- Liquidation of short positions and rising Open Interest fuels speculation about Bitcoin’s price trajectory

- Hike in trader participation and smart long positions hinted at growing institutional confidence

Following significant liquidations of short positions, a rise in Open Interest, and a notable shift in smart long positions, speculation is mounting about the possibility of a local top in Bitcoin’s [BTC] price action.

These recent developments have captured the attention of traders and analysts alike, prompting a deeper look into how the change in market sentiment could impact Bitcoin’s short-term price trajectory.

Liquidation of short positions and its impact

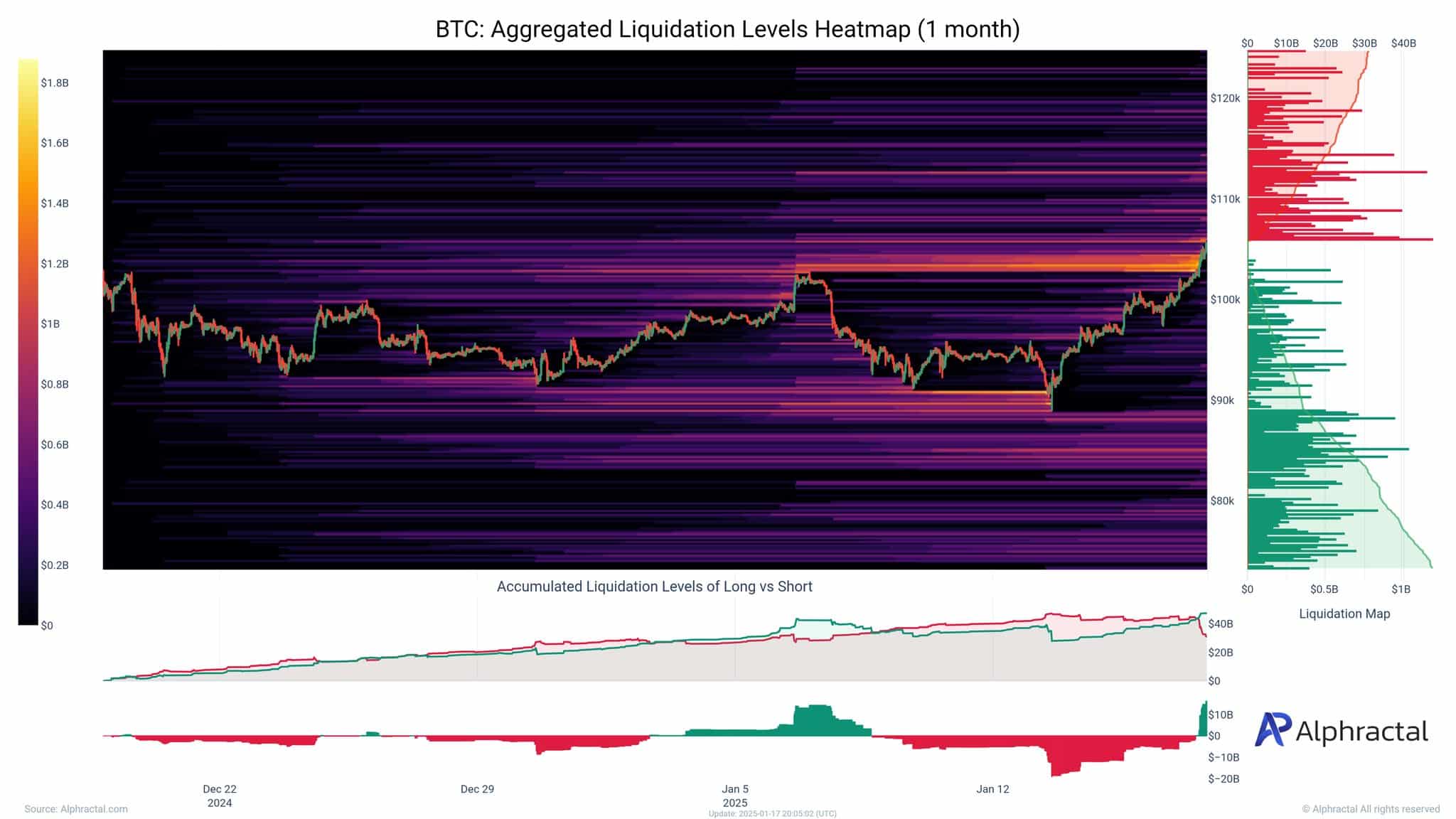

The liquidation heatmap revealed a significant concentration of liquidations near the $100,000-mark. The latest rally in Bitcoin’s price triggered the clearing of a vast majority of short positions, as evidenced by the hike in liquidation volume in higher price ranges.

The accumulated liquidation levels indicated a sharp imbalance, with short liquidations overwhelmingly dominant in the days leading up to 17 January.

Source: Alphractal

These liquidations have injected significant buying pressure into the market, forcing shorts to cover positions, thereby driving prices higher.

Additionally, the heightened volume of liquidations around key resistance levels highlighted how market participants underestimated Bitcoin’s bullish momentum, inadvertently contributing to upward price acceleration. This surge has reinforced Bitcoin’s bullish sentiment, albeit cautiously.