- Stader crypto retained its bullish structure on the 4-hour chart.

- Short-term holders in profit could contribute to SD’s drop below $1 support.

Stader [SD] crypto had been in a steady downtrend in September and October. It sustained losses worth 47.5% from the 7th of August to the 2nd of November. Since then, Stader crypto has rallied a whopping 250.7% in six days.

At its peak at $1.5, SD had registered gains worth 414.1% in just over five days. The pullback of the past 12 hours was part of a healthy uptrend, but how deep will this pullback reach?

Stader set to decline below the $1 mark?

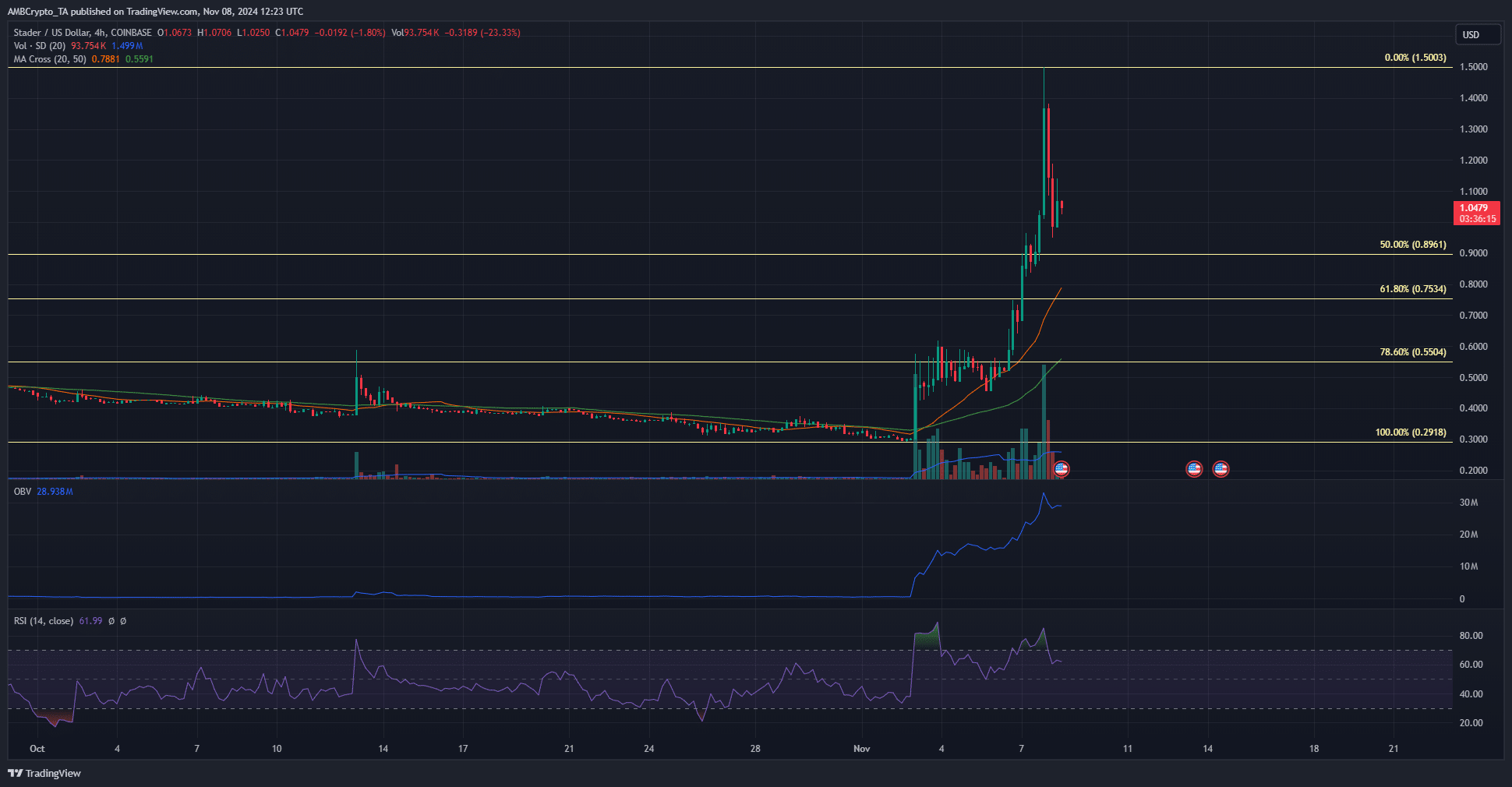

Source: SD/USD on TradingView

At press time, both the psychological round number levels of $1.5 and $1 were key. $1.5 formed the local highs that Stader crypto needed to overcome to resume its uptrend. The $1 support level was tested in recent hours and saw a bounce to $1.14.

This bounce suggested buyers were active at $1 but might not be able to hold on. After a triple-digit percentage move within a week, a deep retracement would only offer investors a chance to re-enter the market.

A pullback below $1 would flip the market structure bearishly, but would also be a healthy outcome for the next price move higher. As things stand, the technical structure on the 4-hour chart and the momentum were in bullish favor.

Profit-taking likely to push Stader crypto southward

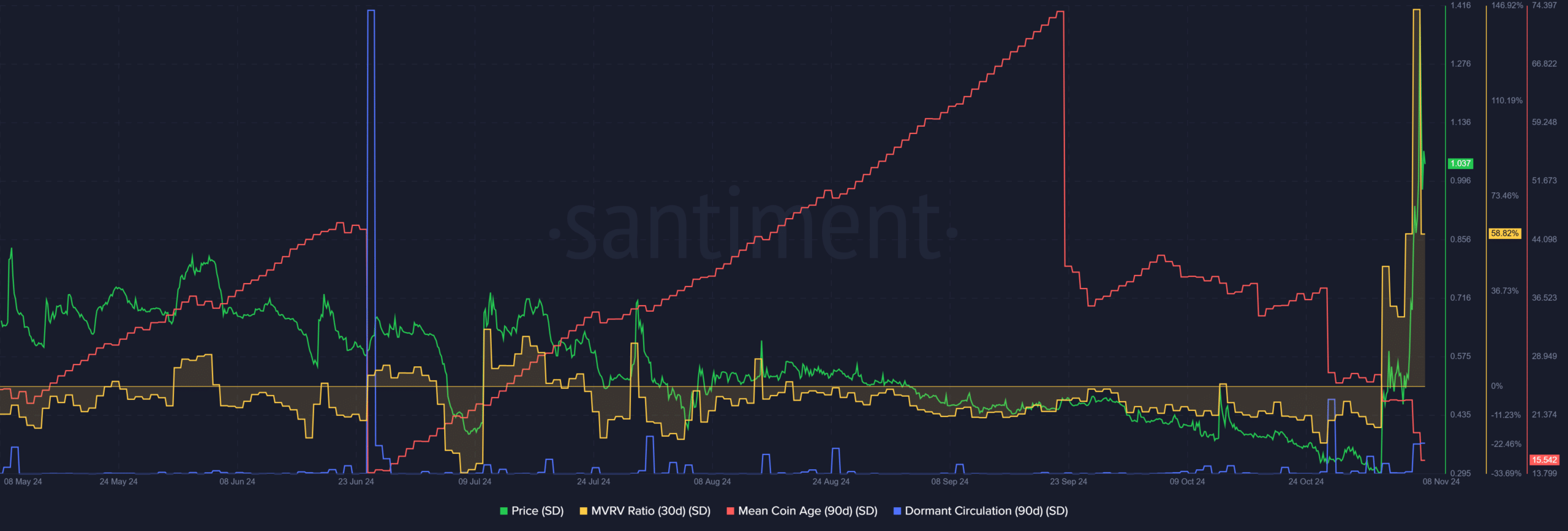

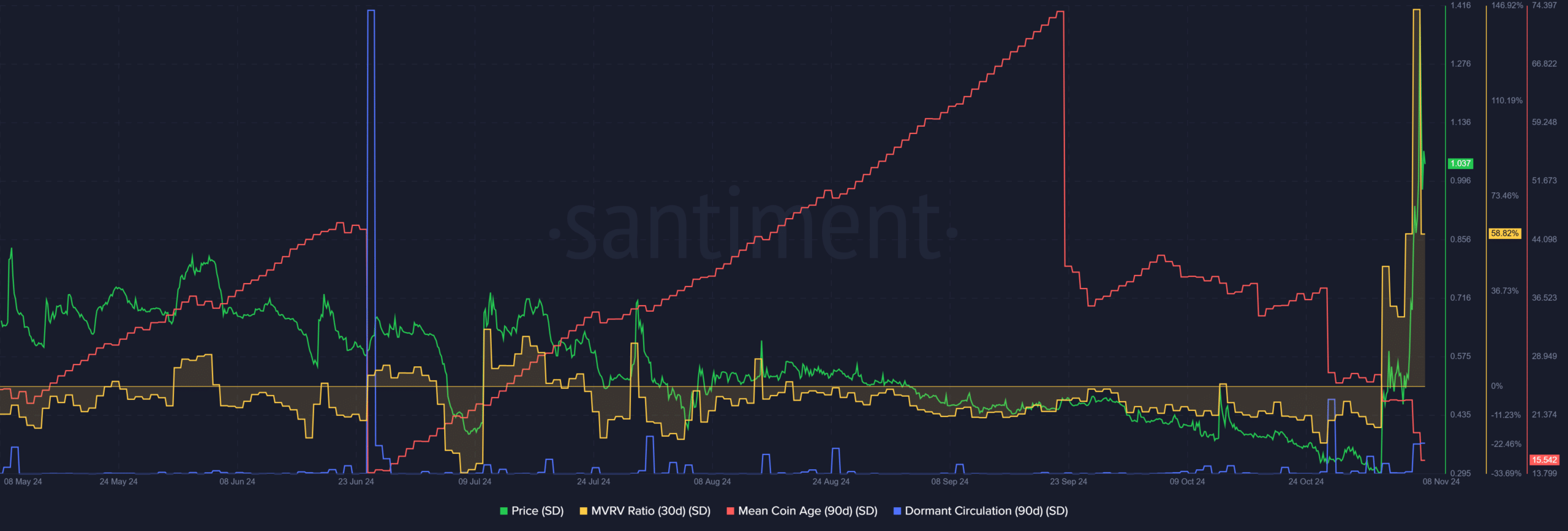

Source: Santiment

On-chain metrics showed that the mean coin age began to trend downward in the final week of September, more than a month before SD rallied past $1. This signaled distribution as prices declined in the past two months.

Is your portfolio green? Check the Stader Profit Calculator

The price surge did not see increased selling pressure, evidenced by the lack of significant peaks on the dormant circulation recently. However, short-term holders were at an enormous profit, averaging 58.6% gains.

This could lead to selling pressure that pulls Stader crypto prices below $1 and toward the moving average support levels at $0.75 and $0.55.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion