- Hyperliquid witnessed a record USDC outflow.

- The outflow coincides with reports of possible attacks from DPRK hackers.

Hyperliquid[HYPE] has once again made headlines, though perhaps not in a way its token holders would prefer. Concerns have been raised over a potential security attack on the network, coinciding with a substantial outflow of USDC on the 23rd of December.

While these events may not be directly connected, they have sparked significant discussion within the crypto community.

Is Hyperliquid under attack?

According to Taylor Montana, a security researcher, suspicious transactions linked to wallets associated with North Korea were detected on the Hyperliquid network.

Montana suggested that these transactions could have been test trades, potentially laying the groundwork for a more extensive attack. Her analysis revealed that the wallets incurred a $701,000 loss from Ethereum perpetual positions.

While this loss may seem minor compared to the group’s past exploits, the possibility of an attack has raised concerns. Montana, who works with MetaMask, highlighted vulnerabilities in Hyperliquid’s validator setup.

She noted that the network operates with only four validators running identical code, making it more susceptible to coordinated attacks.

A USDC outflow coincidence?

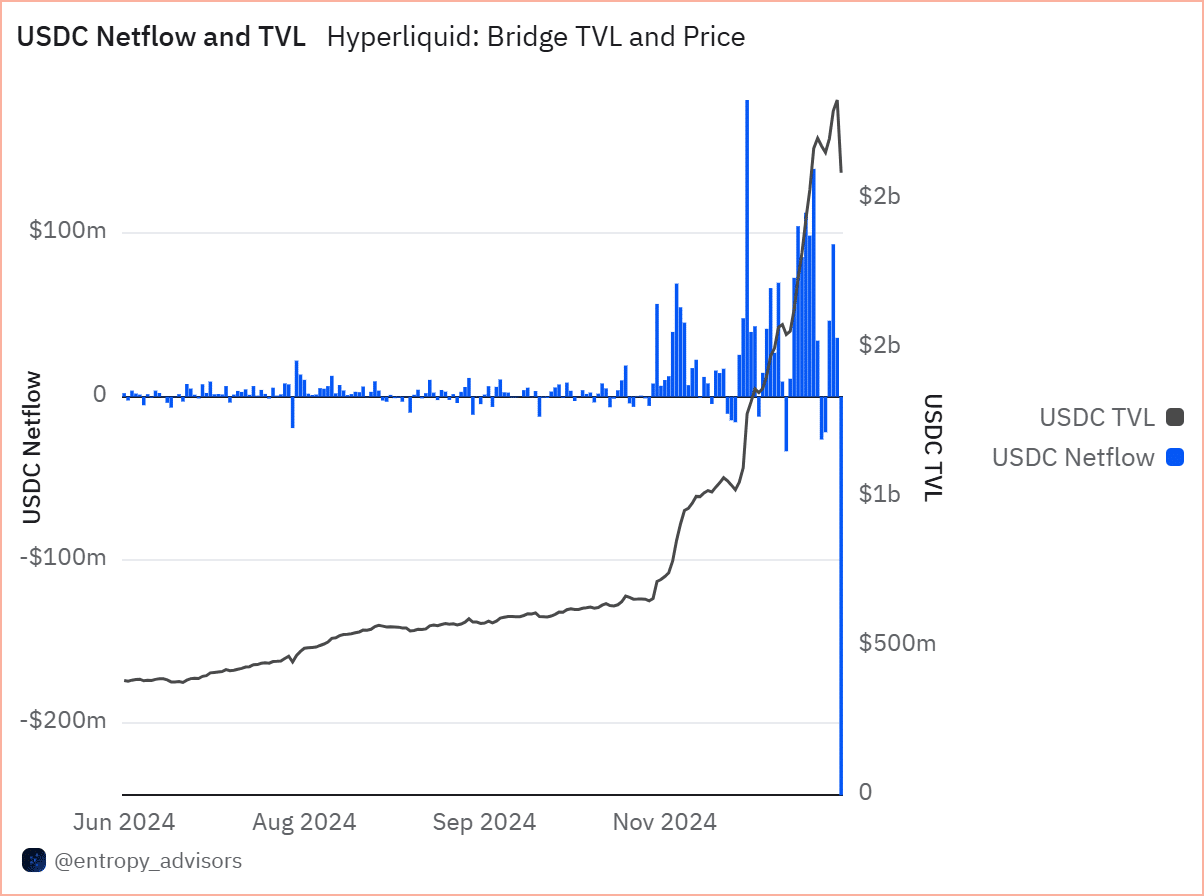

In addition to security concerns, Hyperliquid experienced a massive USDC outflow on the 23rd of December.

Data from Dune Analytics revealed an outflow of $249 million during the last trading session, marking the largest single outflow recorded on the network to date.

While the outflow itself isn’t inherently suspicious, its timing has fueled speculation about its connection to the alleged hacker activity.

Source: DuneAnalytics

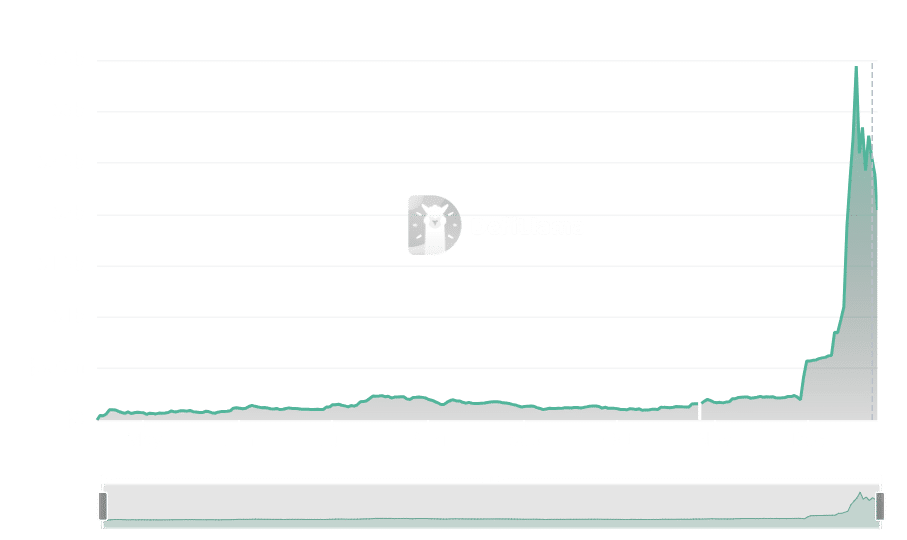

Hyperliquid’s Total Value Locked (TVL) remains substantial despite the outflow, standing at over $2 billion, according to DeFiLlama.

However, this figure reflects a significant drop from its $3 billion TVL on 17 December, largely attributed to the decline in HYPE’s value.

Source: DefiLlama

HYPE’s price action and the team’s response

At the time of writing, HYPE, Hyperliquid’s native token, is trading at approximately $29.80, reflecting a recovery of over 4.5% following its dip to $25. On the 22nd of December, HYPE’s value plummeted by over 11%, contributing to the drop in TVL.

The news of a potential attack partly fueled this decline but has since shown signs of stabilization.

In response to the reports, the Hyperliquid team dismissed the attack claims, stating that no vulnerabilities had been identified.

While the team refrained from naming individuals, their statement suggested that the researcher’s approach lacked professionalism, implying her findings were exaggerated or unfounded.

– Realistic or not, here’s HYPE market cap in BTC’s terms

While Hyperliquid has denied any active vulnerabilities, the combination of security concerns and significant USDC outflows has left the community on edge.

With HYPE showing resilience, it remains to be seen how the network will address these challenges and rebuild trust.