- Arbitrum hits $21.45 billion in monthly volume, signaling strong market demand and potential breakout.

- Daily active addresses and open interest surge indicate sustained investor confidence in ARB’s growth.

Arbitrum [ARB] has made history by becoming the first Layer 2 network to surpass $20 billion in monthly volume on the Uniswap Protocol, closing November with a staggering $21.45 billion.

This achievement highlights Arbitrum’s increasing dominance in the Ethereum scaling race.

Additionally, ARB has surged by 12.23% in the last 24 hours, now trading at $1.08 at press time. This price increase reflects a growing investor sentiment, but the critical question remains: will this momentum continue, or is it just a brief rally in an unpredictable market?

Is ARB on the verge of a major breakout?

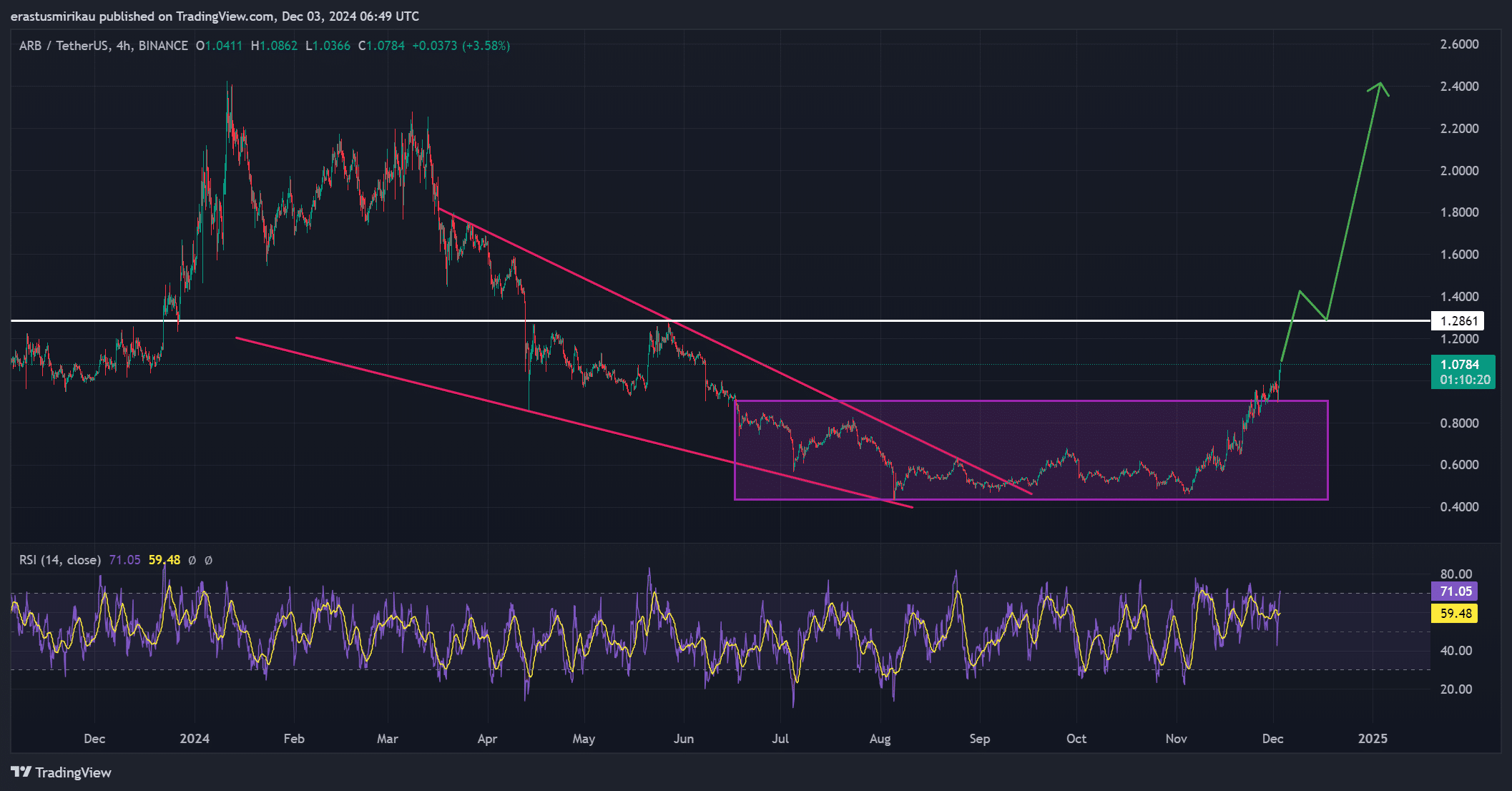

Arbitrum’s price chart shows promising signs of a breakout. The token has successfully escaped a prolonged rectangular consolidation phase, marking a bullish shift.

After the breakout, ARB retested previous resistance levels, confirming the strength of the move.

ARB was approaching a key resistance at $1.28 at press time. A successful breakout above this level could propel the price toward $2.40, offering significant upside potential.

However, traders should be cautious, as the RSI stands at 71.05, suggesting the token is in overbought territory. Consequently, a short-term pullback could occur, but the overall bullish trend remains intact.

Source: TradingView

Are more users flocking to Arbitrum?

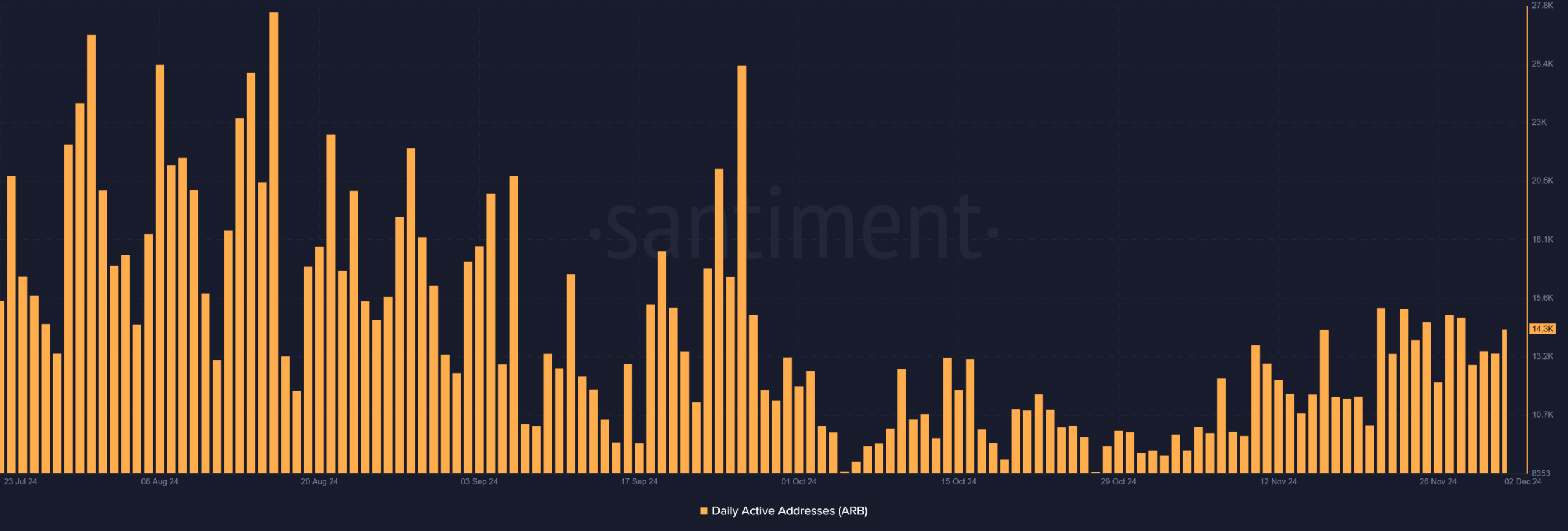

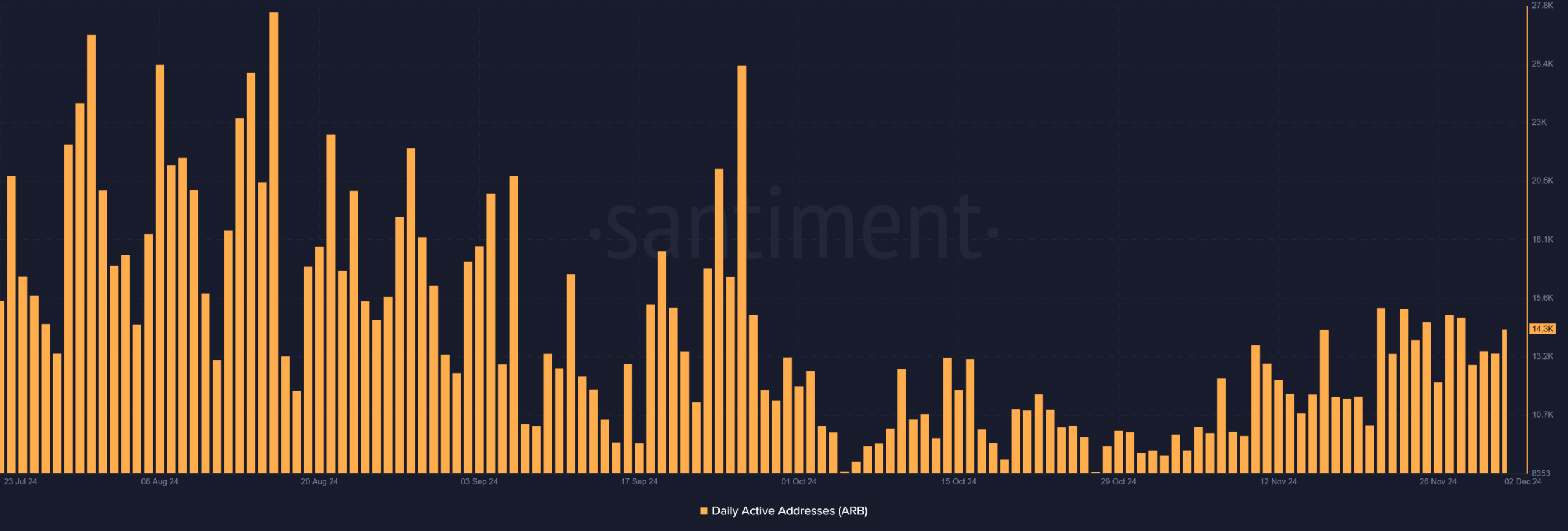

Daily Active Addresses (DAA) on ARB show positive signs of increasing engagement. At 14,386, the DAA has grown from 13,368 the previous day, signaling a rise in network adoption.

This surge in active addresses suggests that more users are engaging with Arbitrum, which could fuel further demand for $ARB.

Therefore, the growing user base is a crucial indicator of the network’s expanding ecosystem, further solidifying its long-term potential.

Source: Santiment

What does the open interest surge mean for ARB?

Additionally, open interest has surged by 16.35%, reaching $285.07 million. This increase indicates that more traders are positioning themselves for continued price movement.

Rising open interest often correlates with growing investor confidence, suggesting that the market anticipates sustained bullish momentum. Consequently, this surge could further support upward price action in the near term.

Source: Coinglass

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Can Arbitrum maintain its bullish momentum?

At press time, ARB’s record-breaking $21.45 billion in monthly volume and 12.23% price surge point to strong market sentiment. With key resistance at $1.28, rising active addresses, and a notable jump in open interest, ARB shows strong potential for continued growth. However, the overbought RSI warrants caution.

Therefore, while the bullish trend is likely to persist, investors should stay alert for any potential short-term corrections.