- Aptos’ 3.70 million daily transactions highlighted its growing ecosystem but faced social visibility challenges.

- Technical indicators showed mixed signals, with bearish trends and oversold conditions creating uncertainty.

Aptos [APT] has reached an extraordinary milestone, recording 3.70 million daily transactions with an average throughput of 3700 TPS and a minimal fee of $0.00005.

This achievement is bolstered by a Total Value Locked (TVL) of over $1 billion and a market cap of $5.35 billion.

These impressive figures position Aptos among the top contenders in the blockchain industry.

However, at press time, APT is trading at $8.99, reflecting a 6.58% decrease over the past day, signaling potential headwinds that Aptos may need to overcome.

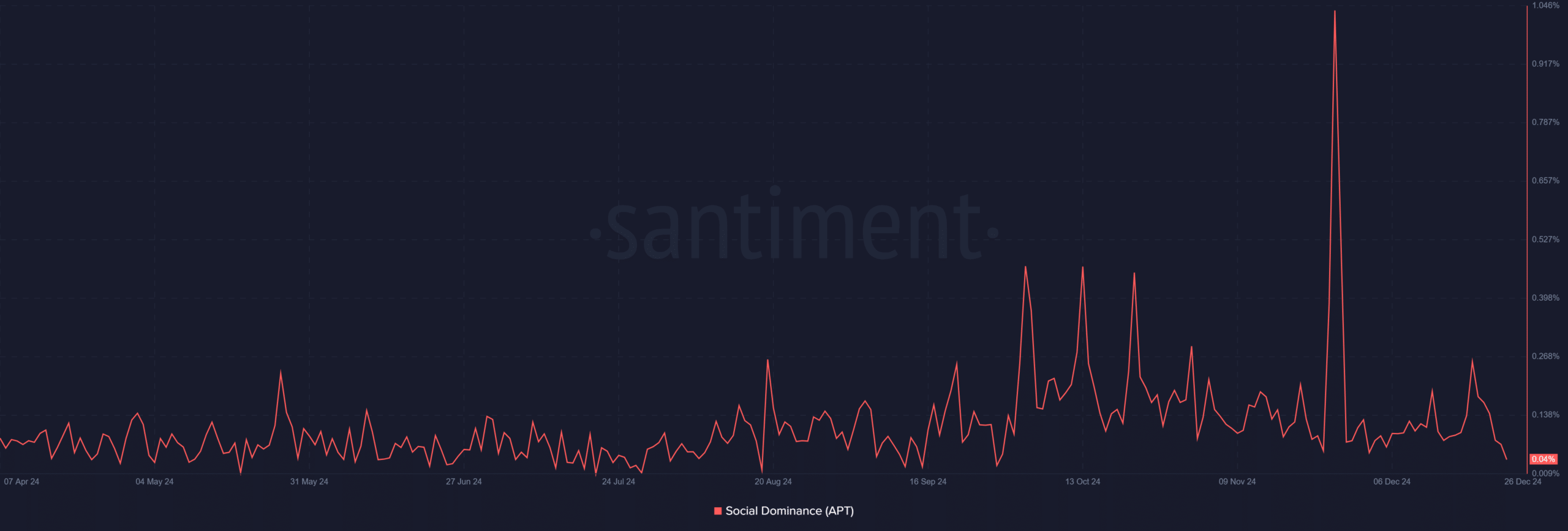

Social Dominance struggles despite ecosystem success

Despite its significant achievements, Aptos faces challenges in social engagement.

Its press time Social Dominance stood at a mere 0.04%, significantly lower than the sporadic peaks observed earlier in the year, such as November’s brief surge above 1%.

This indicates limited visibility and engagement across the broader crypto community. However, this challenge presents an opportunity for Aptos to ramp up its marketing and community-building initiatives.

Source: Santiment

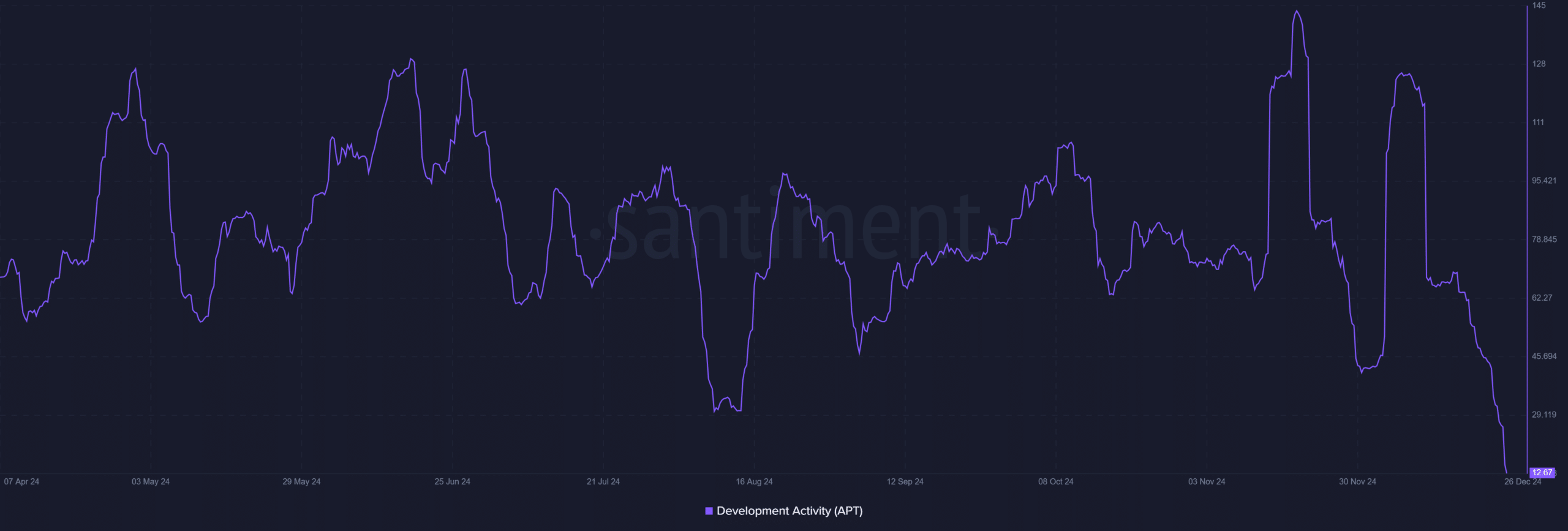

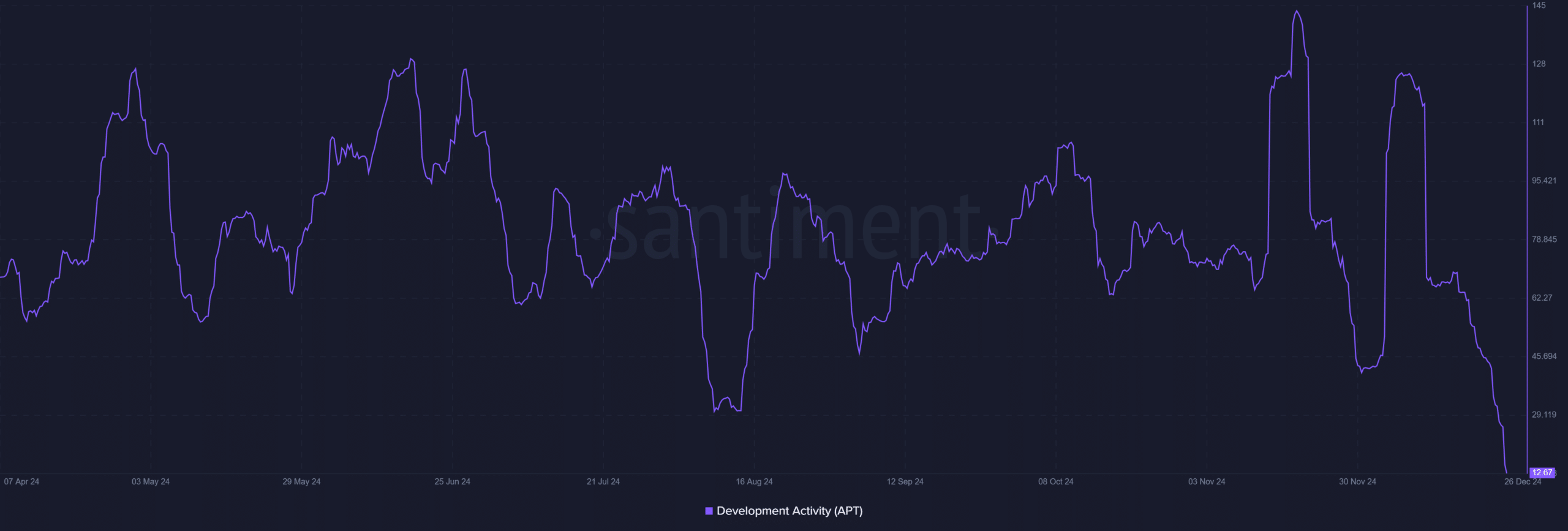

Development activity drops to concerning lows

Development activity on Aptos has seen a sharp decline, with recent figures dropping to just 12.67 compared to highs above 95 earlier this year. This decline raises concerns about the pace of innovation and ecosystem expansion.

Therefore, prioritizing development initiatives is essential for sustaining interest from developers and attracting new projects.

Additionally, consistent updates and feature rollouts could reinforce Aptos’ reputation as a technologically advanced blockchain.

Source: Santiment

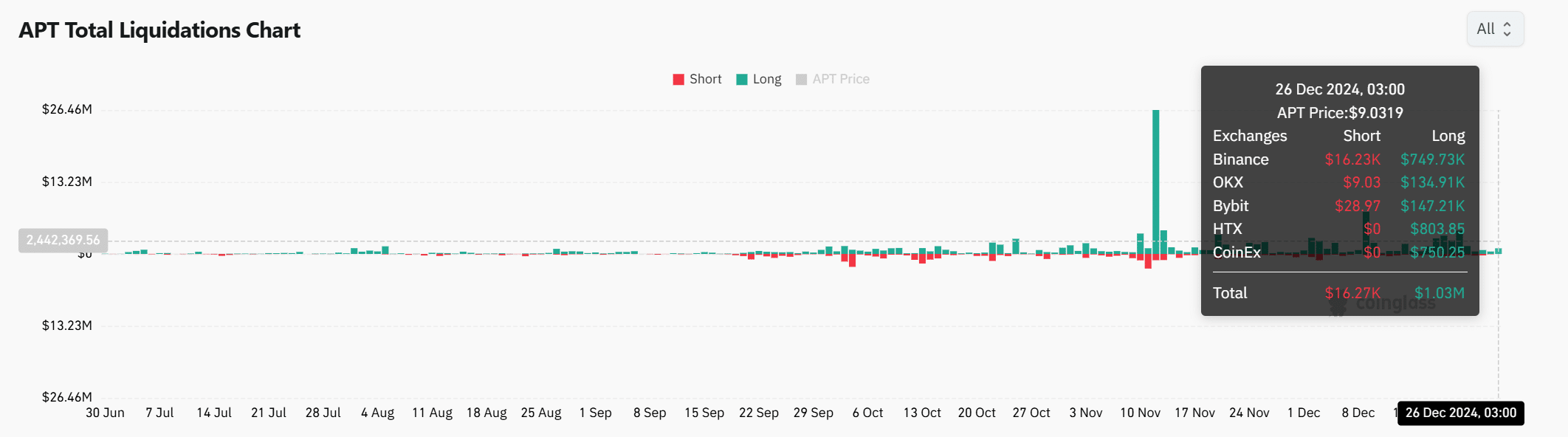

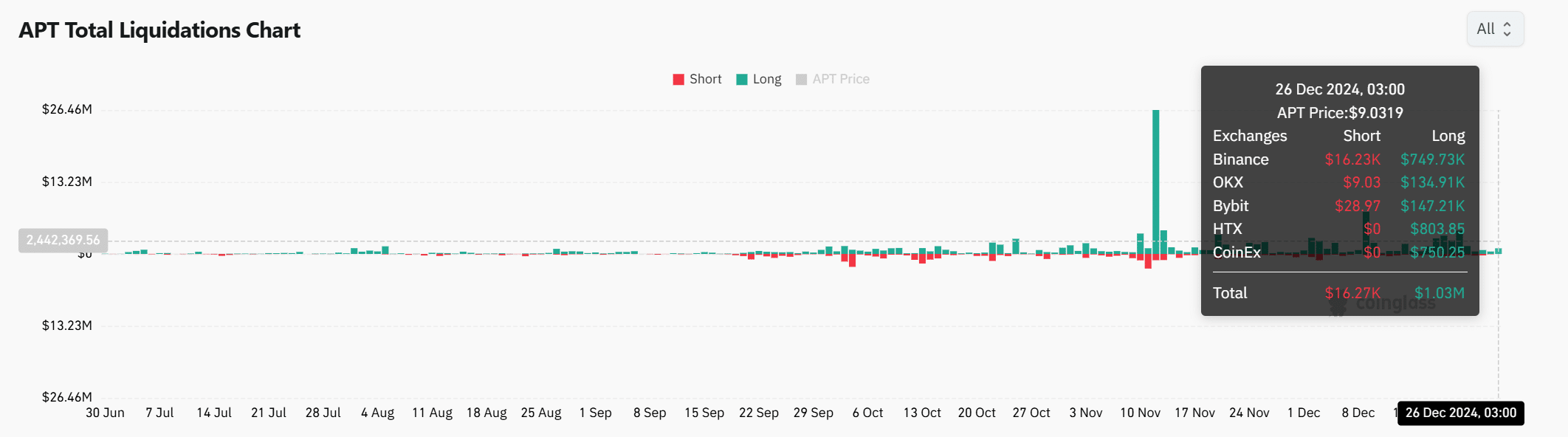

APT market liquidations highlight volatility

Recent liquidation data reflects growing uncertainty in the Aptos market, with over $1.03 million in long positions cleared, primarily on Binance.

This liquidation trend highlights the cautious sentiment among investors as Aptos trades near key support levels.

However, such market behavior also indicates the heightened volatility that traders can exploit for potential gains.

As Aptos continues to evolve, stabilizing its price performance will play a critical role in maintaining investor trust.

Source: Coinglass

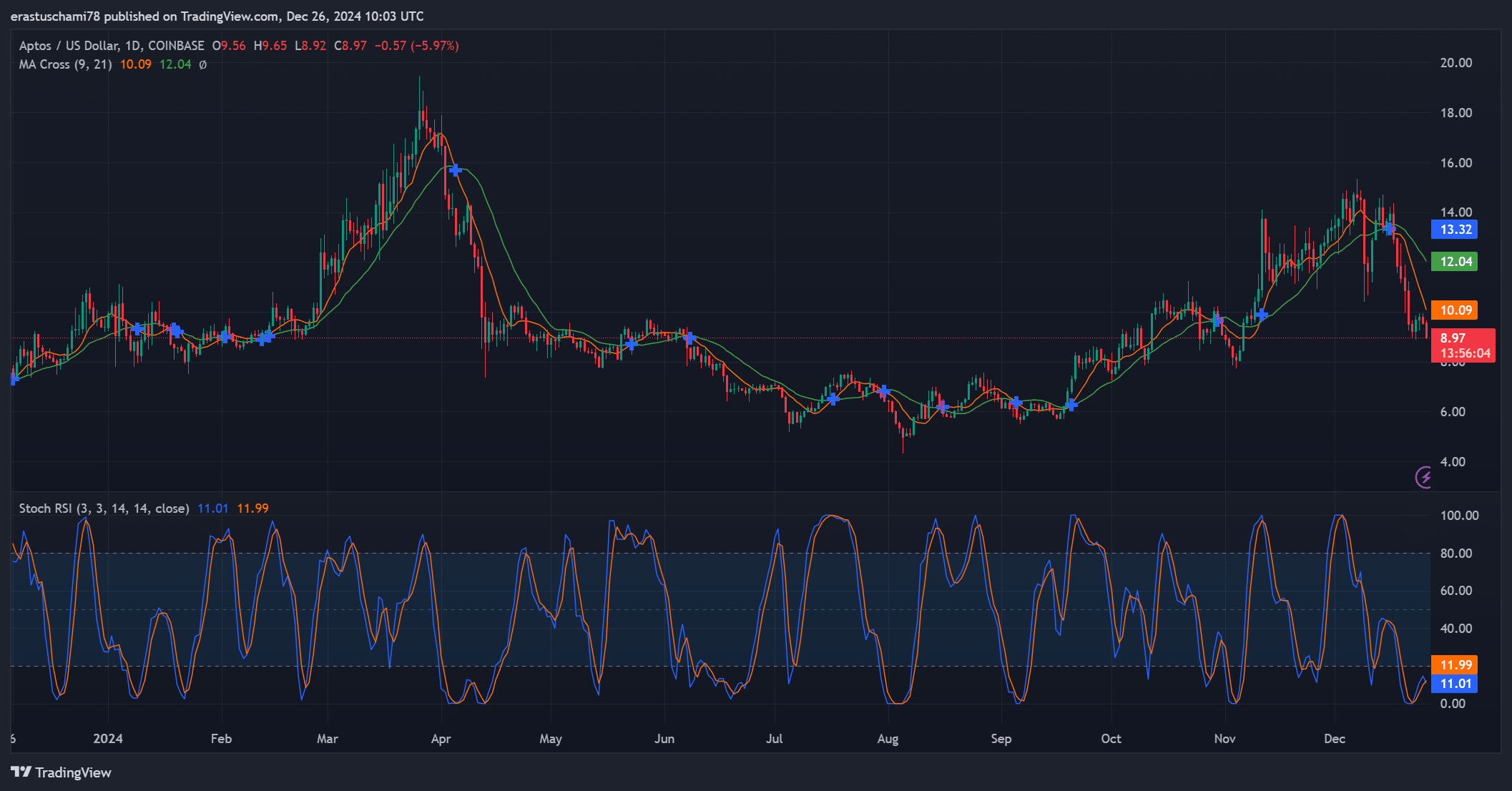

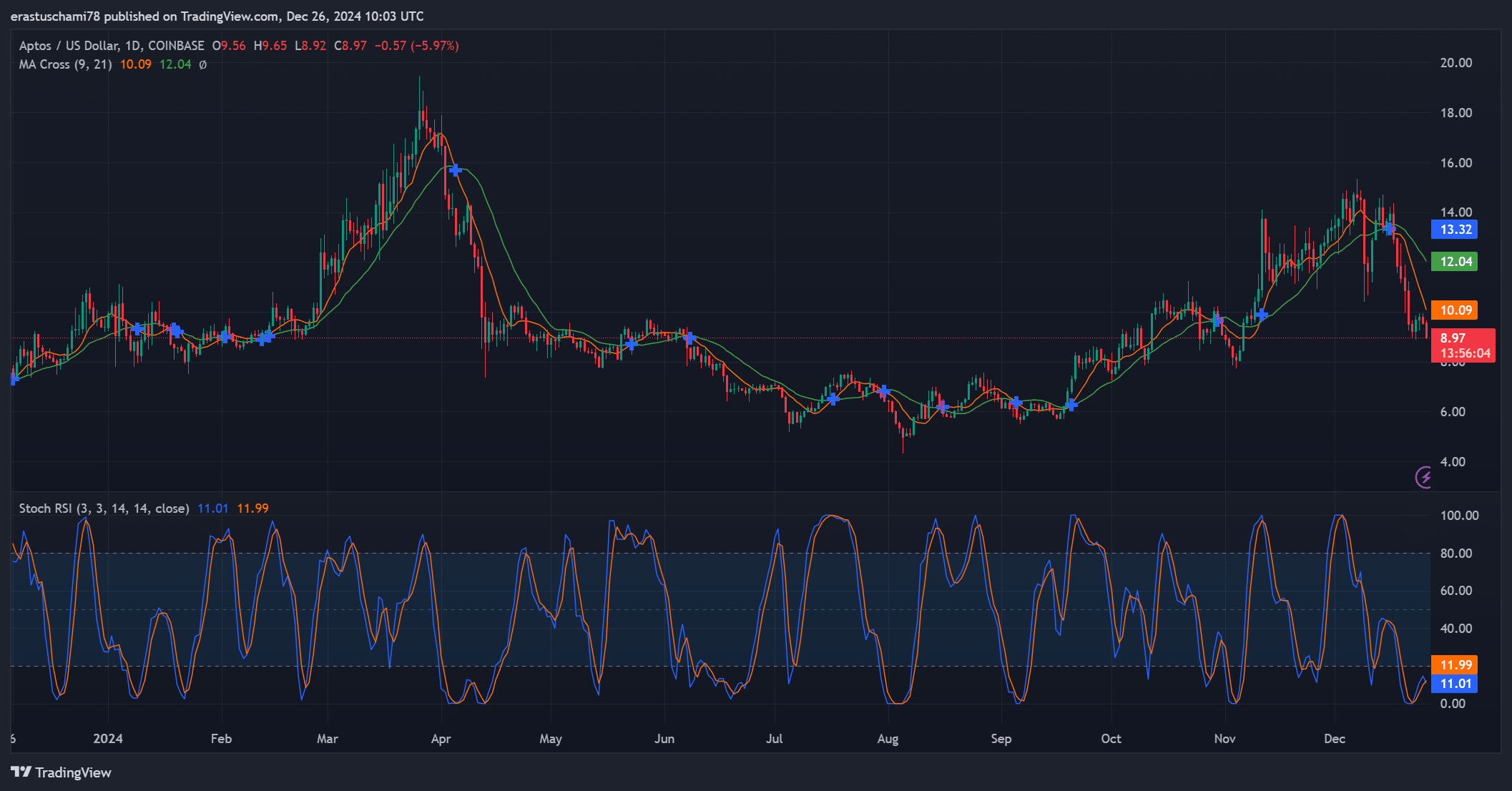

Technical indicators provide conflicting insights

The technical outlook for APT remains mixed, with both bullish and bearish signals. The Stochastic RSI shows oversold conditions, with values at 11.01 and 11.99, suggesting a potential rebound.

However, the Moving Average (MA) cross paints a bearish picture, with the 9-day MA positioned below the 21-day MA.

Consequently, traders are likely to remain cautious, awaiting clearer signals before making decisive moves.

Source: TradingView

Read Aptos’ [APT] Price Prediction 2024–2025

Conclusion: Can Aptos sustain its momentum?

APT has demonstrated remarkable progress in transaction volume and ecosystem value. However, sustaining this growth requires addressing its low social dominance, declining development activity, and market volatility.

Therefore, while Aptos shows great promise, its long-term success depends on consistent innovation, stronger community engagement, and effective price stabilization strategies.