- The Ethereum Foundation has sold over 1,000 ETH again

- Its previous selling spree was received by much criticism from the community

Over the last 24 hours, the Ethereum Foundation has executed two transactions, selling more of its ETH holdings in exchange for DAI. This move comes despite facing significant criticism during their previous large-scale sale of ETH assets.

The Foundation’s decision to convert ETH into stablecoins like DAI could be a move towards managing their assets. However, it may also raise concerns about the potential impact on market sentiment and ETH’s price stability.

Ethereum Foundation on the move again!

According to data from Spot on Chain, the Ethereum Foundation sold 100 ETH for over 241,000 DAI on 5 September.

While this initial transaction did not spark significant reactions, the most recent transaction did draw some attention. On 6 September, the Foundation transferred 1,000 ETH, valued at approximately $2.38 million, to a multi-signature wallet. Based on previous transaction patterns, this ETH is expected to be transferred to another wallet and likely swapped for DAI.

Despite the scrutiny surrounding these transactions, the Ethereum Foundation still holds a substantial amount of ETH — Over 274,000 ETH, valued at more than $652 million. Although the 1,000 ETH sale has raised some concerns, another notable transaction from 13 days ago came into the spotlight. That transaction showed the Foundation moving over 35,000 ETH to Kraken, prompting questions from observers about the motives behind these sales.

At the time, Ethereum’s Vitalik Buterin responded to accusations about the Foundation selling off assets. Still, neither he nor the Foundation has made a public statement regarding these latest transactions.

Ethereum’s social metrics show a lack of impact

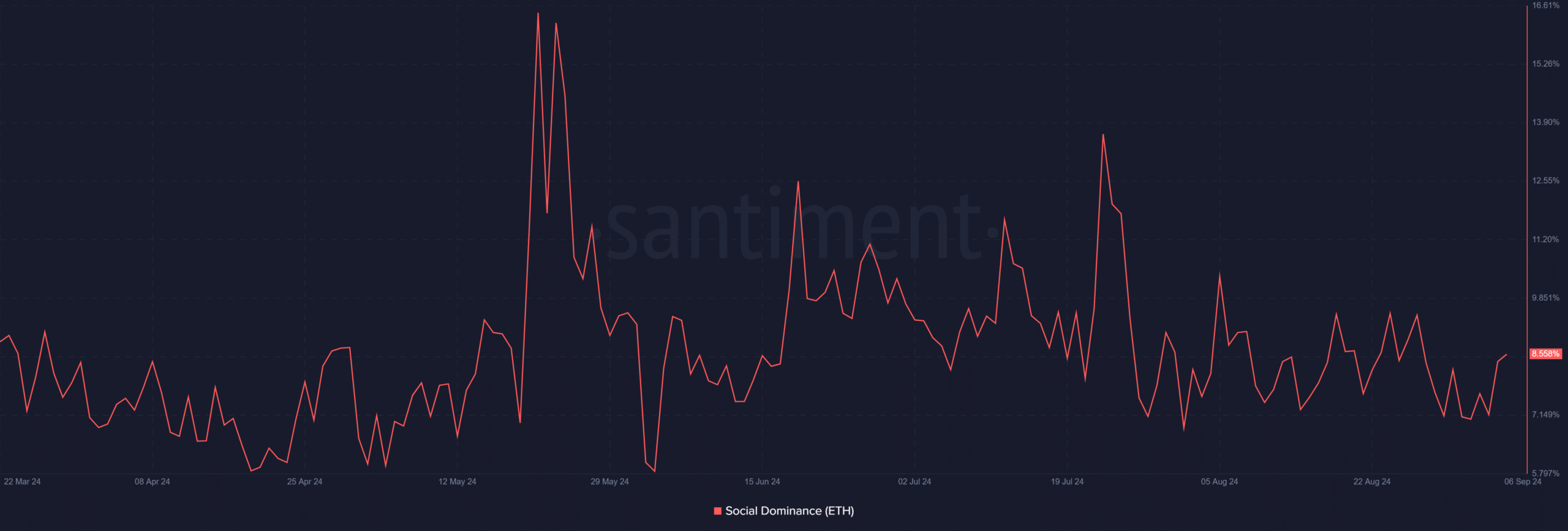

A recent analysis of Ethereum’s social dominance showed a slight hike, with Ethereum taking up over 8% of the overall crypto discussions.

However, a closer look at the social context on Santiment revealed that the recent sale by the Ethereum Foundation is yet to become a trending topic. Despite the Foundation’s sale of ETH, this event has not significantly affected the broader conversation within the crypto community.

Source: Santiment

As the sale has not gained widespread attention, it means that the transaction has not affected market sentiment meaningfully.

This means that for now, the sale is unlikely to hurt Ethereum’s price. While it’s still early, the lack of reactions from the community point to a relatively neutral market response. One with no immediate expectations of significant price drops tied to the Foundation’s actions.

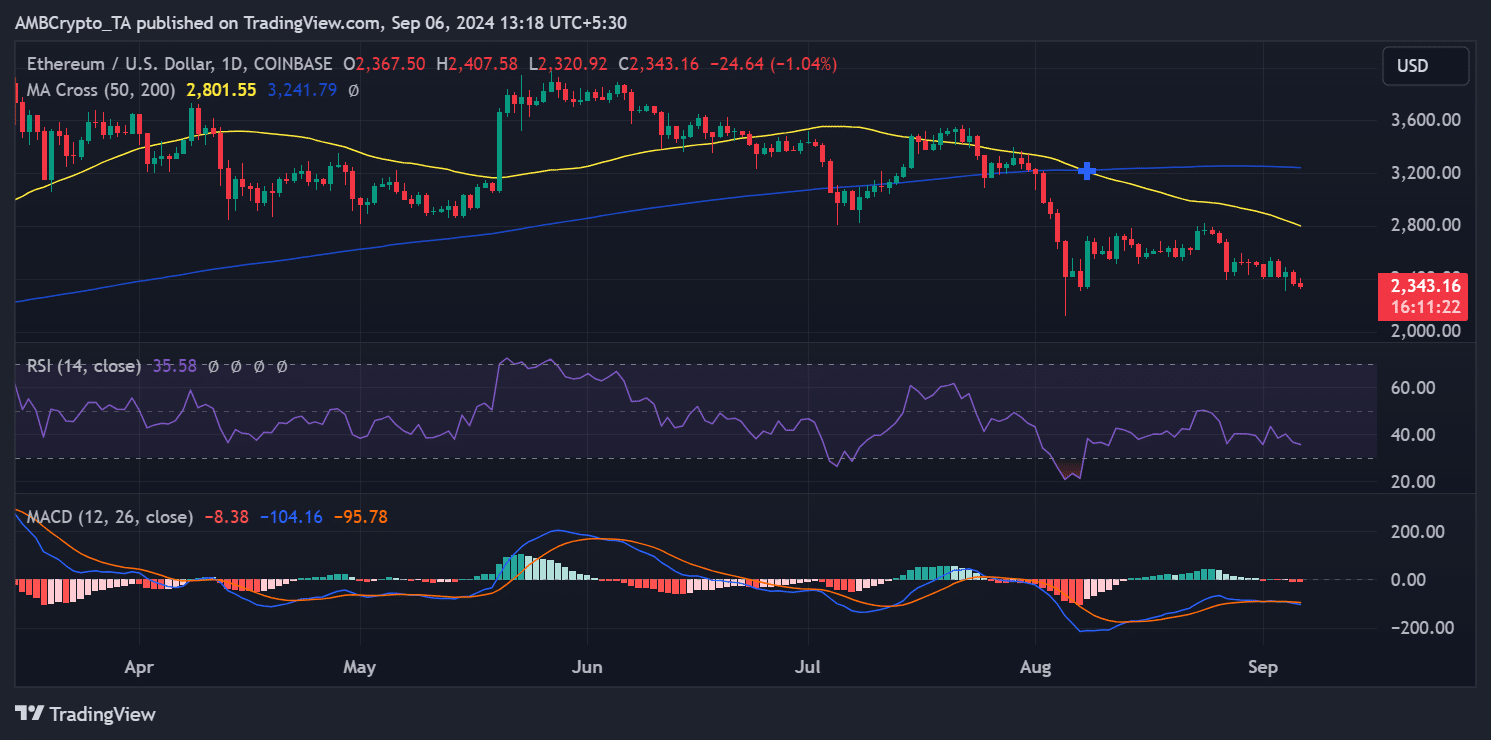

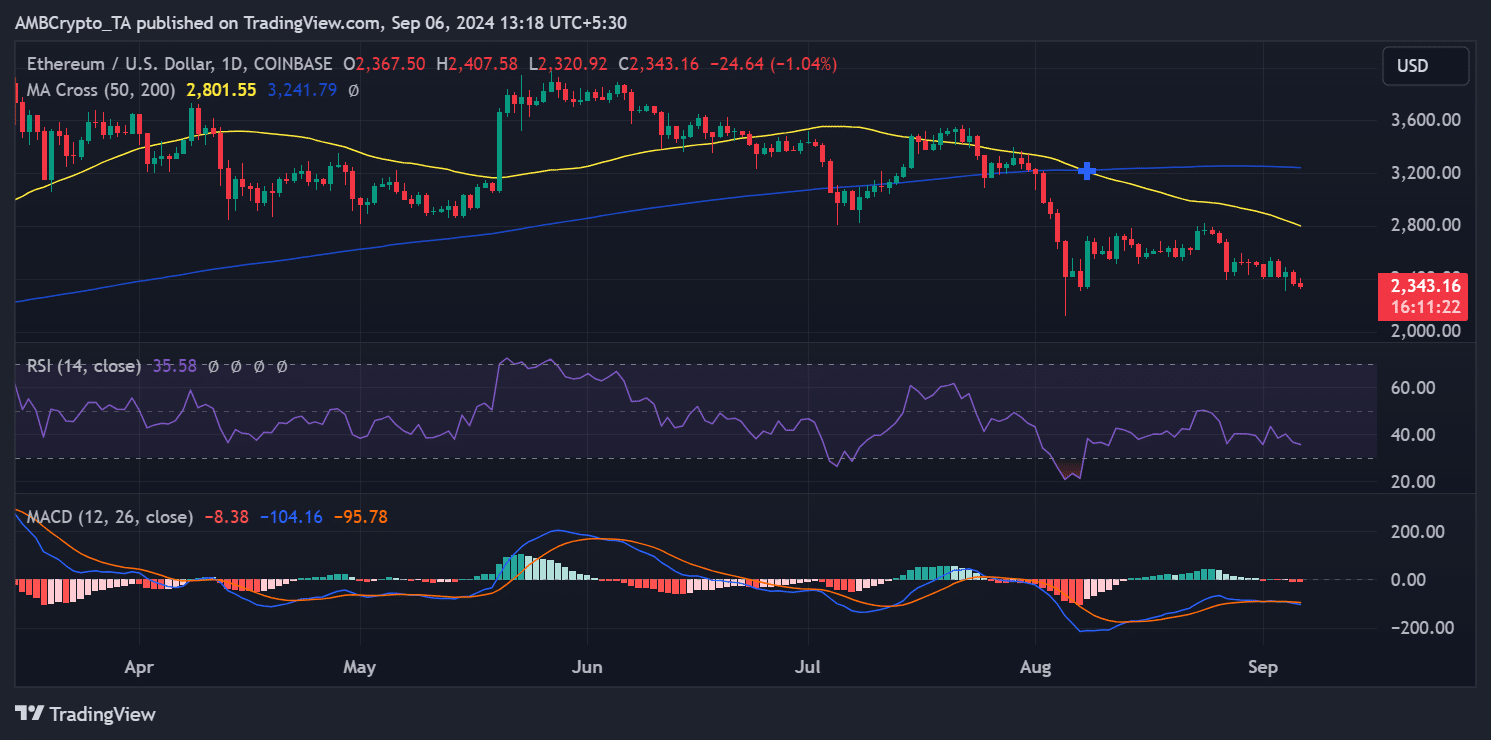

ETH continues its downward trajectory

By the end of trade on 5 September, ETH was trading at around $2,367, following a decline of over 3% on the charts. This bearish momentum persisted into its latest trading session, with the altcoin trading at approximately $2,343 soon after.

Source: TradingView

While ETH’s price might continue to decline, the recent sell-offs by the Ethereum Foundation are not contributing factors. In fact, the prevailing price action seems more aligned with broader market conditions, as the sell-off has not yet triggered a significant shift in sentiment.

– Read Ethereum (ETH) Price Prediction 2024-25

Additionally, Ethereum, at press time, remained firmly in a bear trend, as indicated by its Relative Strength Index (RSI). Until the RSI signals a shift in momentum or other technical indicators improve, ETH will continue to struggle in the near term.