- The altcoin market cap has risen to $845 billion, with analysts predicting a potential upside reversal.

- ADA continues to struggle, experiencing a 13% decline in the past week amid decreasing whale transactions.

The global altcoin market has been navigating through a period of both optimism and caution.

As of the time of writing, the global altcoin market cap stood at $845 billion, marking a significant recovery from the $729 billion recorded on the 24th of August.

This resurgence in market cap has sparked discussions among analysts, with opinions divided on the future trajectory of altcoins.

Altcoin season incoming?

One such analyst, known as Moustache, recently shared his outlook on the altcoin market in a post on X (formerly Twitter).

He presented the altcoin market’s behavior over the past five years, highlighting a consistent trendline that has historically served as a support level.

According to Moustache, each time the market has touched this trendline, it has triggered a significant reversal to the upside.

This pattern was observed in 2019, 2020, and 2023, leading to substantial rallies, including the altcoin bull run in 2021.

Now, in 2024, the altcoin market has once again reached this critical trendline, suggesting that another reversal and potential rally could be on the horizon.

Source: Moustache/X

Moustache emphasized the importance of patience in the current market, stating,

“Altcoins are on a trendline that has been of great importance for 5 years. In the past, every touch of this trendline has led to a subsequent Altcoinseason. As mentioned many times before: You need patience in this market. Those who have it will be richly rewarded.”

However, while this historical trendline offers hope, the current market conditions for major altcoins paint a more cautious picture.

Cardano as a case study

Despite the optimistic outlook provided by the trendline analysis, individual altcoins such as Cardano [ADA] have been facing significant challenges.

ADA, one of the top altcoins by market cap, has been on a consistent downtrend over the past few weeks.

In the last seven days alone, ADA has seen a 13% decline in value, with its price dropping by an additional 4% in the past 24 hours. As of the time of writing, ADA was trading at $0.3291.

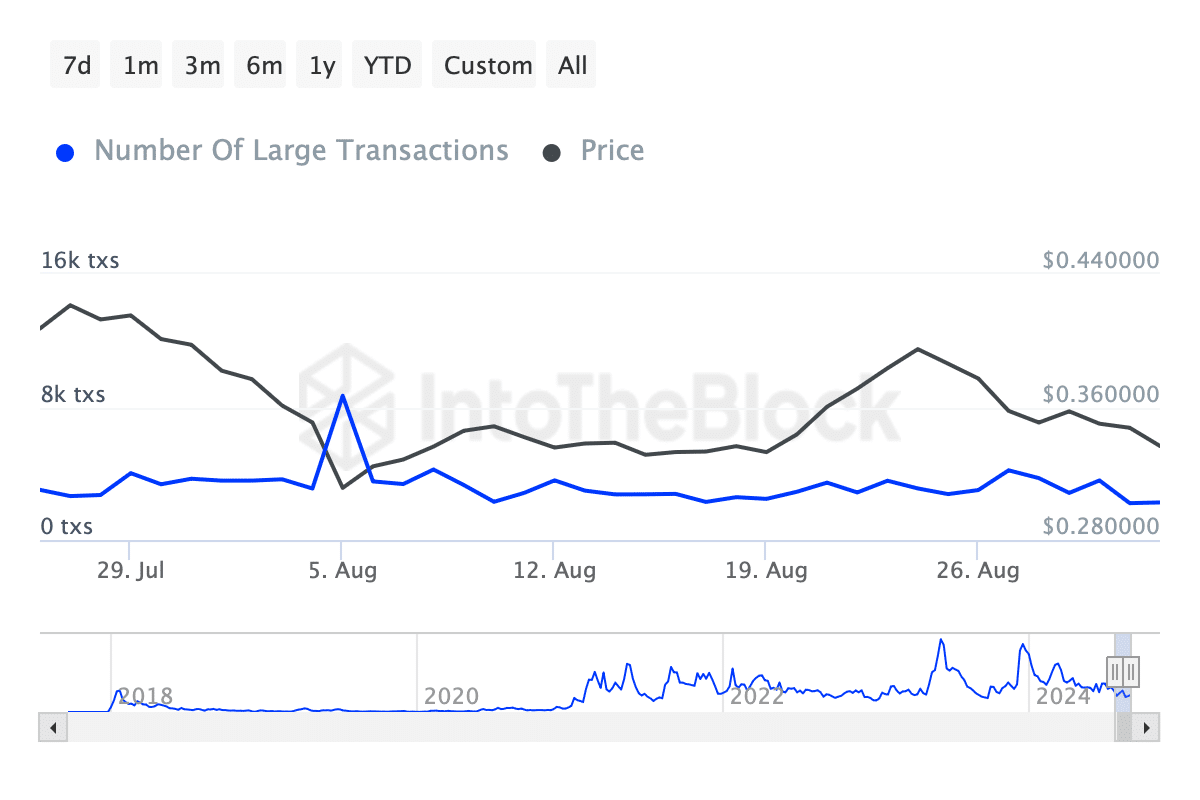

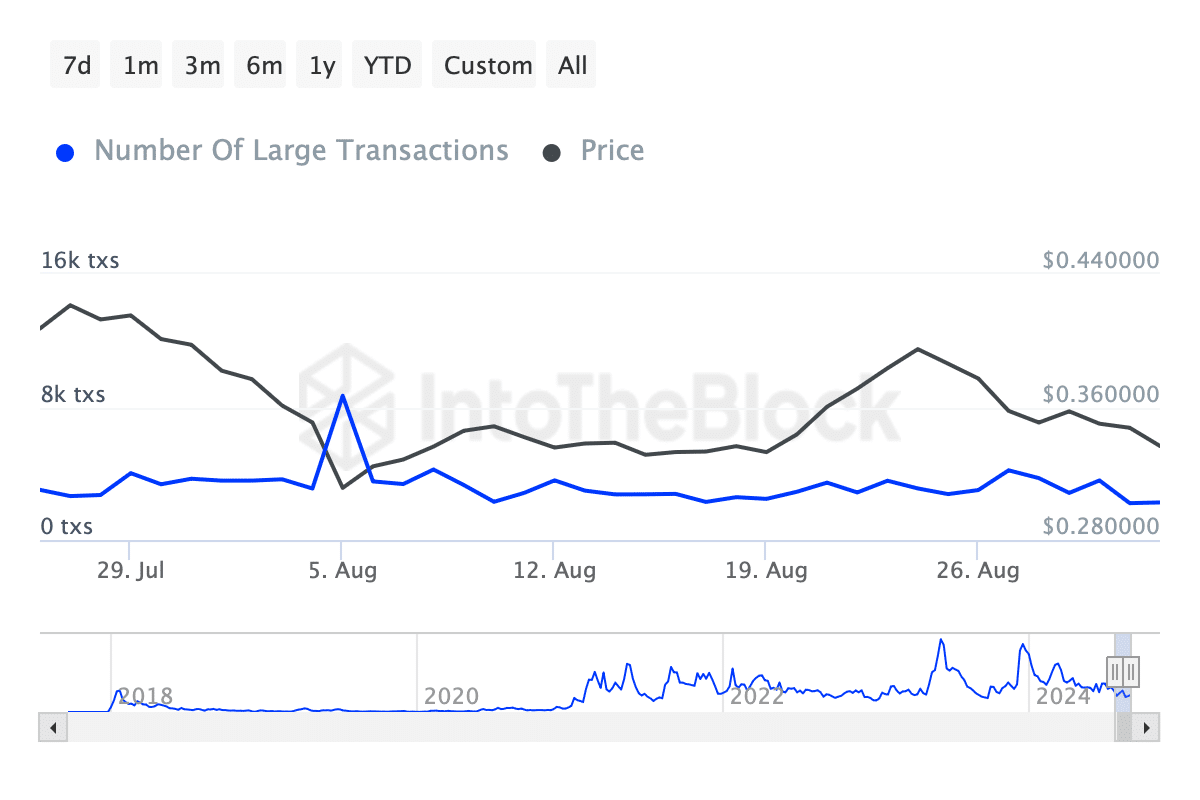

This downward trajectory is also reflected in the activity of large-scale transactions within the ADA network.

Source: IntoTheBlock

According to data from IntoTheBlock, the number of whale transactions—those exceeding $100,000—has decreased significantly, dropping from over 4,000 late last month to below 2,500 as of press time.

This reduction in whale activity suggested a cautious approach from large investors, further contributing to the bearish sentiment surrounding ADA.

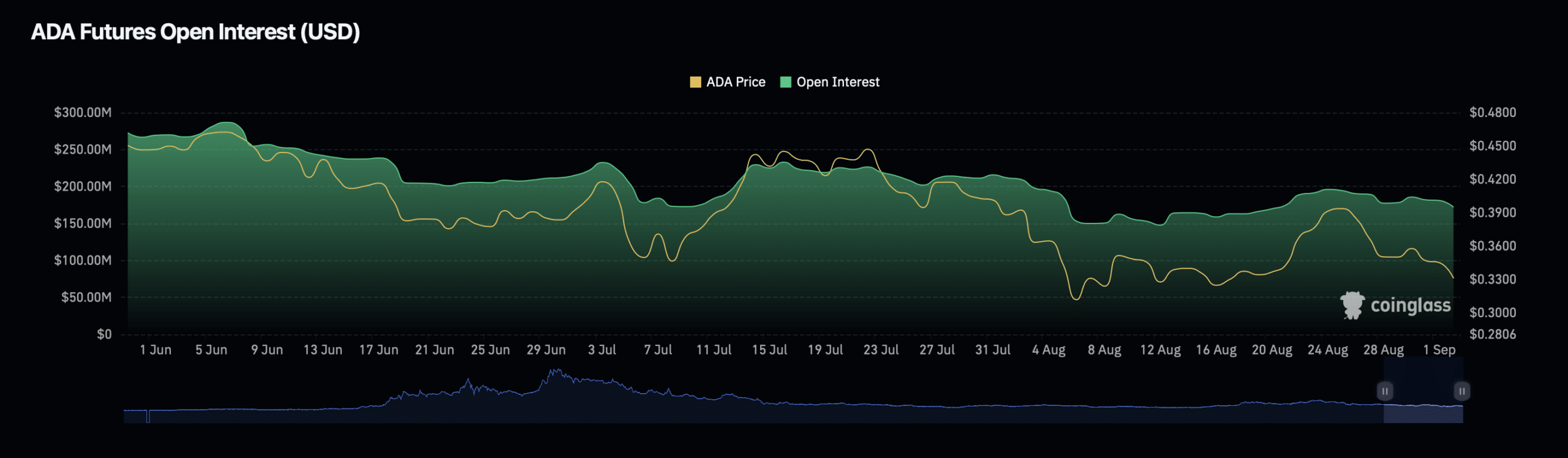

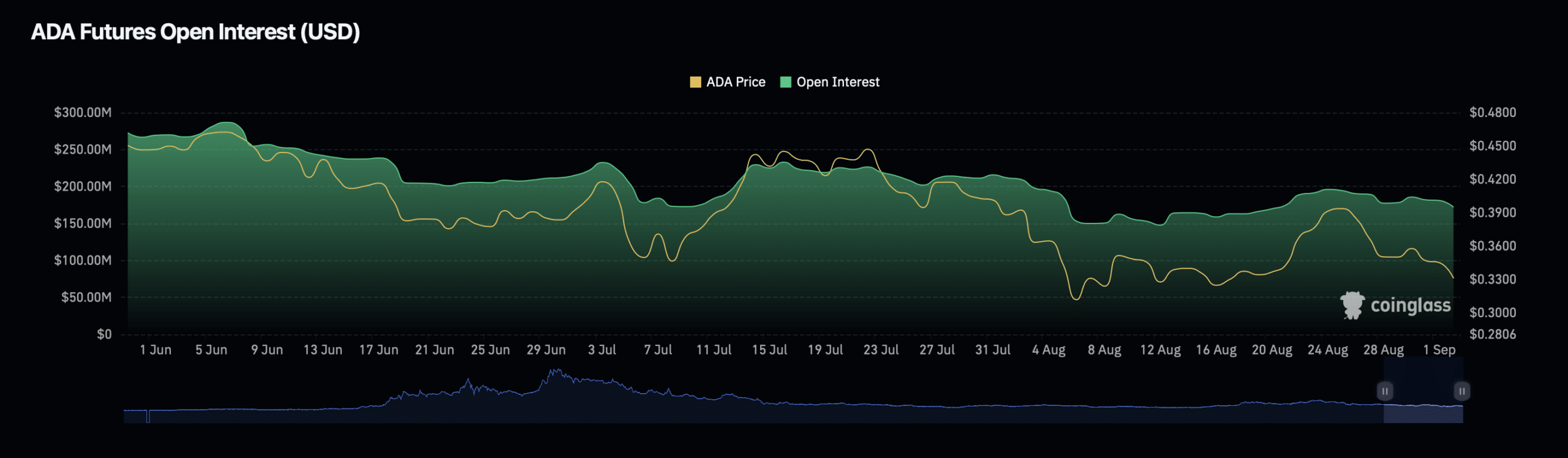

In addition to the decline in whale transactions, ADA’s Open Interest, a measure of the total number of outstanding derivative contracts, has also seen a decrease.

Over the past day, ADA’s Open Interest has dropped by 4.59%, bringing it to a press time valuation of $172.99 million.

Source: Coinglass

Read Cardano’s [ADA] Price Prediction 2024 – 2025

It’s worth noting that ADA’s Open Interest volume has increased by 107%, reaching $273.49 million.

So, while the number of contracts has decreased, the value of those remaining has risen, possibly hinting at increased volatility in the near future.