- Bitcoin has lacked the momentum to break key resistance levels in recent months.

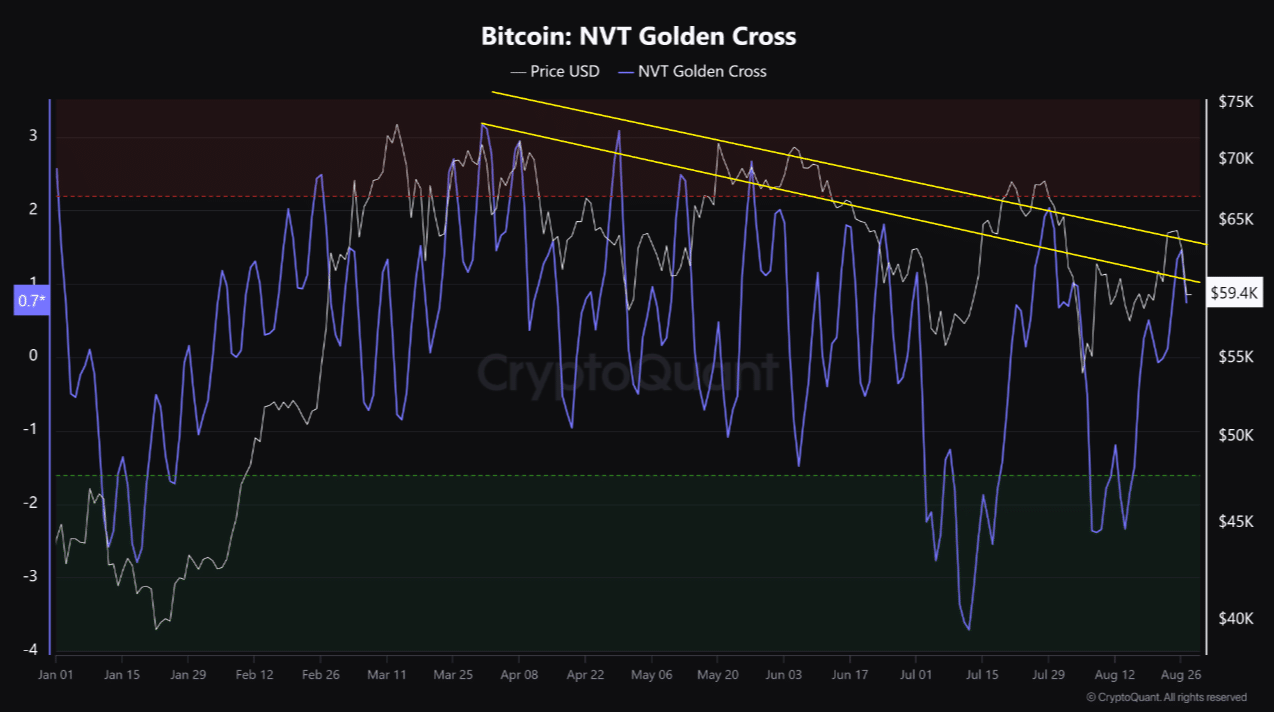

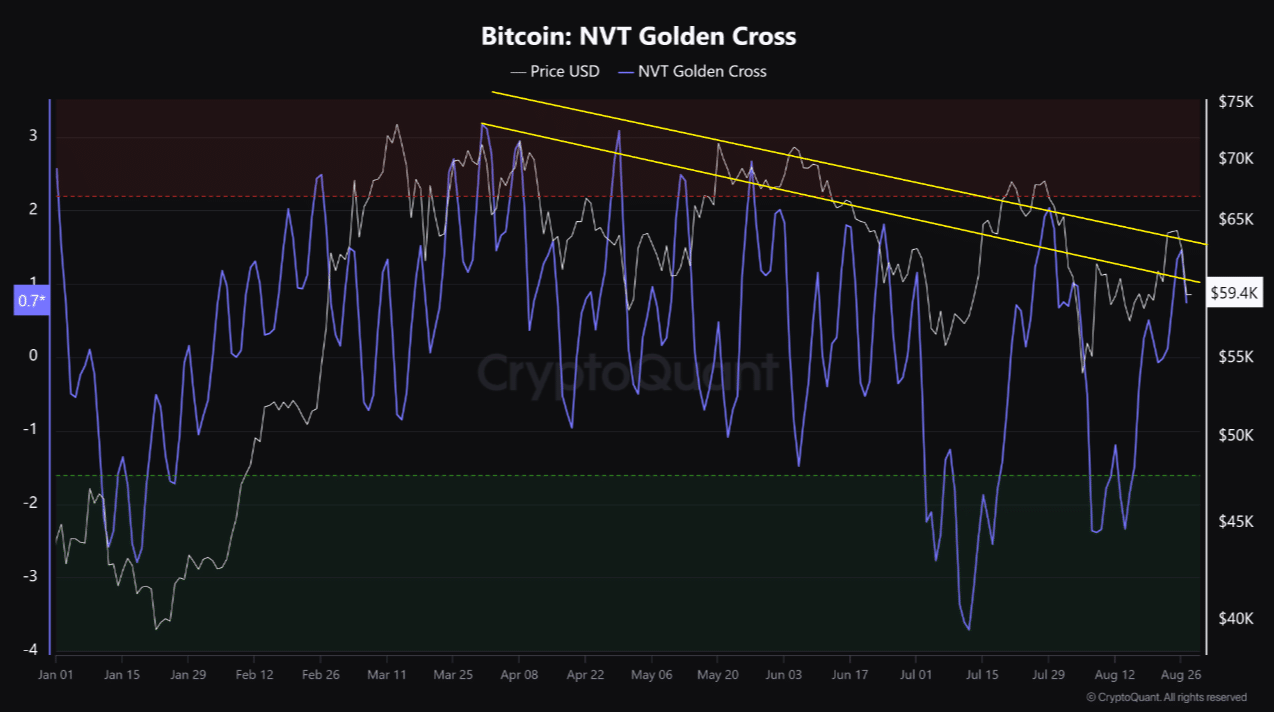

- The waning bullish momentum was evident in the Bitcoin NVT Golden Cross metric.

Bitcoin [BTC] was in a tough position at press time.

The spot ETF inflows were negative and the recent sharp price drop caused large liquidations. The massive outflow of BTC from Binance did not bolster the market sentiment either.

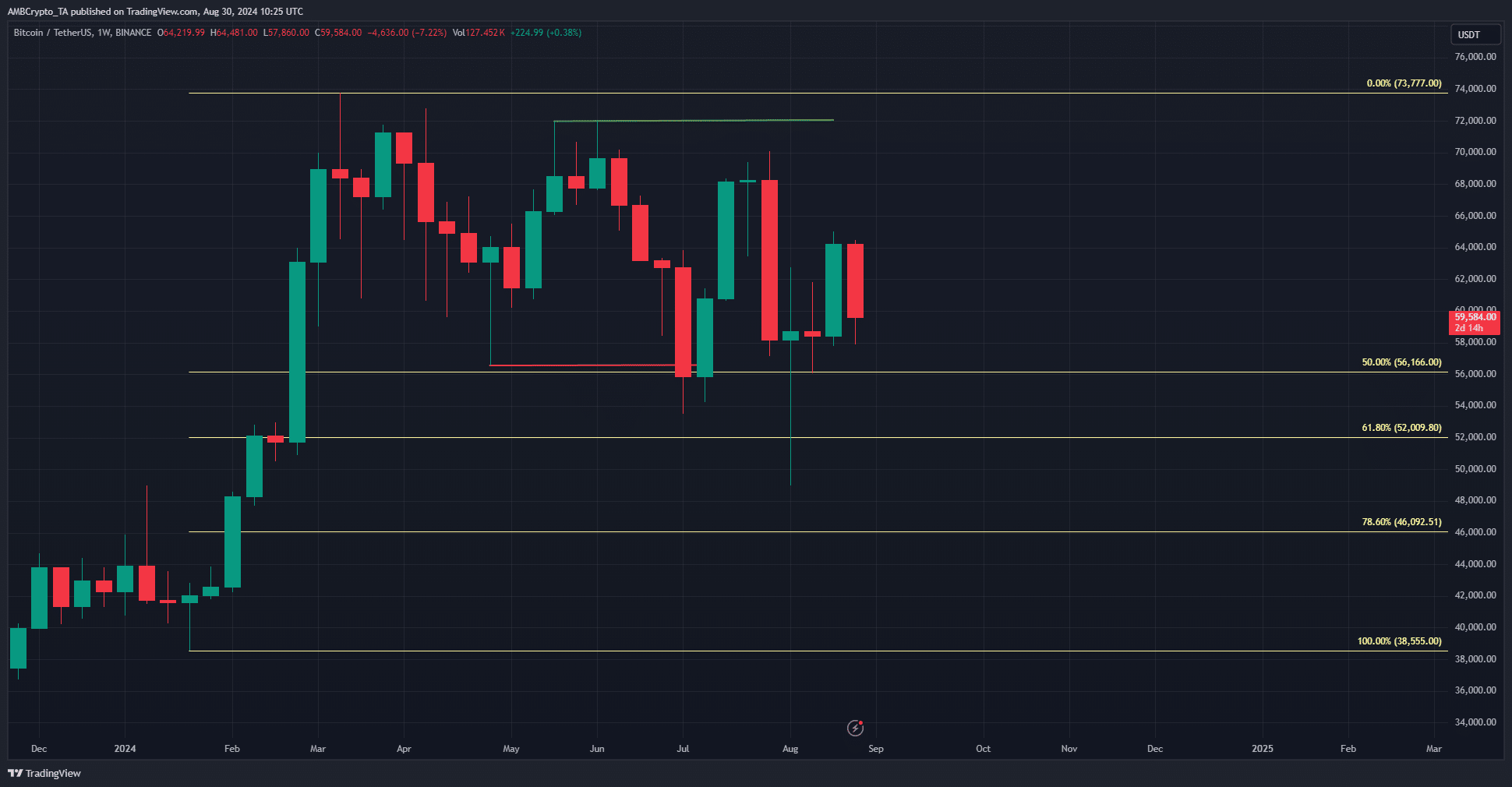

Source: BTC/USDT on TradingView

On the weekly chart, the market structure remained bearish. A new high was not reached, and the king of crypto was forming a series of lower highs since April. Should traders anticipate more weakness?

The Bitcoin Golden Cross trend

Source: CryptoQuant

In a post on CryptoQuant, crypto analyst Burrak Kesmeci observed that the peaks of the Bitcoin NVT Golden Cross were in a downward trend over the past six months.

The values of the peaks fell from 3.17 on the 31st of March to 1.46 on the 26th of August.

The Network Value to Transactions (NVT) Golden Cross metric compares the short-term and long-term trend of the NVT metric, giving a Bollinger Bands-like signaling indicator.

Values of above 2.2 indicate the network is likely overpriced, while values under -1.6 signal a market bottom.

The decline in the peak values since late March is a sign that Bitcoin might be undervalued relative to its transaction volume and presented an accumulation opportunity.

It also highlighted the bulls’ inability to force a breakout past key resistance levels such as $70k.

On-chain data supports the bullish side

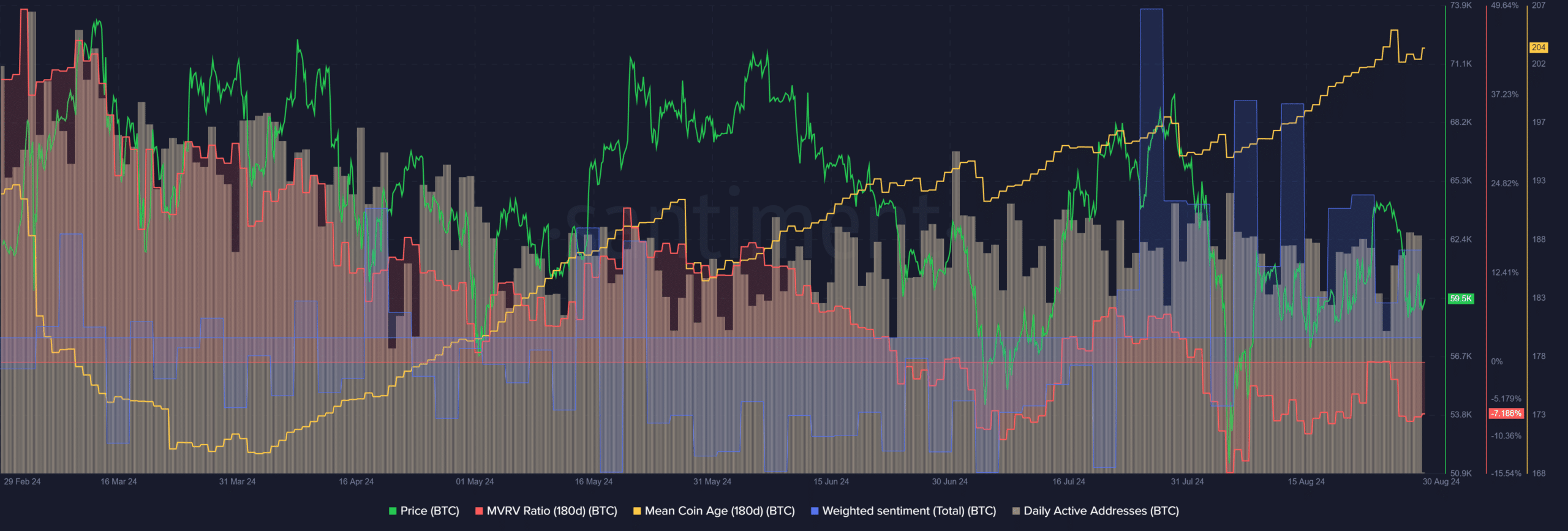

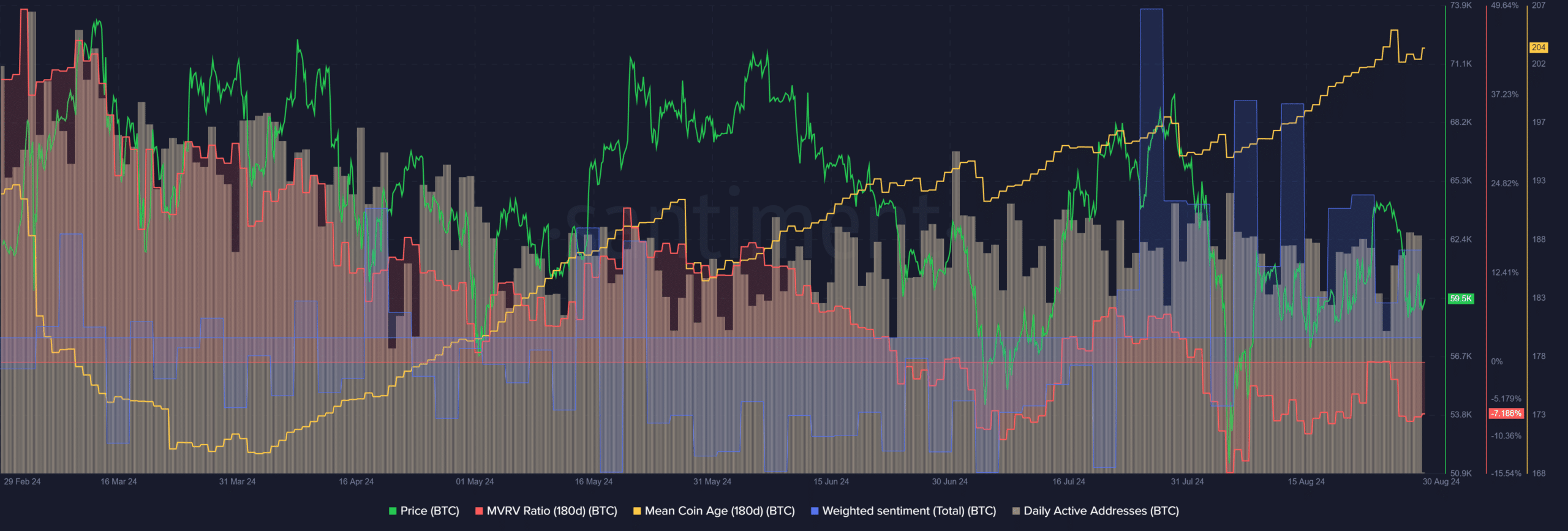

Source: Santiment

The 180-day mean coin age continued to trend upward since late March, even though the weekly market structure turned bearish in recent months.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Also, the past month saw strongly positive social media engagement, even though the Bitcoin price trend was choppy.

The MVRV was negative to show holders were at a loss and that the asset was likely undervalued. Meanwhile, the daily active addresses metric has been stable since June.