- DEGEN price action on the lower time frame suggest potential shift in dynamics.

- DEGEN saw a spike in large on-chain inflows as funding rates stabilized.

Degen [DEGEN] has been in a 20% decline in the past 7 days although it reignited hope as of press time with 6% gain in the last 24 hours.

The asset recently rebounded from a support zone, indicating strong buying interest at lower price levels. This recovery has now positioned DEGEN at a critical juncture near a known resistance zone.

The analysis revealed that DEGEN was testing a resistance, which if surpassed, could signal a strong uptrend. This depicted a clear resistance break at $0.023, suggesting potential for continued gains.

The trading volume showed an increase concurrent with the price surge, a bullish indicator supporting the possibility of further appreciation if momentum above the crucial resistance sustained.

Source: Trading View

Market sentiment appeared optimistic as DEGEN aimed to establish new highs, with targets set towards and above the $0.072 price levels.

The setup favors bullish outcomes for DEGEN, provided it can firmly hold above the key resistance, transforming it into support for future advances.

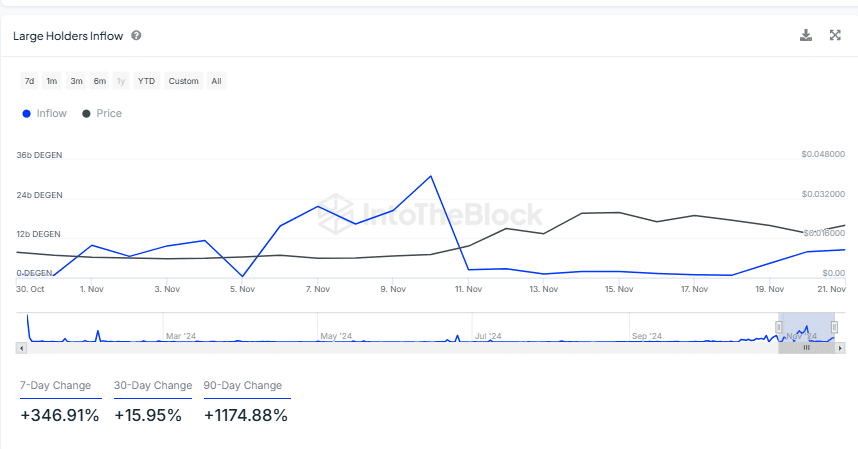

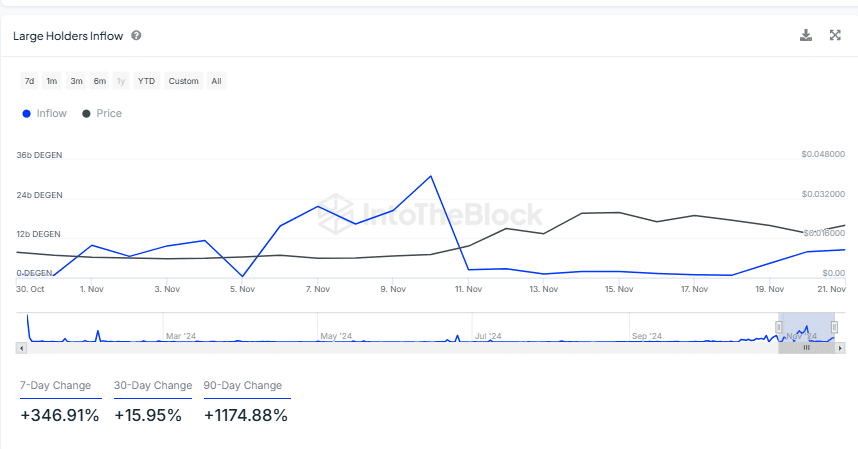

DEGEN large inflow

DEGEN also witnessed a significant influx of large holders this month, as depicted in the on-chain data chart. Over the first half of November, the inflow of the tokens notably surged, reaching the peak.

This influx coincided with a substantial increase in DEGEN’s market price, suggesting that large holders were accumulating positions during this period.

The graph clearly showed that as the inflow increased, DEGEN’s price moved upward, peaking when inflows were at their highest fueling the potential of a new ATH.

Source: IntoTheBlock

However, after the peak, despite continued large holder activity, the price began a gradual decline. This indicated that while initial large inflows corresponded with price increases, subsequent investments have not been able to sustain the upward momentum.

The trend highlighted the impact of substantial investments on market dynamics in crypto space, particularly how they can influence price movements in the short term.

The correlation between large holder activities and price changes provided a clear insight into the speculative nature of the DEGEN market during this observed period.

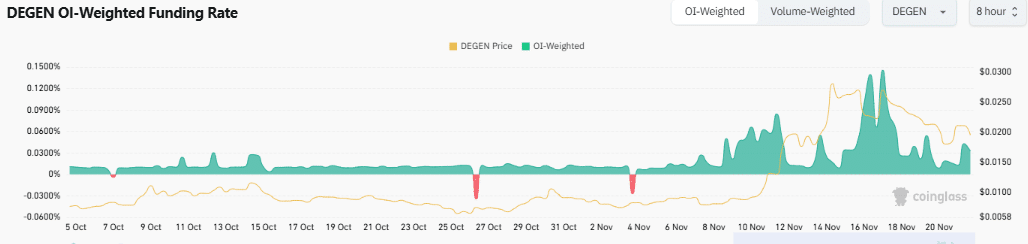

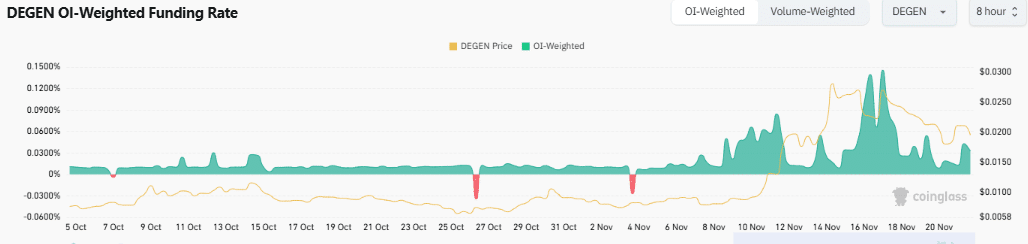

Open interest and funding rates

The DEGEN OI-weighted funding rate and its price movements have demonstrated a compelling correlation, particularly noticeable from early to mid-November.

During this period, as the funding rate dipped negatively on occasions, the DEGEN price experienced significant spikes, highlighting a trend where traders might be taking positions in anticipation of price increases.

Source: Coinglass

Notably, when the funding rate peaked around this month, the DEGEN price reached as high as $0.03 making it more likely to get a new ATH.

Is your portfolio green? Check out the DEGEN Profit Calculator

This pattern suggested that periods of lower or negative funding rates could be key buying opportunities for traders looking for quick gains, signaling underlying bullish sentiments towards DEGEN.

Such data provided critical insights into trader behavior and market sentiment, offering potential strategies for timing market entry and exits effectively.