- The Fed greenlighted banks to support crypto and stablecoin activities.

- However, regular banking oversight will still be applicable.

The Fed retracted previous guidance that cautioned banks against engaging in crypto, stablecoins, and related activities.

On the 24th of April, the U.S. banking regulator said that the move was to ‘support innovation’ in the sector,

“These actions ensure the Board’s expectations remain aligned with evolving risks and further support innovation in the banking system.”

The agency rescinded two supervisory letters issued in 2022 and 2023.

These prior guidelines, jointly with other regulators, the FDIC and OCC, warned banks of the volatility, liquidity, and legal risks of engaging in crypto-asset and stablecoin activities.

Great for Bitcoin?

The Fed’s shift and softer stance on banking support for crypto activities was well received by the industry. In fact, Michael Saylor, founder of Strategy (formerly MicroStrategy), viewed the move as a great for Bitcoin [BTC].

“Banks are now free to begin supporting Bitcoin.”

For his part, Alex Svanevik, CEO of blockchain analytics Nansen, said that the update was great for banks eyeing the stablecoin market.

“Good news if you want big banks in the stablecoin game, and a sign that regulators are adjusting rather than outright blocking crypto integration.”

However, the Fed noted that regular banking oversight will still apply to crypto activities.

“Board will no longer expect banks to provide notification and will instead monitor banks’ crypto-asset activities through the normal supervisory process.”

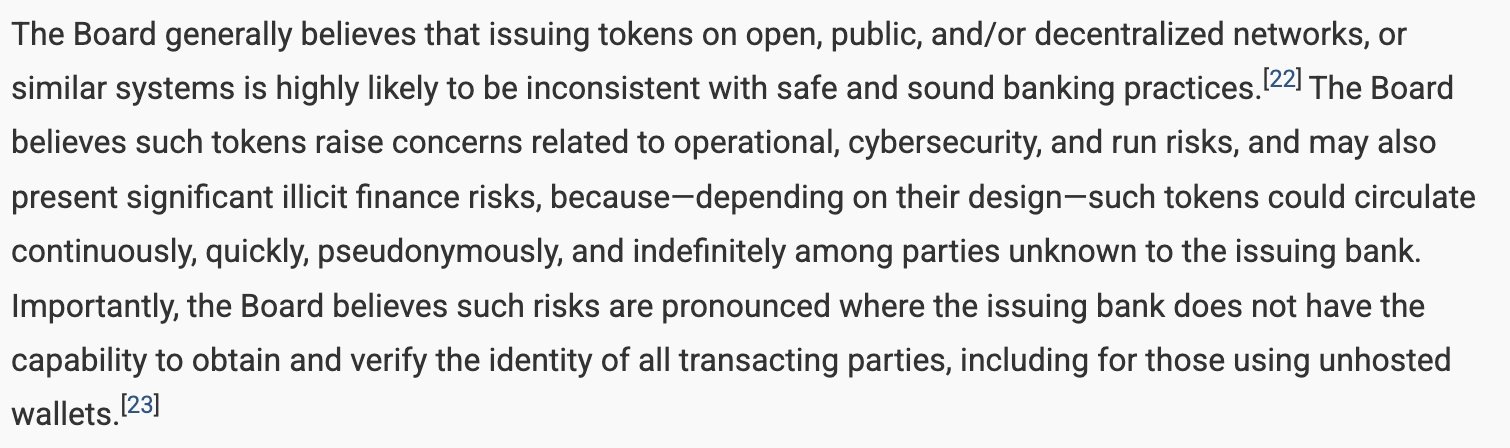

However, Caitlin Long, founder of Custodian Bank, pointed out that the Fed didn’t rescind one anti-crypto guidance issued in 2023 via a Board vote.

She warned that it wasn’t over, but passing the stablecoin law could overturn the guidance.

Source: Fed (excerpt of the 2023 guidance)

That said, in March, the OCC (Office of the Comptroller of the Currency) was the first to signal a pro-crypto shift and stated that banks could handle crypto and stablecoins.

Afterwards, the FDIC (Federal Deposit Insurance Corporation) followed suit and launched an investigation into the infamous crypto de-banking under the Biden Administration.

Under the Trump Administration, the sector has enjoyed much-needed regulatory relief.