- ai16z has made a strong upswing on its price charts, rising by 16.5% as demand for long positions soars.

- The altcoin is experiencing strong demand for long positions, risking a long squeeze.

ai16z [AI16Z] experienced a massive uptick on its price charts in the last 24 hours, surging from a low of $00.129 to a high of $0.157. This marked a 16.5% increase on its daily charts.

Over the same period, the memecoin saw a 16.31% increase in its volume, reaching $118.4 million.

Equally, ai16z’s Open Interest has surged by 17.8% hitting $61.19 million. When both volume and OI rise, it suggests that investors are strategically positioning before the market makes a move — they are opening positions.

Source: Coinalyze

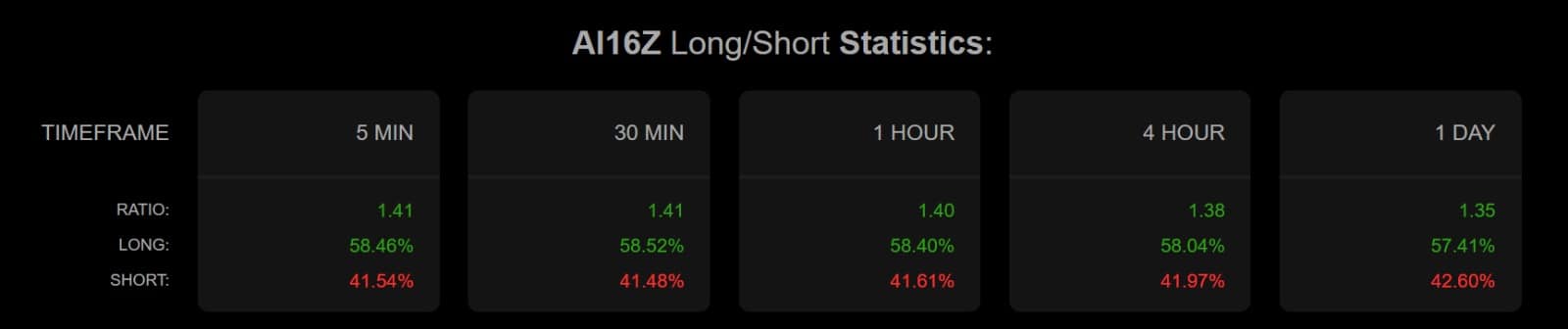

Looking at the Long/Short Ratio, it shows that these investors are entering the market and opening long positions.

In fact, longs account for 57.41% of Future contracts, while shorts are 42.6%. When longs dominate, it suggests that investors are optimistic and expect prices to move upwards.

Moreover, the Funding Rate remained positive for two straight days—another telltale sign of bullish market sentiment.

Still, whether this rally has legs or not remains in question.

Is a rally ahead for ai16z or is it just a bull trap?

According to AMBCrypto’s analysis, ai16z buyers are getting back into the market to strategically position themselves.

Source: TradingView

For starters, ai16z’s RSI had risen from 41 to 47 at press time. An uptick in RSI suggests that buyers are starting to come back into the market and there are more gains than losses.

Since RSI stayed below the 50 mark, bearish undertones still lingered. A break above 50 would solidify bullish strength.

Currently, although buyers are back in the market, they have not yet had total control of the market and sellers are still active.

Source: CoinGlass

A trap—or a launchpad?

Having said that, sellers didn’t disappear. Spot netflow remained positive, suggesting exchange deposits outpaced withdrawals.

Of course, this pattern usually signals profit-taking, especially by holders who had been underwater and used the bounce to exit. Despite the rise in longs, such selling pressure diluted the uptrend’s strength.

As such, the uptrend seems weak.

Looking at mixed signals, it could be safe to say that ai16z is seeing a bull trap, and a long squeeze might occur.

Therefore, ai16z could retrace from the recent uptick and decline to $0.146. However, if the attempt by bulls holds, we could see the altcoin surge to $0.160.