- After a short trip above $64k, BTC once again fell under that level.

- A few market indicators suggested that BTC was overbought.

After crossing $64k on the 23rd of September, Bitcoin [BTC] has once again fallen under that mark. In the meantime, an analyst revealed that buying pressure on the coin has increased. Will this development have any major impact on BTC’s price action?

People are again buying Bitcoin

After a lot of wait, BTC finally managed to cross the $64k barrier for a short duration. Though it fell under that mark again, the latest analysis suggested that buying pressure was high.

Ali, a popular crypto analyst, recently posted a tweet revealing that investors were accumulating. This assessment was based on the wicks on BTC’s monthly price chart.

Source: X

In fact, AMBCrypto’s analysis of CryptoQuant’s data also found a similar trend. According to our analysis, Bitcoin’s net deposit on exchanges was lower compared to the last seven days’s average. This clearly signaled that buying pressure on the king coin has increased.

The miners were also willing to hold their coins as the BTC’s Miners’ Position Index (MPI) was green. Additionally, the Coinbase premium suggested that buying sentiment was strong among US investors. Generally, a rise in buying pressure results in a price hike.

Source: CryptoQuant

Will BTC’s price rise again?

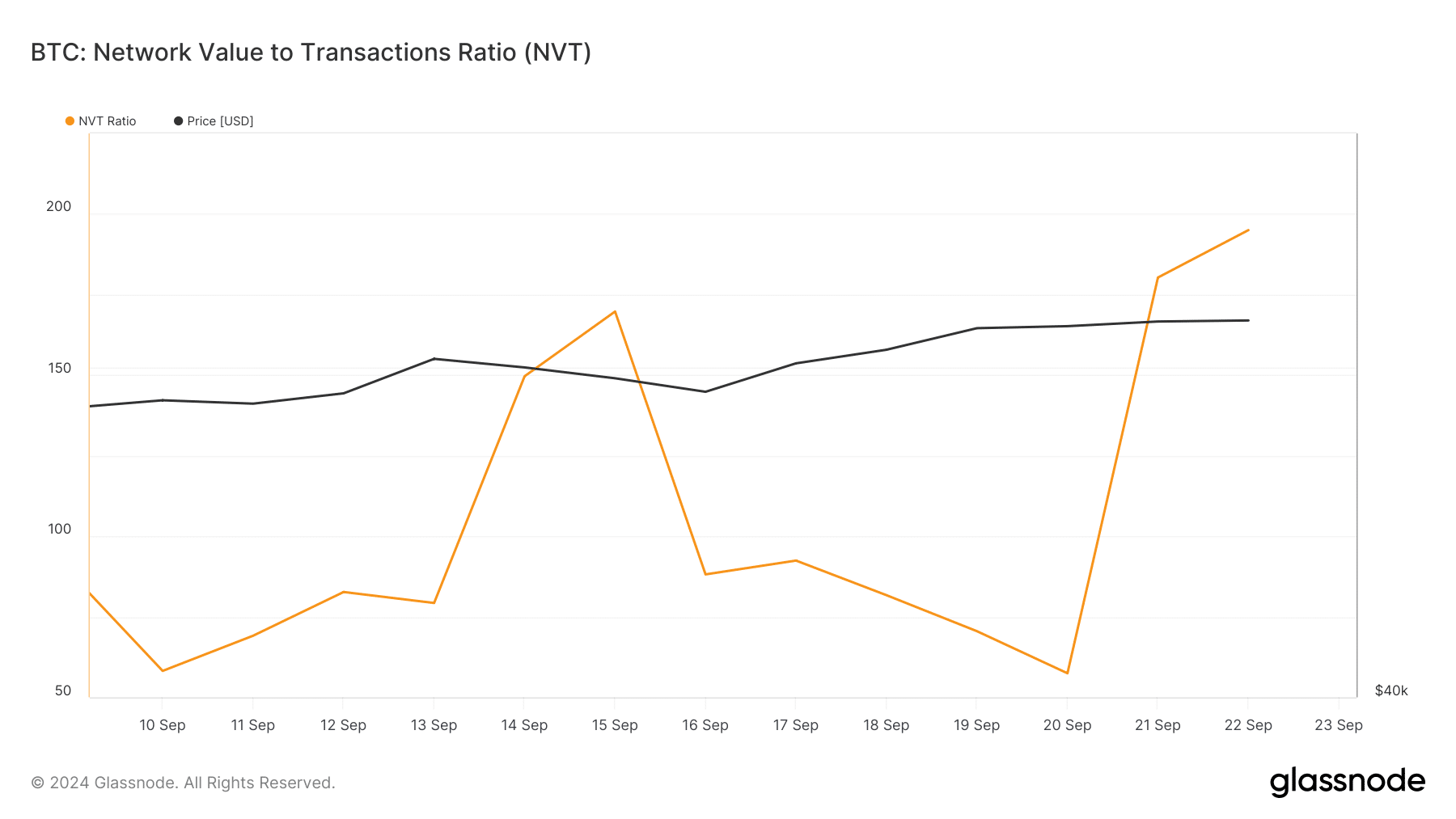

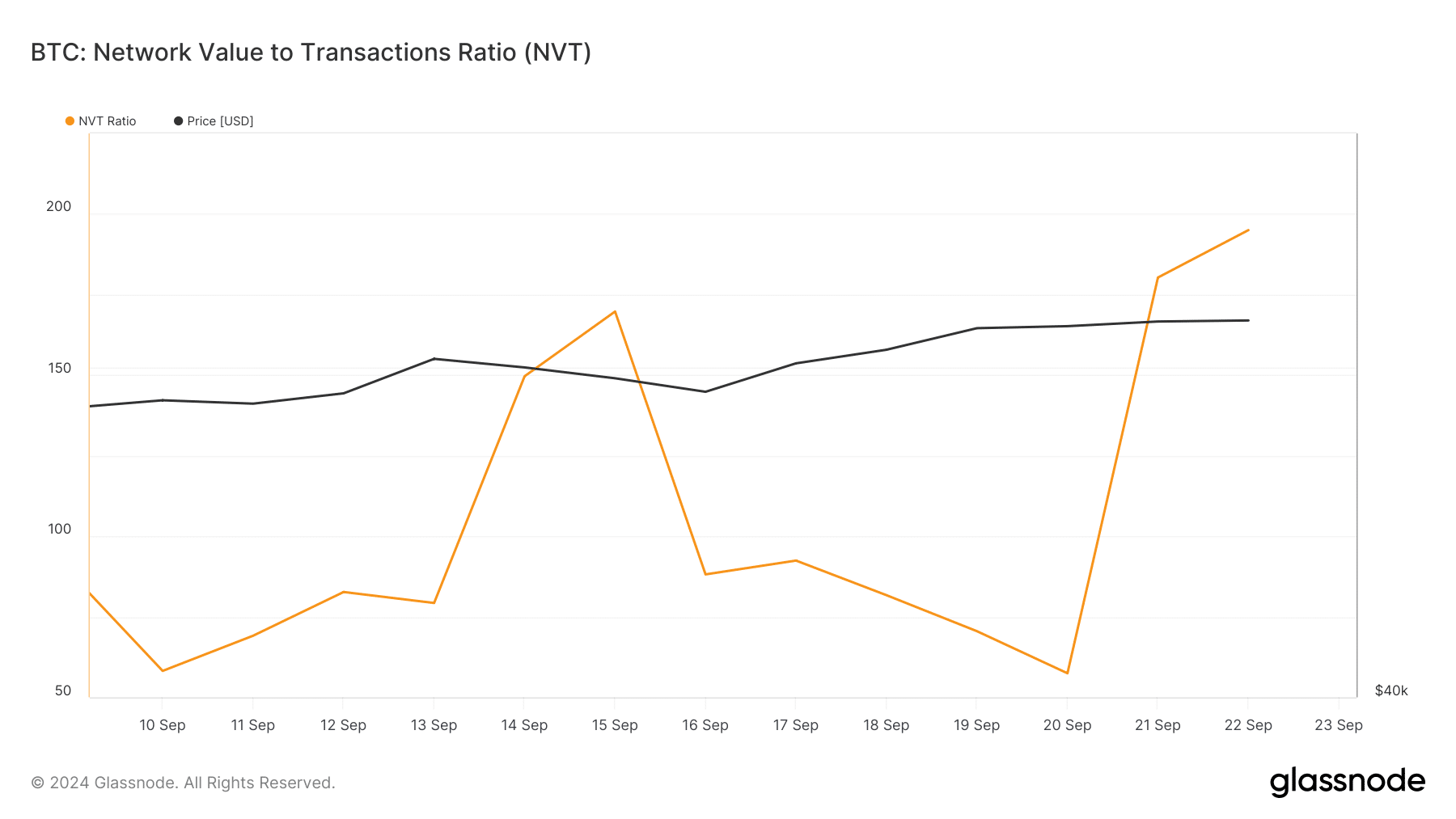

Though buying pressure on the coin was high, a few of the metrics suggested a price correction. For instance, our look at Glassnode’s data revealed that BTC’s NVT ratio increased sharply.

A rise in the metric means that an asset is overvalued, which hints at a price correction.

Source: Glassnode

Apart from that, AMBCrypto found that Bitcoin’s Relative Strength Index (RSI) was in an overbought zone. The stochastic was also in the same zone, further increasing the chances of a price correction in the coming days.

Source: CryptoQuant

However, at the time of writing, Bitcoin’s fear and greed index was in the “fear” zone. Usually, when the metric hits this level, it indicates a price rise. Therefore, AMBCrypto chose to check BTC’s daily chart to better understand what to expect from the king coin.

As per our analysis, BTC was once again approaching a crucial resistance at $64.1k. The good news was that the MACD displayed a bullish advantage in the market. BTC’s Chaikin Money Flow (CMF) also was bullish as it moved northwards.

Read Bitcoin (BTC) Price Prediction 2024-25

These indicated that the chances of a successful break above the resistance were likely. If that happens, then BTC might soon target $68k.

Nonetheless, in the event of a bearish trend reversal, investors might witness BTC dropping to $57k again.

Source: TradingView