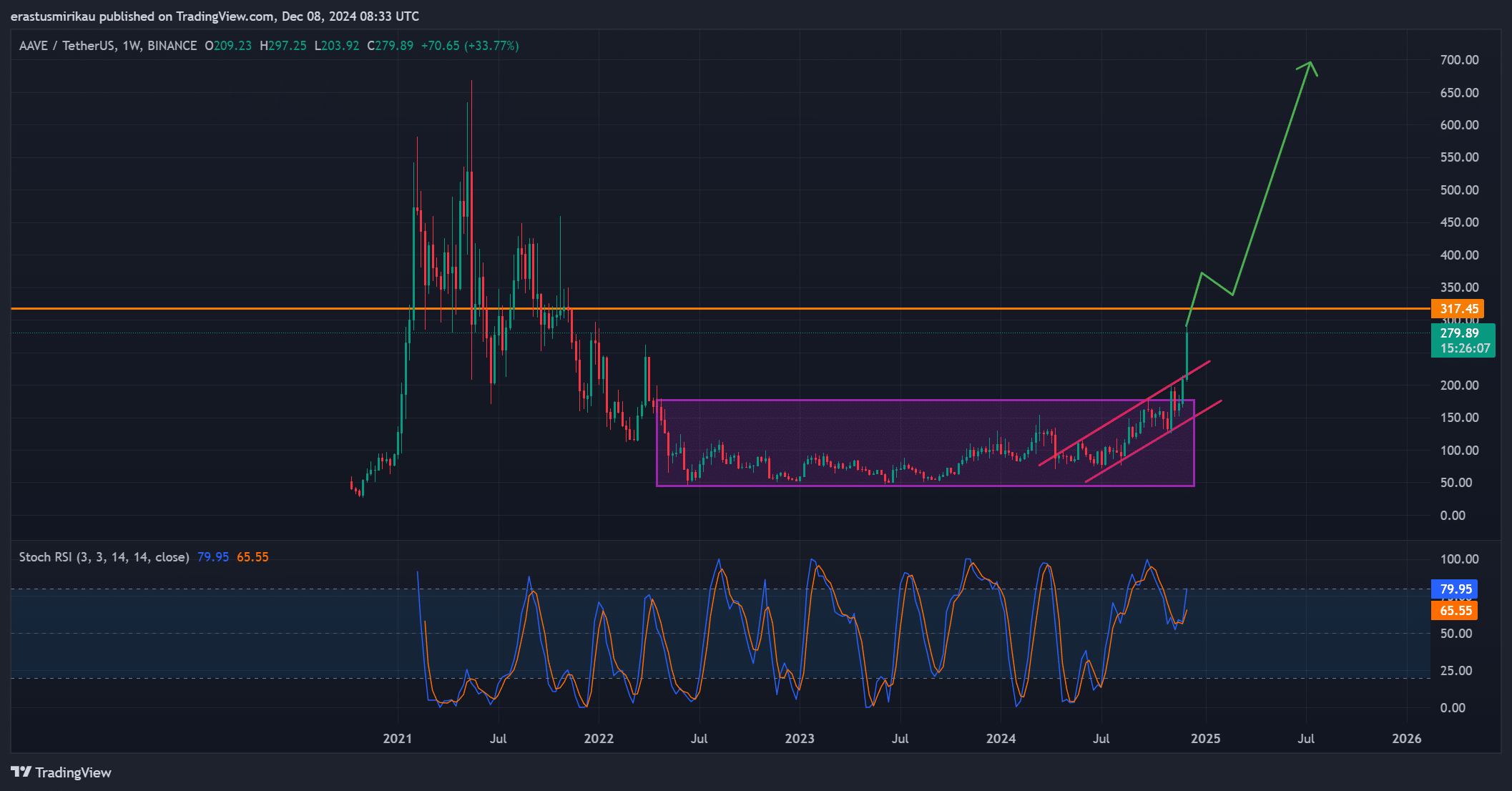

- AAVE has broken out of consolidation and an ascending channel, signaling strong bullish momentum.

- On-chain and exchange data showed growing investor interest, indicating a potential upward trend.

Aave [AAVE] has shattered its long-standing consolidation phase and exited the ascending channel, showcasing strong bullish momentum.

At press time, AAVE traded at $279.53, experiencing a 1.68% decline in the past 24 hours.

However, despite this short-term setback, technical and on-chain indicators pointed to a potential upward trend. Could AAVE be on the brink of a significant bullish breakout in the crypto market?

What do the charts say about AAVE’s technical movement?

AAVE was a crucial resistance level of $317 at press time, a point that could confirm the bullish trend. The breakout from the consolidation phase and ascending channel signals a robust upward movement.

The Stochastic RSI was 79.95, indicating strong bullish sentiment.

However, such a high RSI also suggests overbought conditions, which could trigger a temporary pullback. Nevertheless, AAVE’s consistent upward movement and breakouts showed solid support.

Therefore, a decisive break above $317 would likely drive further bullish momentum and attract more investor attention.

Source: TradingView

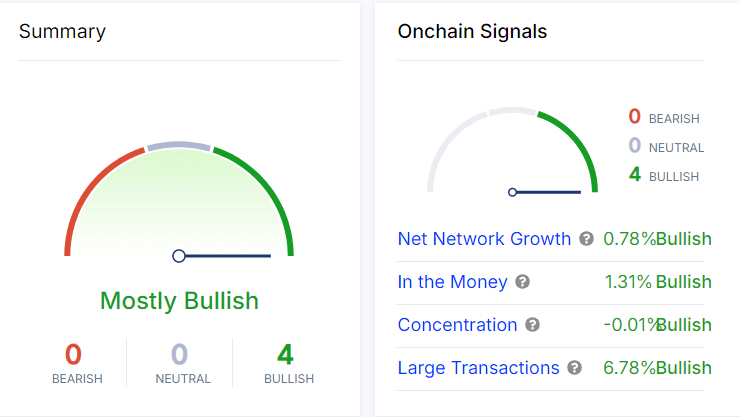

What are the on-chain signals telling us?

On-chain data adds to the bullish outlook for AAVE. Net network growth stood at 0.78%, indicating an increase in active users. Additionally, 1.31% investors were “in the money,”, reinforcing the bullish sentiment.

Concentration data also reveals a slight bullish trend of -0.01%, while large transactions have surged by 6.78%.

These suggested significant investor interest and activity, highlighting a growing bullish trend within the altcoin ecosystem.

Source: IntoTheBlock

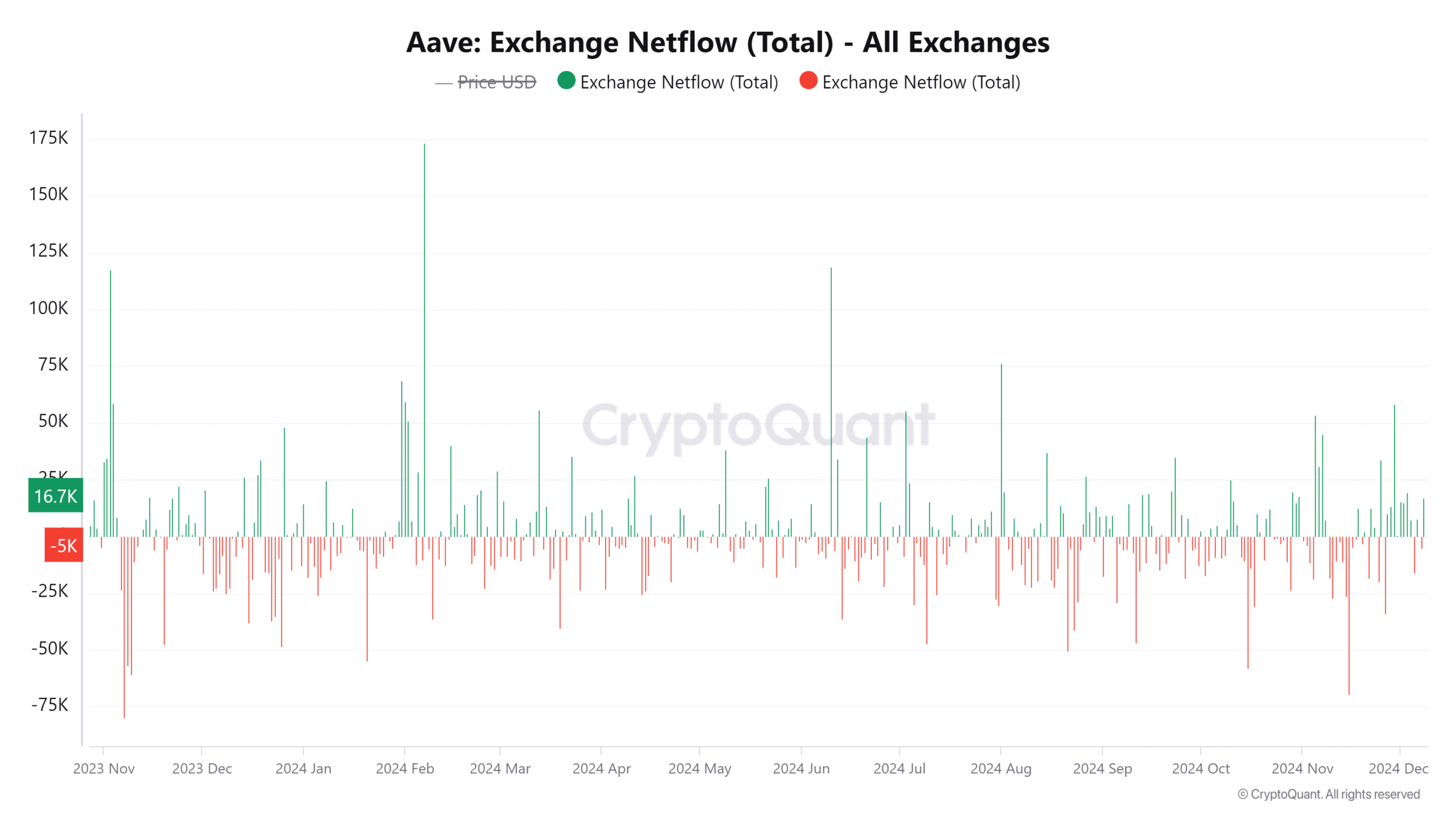

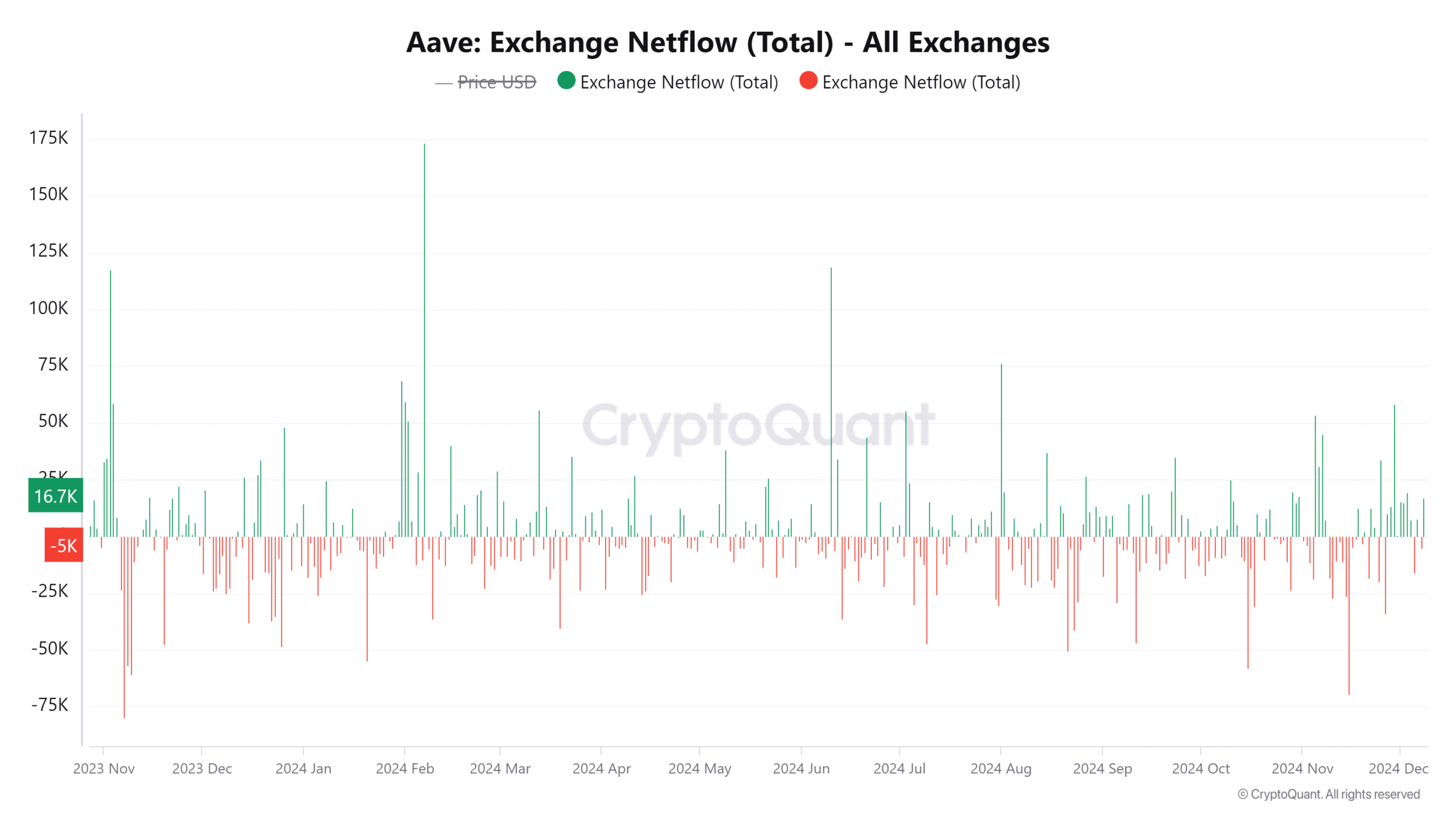

What does the exchange netflow reveal about AAVE’s strength?

The exchange netflow saw a 24-hour drop of 3.35%, reaching 22.5459k. This suggested that more investors were moving their holdings off exchanges, a sign of long-term bullish sentiment.

Investors prefer storing assets in private wallets rather than on exchanges, expecting higher returns in the near future.

Source: CryptoQuant

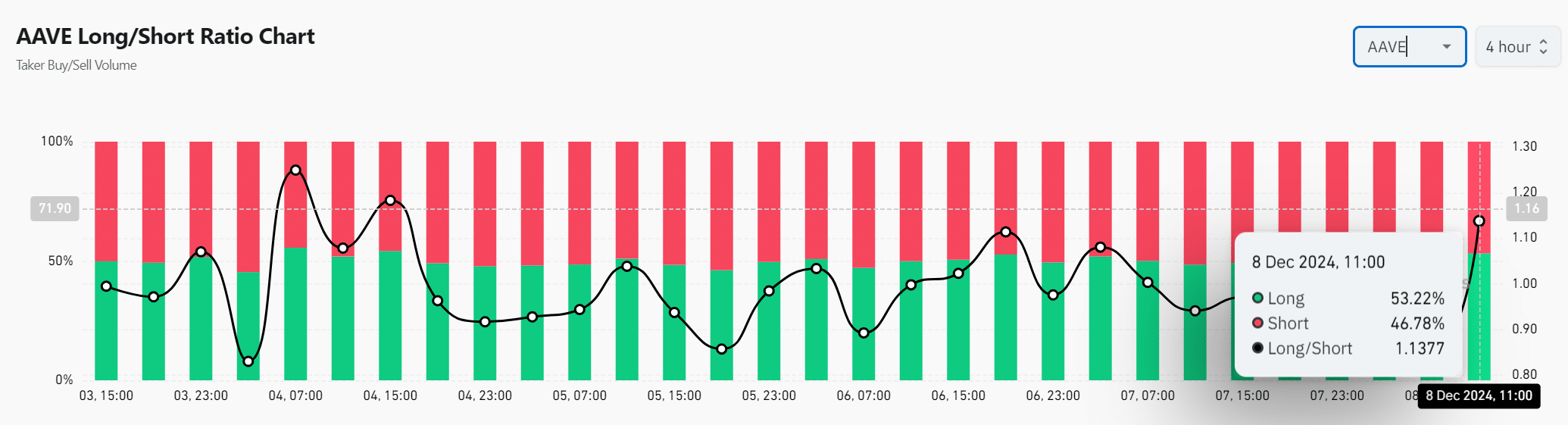

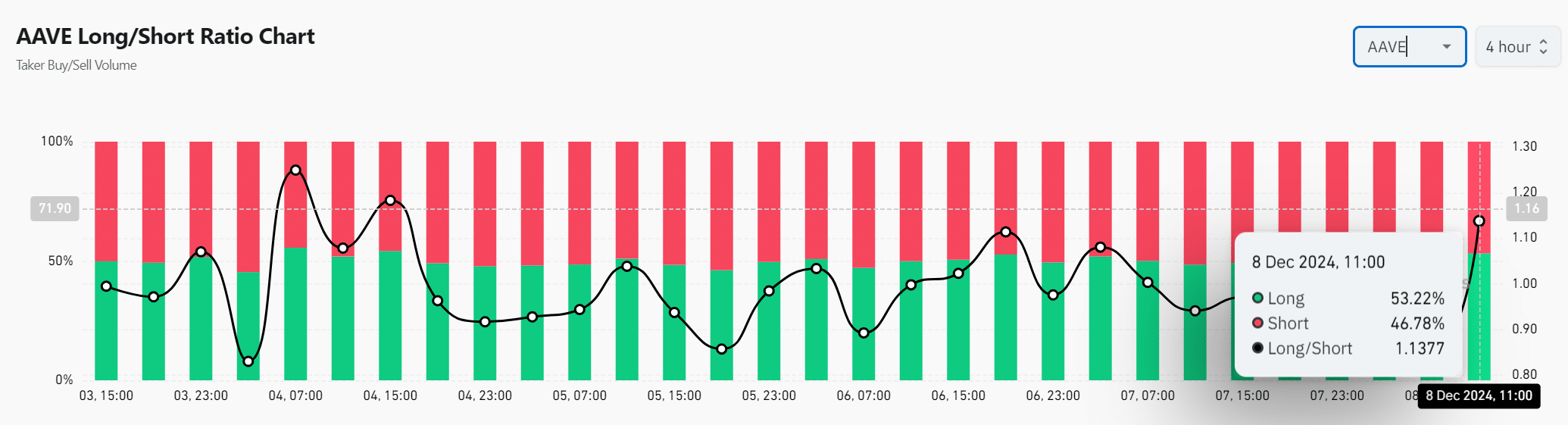

What do long and short positions say about market sentiment?

The long/short ratio was 1.1377 at the time of writing, with long positions at 53.22% and short positions at 46.78%. The higher percentage of long positions indicated strong bullish sentiment among traders.

Therefore, investors remained confident in AAVE’s continued upward movement and anticipated significant gains.

Source: Coinglass

Read Aave’s [AAVE] Price Prediction 2024-25

AAVE shows bullish momentum across technical, on-chain, and exchange indicators. The $279.53 price level, combined with the breakout from the long consolidation phase and ascending channel, signals strong bullish interest.

Therefore, AAVE is likely on the verge of a breakout, with a significant upward trend anticipated in the near future.