- AVAX formed a bullish pattern, with $43.50 and $60 as key resistance levels.

- Market indicators showed strong momentum, supported by rising Open Interest and trader activity.

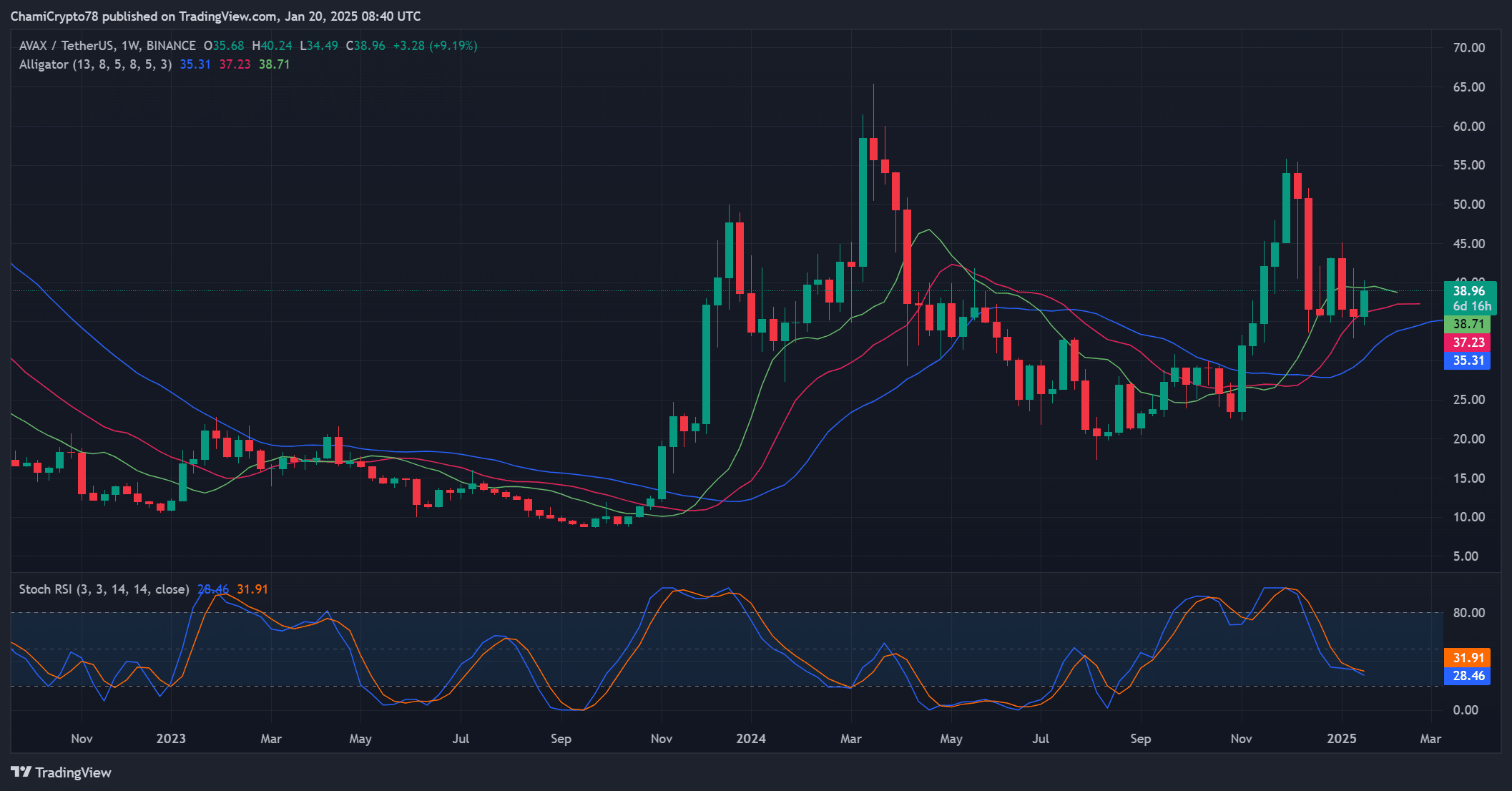

Avalanche [AVAX] is making waves as it consolidates within a symmetrical triangle, a classic bullish pattern that often precedes explosive moves. Trading at $38.98, up 2.98% at press time, AVAX is showing signs of a potential rally.

With strong support at the 50-week moving average and bullish sentiment gaining traction, traders are closely watching for the next big move. The question remains: can AVAX surpass key resistance levels and push higher?

Is AVAX ready for a price breakout?

AVAX’s price action suggests an upward breakout could be imminent due to its inverted head-and-shoulders pattern. This formation, with its head at $32.67 and shoulders on either side, signals strong bullish potential.

Resistance at $43.50 is the next key barrier, followed by $60, a critical target for bulls. The symmetrical triangle structure also supports this bullish outlook.

However, failure to hold above $43.50 could disrupt this momentum, making these levels crucial for traders to monitor.

Source: TradingView

What do technical indicators reveal?

Technical indicators provide additional evidence supporting the bullish case for AVAX. The Stochastic RSI stands at 31.91, indicating oversold conditions and suggesting a rebound could be around the corner.

Additionally, the Williams Alligator lines (35.31, 37.23, 38.71) are narrowing, signaling consolidation. As these lines begin to diverge, a breakout could gain momentum.

These indicators underscore the importance of upcoming price movements, with both resistance and support levels playing a pivotal role.

Source: TradingView

How market interest adds to the momentum

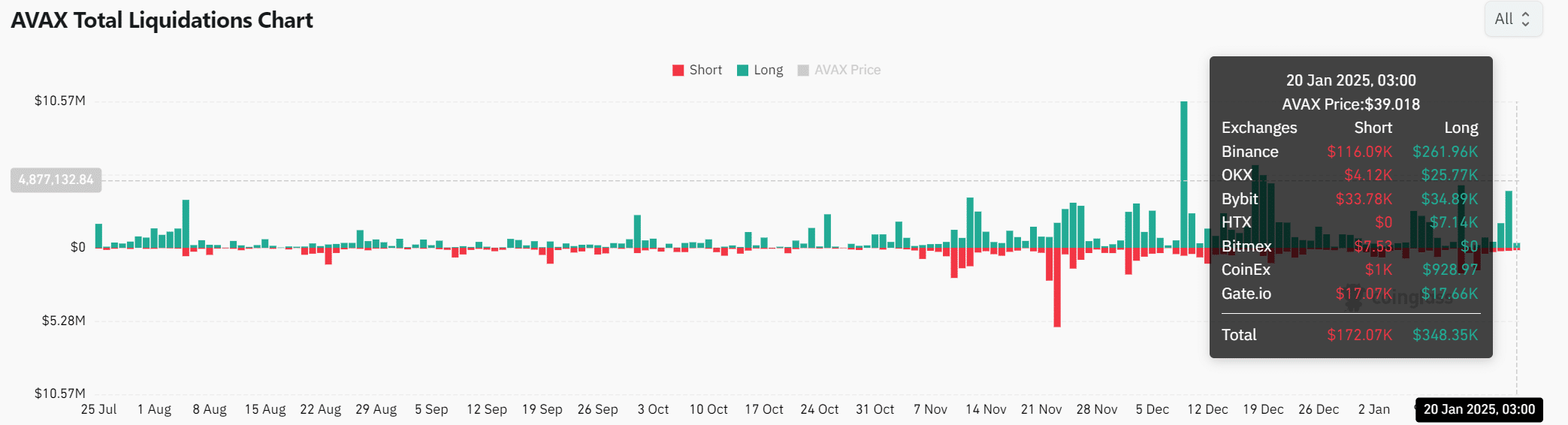

Market data highlights the growing interest in AVAX, as Open Interest rose 1.61% to $706.52 million, reflecting increased trader activity. Furthermore, total liquidations totaled $348.35K in long positions and $172.07K in shorts, showing heightened volatility.

This increased trading volume, alongside rising open interest, suggests that traders are positioning themselves for significant price action. However, sustained momentum will depend on whether buyers can maintain control at key levels.

Source: Coinglass

Read Avalanche’s [AVAX] Price Prediction 2024–2025

Conclusion: Is AVAX primed for a rally?

AVAX appears poised for a breakout as it consolidates within a symmetrical triangle, supported by bullish price action and strong technical indicators. If the price can break and hold above $43.50, the path to $60 becomes more likely.

Therefore, with rising market interest and technical alignment, AVAX could be gearing up for its next major rally.