- Bitcoin’s holiday rally brings it close to $100K, fueling speculation and heightened volatility.

- Leverage and market sentiment is critical as BTC navigates liquidation zones and key price levels.

Bitcoin [BTC] delivered a holiday surprise this Christmas, surging to a remarkable $99.8K and reigniting trader optimism for a potential breakout above $100K.

As it edges closer to this critical psychological and technical level, market participants are bracing for heightened volatility.

Above $100K lies a pivotal liquidation zone for short positions, where a breach could ignite a rapid rally toward $110K.

However, the path is fraught with risks, as the $90K level below represents a precarious support that, if tested, could trigger significant liquidations of long positions.

Bitcoin’s ability to navigate these levels will define its trajectory as it closes the year with unprecedented momentum.

BTC’s performance — A holiday miracle!

Bitcoin’s surge to $99.8K on Christmas marked a pivotal moment in the final quarter of 2024, with both social sentiment and price dynamics aligning to push the cryptocurrency closer to the psychological $100K threshold.

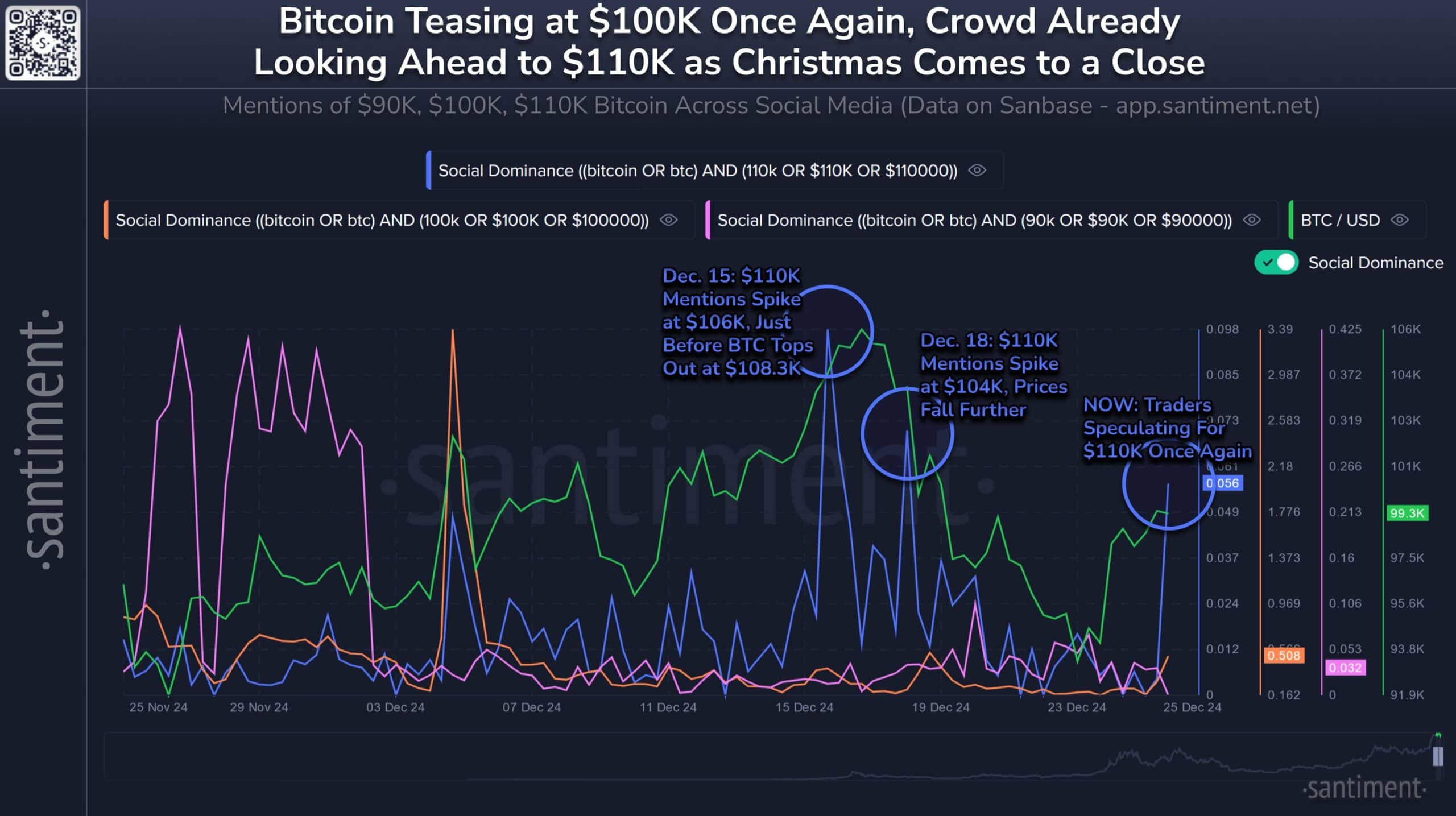

On the 25th of December, mentions of $100K surged alongside Bitcoin’s price, showing the psychological importance of this level.

Traders’ focus has also shifted to $110K, with a notable increase in mentions of this target, mirroring patterns observed earlier in December during Bitcoin’s rallies to $106K and $104K.

Source: Santiment

Historical data suggests that social-driven price euphoria has played a pivotal role in Bitcoin’s performance this month.

For instance, on the 15th of December, mentions of $110K spiked significantly just as Bitcoin peaked at $108.3K.

Similarly, another surge in social chatter on the 18th of December coincided with Bitcoin’s attempt to stabilize at $104K before retreating further.

These trends demonstrate that speculative sentiment often leads to short-term tops, particularly at key price milestones.

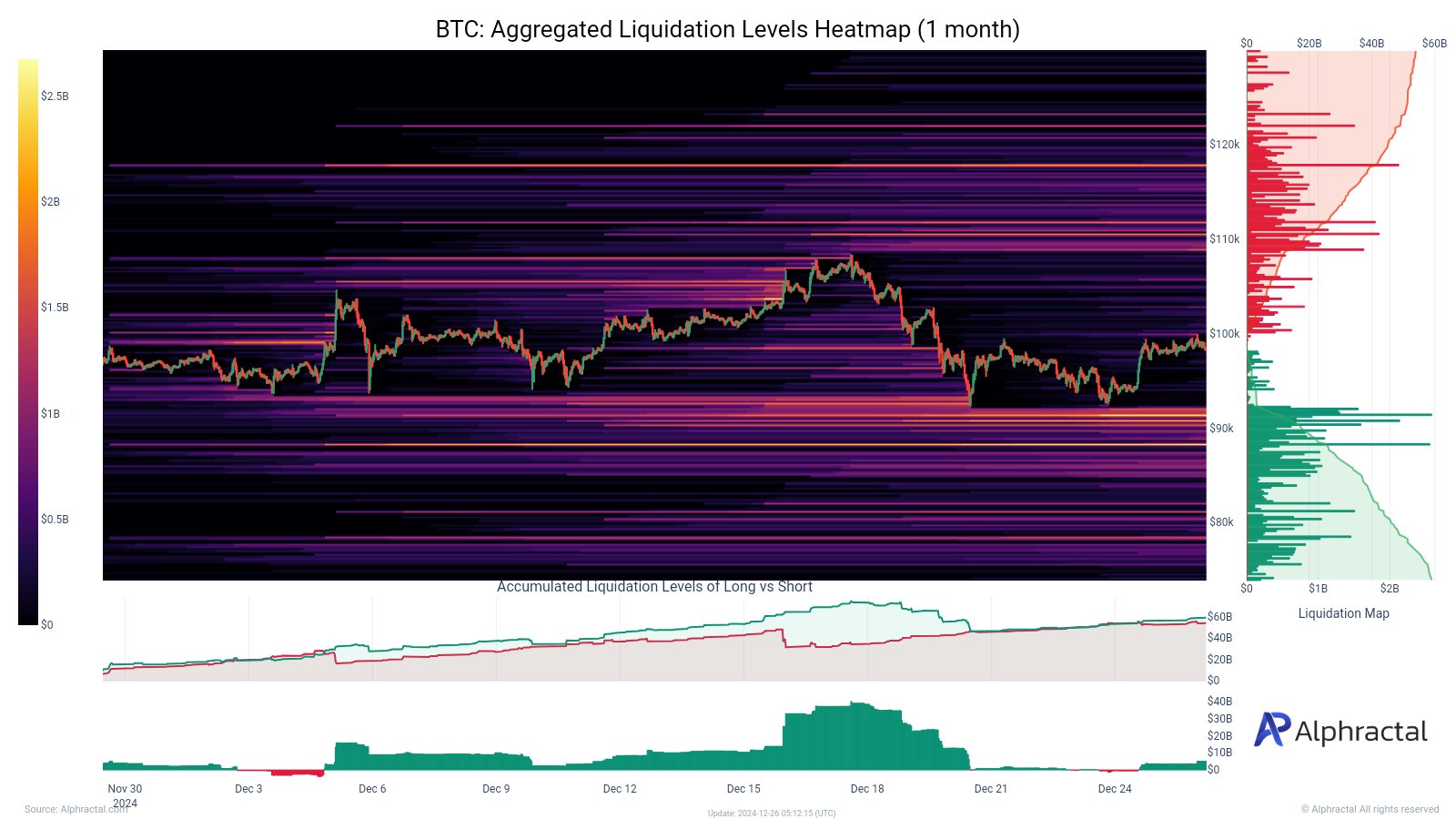

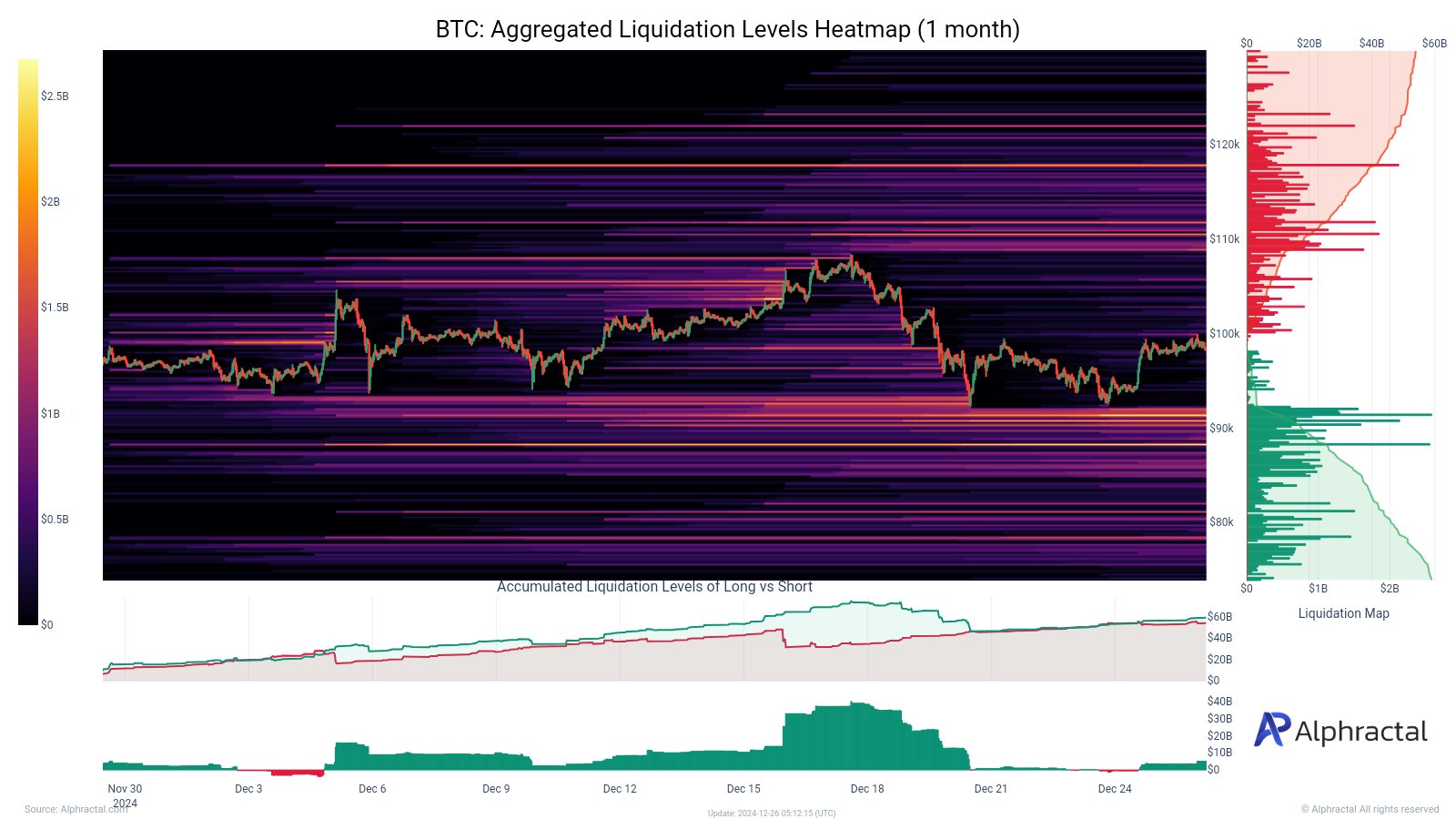

As Bitcoin closes in on the $100K mark, its volatility remains underpinned by liquidation pressures.

On the upside, breaching $100K could trigger cascading liquidations of short positions, propelling Bitcoin toward $110K.

However, the $90K support level below remains a critical zone to watch, as long liquidations here could fuel a sharp reversal.

The market’s current behavior signals cautious optimism.

Traders are speculating heavily about Bitcoin’s ability to maintain its upward momentum, but its recent history of pullbacks following sentiment-driven peaks suggests the path to $110K will require more than social hype.

Sustained demand and strong technical support will be key to breaking through and holding higher levels.

Bitcoin: Key liquidation zones

Bitcoin’s recent move toward $100K highlights two critical zones that could define its near-term trajectory.

The $110K level stands out as the primary liquidation zone for short positions, representing a potential inflection point where a break above could fuel a sharp rally.

Source: Alphractal

On the flip side, the $90K region has emerged as a crucial support level for long positions. A dip below this range could cascade into significant liquidations, exacerbating downward pressure.

Traders should remain vigilant, as the interplay between these zones will likely dictate Bitcoin’s price action in the coming weeks, especially amidst heightened volatility.