- Spot Bitcoin ETFs absorbed 4,349.7 BTC, far surpassing miner supply this week.

- Institutional demand tightens liquidity, amplifying Bitcoin’s price sensitivity and volatility risks.

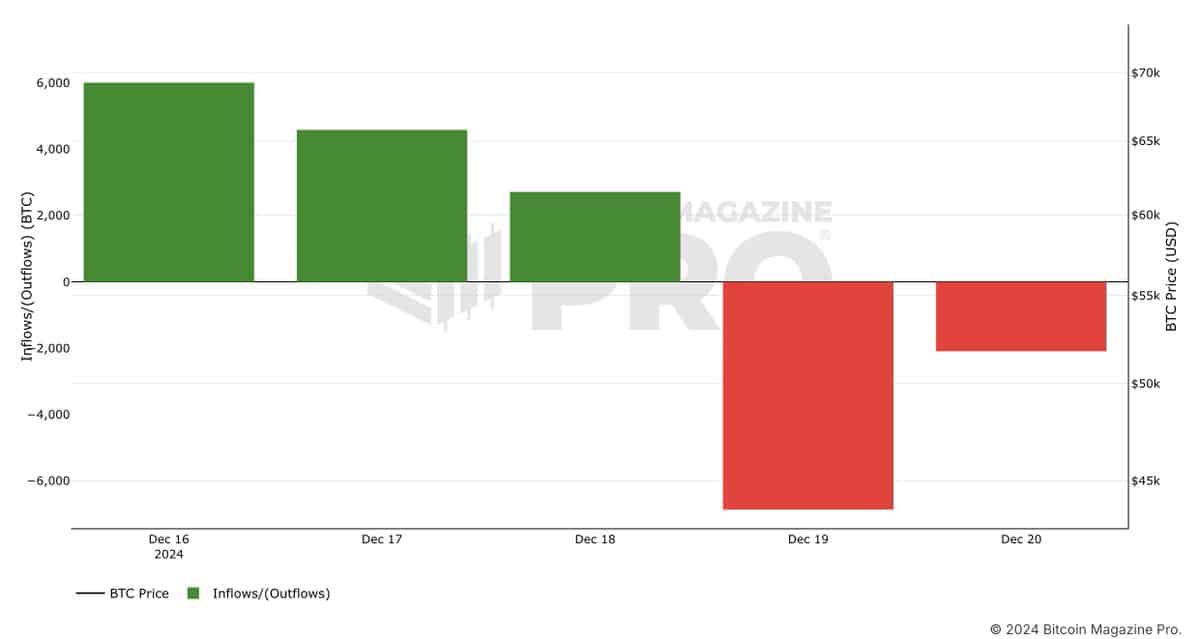

Institutional demand for Bitcoin [BTC] shows no signs of abating, even amid price volatility. In the past week, spot Bitcoin ETFs recorded inflows of 4,349.7 BTC, worth $423.6 million – nearly double the 2,250 BTC mined in the same period.

This imbalance highlights the growing dominance of institutional investors in shaping market dynamics and raises critical questions about Bitcoin’s ability to meet escalating demand.

Bitcoin ETFs absorb liquidity faster than miners supply

Spot Bitcoin ETFs have emerged as a cornerstone for institutional exposure to Bitcoin, offering a simplified alternative to direct asset custody. This week’s inflows exemplify the changing dynamics, with ETFs accumulating more BTC than miners can produce.

Source: X

The divergence between ETF inflows and miner output reflects tightening liquidity in Bitcoin markets. While miners grapple with post-halving challenges, ETFs continue to absorb a significant portion of the circulating supply.

Institutional investors, undeterred by recent price declines, appear committed to Bitcoin as a long-term macroeconomic hedge, reinforcing its appeal beyond speculative trading.