- USDT dominance dropped this week, confirming $62 as BTC’s new local low

- Weekend action would be crucial for BTC’s next move as it neared key support on the charts

The market hasn’t yet entered the extreme greed phase that often signals a market top, like when Bitcoin [BTC] hit its ATH of $73k in March.

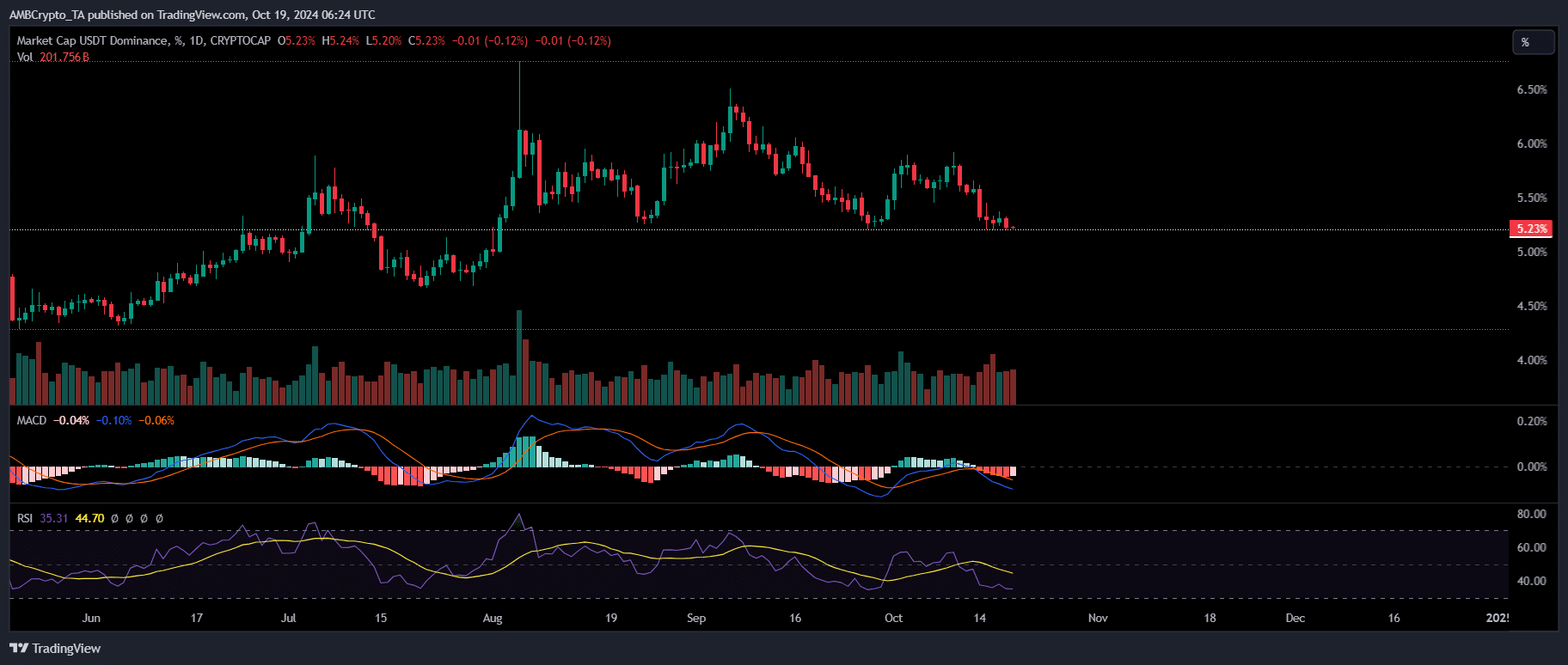

However, over the past seven days, a noticeable surge in liquidity has flowed into the market. This shift came on the back of BTC breaking through key psychological levels. A major driver of this liquidity has been the declining dominance of Tether [USDT] – A sign that capital may be moving away from stablecoins into Bitcoin.

This trend was confirmed by a bearish MACD crossover on the same day.

Source: TradingView

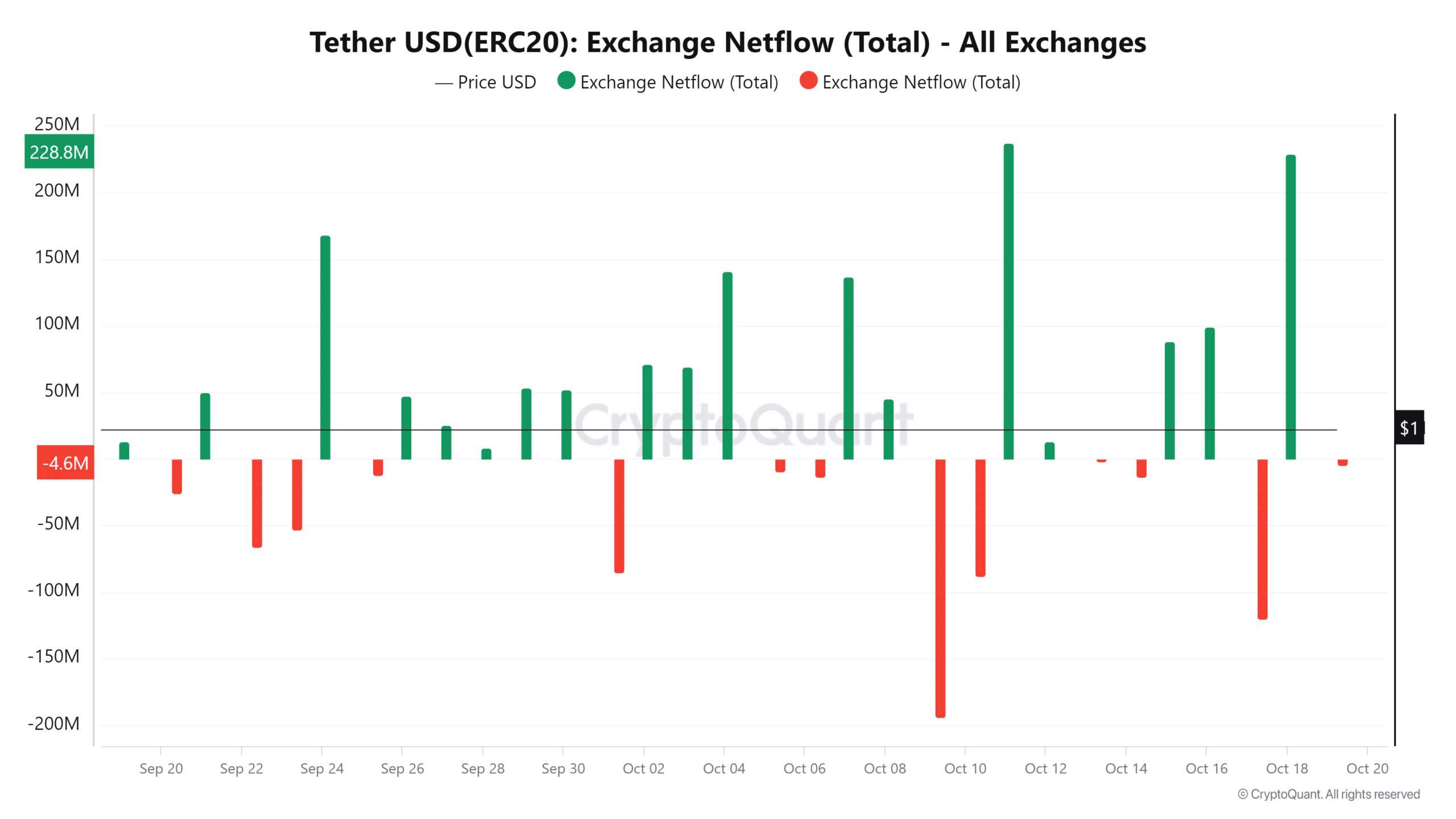

In simple terms, a significant amount of liquidity has flowed into BTC as investors viewed $62k as a new low and bought the dip.Additionally, another historic milestone highlighted the growing significance of USDT and USDC. This further deepened their impact on BTC’s price action.

Currently, USDT and USDC make up almost 50% of the total transaction volume in major crypto assets. This simply reinforces their status as safe havens when Bitcoin nears a market top.

At the time of writing, USDT seemed to be nearing a key support level – One which it has tested twice since July. Each time, Bitcoin faced strong resistance around $65k, resulting in significant pullbacks.

With BTC trading at $68,346, a hike in USDT dominance could trigger a correction. This would indicate market panic as sellers take profits before the rally wanes.

Tracking USDT dominance is key

Alongside a bearish MACD crossover, several key indicators, including a falling RSI, suggested that USDT dominance may continue to decline, possibly revisiting early July levels when BTC was around $68k.

If this trend persists, Bitcoin could enjoy a bullish weekend, fueled by strong sentiment as high liquidity flows into BTC from USDT.

Source: CryptoQuant

However, caution is warranted. While USDT outflows have been gaining momentum, they could trigger a short-term correction. Still, this doesn’t guarantee an outright pullback unless this behavior continues for the next few days.

Read Bitcoin (BTC) Price Prediction 2024-25

Therefore, closely monitoring the USDT dominance chart is essential. A slight divergence from the prevailing downtrend might signal the end of this bullish cycle.

If history is any guide, it could push BTC back below $62k – The established local low.