- Solana’ recovery is under pressure from large-scale sell-offs and weak sentiment.

- Beyond technical, Solana found itself embroiled in controversy.

Solana [SOL] has plunged 36% this month, ranking as the worst-performing top asset. A 2% uptick in trading volume, coupled with an oversold RSI and a bullish MACD crossover, signals potential dip buying around $120.

However, with risk appetite still low, can SOL bulls leverage technicals alone to stage a recovery?

Beyond the charts: Key factors at play

Pumpfun continues to fuel selling pressure on Solana, recently transferring 196,370 SOL worth $25.3 million to Kraken.

In total, it has deposited 2,629,656 SOL worth $511 million at $194 and offloaded 264,373 SOL for $41.64 million USDC at $158, contributing to the ongoing downturn.

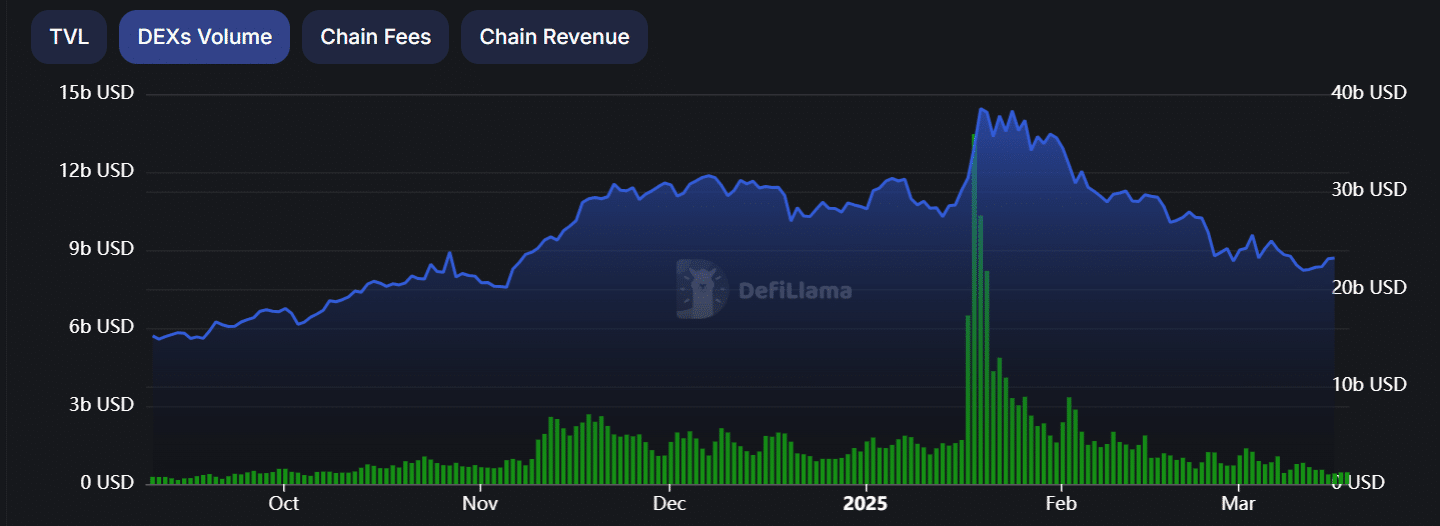

With increasing sell-side liquidity in a risk-off market, a rebound looks uncertain. Meanwhile, Solana’s DEX volume and TVL have slipped back to pre-election levels, signaling weakening network activity.

Historically, Solana’s recovery phases have been marked by double-digit growth in TVL and DEX volume, often signaling a market bottom.

However, on the 15th of March, its DEX volume dropped below $1 billion, raising concerns about a potential trend reversal.

Source: DefiLlama

Unless traders step in with strong buy-side momentum, further downside remains likely. Adding to the uncertainty, Solana now faces backlash over a controversial advertisement on X (formerly Twitter).

The ad, which amassed 1.2 million views, was met with overwhelming negativity, forcing Solana to delete it. However, the damage was done, impacting market sentiment.

Compounding bearish signals, Weighted Sentiment has flipped negative, reinforcing the lack of bullish confirmation and suggesting investors remain cautious about a potential rebound.

Assessing Solana’s next move

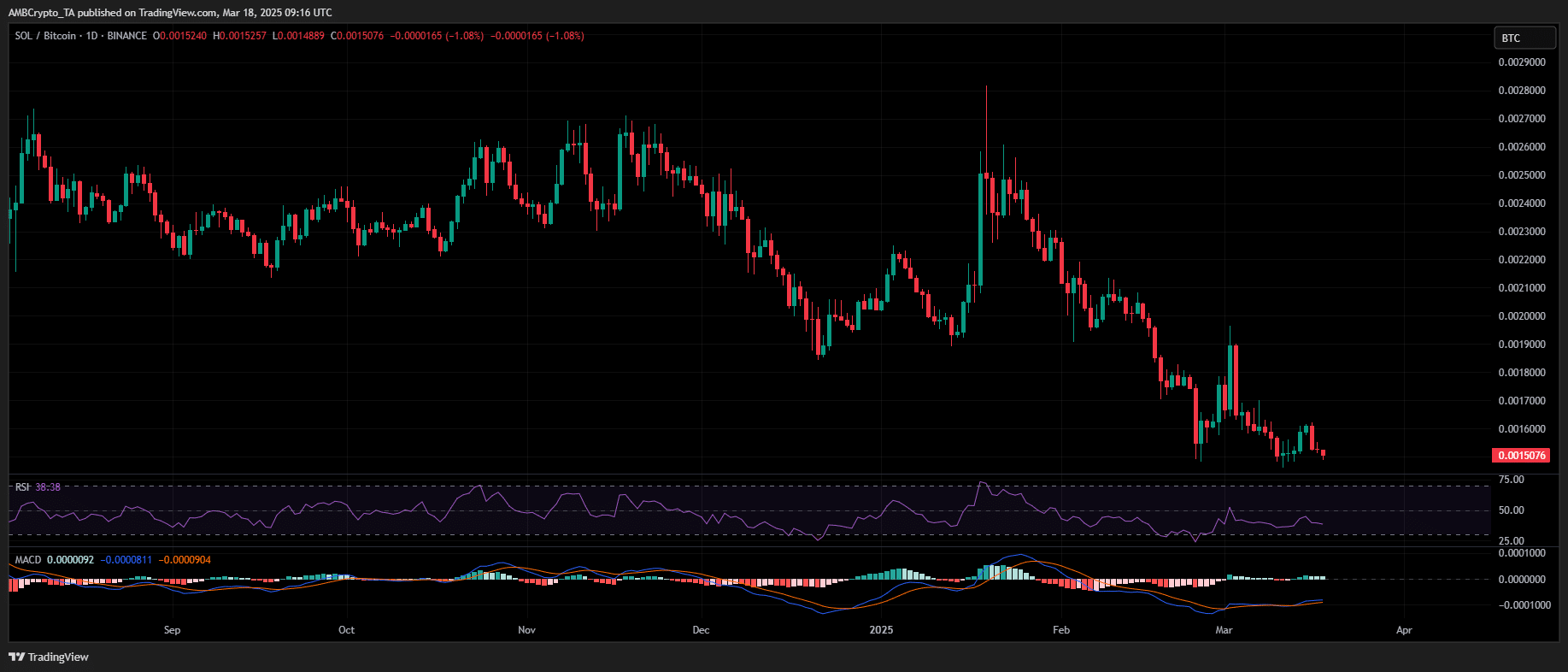

Solana’s price action highlights a persistent supply-demand imbalance. While Bitcoin consolidates, Solana has yet to see strong capital inflows from strategic investors.

Despite a 30% monthly decline, discounted prices have not triggered strong accumulation. The SOL/BTC pair continues to print lower lows, recently plunging to a two-year low, signaling weakening relative strength.

Source: TradingView (SOL/BTC)

With large-scale sell-offs and bearish sentiment dominating, the absence of conviction from risk-managed traders weakens SOL’s chances of reclaiming key resistance levels.

Given the current market dynamics, a further pullback toward $120 or lower appears increasingly probable.