- Bitcoin dominance was showing signs of cooling off after breaching a key resistance zone.

- Are alternative assets primed for a resurgence in investor portfolios?

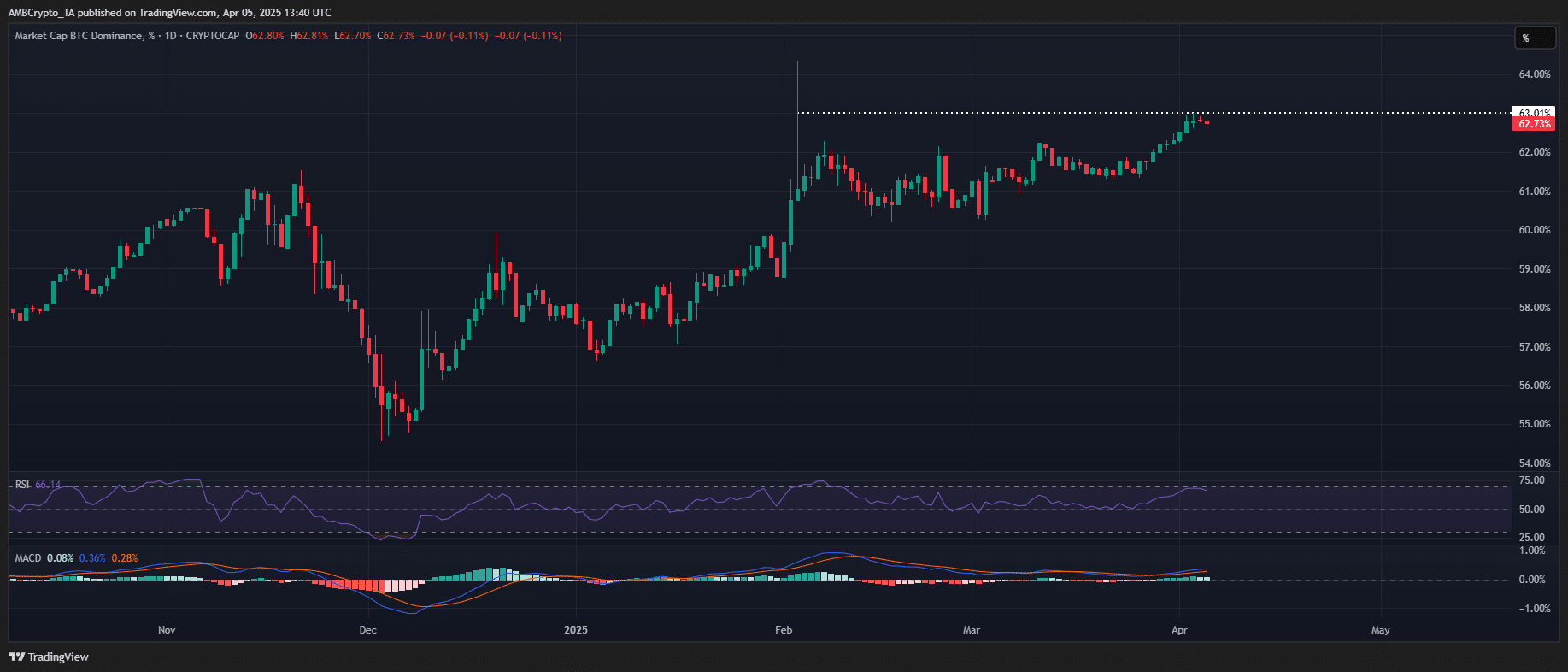

After a strong rally, Bitcoin dominance [BTC.D] has started to show signs of exhaustion.

At press time, the Relative Strength Index (RSI) was deeply overbought, increasing the likelihood of a corrective retracement, while the MACD bearish crossover signaled a momentum shift as BTC.D tests the key 63% resistance level.

Historically, such technical conditions have preceded capital rotations into risk-on assets, suggesting a potential altcoin resurgence if BTC.D begins to unwind.

Source: TradingView (BTC.D)

However, confirmation of a local top remains elusive. While Bitcoin has demonstrated structural resilience amid macro headwinds, high-cap altcoins remain highly volatile with failed support retests.

Solana [SOL] serves as a prime example – Despite its eight-month low, the asset has twice reclaimed $115 in March. Yet, it has failed to establish a firm support base, leaving it structurally weak and susceptible to further distribution cascades.

The same pattern extends to most altcoins, reinforcing a fragile market structure. Consequently, diminishing the likelihood of a sustained capital rotation despite BTC.D’s overheated technicals.

Altcoins poised to decouple from Bitcoin dominance

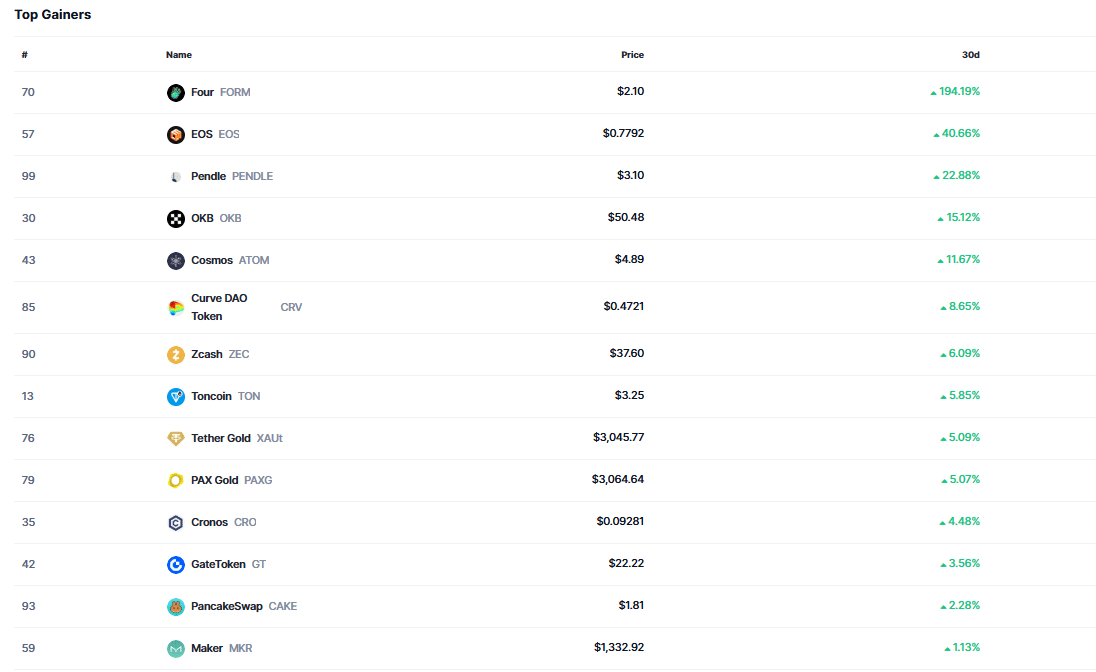

CoinMarketCap’s monthly gainers chart underscores a decisive capital rotation into low and mid-cap altcoins.

Topping the leaderboard is Four [FORM], a low-cap asset that has posted a 194.19% rally to $2.10, signaling heightened speculative interest and liquidity influx.

Mid-cap assets such as EOS [EOS], OKB [OKB], and Cosmos [ATOM] have also posted notable gains, each maintaining a market capitalization above $1 billion, signaling broader market participation beyond Bitcoin’s dominance.

Source: CoinMarketCap

In contrast, high-cap altcoins continue to face distribution pressure. Despite some trading at sub-$1 levels, their demand has waned as BTC dominance peaks.

Notably, no high-cap asset has made it onto the top gainers’ list, with Cardano [ADA] leading the downside, registering a steep 30% monthly drawdown.

As leaders within the altcoin market, their failure to establish bullish momentum disrupts capital rotation dynamics.

This structural divergence underscores why, despite Bitcoin dominance flashing overbought conditions, a sustained altcoin season remains improbable.