- BTC could top out in late 2025 based on historical trends.

- Analysts believe BTC could hit $200K — $260K by the end of 2025; the Power Law model suggests $400K.

Based on historical trends, Bitcoin [BTC] could be in its last stage before the final leg of this cycle’s bull run.

Most market observers point to Q4 2024 as a potential breakout for the 6-month-long price range.

If so, a bullish break-out would trigger BTC’s next and final price rally for this cycle. However, most market cycle analysts believe BTC could top out by Q3/Q4 2025.

So, how high can the asset go before it tops out?

How high can BTC go, $200K?

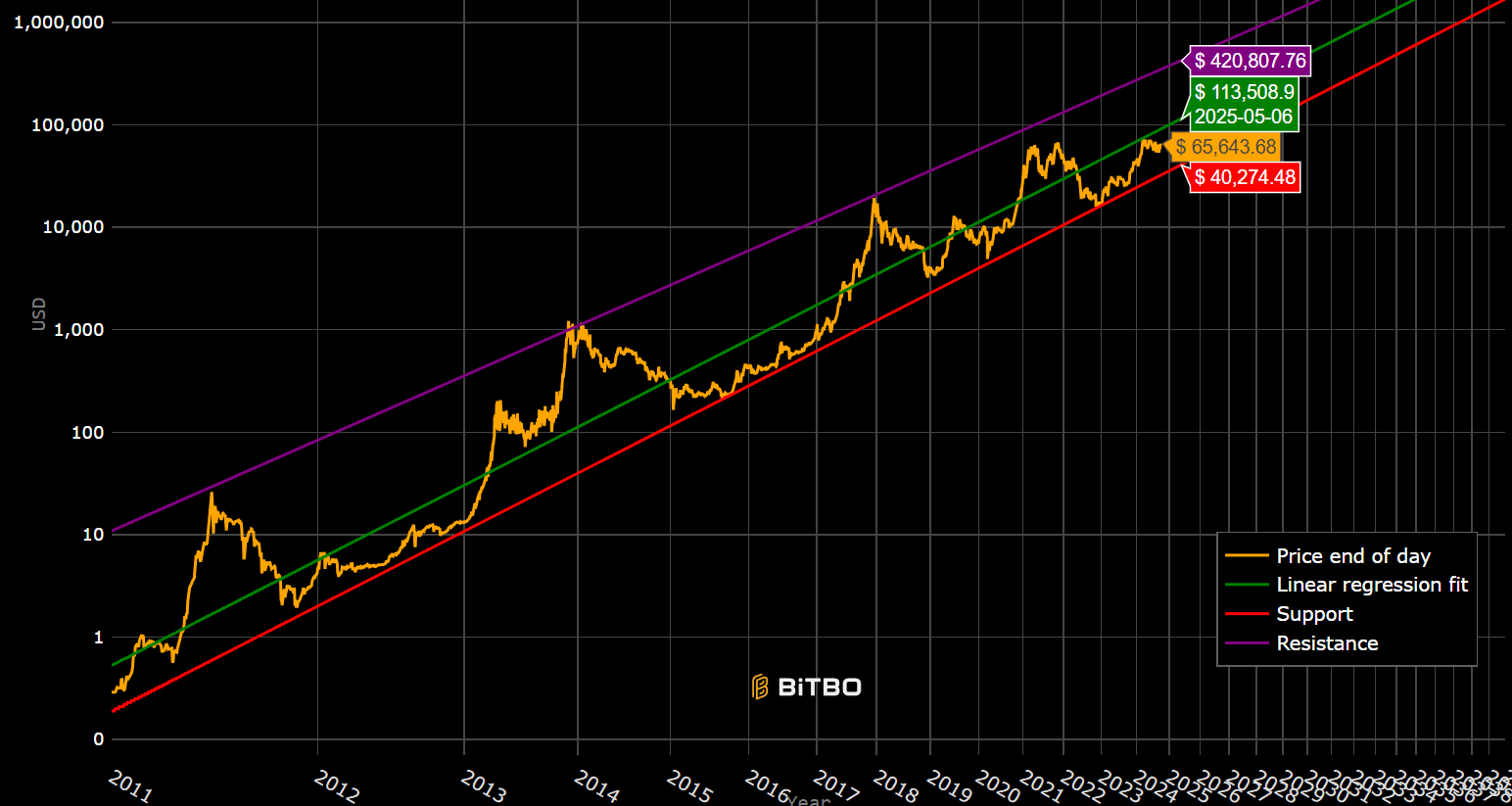

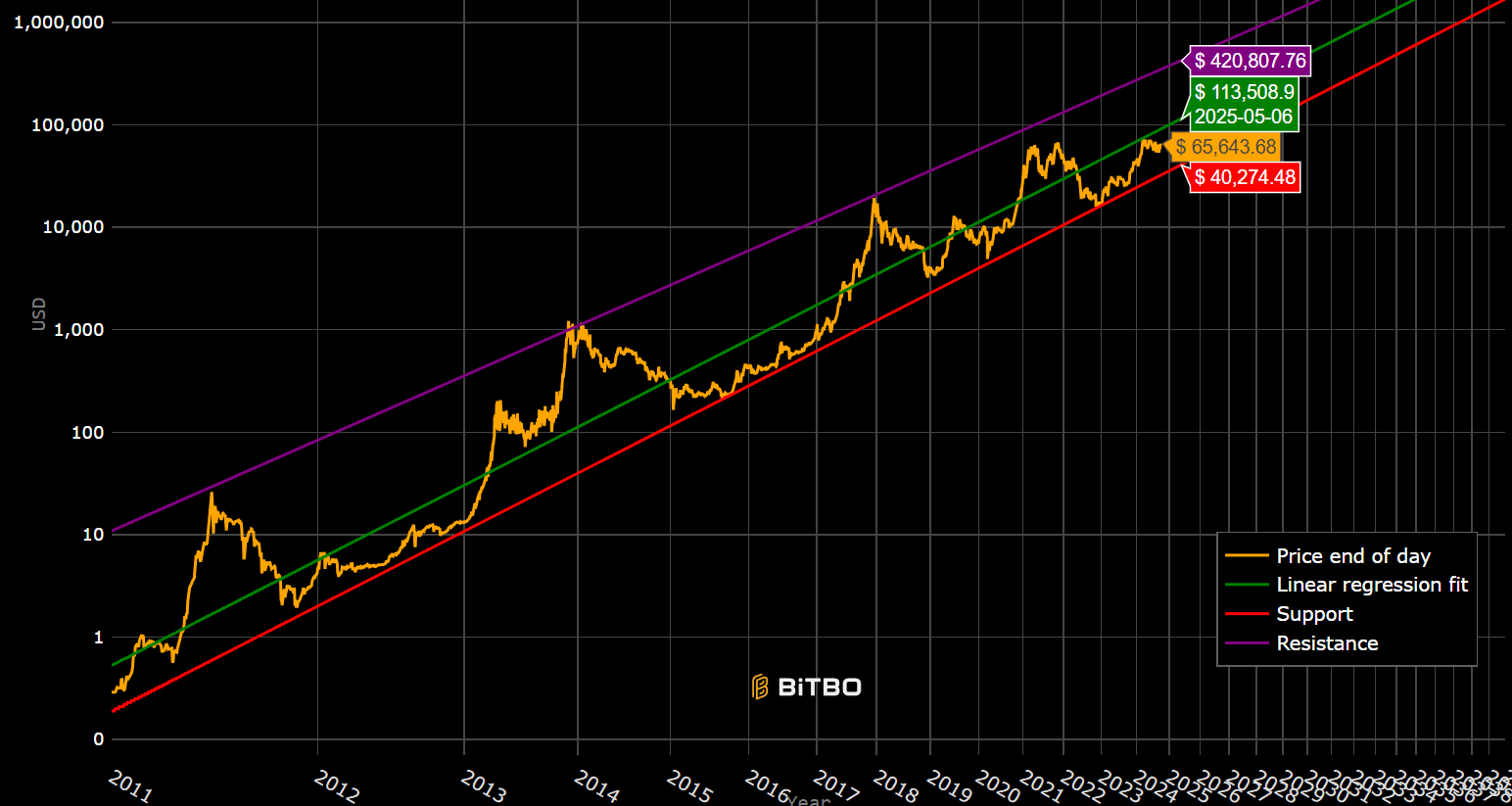

Source: Bitbo

According to the Bitcoin power law model, the rough estimate would be around $400K if the historical trends play out.

For context, BTC always hit the model’s resistance level and topped out in previous cycles, apart from the 2021 one.

If the trend repeats, the model projected $400K as the likely target to watch, an outlook reinforced by analyst Ali Martinez. Even the Stock-Over-Flow (S/F) model target was close to $400K.

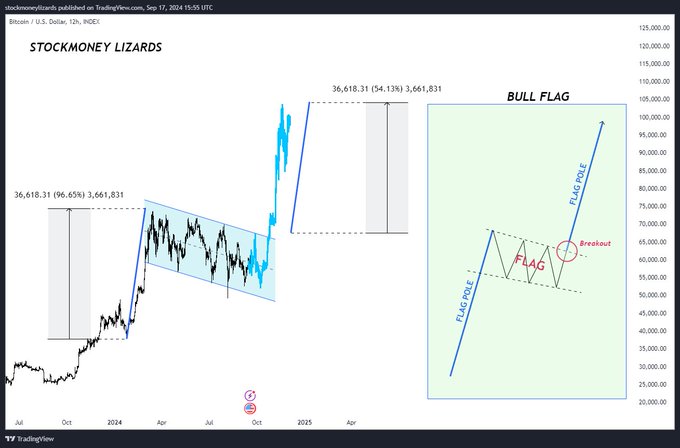

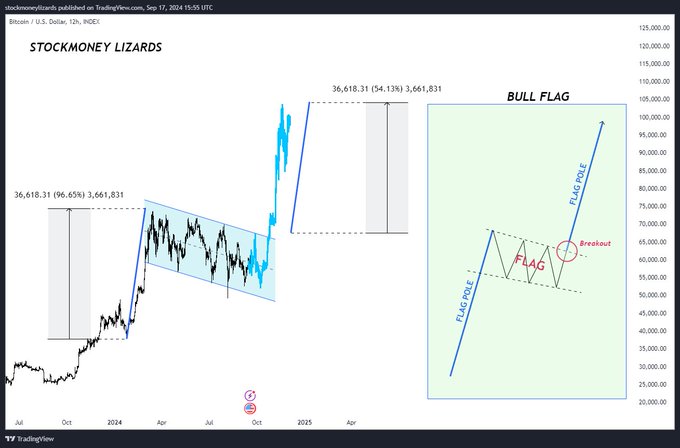

However, Stockmoney Lizards, another BTC analyst, projected that BTC could hit a top near $200K—$260K by October 2025.

“We are entering what could be the final pump of this Bitcoin cycle. The cycle top is expected around September to October 2025. My personal price target for Bitcoin is between $200,000 and $260,000.”

Source: Stockmoney Lizards

The analyst timeline and October 2025 target were based on past trends, where BTC topped out 48 months after the previous peak.

Interestingly, his price target was similar to that of Standard Chartered Bank. The bank projected that BTC could hit $250K by the end of 2025.

For 2024, the bank foresaw BTC climbing above $125K if Trump wins the election. However, if historical patterns played out, Stockmoney Lizards estimated $100K per BTC by year-end.

Source: X

Meanwhile, BTC was valued at $65K at press time. However, the macro front was increasingly becoming a key tailwind for the asset.

After the U.S. Fed pivot on the 18th of September, China launched an aggressive economic stimulus package to revive the economy.

Market pundits believe that these macro updates could boost BTC’s rally.