- A positive movement on some on-chain metric doesn’t necessarily suggest a bullish trend for AVAX.

- Whales and retailers are rapidly selling off their AVAX holdings but a little hope remains.

The price trajectory for Avalanche [AVAX] has been sharply bearish, with a 17.13% decline over the past week, and prospects for recovery seem slim.

Despite some encouraging signs, such as a 53.73% increase in trading volume in the last 24 hours and a rise in daily active users and large transactions, AMBCrypto reports that these factors might not herald a reversal of the current trend.

Increased activity suggests exit by major holders

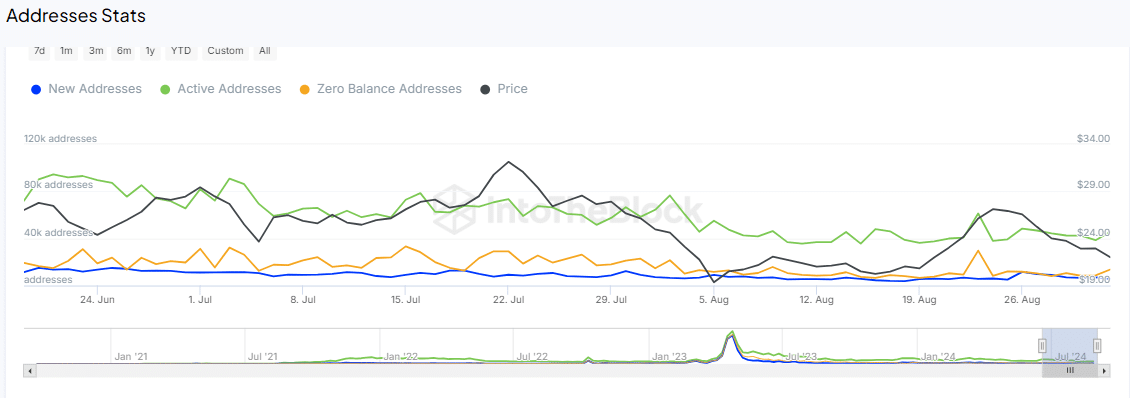

IntoTheBlock data reveals heightened activity on AVAX, with the number of active addresses climbing from 38.58k to 45.69k in just 24 hours.

Concurrently, the number of large transactions also grew, from 166 to 297 transactions within the same timeframe.

Source: IntoTheBlock

Typically, such spikes might suggest a bullish trend, but the accompanying decline in AVAX’s price indicates otherwise.

This pattern of increased user engagement coupled with a price fall points to profit-taking and distribution activities.

In simpler terms, it appears that whales, or large holders, are offloading their AVAX to cash out on profits, transferring their holdings to a wider range of smaller investors—a move that often signals a potential further decline in price.

Further analysis by AMBCrypto confirms that this sell-off involves not just whales but retail traders as well.

Whales, retailers losing confidence in AVAX

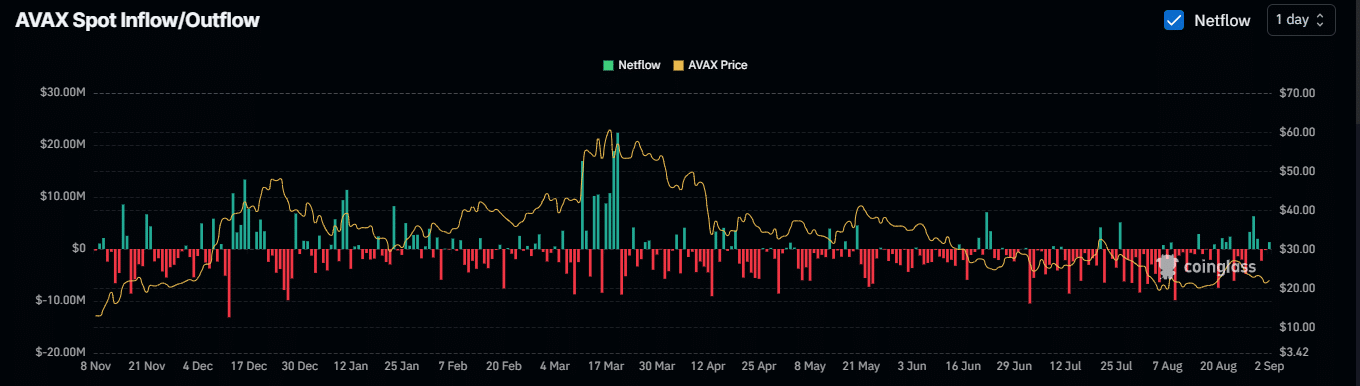

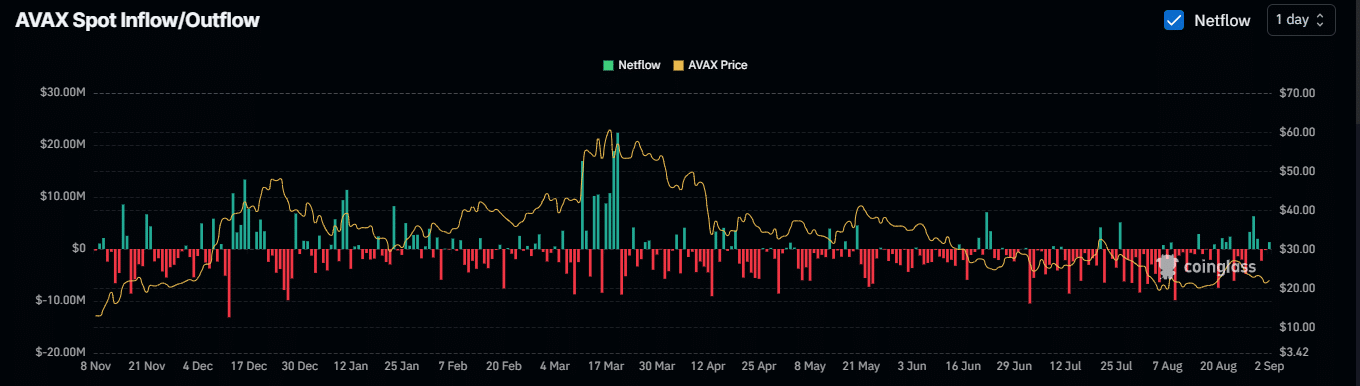

According to Coinglass, the Netflow of AVAX on major centralized exchanges has been predominantly positive, which typically signals a bearish outlook for the cryptocurrency.

A positive Netflow indicates that the volume of AVAX being deposited on these exchanges surpasses the amount being withdrawn, suggesting an increased willingness among traders to sell rather than hold.

Source: Coinglass

This situation also means that a surge in inflows contributes to an increased circulating supply on exchanges which will further exert downward pressure on the price.

The bearish sentiment is also evident among retail traders, as indicated by a negative Open Interest (OI) Weighted Funds rate.

This negative indicator reflects a pessimistic outlook in the futures and derivatives markets, with traders likely closing their positions in anticipation of further price declines or to minimize losses.

AMBCrypto’s analysis of technical indicators reveals persistent bearish patterns but a possible rebound approaching.

A glimmer of hope for AVAX remains

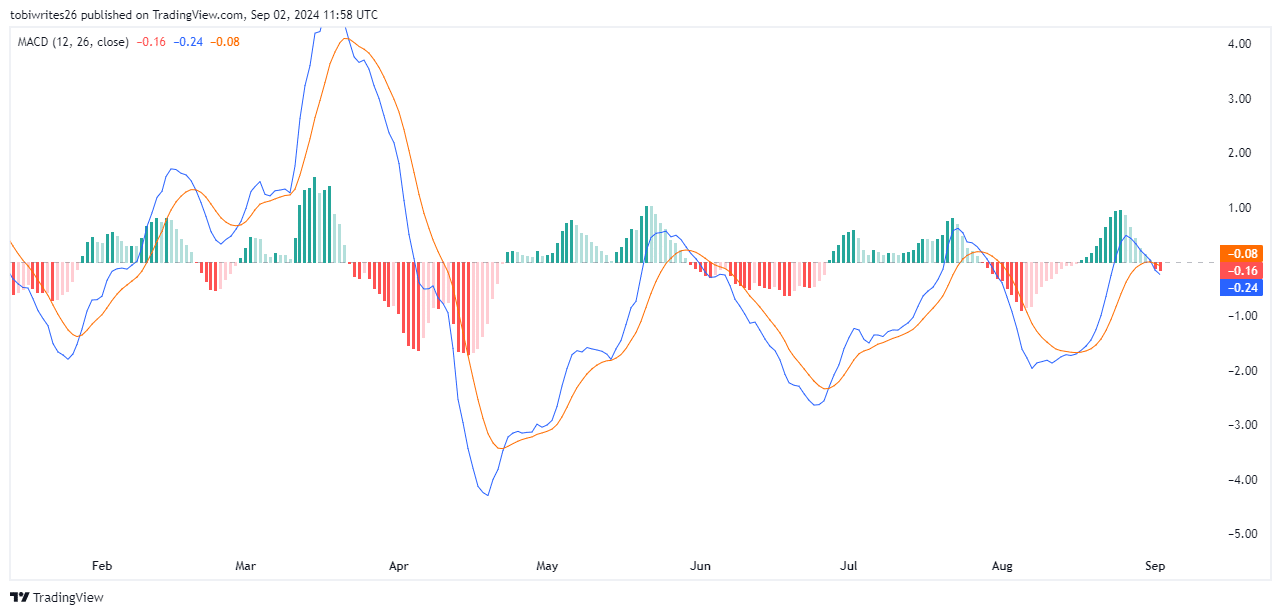

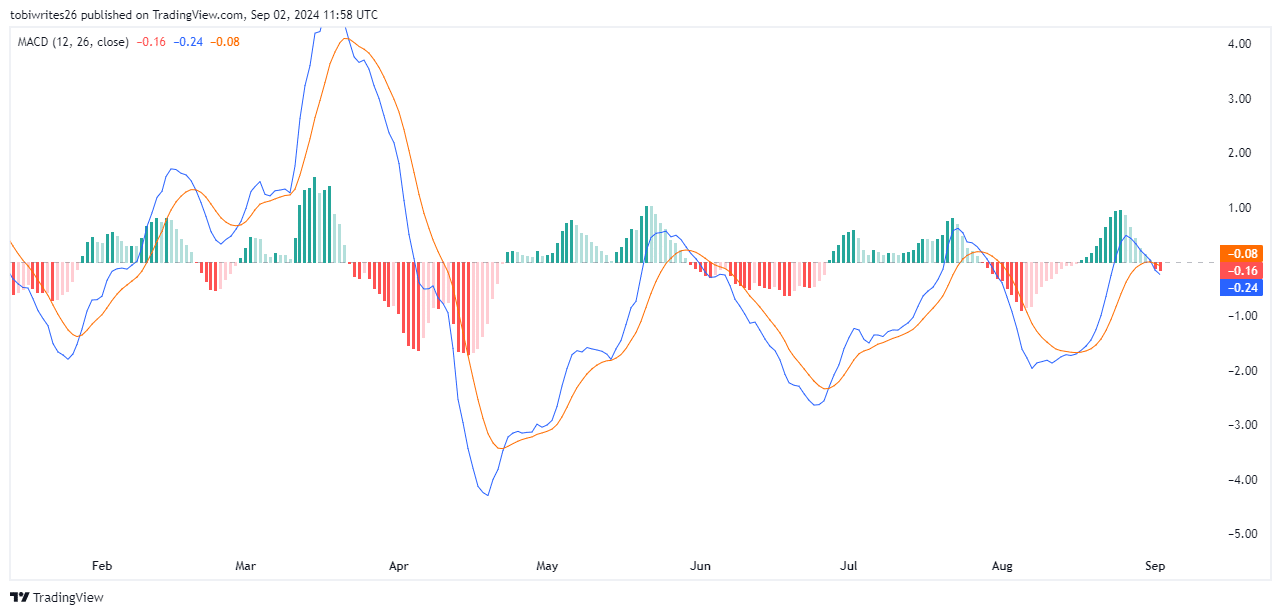

The Moving Average Convergence Divergence (MACD) indicator has intensified the bearish outlook for AVAX, as the MACD line (blue) crossing below the signal line (red) suggests a forthcoming decline in momentum and price.

Source: Trading View

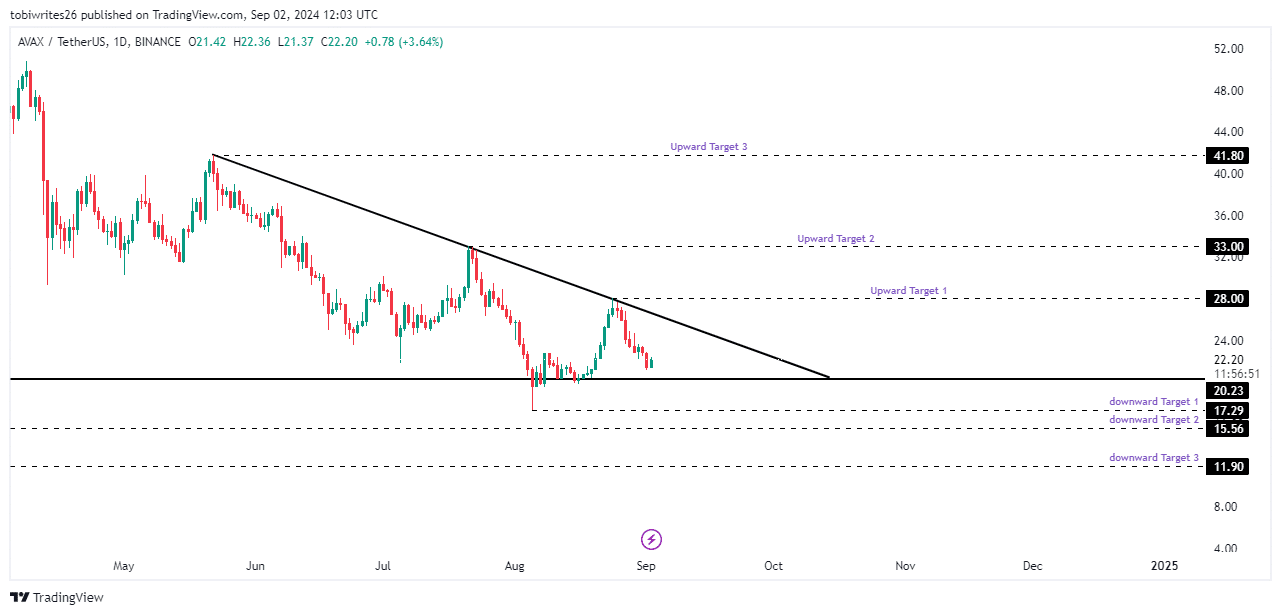

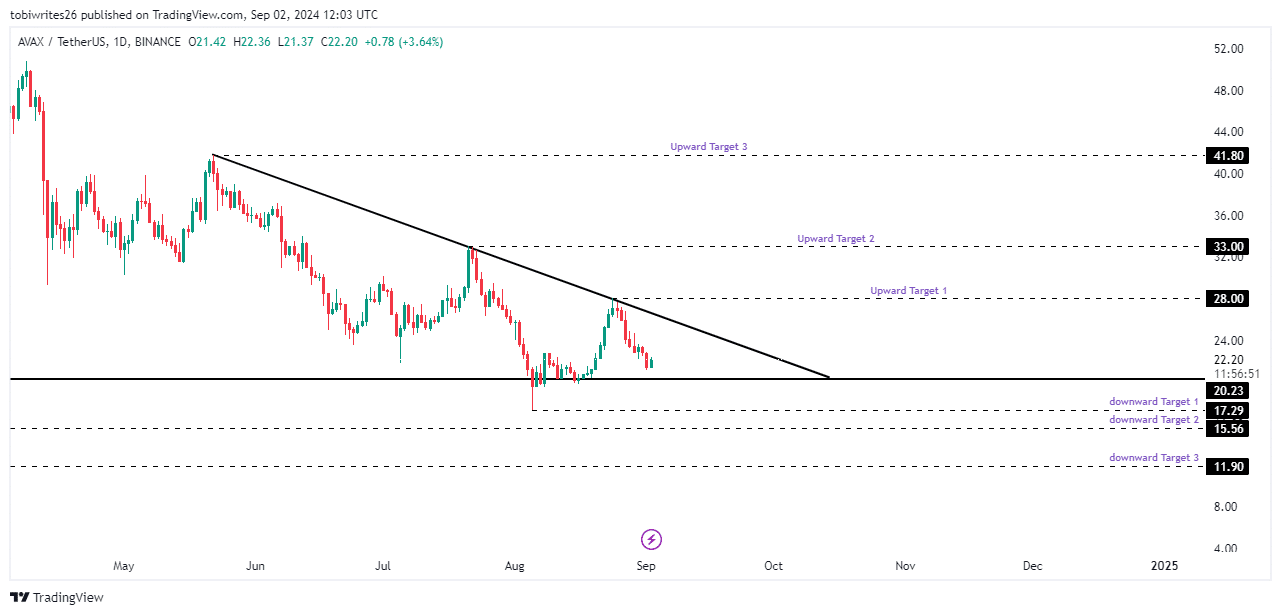

This trend points to a potential drop in AVAX’s price in the near term. However, the presence of key technical patterns, such as local support and a descending trend line on the daily chart, suggests a possible bullish reversal ahead.

The recent sell pressure on AVAX might be price-seeking to test its local support zone at $20.23, a level historically associated with strong buying interest.

Is your portfolio green? Check the Avalanche Profit Calculator

Should this support hold, it could trigger a rally, pushing the price past the descending trend line towards a close target of $28.

Source: Trading View

On the flip side, should bearish forces overpower, AVAX might descend to the first lower support at $17.29. Further pressure could then drive the price down to $11.90.