- Over 100 million ADA sold by whales in a week, yet the total number of holders continues to grow.

- Despite whale exits, ADA’s price remains above key support levels. Can retail investors absorb the selling pressure?

The past week has seen a significant shift in Cardano’s [ADA] market trend as large investors offloaded over 100 million ADA.

This whale activity has triggered concerns among traders, especially given ADA’s muted price response in recent days. Despite the heavy sell-off, the total number of holders continues to climb, presenting a mixed market sentiment.

Cardano whale sell-off: A cause for concern?

Data revealed that addresses holding between 1 million and 10 million ADA reduced their holdings significantly.

Source: X

This selling pressure coincided with a steady downtrend in ADA’s price, which dipped to $0.7046, at the time of writing.

While whales often dictate short-term price action, the ongoing accumulation by smaller holders suggests broader market interest remains intact.

ADA’s price reaction

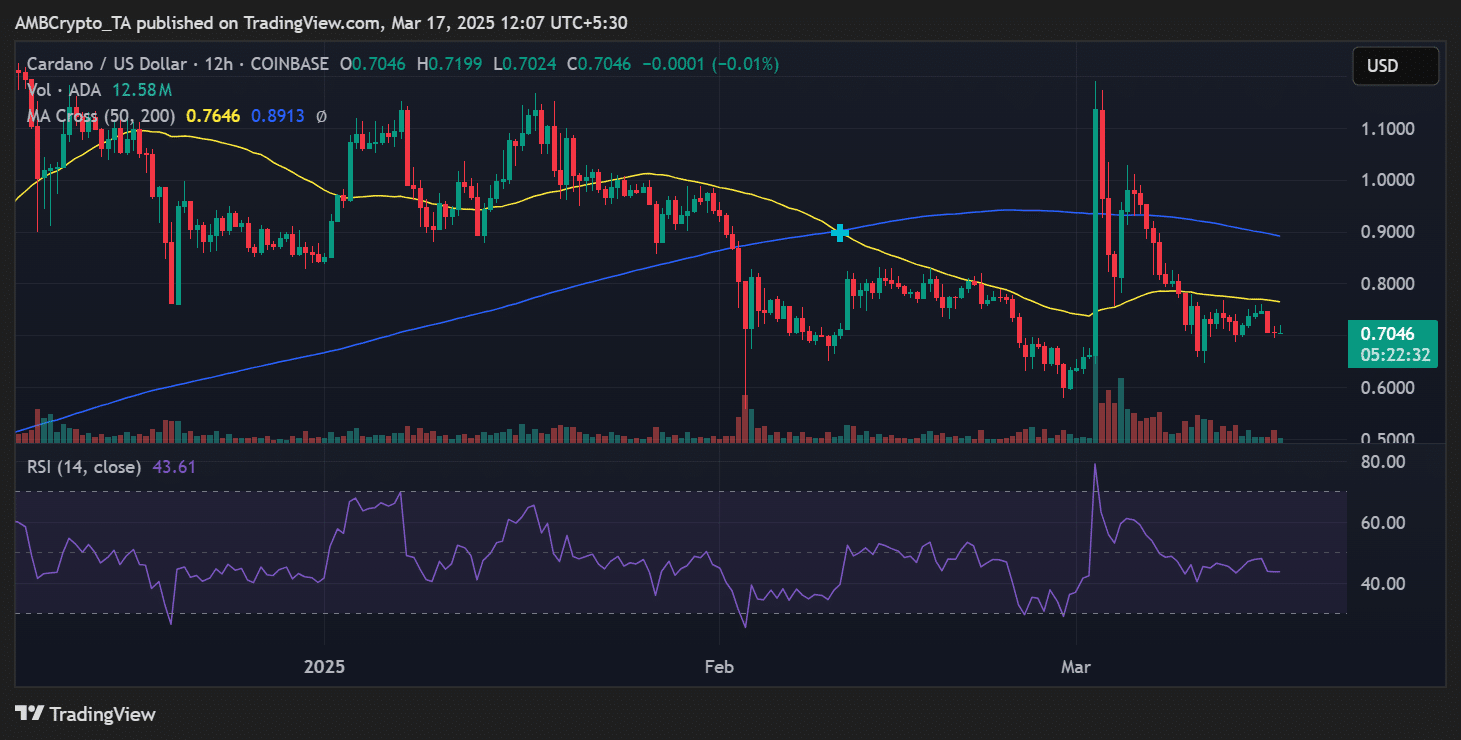

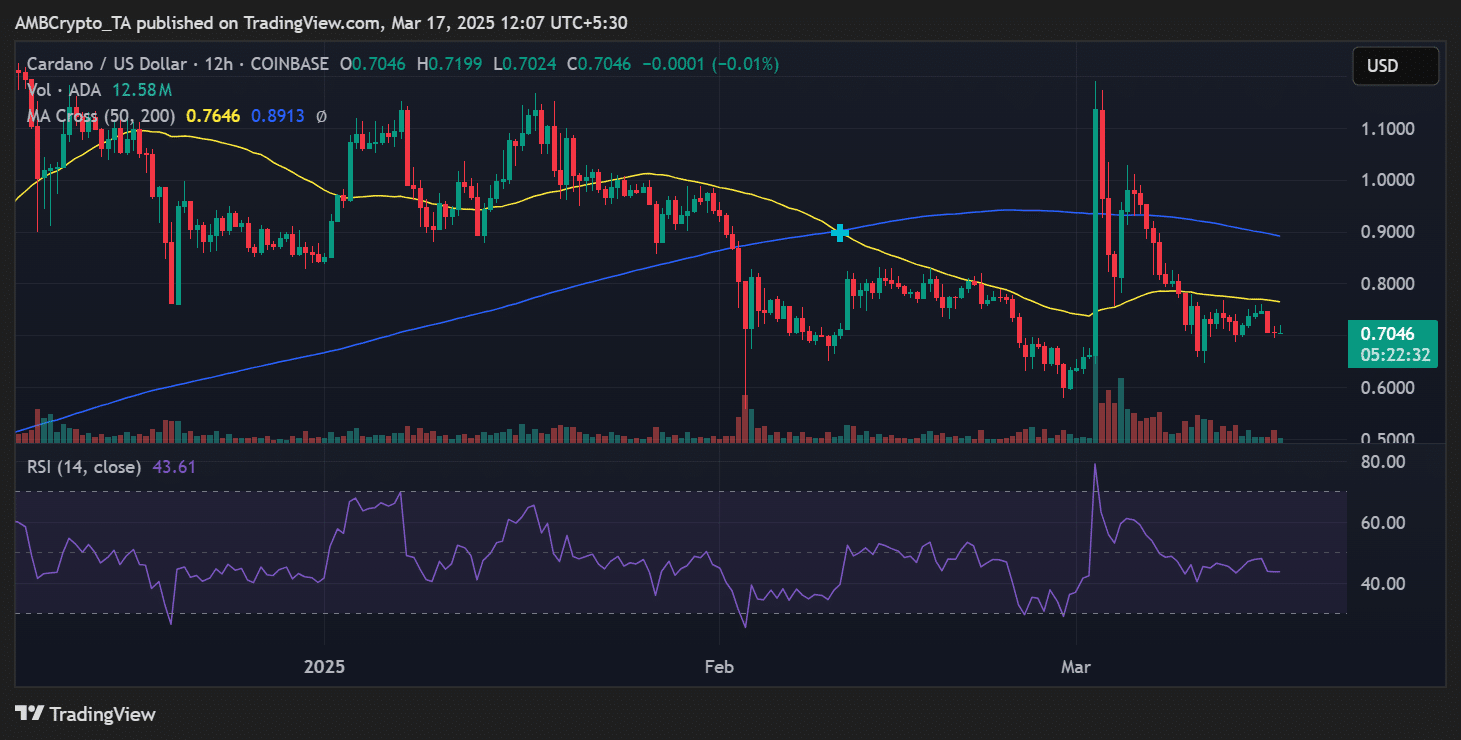

Cardano has been in a prolonged downtrend on the price chart, struggling to break key resistance levels. The 50-day and 200-day Moving Averages (MA) at $0.7646 and $0.8913 indicate a bearish outlook, respectively.

A move above the 50-day MA could signal recovery, but failing to hold current levels might push ADA toward $0.65.

Source: TradingView

The RSI (Relative Strength Index) was at 43.61, as of this writing, indicating neutral momentum. This suggests ADA is not in oversold conditions yet, but sustained whale sell-offs could push it further downward.

Cardano holder count rises despite whale exodus

Interestingly, the total number of Cardano holders has steadily increased, now surpassing 4.46 million. This indicates a divergence between whale activity and retail accumulation.

![Cardano [ADA] holders](https://ambcrypto.com/wp-content/uploads/2025/03/Cardano-ADA-06.36.54-17-Mar-2025.png)

![Cardano [ADA] holders](https://ambcrypto.com/wp-content/uploads/2025/03/Cardano-ADA-06.36.54-17-Mar-2025.png)

Source: Santiment

Such trends often signal long-term confidence in an asset, even when large investors take profits or reallocate their portfolios.

Will ADA rebound or continue to decline?

For Cardano to regain bullish momentum, it must reclaim the $0.75-$0.80 range. The next significant resistance is $0.78, with a stronger bullish confirmation occurring if the price moves above $0.80.

On the downside, losing support at $0.70 could result in accelerated declines toward $0.65. With whales exiting and retail traders stepping in, ADA is at a critical juncture.

Traders should monitor volume trends and key price levels closely to anticipate the market’s next direction.