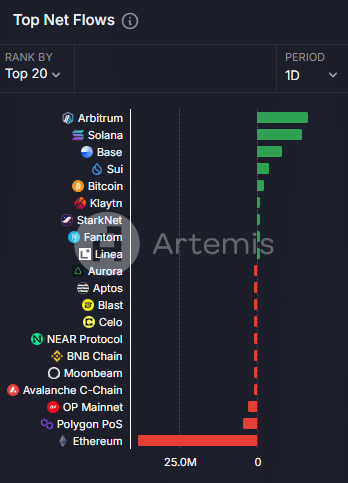

- The network recorded the highest netflow among layer-one blockchains, outperforming peers like Solana and Sui Network.

- However, market sentiment remains bearish, with little indication of an imminent rally.

After briefly reclaiming a price above $1, supported by a 26.19% weekly rally, Arbitrum [ARB] has declined by 0.50% in the last 24 hours. This drop persists despite bullish activity on the chain.

Analysis by AMBCrypto suggests that declining interest from retail and whale investors is a key factor contributing to the asset’s recent downturn.

Price remains stagnant as chain activity spikes

Artemis data shows that Arbitrum, home to the ARB token, recorded a significant spike in Chain Netflow over the past 24 hours, reaching $16.6 million. This figure surpassed prominent layer-one blockchains like Solana and Sui Network.

Source: Artemis

Chain Netflow, which measures the net movement of assets into and out of a blockchain, indicates increased network activity when positive. Despite this surge, ARB’s price has yet to respond with any notable upward movement.

According to further analysis by AMBCrypto, bearish sentiment continues to dominate the market, stalling ARB’s potential recovery.

Traders pull back as bears dominate the market

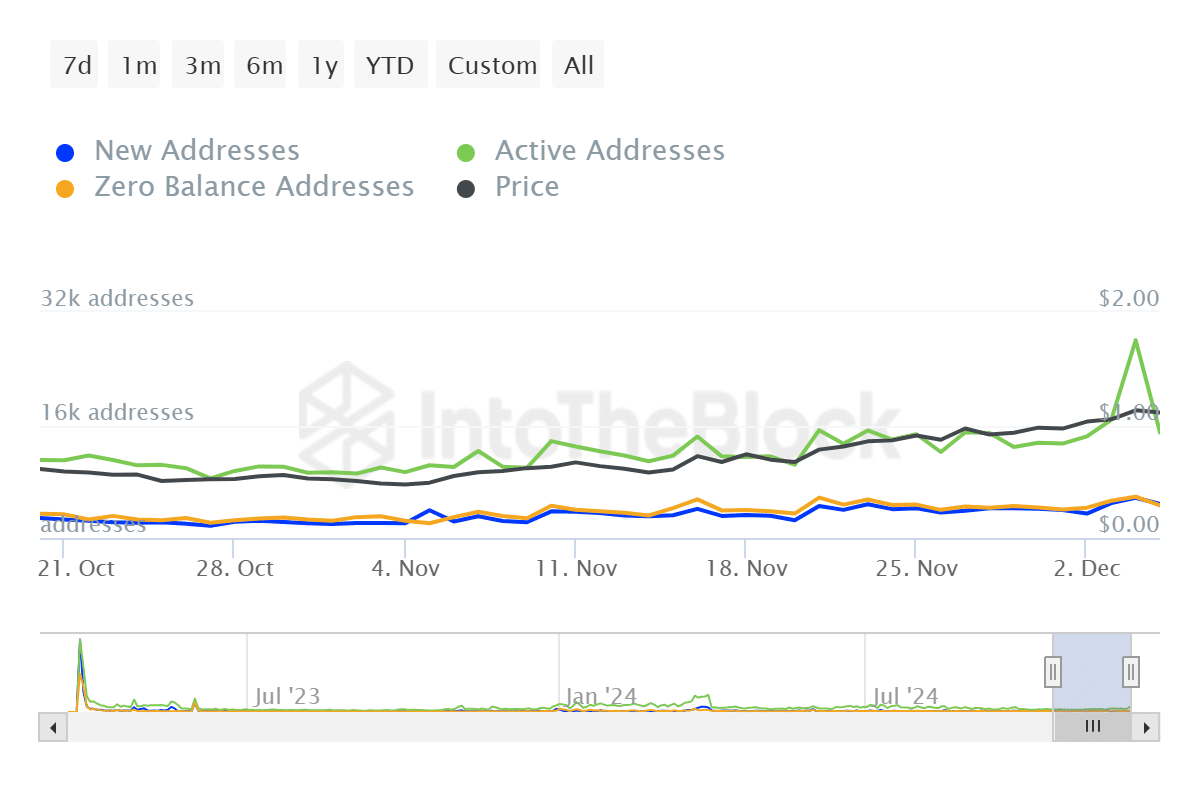

Active addresses (AA) in the market have dropped sharply over the past 24 hours, falling from 28,000 to 14,950—just over half of the previous day’s total. This significant decline indicates waning interest among market participants.

On a weekly scale, however, AA has seen a slight increase of 0.54%, suggesting a minor rebound in engagement over a broader timeframe.

Source: IntoTheBlock

The decline in AA aligns with bearish activity confirmed by the Bull and Bear indicators from IntoTheBlock.

This metric tracks the market’s dominant force, and current data shows 139 bearish addresses compared to 130 bullish ones. When bears outnumber bulls, the asset’s price is more likely to decline.

Additionally, AMBCrypto observed that whale activity has mirrored this trend, with larger investors retreating from the market. This further reinforces bearish sentiment.

Whales retreat as ARB faces further declines

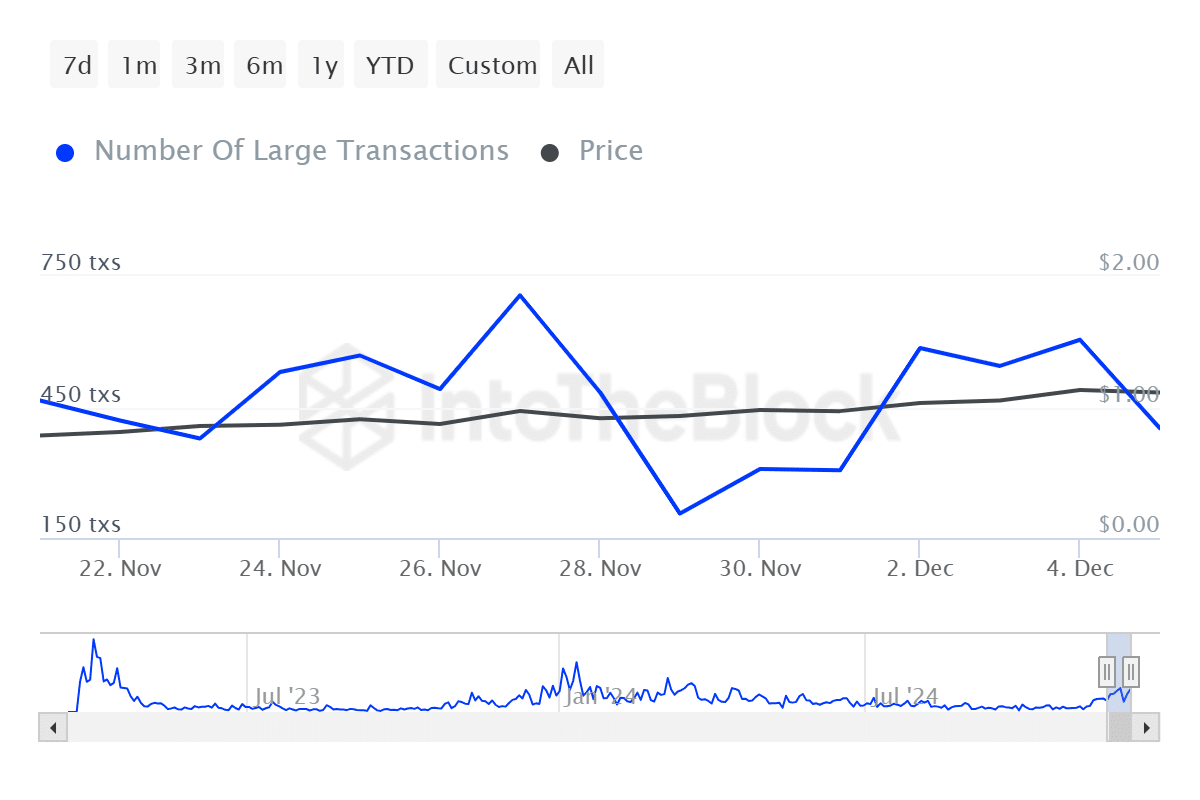

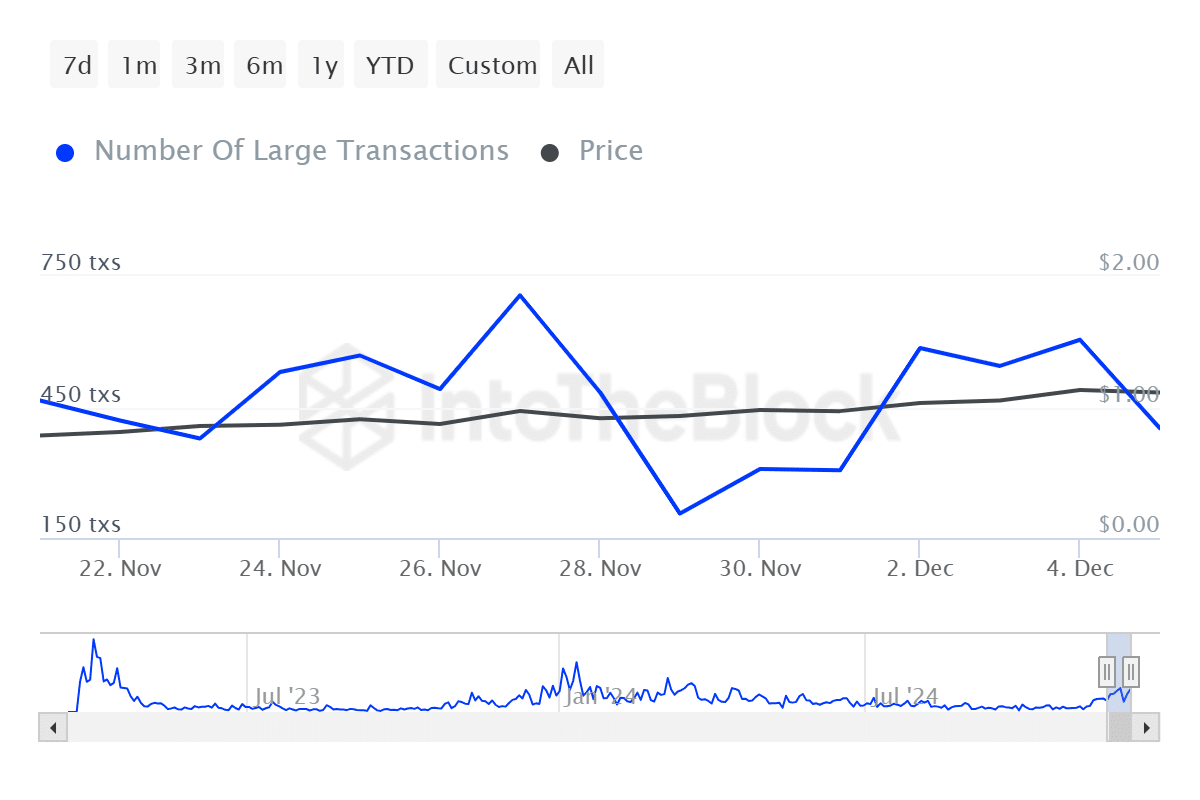

In the last 24 hours, the number of large transactions involving ARB has dropped to 401, with a total volume of 120.59 million ARB.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

A lack of whale activity typically indicates an absence of accumulation, a crucial phase that often precedes an upward price movement.

Source: IntoTheBlock

Combined with declining retail interest, this reduced participation from whales suggests that ARB may face additional downward pressure in the market.