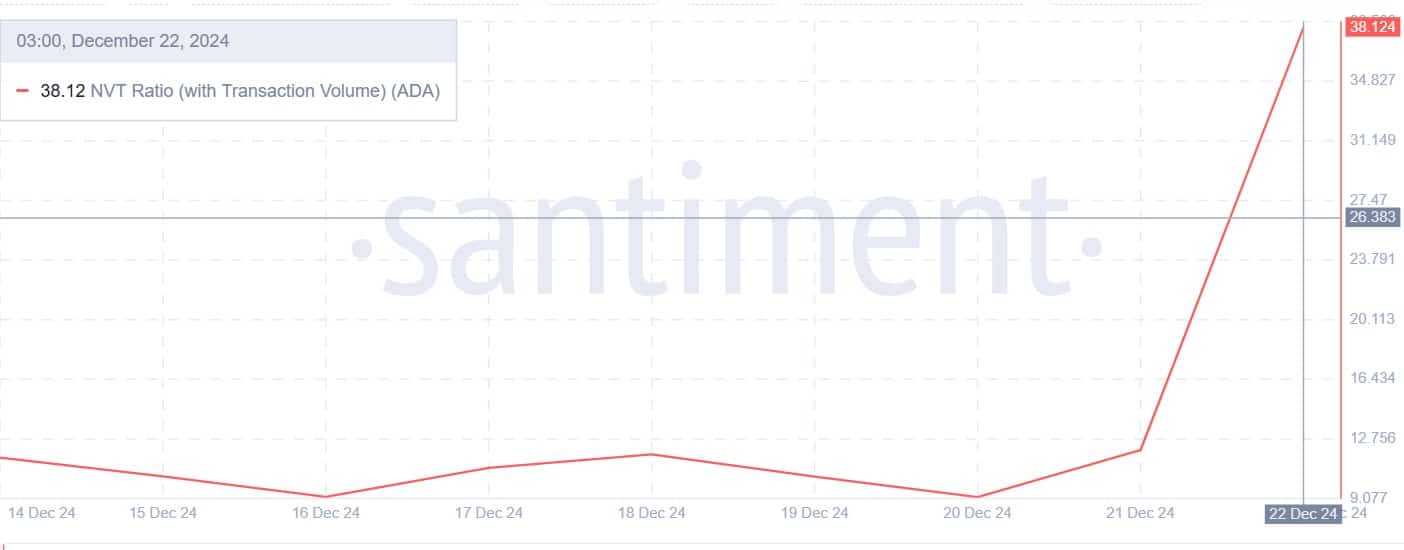

Source: Santiment

Additionally, Cardano’s NVT ratio with transaction volume has spiked from 9.17 to 38.12 at press time.

This implies that despite the recent drop, ADA’s market value is still growing faster than its on-chain transaction. Such a trend suggests that speculation is driving price growth rather than increased usage and price is still inflated.

Therefore, for sustained price growth, Cardano needs to see a relative increase in active addresses, transactions, and overall on-chain activities.

Read Cardano’s [ADA] Price Prediction 2024-25

As such, with the prevailing conditions, it seems ADA’s corrective phase is not over. As such, before a trend reversal, ADA could drop to $0.85 in the short term.

Subsequently, a trend reversal will see Cardano reclaim the $1.0 resistance. The $6 is currently far-fetched as the altcoin has to break out from $1.2, $1.6, $1.8, and $2.4 resistance levels.