- After a 23% drop, AVAX’s new support was near $40.

- A 602.61% spike in transaction volume signaled rising institutional interest.

Avalanche [AVAX] has shown considerable volatility in recent weeks, providing traders with notable opportunities.

After consolidating through the 7th of December, the price surged on the 8th of December during the NYSE evening open, but quickly fell 23%, settling at $40 on the 9th of December.

At press time, AVAX was trading at $45.50, with a potential upside of 66% should it move towards key resistance levels.

The price drop and subsequent pullback suggested a consolidation phase, which might be setting the stage for further upward movement.

With increasing trading volume and strong support levels, AVAX could break higher in the coming weeks.

AVAX looks overbought but stable

AVAX’s recent price action highlighted its strong upward trend but also signals caution.

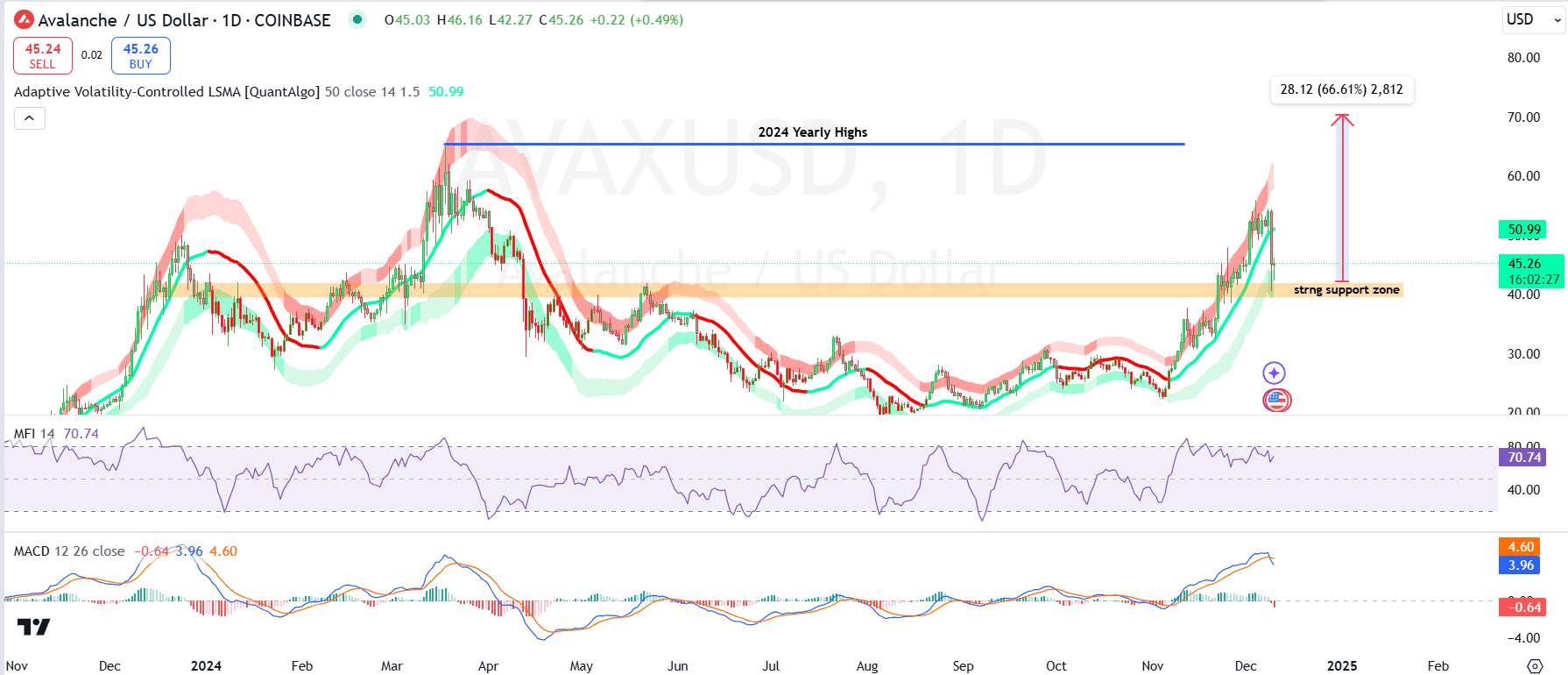

The Adaptive Volatility-Controlled LSMA indicator showed AVAX trading slightly below a key 50-period moving average, which may act as resistance in the short term.

Despite this, the token was consolidating near $45.26, with support seen at the $40-$42 range. The price target of $70, reflecting a 66.61% increase, could remain an upside if momentum builds.

Source: TradingView

The Money Flow Index reading of 70.74 indicated that AVAX was approaching overbought territory. However, the asset still has room for further upside.

The MACD suggests bullish momentum, with the MACD line above the signal line, though the histogram shows slight weakening.

While reduced momentum is visible, the indicator does not yet point to a reversal, signaling a continuation if support holds. In the near term, the key resistance level was $50. 2024’s yearly high of $65 is a crucial target.

AVAX transactions on the rise

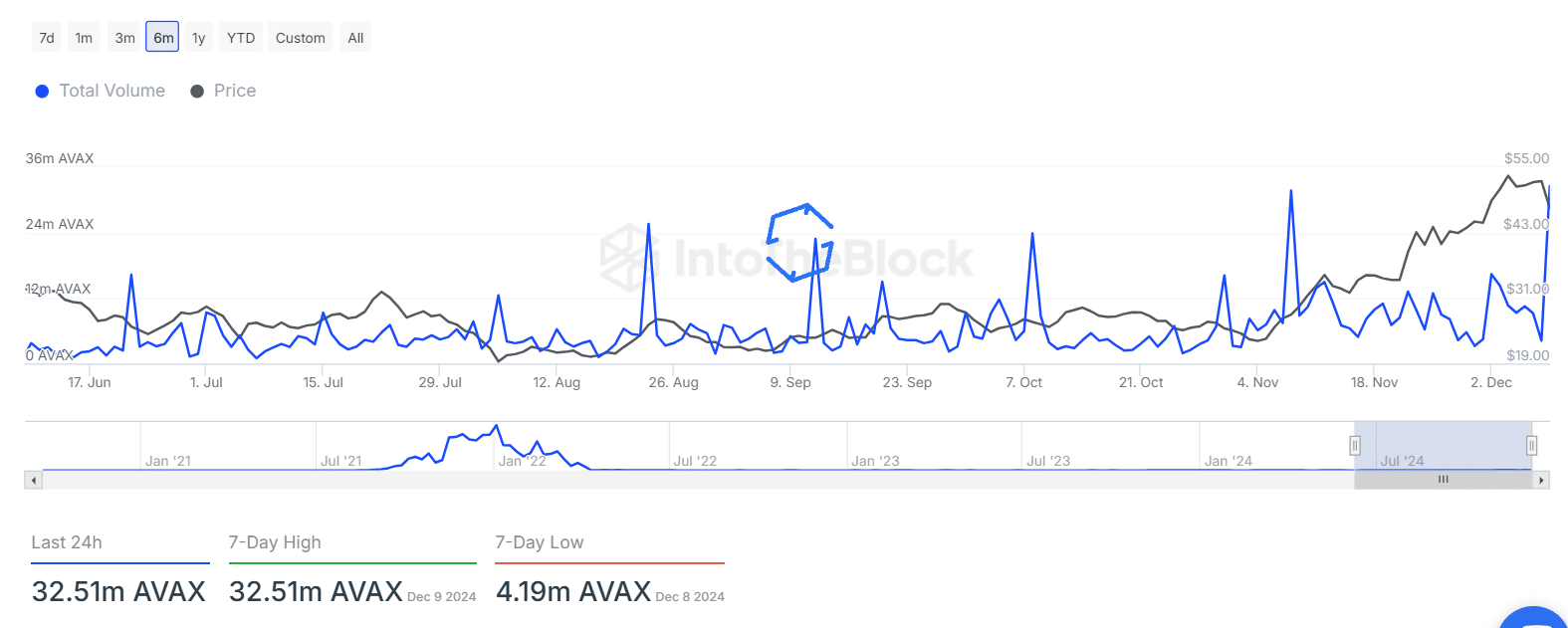

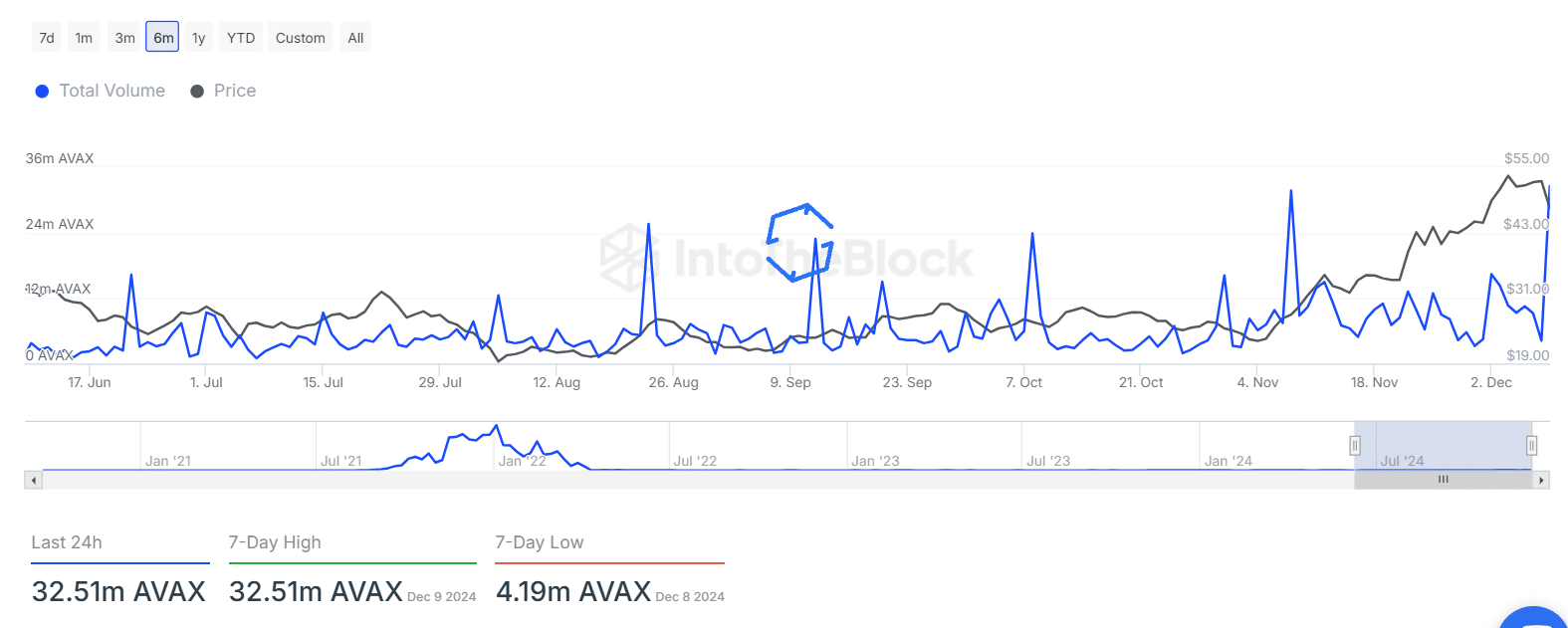

Avalanche has witnessed notable increases in market activity, particularly in terms of transaction volume. In the last 24 hours, 32.51 million AVAX tokens were transacted, marking a 7-day high.

However, the price corrected to $45.23, reflecting a 5.76% decline. While this decline might seem concerning, the surge in transaction volume suggested growing institutional and whale participation.

Source: IntoTheBlock

Data from the IntoTheBlock showed that larger transaction volumes, particularly spikes in September and November, aligned with periods of price volatility.

These spikes underscored significant market involvement, often leading to price swings.

This active participation suggests strong investor confidence in AVAX, signaling that despite short-term corrections, the overall outlook remains positive.

More growth to come for AVAX?

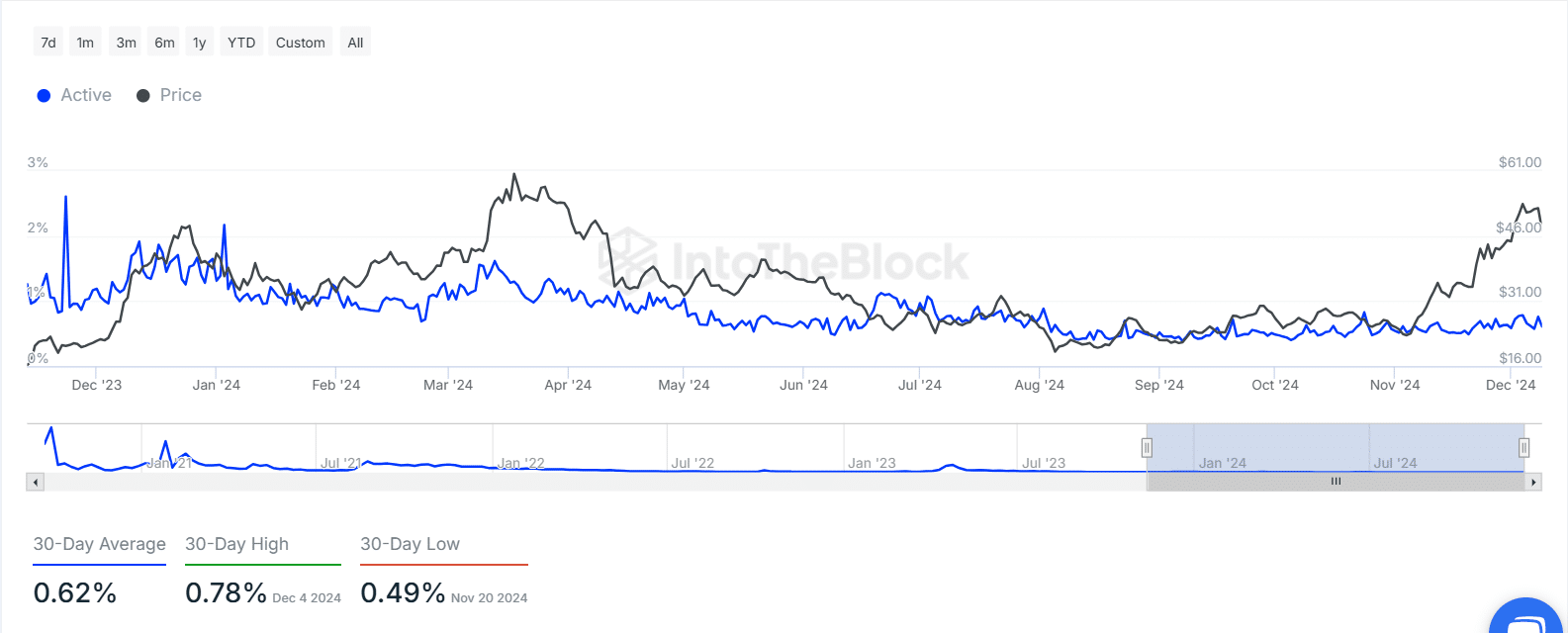

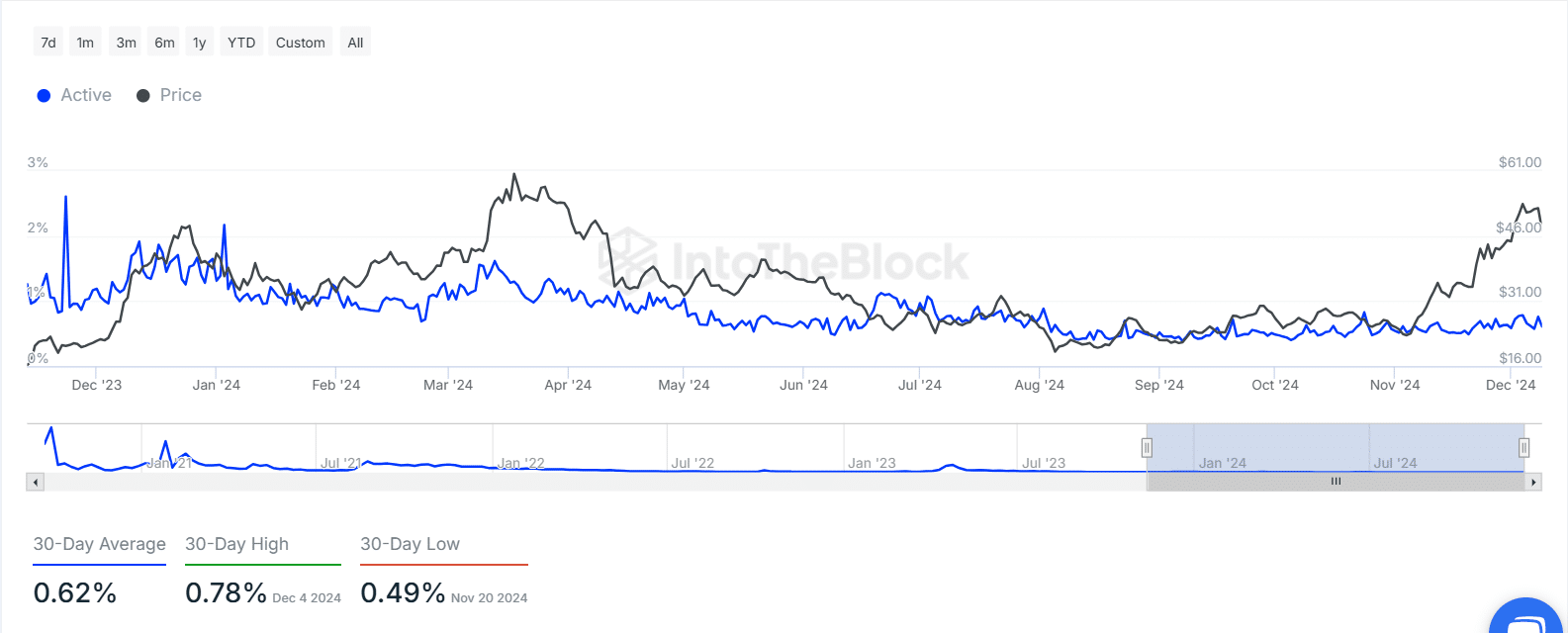

Avalanche’s Active Address Ratio offered insight into sustained network engagement over the past year. The average ratio has remained stable at 0.62% over 30 days, with recent peaks at 0.78% in December.

This consistent activity suggested that a solid portion of AVAX holders remained engaged in transactions, which is a positive indicator of long-term network usage.

The higher active address ratio correlated with price rallies, as seen during AVAX’s climb toward $61. This sustained user activity signaled that the network remained robust, even amid price fluctuations.

Source: IntoTheBlock

As engagement continues to rise, it could lead to future price increases, supported by strong community and investor activity.

Overall, the steady engagement shown by the Active Address Ratio highlighted the resilience of the Avalanche ecosystem.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

Even as the market experiences volatility, AVAX’s active user base suggested a healthy, growing network.

This consistent participation indicates that AVAX has strong long-term potential, despite short-term market corrections.