- Whale activity surged as Bitcoin formed a double-bottom pattern, testing key resistance levels

- Market sentiment strengthened on the back of rising active addresses, declining exchange reserves, and the bullish buy/sell ratio

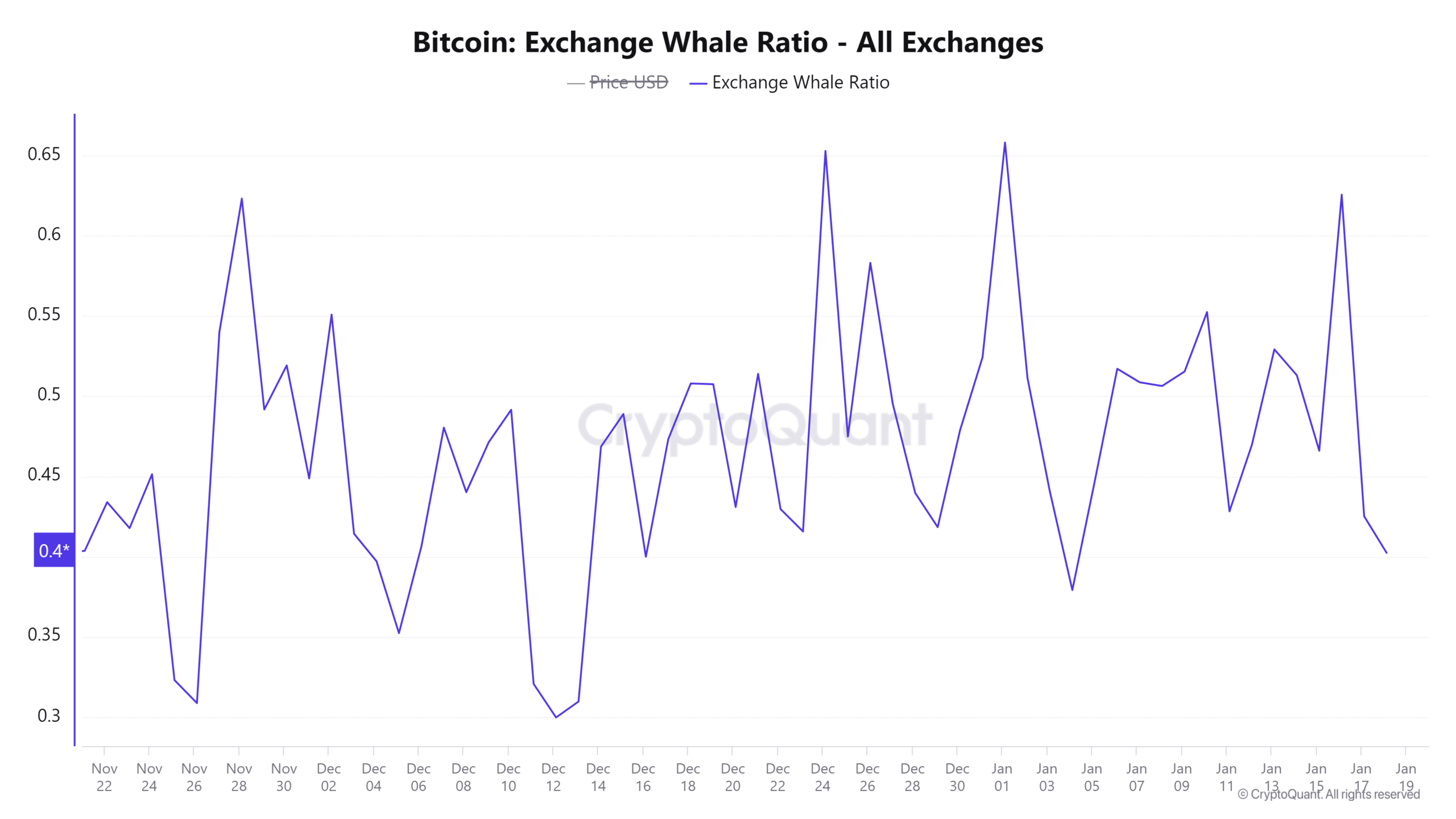

Whale activity on Binance has spiked significantly lately, with the whale ratio climbing by over 1.02%. This metric, which tracks the top inflows compared to total inflows, is used to assess large movements by major Bitcoin holders.

Historically, such elevated whale activity is often seen as a precursor to large-scale buying or selling. In fact, this often precedes major price movements on the charts too.

Needless to say, its latest surge has raised questions about whether Bitcoin [BTC] is on the verge of a significant market shift or just a temporary rally.

Source: CryptoQuant

Is Bitcoin ready to test new highs?

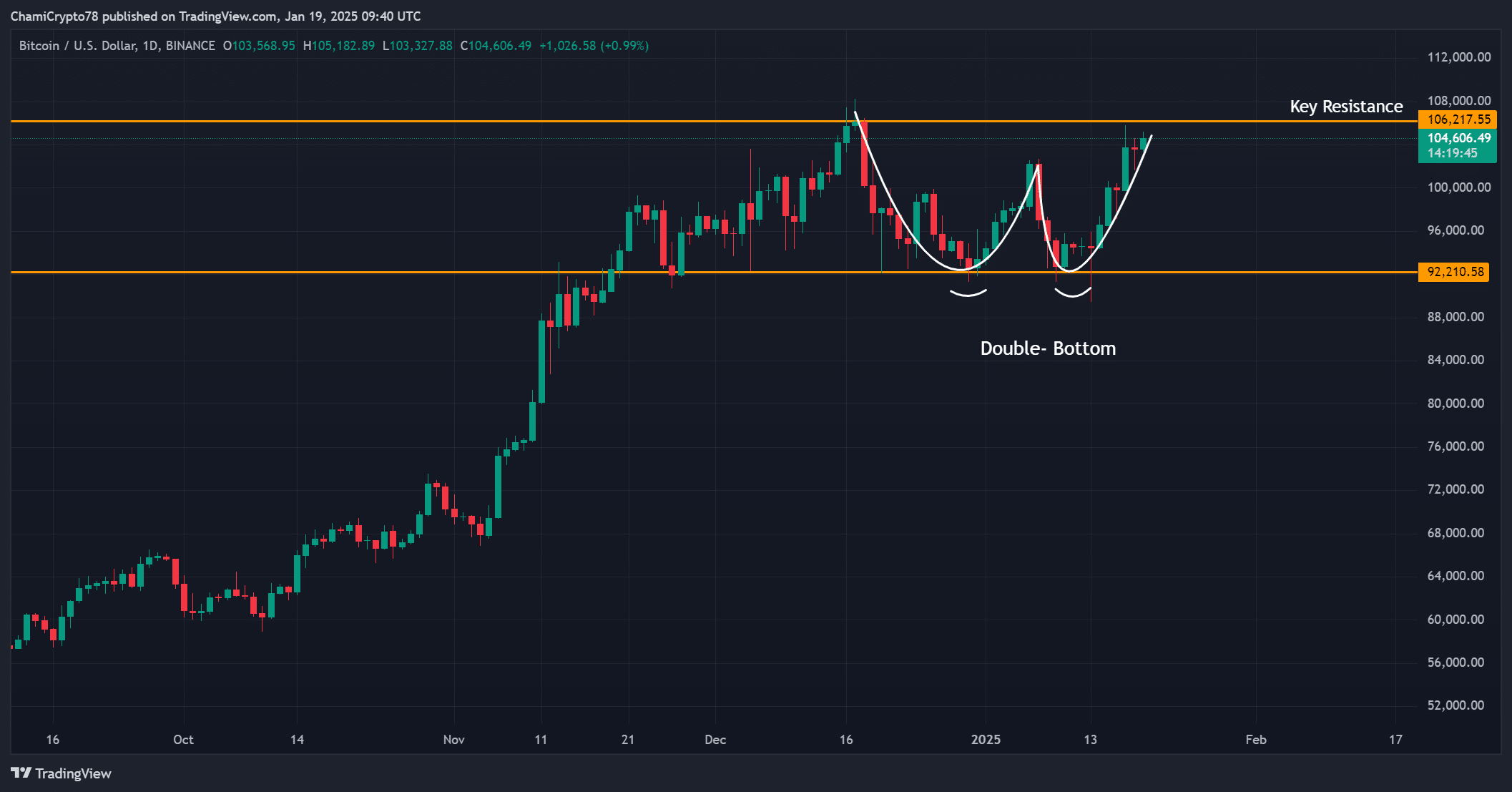

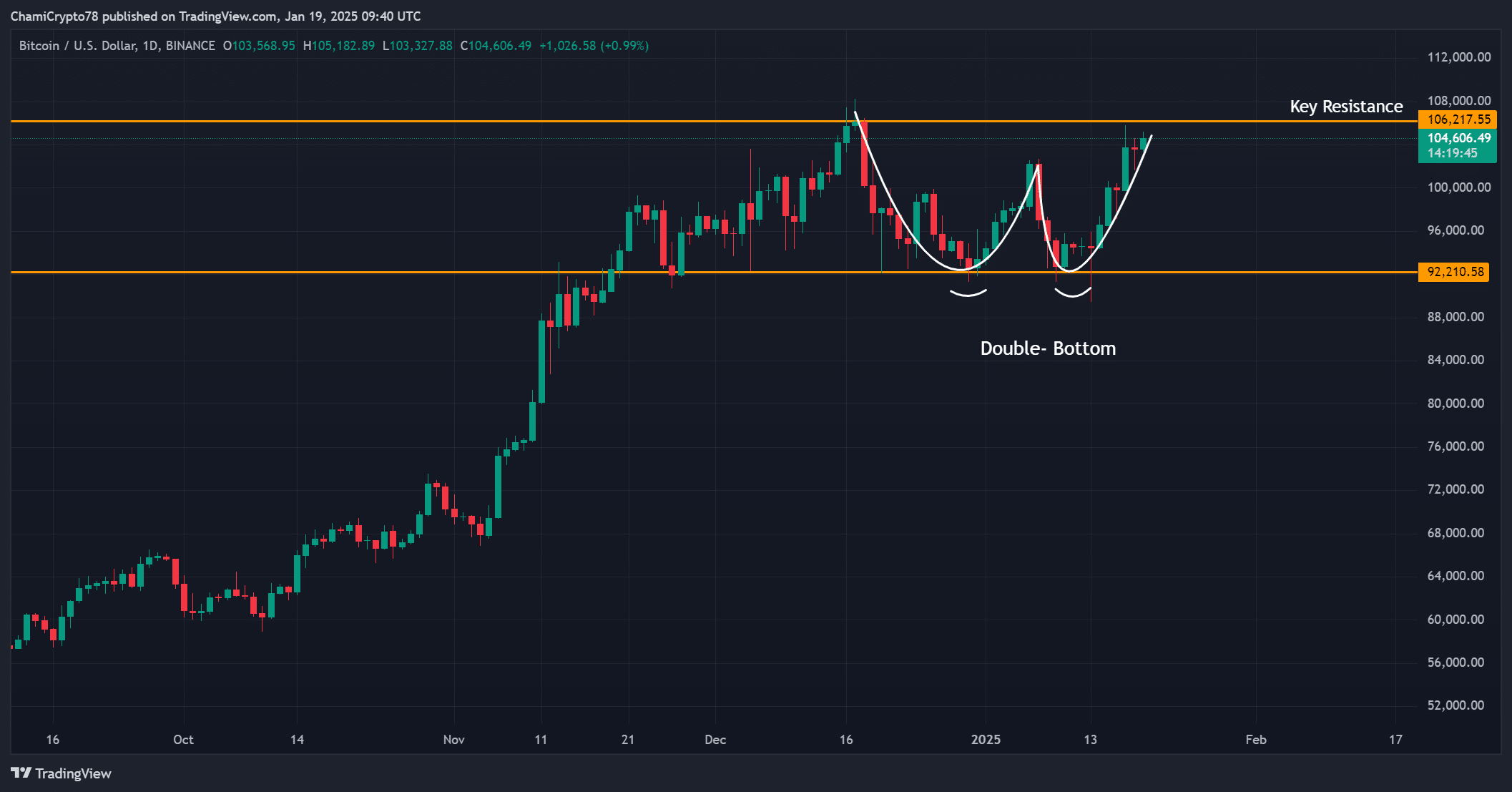

Bitcoin, at the time of writing, was trading at $104,473.77, following a 1.39% hike in the last 24 hours. Its price action on the charts revealed a double-bottom pattern forming strong support near $92,000, while the resistance at $106,200 remained a key hurdle.

If BTC can breach this resistance, it may pave the way for a major breakout. However, failure to maintain upward momentum could trigger a retest of lower levels, presenting a critical juncture for traders to monitor closely.

Source: TradingView

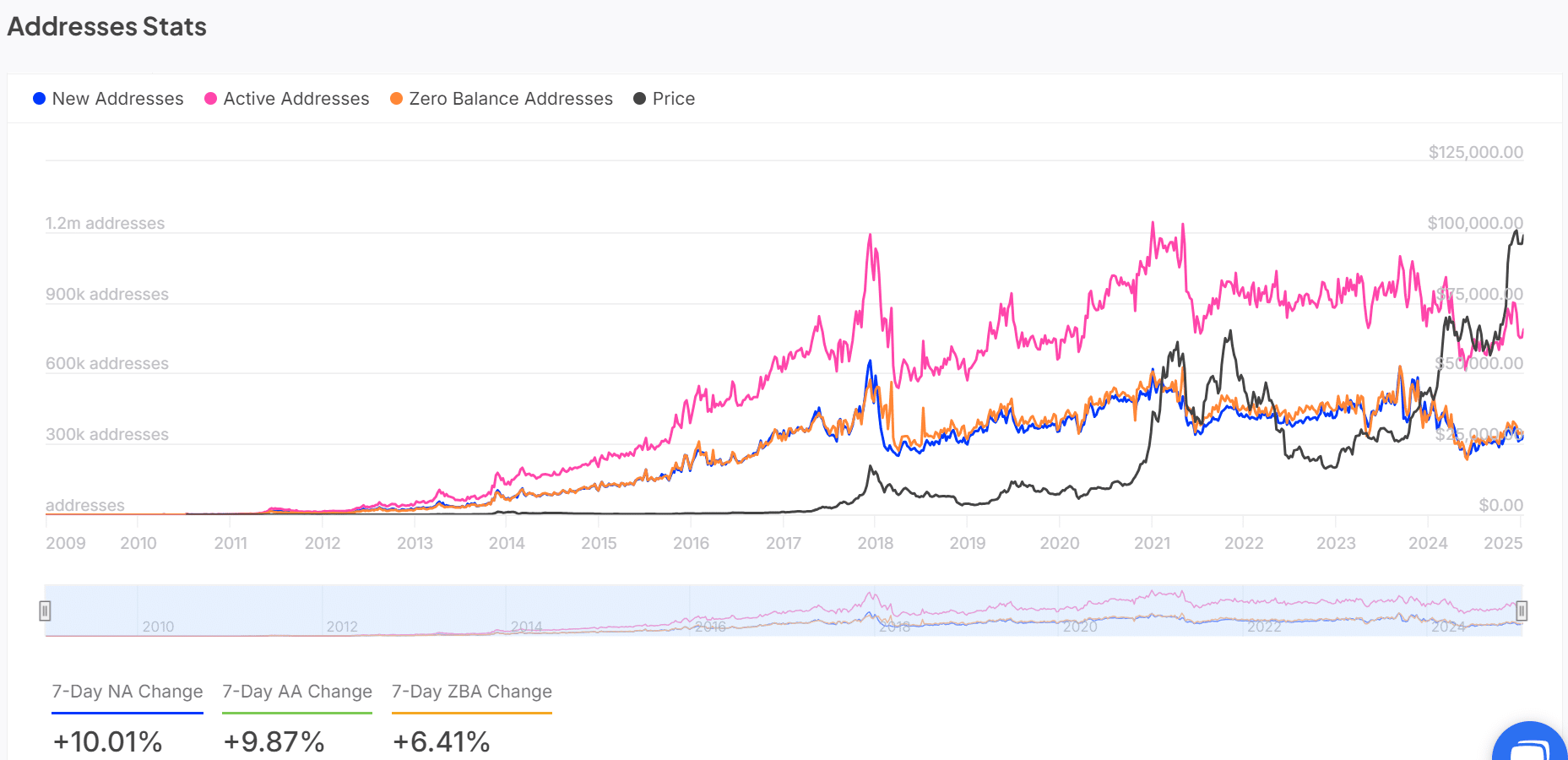

How can active addresses shape the market?

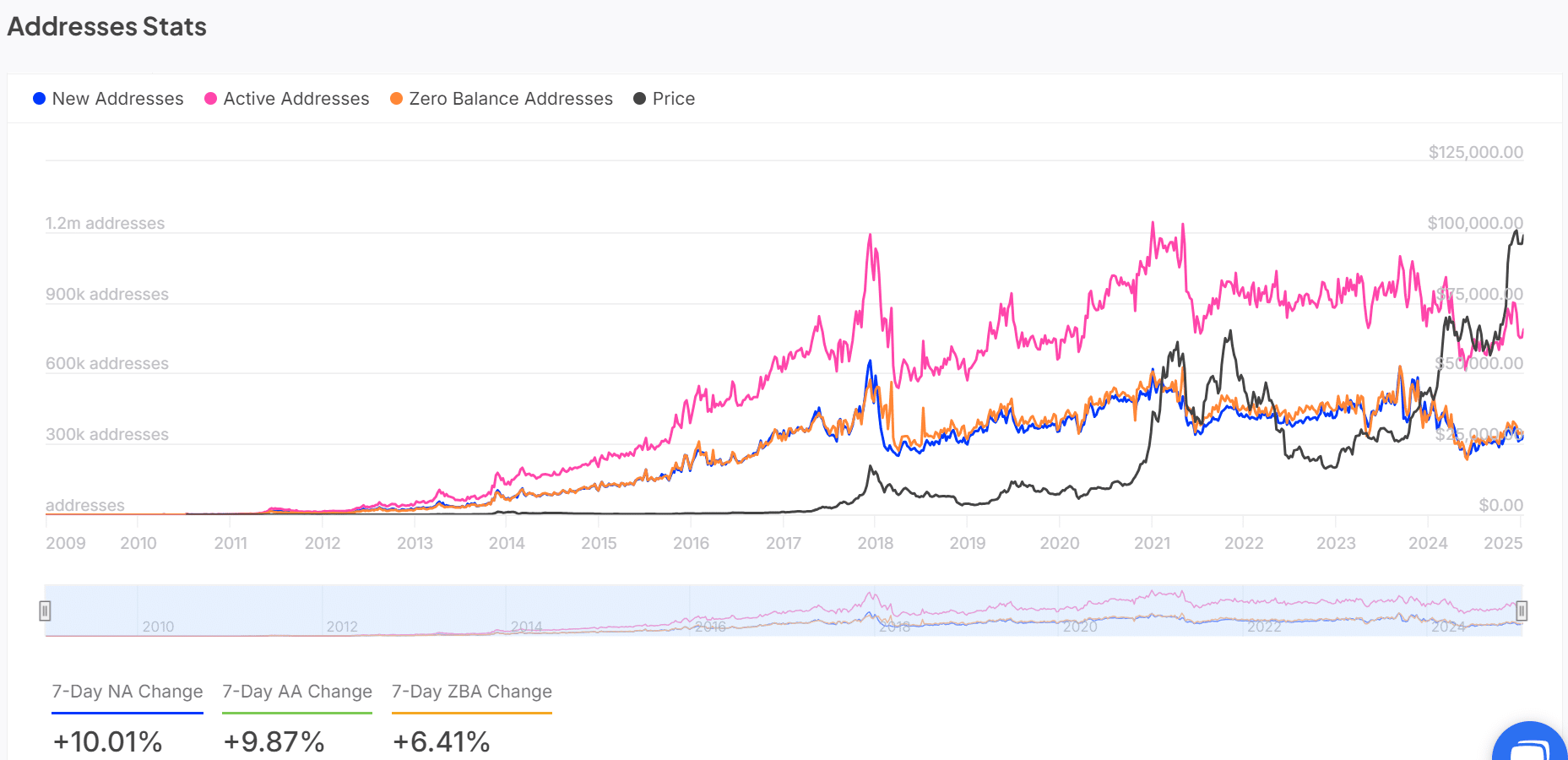

Bitcoin’s active addresses surged by 9.87% over the last 7 days, reflecting growing interest in the crypto-asset. Such a hike is a crucial indicator of market activity, hinting at heightened transactional demand from both retail and institutional investors.

Also, an uptick in the number of active addresses is often seen as a measure of market confidence. If this trend continues, it could provide the transactional support needed to push BTC to higher price levels.

Source: IntoTheBlock

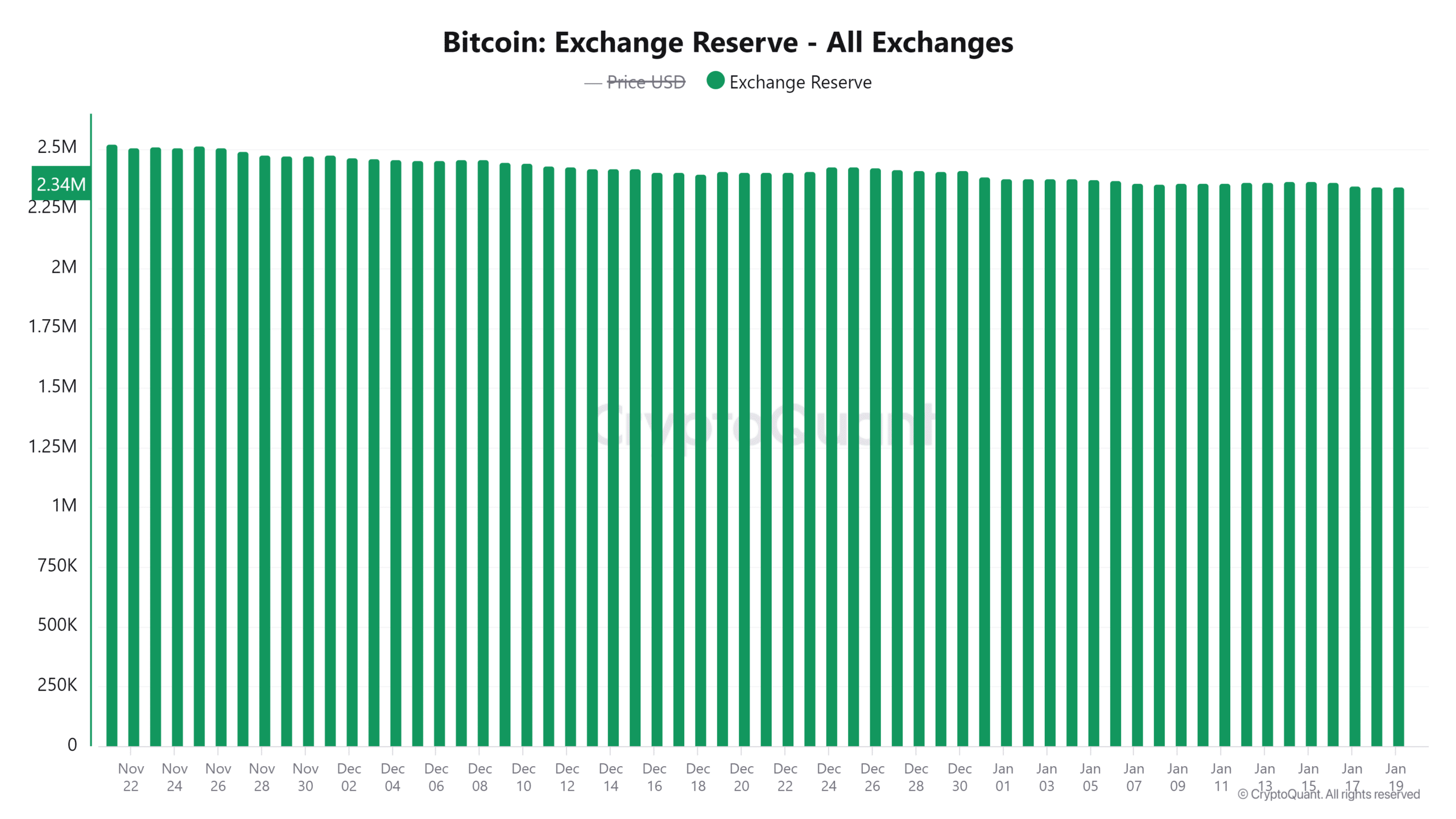

Exchange reserves signal reduced selling pressure

Over the last 96 hours, more than 20,000 BTC, worth over $2 billion, have been withdrawn from exchanges. At the time of writing, exchange reserves sat at 2.344 million BTC, reflecting a sustained decline.

This trend indicated that investors have been moving their holdings to private wallets – A sign of long-term bullish sentiment.

Here, it’s worth noting that reduced exchange reserves typically correlate with a fall in selling pressure, a finding that may further support a potential BTC rally.

Source: CryptoQuant

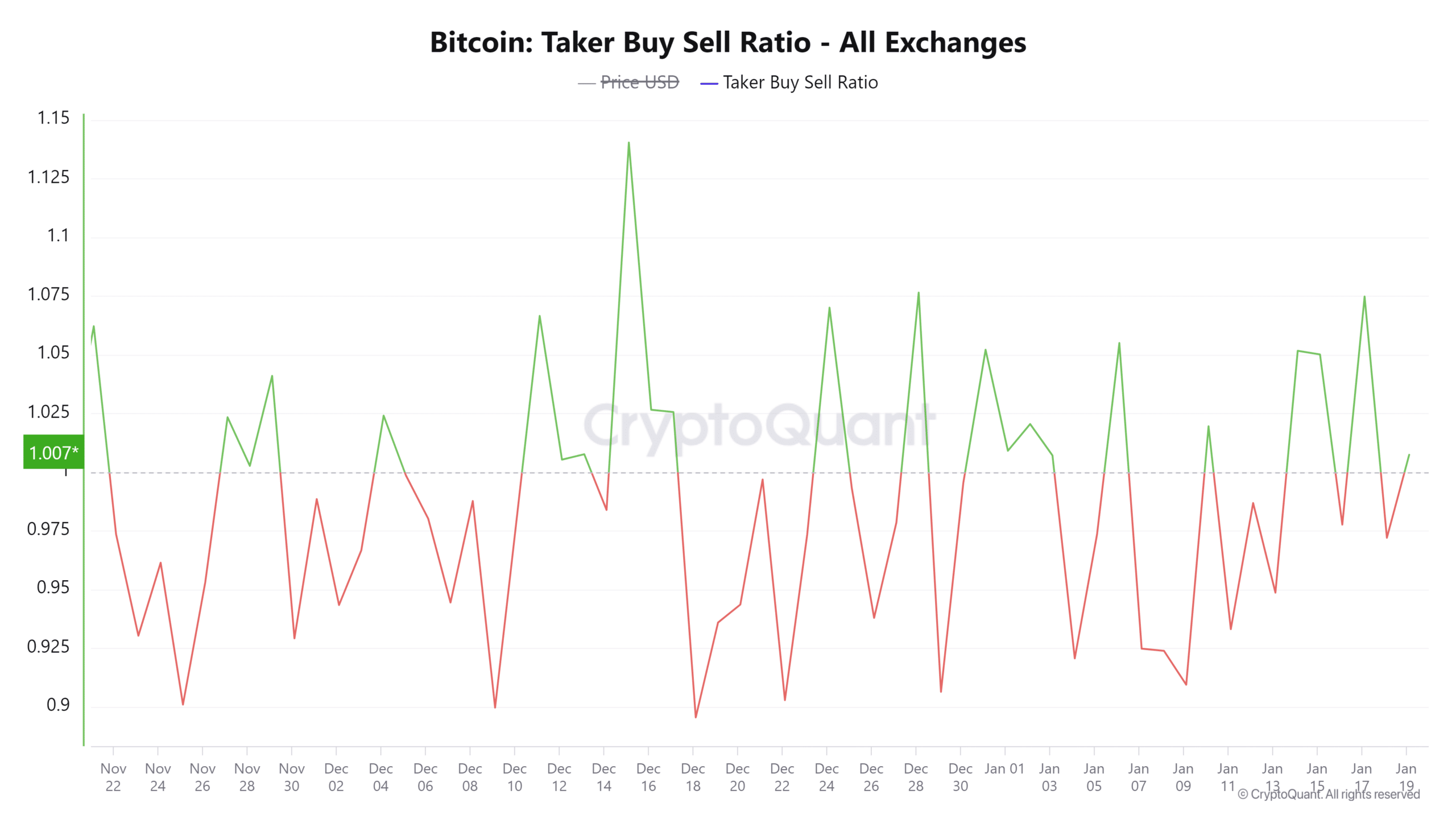

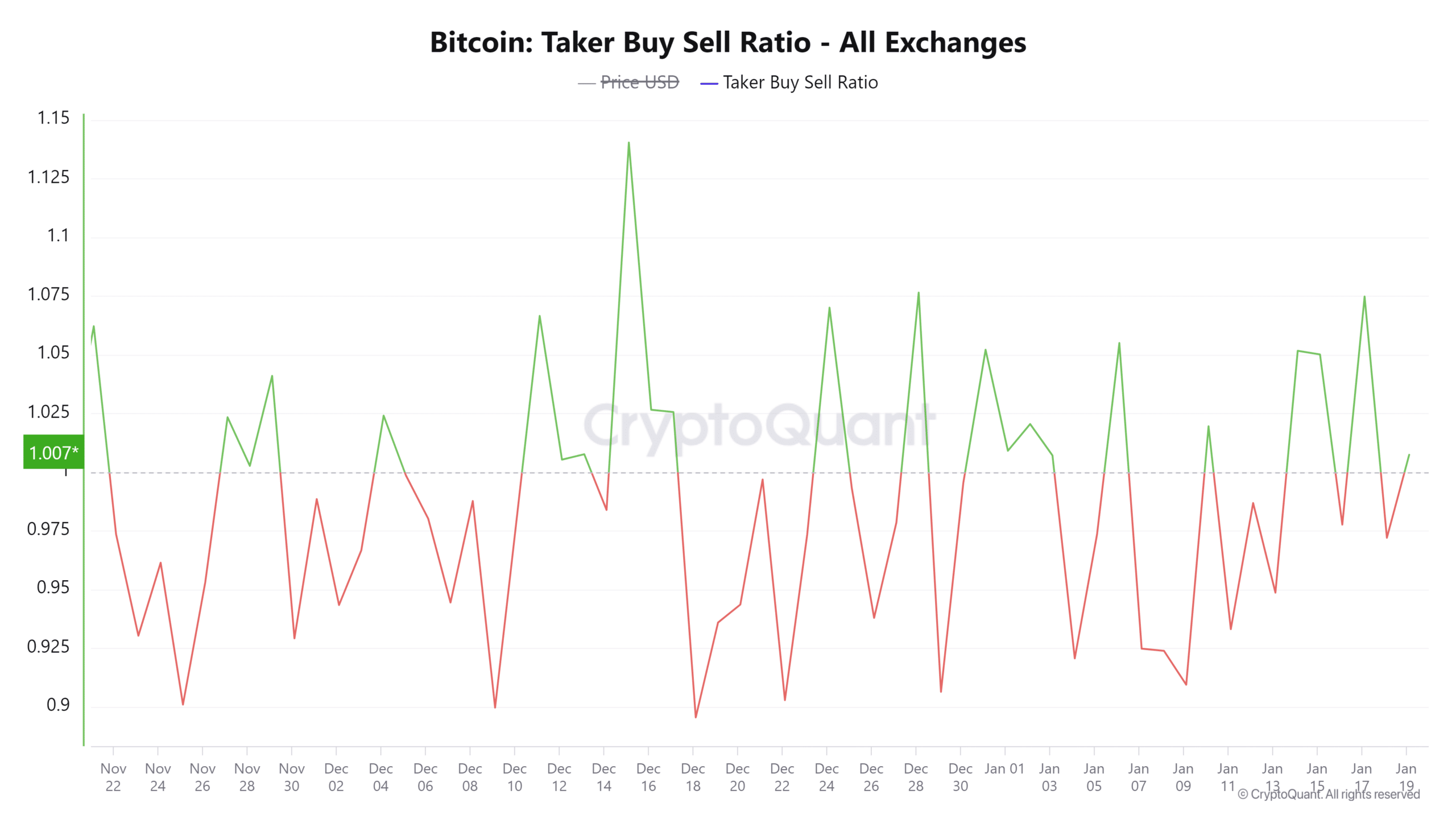

Taker buy/sell ratio indicates bullish momentum

At press time, the taker buy/sell ratio had a reading of 1.01, with a 0.99% hike in buyer dominance. This metric highlighted that market participants have been actively purchasing Bitcoin at higher prices – A sign of growing demand.

Additionally, this bullish sentiment complemented the broader narrative of increasing interest in BTC, further solidifying the possibility of upward momentum in the short term.

Source: CryptoQuant

Is your portfolio green? Check out the Bitcoin Profit Calculator

Given the surge in whale activity, increasing active addresses, declining exchange reserves, and bullish taker buy/sell ratios, Bitcoin appears primed for a breakout.

While risks of a pullback remain, data strongly supported a bullish case for the cryptocurrency.