- A recent report has revealed an interesting connection between global inflation and the crypto market cap.

- Is the recent ‘dip’ in the crypto market cap just a false alarm, or is volatility looming?

A year ago, the crypto market cap was a solid $1.72 trillion. Fast-forward to today, and it’s soared to $3.27 trillion—a staggering 90.11% jump year-to-date.

Interestingly, half of that growth came in Q4 alone.

Clearly, the “Trump pump” was the key catalyst, fueling a massive influx of fresh capital into the crypto market.

However, 2024 closed with the market still 11% off its peak from mid-December.

Could this widening gap be a sign of things to come as we head into what’s shaping up to be the most volatile Q1 yet?

The crypto market must be prepared for a volatile 2025

Interestingly, a recent Grayscale report uncovered a striking link between the crypto and bond markets.

The market cap of digital assets has now surpassed that of the U.S. high-yield bond market, more than doubling its size. Clearly, investors are turning to crypto in search of better returns.

Despite this massive growth, the crypto market’s recent double-digit dip is not just a fluke.

The Fed’s signal for fewer rate cuts in 2025 has sparked some uncertainty, creating a tricky dynamic for both markets.

Here’s the deal: Typically, when interest rates rise, bonds become more attractive. Why? Because the yield increases, offering a better deal for investors.

So, as the Fed leans toward fewer rate cuts, it’s no surprise that investors are flocking to bonds for their steady returns. This could set the stage for a potential rebound in the bond market in 2025.

In response, the crypto market, which often moves inversely to bonds, has taken a hit. Still, this dip might be more about “speculation” on rate hikes than actual changes in borrowing costs.

So, is the crypto market poised for a turnaround, or are we looking at a longer dip?

The U.S. bond market under scrutiny

Technically, bonds play a critical role in how the U.S. government raises funds.

Still, when interest rates rise, they come with a hefty price tag—no wonder the president-elect, Donald Trump, has been outspoken about the Fed’s reluctance to cut borrowing costs.

This could be a pivotal moment for the crypto market. While many expect inflation to rise with Trump’s hardline policies, November’s modest core PCE inflation growth suggested less price pressure than anticipated.

Adding to the mix, mid-December data revealed continuing unemployment claims hitting a three-year high, signaling potential economic strain.

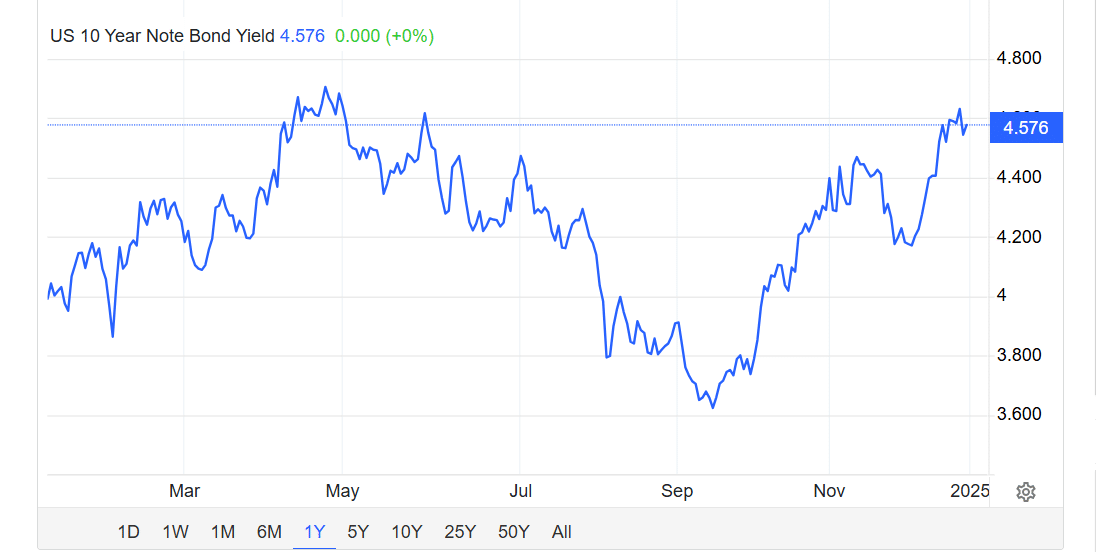

Meanwhile, the yield on the 10-year U.S. Treasury note dropped to 4.576%, dipping further from its recent peak of 4.6%, the highest it’s been since early May.

Source: Trading Economics

These shifting dynamics could lead to the government reconsidering its approach to borrowing costs, especially given the immense debt load it’s facing.

So, what does this mean for investors? It could be time to refocus on crypto. Moreover, with a possible economic downturn looming, the idea of Bitcoin [BTC] as a strategic reserve, as suggested by Trump, is gaining traction.

Read Bitcoin’s [BTC] Price Prediction 2025-26

2025 promises to be a pivotal year for both the bond and crypto markets. With bonds facing mounting challenges, the crypto market presents a profitable opportunity.

But, how the government responds to the macroeconomic trends, particularly around interest rates, remains the key factor to watch in the coming months.